Mexico Ports Infrastructure Market Size, Share, Trends and Forecast by Port Type, Construction Type, Application, and Region, 2025-2033

Mexico Ports Infrastructure Market Overview:

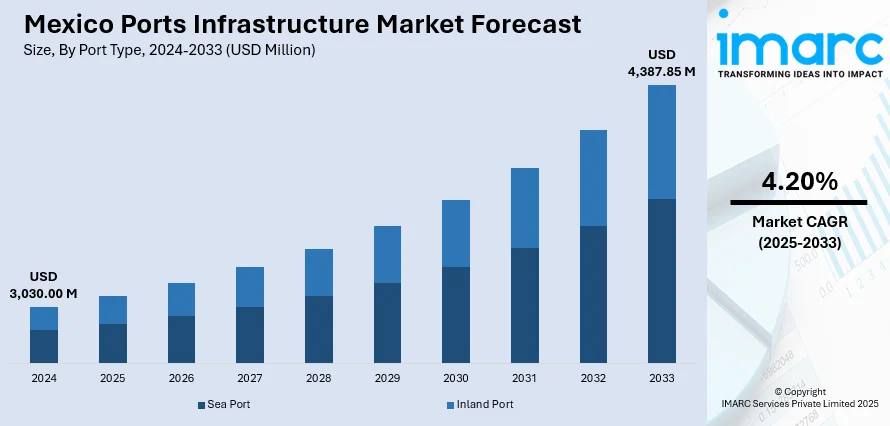

The Mexico ports infrastructure market size reached USD 3,030.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,387.85 Million by 2033, exhibiting a growth rate (CAGR) of 4.20% during 2025-2033. Expansion of trade agreements, strengthening of international commerce, strategic government-led infrastructure initiatives, an enhanced emphasis on multimodal connectivity, continual developments in special economic zones, environmental regulatory enhancements, increasing private sector participation, the digitalization of port operations, and advancement of smart port initiatives are some of the factors that are positively impacting the Mexico ports infrastructure market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,030.00 Million |

| Market Forecast in 2033 | USD 4,387.85 Million |

| Market Growth Rate 2025-2033 | 4.20% |

Mexico Ports Infrastructure Market Trends:

Expansion of Trade Agreements and International Commerce

The expansion of Mexico’s international trade agreements is a critical driver for the market. In recent years, Mexico has significantly strengthened its global trade relationships, particularly through partnerships under the United States-Mexico-Canada Agreement (USMCA) and its participation in the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). These agreements have amplified Mexico’s role as a strategic logistics and trade hub, prompting substantial investments in port modernization and capacity enhancements. Export-oriented industries, including automotive, electronics, and agriculture, increasingly rely on efficient maritime channels, elevating the demand for state-of-the-art port facilities. Among the important Mexico ports infrastructure market trends is the focus on optimizing supply chain networks, which correlates closely with the country's improved trade positioning.

The Mexico ports infrastructure market forecast anticipates continued infrastructure expansion, as import and export volumes rise, demanding faster, larger, and more efficient port handling capabilities. Public-private partnerships (PPPs) are also gaining traction, enabling modernization efforts that meet global standards. Technological advancements such as automation, digital tracking systems, and sustainable energy solutions are becoming integrated into port operations, driven by the needs of international commerce. Additionally, federal and state governments are allocating substantial budgets toward upgrading port infrastructure to minimize logistical bottlenecks, ensuring seamless cargo movement through Mexico’s coastal gateways. Enhanced port infrastructure is essential for Mexico to sustain its competitiveness in global trade routes. Mexico’s Port of Manzanillo will undergo a USD 3 Billion expansion, aiming to more than double its container handling capacity from 3.5 million TEU to 10 million TEU by 2030, establishing it as Latin America's largest container port. The project, led by the Mexican Naval Ministry (SEMAR) and funded through public-private partnerships, will expand the port’s installations by 303% to cover 1,700 hectares and add four container terminals plus petroleum product piers. Authorities plan sustainable development, with an environmental impact study already completed, positioning Manzanillo among the world’s top15 container ports upon completion. Modernized facilities help reduce shipping times, improve customs clearance efficiency, and provide better connectivity to inland transportation systems such as rail and highways. Furthermore, the significant influence of comprehensive trade agreements is projected to persist as a key catalyst in shaping future market dynamics, directly supporting long-term stability and strategic development within Mexico's maritime sector.

