Mexico Portable Power Tools Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Mexico Portable Power Tools Market Overview:

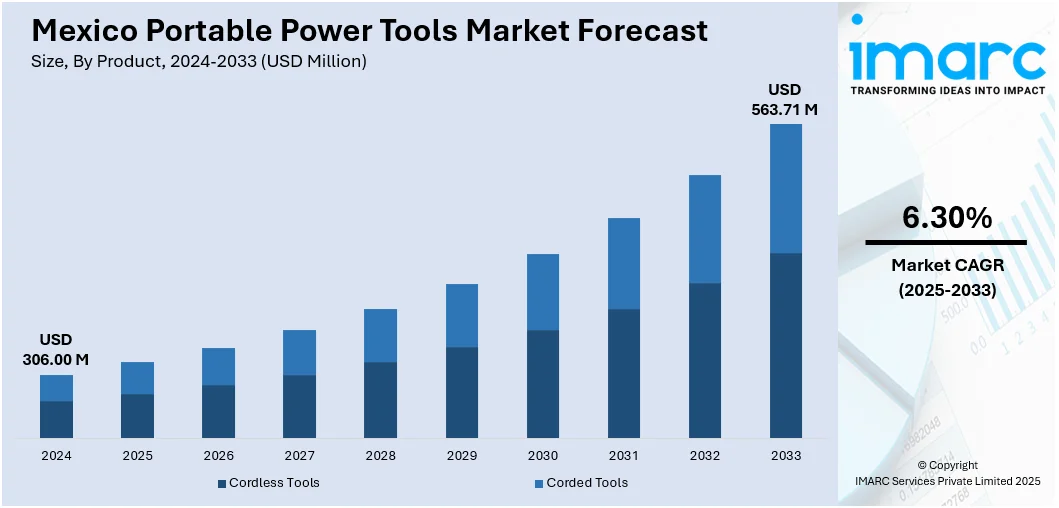

The Mexico portable power tools market size reached USD 306.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 563.71 Million by 2033, exhibiting a growth rate (CAGR) of 6.30% during 2025-2033. The market is driven by the demand for home improvement and do-it-yourself projects. Further, the growth in the construction sector on the back of infrastructure growth and residential building also increases the demand for these types of tools. Apart from this, technological development and the transition towards energy-efficient, battery-powered devices are some of the major drivers expanding the Mexico portable power tools market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 306.00 Million |

| Market Forecast in 2033 | USD 563.71 Million |

| Market Growth Rate 2025-2033 | 6.30% |

Mexico Portable Power Tools Market Trends:

Rising Adoption of Cordless Tools Driven by Urban Construction and End-User Mobility Needs

The market is witnessing a sharp transition from corded to cordless tools, driven largely by urban expansion and infrastructure development. This trend is further fueled by a growing demand for mobility, convenience, and operational flexibility across professional and consumer segments. Construction workers, technicians, and home users increasingly prefer battery-operated tools, such as drills, circular saws, and impact drivers, as they eliminate the constraints of fixed power sources and enable use in remote or partially completed job sites. Furthermore, improvements in lithium-ion battery chemistry have significantly extended the run-time and lifecycle of cordless units while minimizing charging durations and reducing memory effects. Manufacturers are responding with compact and user-friendly designs that maintain high torque and speed, appealing to the safety and efficiency concerns of on-site labor. Also, the surge in government-backed housing and infrastructure projects, along with a growing DIY culture, further consolidates cordless tools as the dominant product category in the market.

To get more information on this market, Request Sample

Expansion of Organized Retail and E-Commerce Channels Enhancing Market Accessibility

The growth of organized retail formats and online sales platforms is positively impacting the Mexico portable power tools market growth. Traditionally, power tools were distributed through hardware stores and regional dealers, which limited product reach and brand visibility, particularly in semi-urban and rural areas. The rise of large-format retailers, dedicated tool outlets, and e-commerce marketplaces that offer expanded product assortments, transparent pricing, and customer reviews. These platforms have democratized access to power tools among home users, small contractors, and independent professionals by simplifying product comparisons and enabling doorstep delivery. Additionally, the growth in e-commerce is further supported by widespread smartphone penetration and improved digital infrastructure across Mexico. According to industry reports, as of 2023, there were more than 97 million internet users, accounting for 81% of the Mexicans. This surge in internet penetration has significantly contributed to the rapid growth of the e-commerce sector, which is projected to reach USD 63 Billion by 2025. As a result, manufacturers are investing in omnichannel strategies and local warehousing to ensure availability, quicker delivery, and strong after-sales service, factors that increasingly influence purchasing decisions.

