Mexico Positive Displacement Pumps Market Size, Share, Trends and Forecast by Product Type, Capacity, Pump Characteristic, Raw Material, End Use Industry, and Region, 2025-2033

Mexico Positive Displacement Pumps Market Overview:

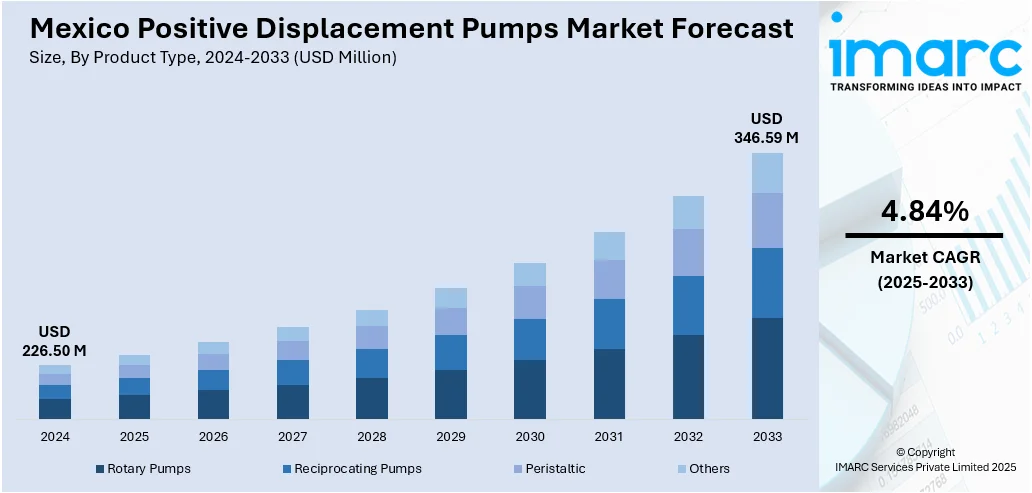

The Mexico positive displacement pumps market size reached USD 226.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 346.59 Million by 2033, exhibiting a growth rate (CAGR) of 4.84% during 2025-2033. Mexico's positive displacement pumps market is being driven by expanding oil and gas operations requiring efficient fluid handling, rapid progress in hygienic food and beverage processing, increased investments in wastewater treatment infrastructure, and rising demand for precision pumping in chemical and pharmaceutical manufacturing, all supported by modernization and industrial automation initiatives across key sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 226.50 Million |

| Market Forecast in 2033 | USD 346.59 Million |

| Market Growth Rate 2025-2033 | 4.84% |

Mexico Positive Displacement Pumps Market Trends:

Expanding Oil & Gas Sector and Midstream Infrastructure Development

The Positive Displacement Pumps (PDP) sector in Mexico is significantly propelled by the continued growth and development of the country's oil and gas industry. PDPs are integral to the upstream, midstream, and downstream operations of the oil sector, as they are capable of efficiently transferring high-viscosity fluids and ensuring a steady flow that remains unaffected by pressure fluctuations. In recent years, Mexico has seen a surge in energy investments, which has been partially stimulated by legislative reforms, such as the 2013 energy reforms, that opened the oil industry to foreign and private investments. Despite certain setbacks under the current administration, multinational corporations like Shell and Repsol continue to engage in exploration and production activities in the Gulf of Mexico. Furthermore, Mexico is making significant investments in the development of midstream infrastructure, including the construction and enhancement of pipelines, refineries (such as the Dos Bocas refinery project), and storage terminals for petroleum products. PDPs are vital in the transportation of crude oil, natural gas liquids, and refined products through these facilities due to their precision flow control and adaptability to varying viscosities and pressure conditions.

To get more information on this market, Request Sample

Growth in the Food & Beverage Processing Industry with a Focus on Hygienic Standards

Another factor contributing to the expansion of the PDP market in Mexico is the rapid growth of the nation’s food and beverage (F&B) processing sector, particularly the heightened demand for sanitary and hygienic pumping solutions. PDPs are extensively utilized in the F&B industry for their ability to process shear-sensitive, viscous, or particulate products, such as yogurt, sauces, syrups, and purees, with minimal degradation. As the second-largest food processor and exporter in Latin America, Mexico has benefited from trade agreements such as the United States-Mexico-Canada Agreement (USMCA), which has fostered foreign direct investment (FDI) in food processing and export activities. Hygienic pumps, specifically lobe, diaphragm, and peristaltic positive displacement pumps, are highly regarded for their compliance with stringent sanitation standards, such as EHEDG and 3-A SSI certifications. Mexican manufacturers are increasingly adopting automation and modernizing their processing lines to align with global food safety standards. This trend is further driven by the expanding markets for packaged foods, dairy processing, craft beverages, and functional foods, both domestically and internationally.

Mexico Positive Displacement Pumps Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, capacity, pump characteristic, raw material, and end use industry.