Government Initiatives and Strategic Infrastructure Programs

Government-led initiatives aimed at infrastructure enhancement form another critical component driving Mexico's ports development. Strategic programs such as the National Infrastructure Program (NIP) and the Special Program for Ports and Merchant Marine (PEPyMM) specifically target maritime infrastructure improvements, demonstrating a robust policy commitment to strengthening transportation frameworks. An important aspect of the Mexico ports infrastructure market trends is the rising attention toward regional integration and strengthening trade corridors. On January 2, 2024, Genesee & Wyoming Inc. (G&W) announced that Grupo México Transportes (GMXT) will become its new joint venture partner in CG Railway (CGR), pending regulatory approvals. GMXT will purchase SEACOR Holdings' stake in CGR, which operates a rail-ferry service between Mobile, Alabama, and Coatzacoalcos, Veracruz across the Gulf of Mexico, offering a three-day port-to-port transit and expedited customs clearance. The partnership is expected to enhance CGR’s service capabilities, extend its network reach, and support growing cross-border trade between the U.S. and Mexico. The Mexico ports infrastructure market growth reflects these focused efforts, where infrastructure investment is pivotal to accommodating larger vessels, managing higher cargo volumes, and fostering resilient supply chain ecosystems.

Special economic zones (SEZs) near ports are being developed to attract manufacturing and logistics companies, further bolstering economic activity around maritime hubs. Increased collaboration between state authorities and multinational corporations accelerates progress on key projects, including dredging operations, terminal expansions, and construction of logistics parks. Amidst these developments, analysts monitoring Mexico ports infrastructure market trends have observed a shift toward digitalization and smart port initiatives. This transformation is expected to continue shaping the Mexico ports infrastructure market outlook, leading to heightened operational efficiencies and a competitive maritime environment that can effectively serve both regional and transcontinental shipping demands. These initiatives focus on modernizing port equipment, expanding terminal capacities, and improving multimodal connectivity between ports and inland distribution centers. Increased investment and regulatory reforms promote private sector participation, encouraging broader funding channels and innovation in infrastructure projects. Comprehensive government programs and policy frameworks are solidifying Mexico’s position in the global maritime sector.

Mexico Ports Infrastructure Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on port type, construction type, and application.

Port Type Insights:

- Sea Port

- Inland Port

The report has provided a detailed breakup and analysis of the market based on the port type. This includes sea port and inland port.

Construction Type Insights:

- Terminal

- Equipment

The report has provided a detailed breakup and analysis of the market based on the construction type. This includes terminals and equipment.

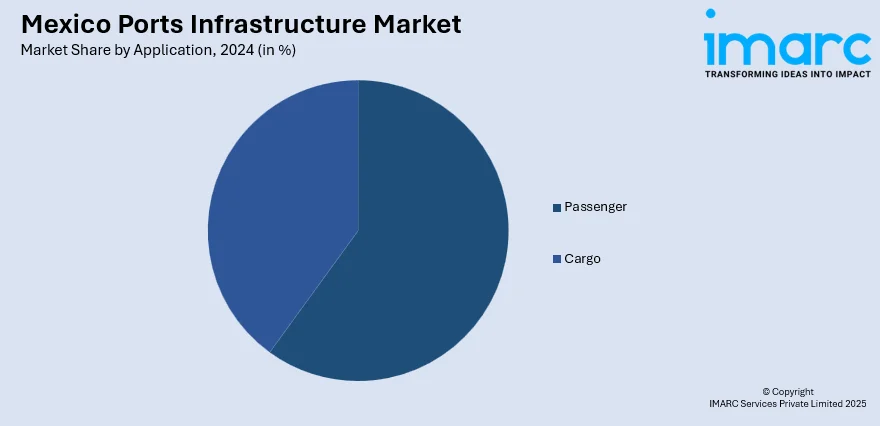

Application Insights:

- Passenger

- Cargo

The report has provided a detailed breakup and analysis of the market based on the application. This includes passenger and cargo.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Ports Infrastructure Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Port Types Covered | Sea Port, Inland Port |

| Construction Types Covered | Terminal, Equipment |

| Applications Covered | Passenger, Cargo |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico ports infrastructure market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico ports infrastructure market on the basis of port type?

- What is the breakup of the Mexico ports infrastructure market on the basis of construction type?

- What is the breakup of the Mexico ports infrastructure market on the basis of application?

- What is the breakup of the Mexico ports infrastructure market on the basis of region?

- What are the various stages in the value chain of the Mexico ports infrastructure market?

- What are the key driving factors and challenges in the Mexico ports infrastructure market?

- What is the structure of the Mexico ports infrastructure market and who are the key players?

- What is the degree of competition in the Mexico ports infrastructure market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico ports infrastructure market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico ports infrastructure market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico ports infrastructure industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)