Growing Demand from Automotive Aftermarket and Light Manufacturing Sectors

Mexico's position as a key hub in the global automotive supply chain is contributing substantially to the demand for portable power tools, particularly in aftermarket repair, bodywork, and assembly applications. The country is home to major vehicle assembly plants and a vast network of Tier 1 and Tier 2 suppliers, which in turn support a thriving aftermarket services industry. In this context, portable tools such as pneumatic wrenches, grinders, and polishers are extensively used for assembly, repair, and surface treatment tasks. Additionally, the light manufacturing sector, covering fabricated metal products, electrical components, and home appliances, relies heavily on handheld power tools to support precision, speed, and workflow flexibility. The increased mechanization of small- and medium-sized enterprises (SMEs) in these industries has widened the user base beyond large factories to independent workshops and subcontracting units. These sectors demand tools that balance performance with durability under continuous operation, thus influencing design trends toward ruggedized, lightweight, and low-maintenance devices optimized for repetitive use.

Mexico Portable Power Tools Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Cordless Tools

- Corded Tools

The report has provided a detailed breakup and analysis of the market based on the product. This includes cordless tools and corded tools.

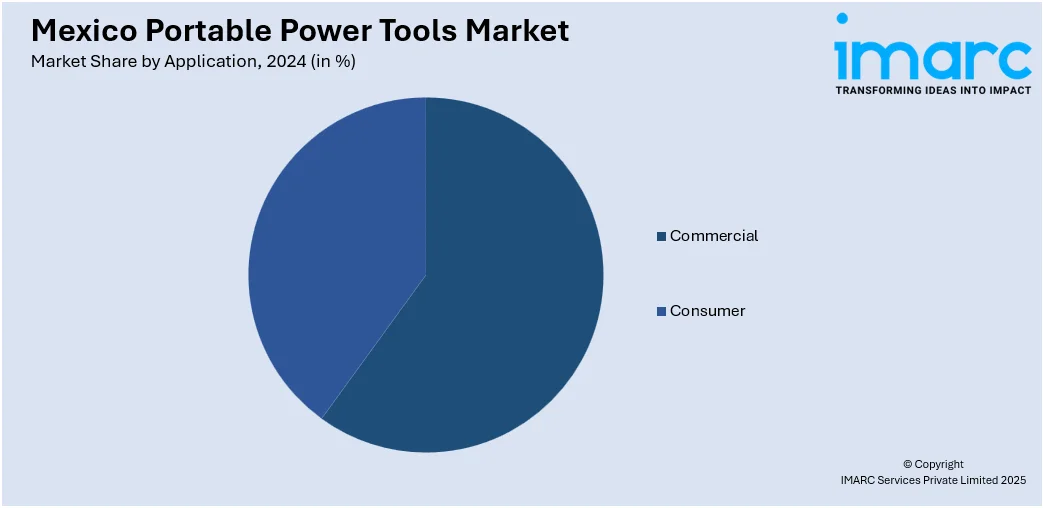

Application Insights:

- Commercial

- Consumer

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial and consumer.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Portable Power Tools Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Cordless Tools, Corded Tools |

| Applications Covered | Commercial, Consumer |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico portable power tools market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico portable power tools market on the basis of product?

- What is the breakup of the Mexico portable power tools market on the basis of application?

- What is the breakup of the Mexico portable power tools market on the basis of region?

- What are the various stages in the value chain of the Mexico portable power tools market?

- What are the key driving factors and challenges in the Mexico portable power tools market?

- What is the structure of the Mexico portable power tools market and who are the key players?

- What is the degree of competition in the Mexico portable power tools market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico portable power tools market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico portable power tools market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico portable power tools industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)