Product Type Insights:

- Rotary Pumps

- Vane

- Screw

- Lobe

- Gear

- Progressing Cavity (PC)

- Others

- Reciprocating Pumps

- Piston

- Diaphragm

- Plunger

- Others

- Peristaltic

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes rotary pumps (vane, screw, lobe, gear, progressing cavity (PC), and others), reciprocating pumps (piston, diaphragm, plunger, and others), peristaltic, and others.

Capacity Insights:

- Low Capacity Pumps

- Medium Capacity Pumps

- High Capacity Pumps

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes low capacity pumps, medium pumps, and high capacity pumps.

Pump Characteristic Insights:

- Standard Pumps

- Engineered Pumps

- Special Purpose Pumps

The report has provided a detailed breakup and analysis of the market based on the pump characteristic. This includes standard pumps, engineered pumps, and special purpose pumps.

Raw Material Insights:

- Bronze

- Cast Iron

- Polycarbonate

- Stainless Steel

- Others

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes bronze, cast iron, polycarbonate, stainless steel, and others.

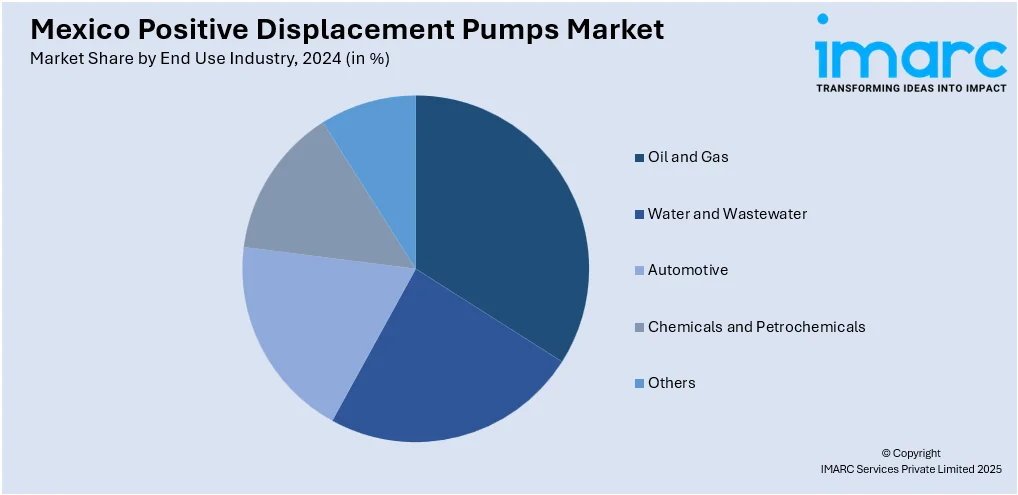

End Use Industry Insights:

- Oil and Gas

- Water and Wastewater

- Automotive

- Chemicals and Petrochemicals

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes oil and gas, water and wastewater, automotive, chemicals and petrochemicals, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Positive Displacement Pumps Market News:

- January 2025: The Mexican government introduced a comprehensive legislative framework to reinforce the roles of state-owned enterprises PEMEX and CFE in the energy sector. This includes the absorption of their subsidiaries, re-establishing them as state-owned entities, and granting PEMEX preferential rights in exploration and extraction. This shift is expected to increase infrastructure development and upstream activities, driving higher demand for positive displacement pumps, which are critical for reliable fluid handling in oil extraction, refining, and power generation processes due to their efficiency in high-viscosity and high-pressure operations.

Mexico Positive Displacement Pumps Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Capacities Covered | Low Capacity Pumps, Medium Capacity Pumps, High Capacity Pumps |

| Pump Characteristics Covered | Standard Pumps, Engineered Pumps, Special Purpose Pumps |

| Raw Materials Covered | Bronze, Cast Iron, Polycarbonate, Stainless Steel, Others |

| End Use Industries Covered | Oil and Gas, Water and Wastewater, Automotive, Chemicals and Petrochemicals, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico positive displacement pumps market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico positive displacement pumps market on the basis of product type?

- What is the breakup of the Mexico positive displacement pumps market on the basis of capacity?

- What is the breakup of the Mexico positive displacement pumps market on the basis of pump characteristic?

- What is the breakup of the Mexico positive displacement pumps market on the basis of raw material?

- What is the breakup of the Mexico positive displacement pumps market on the basis of end use industry?

- What is the breakup of the Mexico positive displacement pumps market on the basis of region?

- What are the various stages in the value chain of the Mexico positive displacement pumps market?

- What are the key driving factors and challenges in the Mexico positive displacement pumps market?

- What is the structure of the Mexico positive displacement pumps market and who are the key players?

- What is the degree of competition in the Mexico positive displacement pumps market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico positive displacement pumps market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico positive displacement pumps market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico positive displacement pumps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)