Mexico Potato Chips Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Mexico Potato Chips Market Overview:

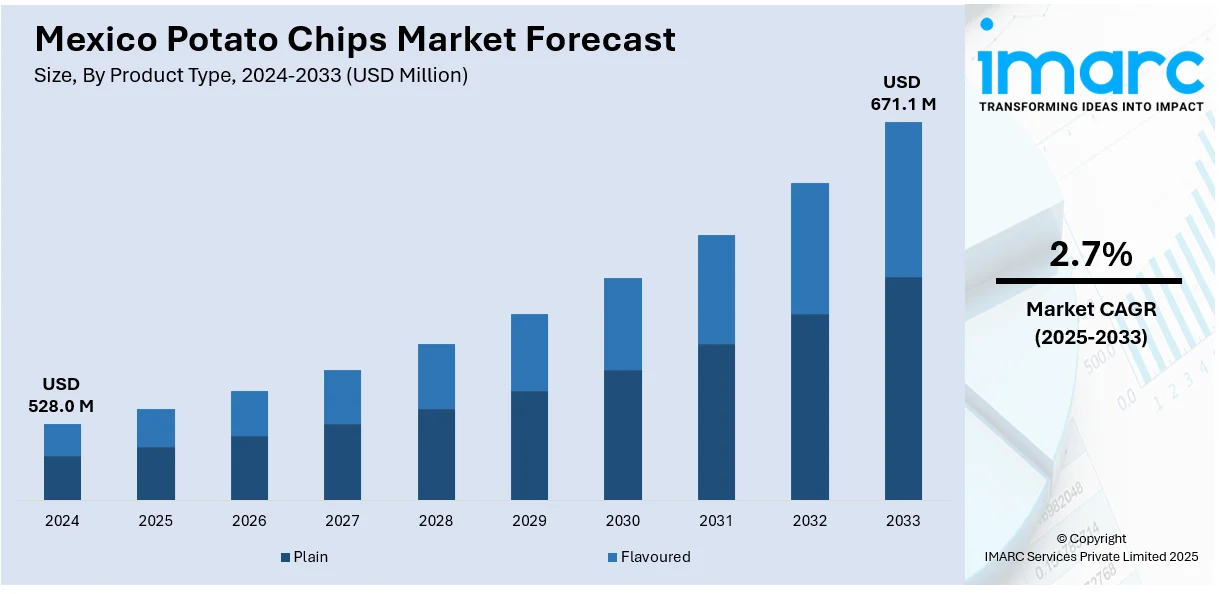

The Mexico potato chips market size reached USD 528.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 671.1 Million by 2033, exhibiting a growth rate (CAGR) of 2.7% during 2025-2033. The market is influenced by trends like rising demand for convenience snacks, urbanization, and rising disposable income. Shifts in consumer taste preferences for flavorful and premium segments and robust retail distribution channels also fuel the Mexico potato chips market growth. Marketing efforts and social media trends are also among the drivers of consumption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 528.0 Million |

| Market Forecast in 2033 | USD 671.1 Million |

| Market Growth Rate 2025-2033 | 2.7% |

Mexico Potato Chips Market Trends:

Rising Demand for Health-Conscious Potato Chips

In Mexico, there is growing demand for health-conscious potato chips. With more people becoming conscious about healthy eating, consumers are looking for snacks with less additives, less fat, and more healthier components. This has resulted in a huge upsurge of demand for baked, organic, and gluten-free potato chips. Most brands are also launching chips with alternative flavor options, like lower-salt or natural flavors, to appeal to health-conscious consumers. Products that contain non-GMO potatoes and products that utilize healthier oils, including avocado or olive oil, are also becoming increasingly popular. This change in consumer behavior is leading manufacturers to innovate and provide healthier alternatives to traditional fried chips. As the Mexican consumer continues to become more health-oriented, this trend will continue to expand, giving brands a new avenue to launch healthier snack alternatives in the competitive marketplace. In March 2025, a government-initiated ban on junk food in schools throughout Mexico was implemented as the nation seeks to address one of the globe’s most severe obesity and diabetes crises. The health guidelines, initially released last autumn, directly target salty and sweet processed foods that have long been a mainstay for Mexican schoolchildren, including sugary fruit beverages, packaged snacks, artificial chicharrónes, and soy-wrapped, chili-flavored peanuts.

Popularity of Premium and Artisanal Potato Chips

The Mexico potato chips market outlook is also witnessing an increase in demand for premium and artisanal types. Urban consumers are increasingly seeking out novel, high-quality snacks that provide unique flavors and experiences. This has resulted in the emergence of small, niche players that emphasize artisanal production processes, high-quality potatoes, and natural ingredients. These upscale products usually carry exotic or intense flavors, including jalapeño, lime, and local spices, which appeal to Mexican palates. In addition, consumers' interest in locally produced ingredients appeals to those seeking authentic and sustainable offerings. The artisanship of chips is driven by increasing demand for gourmet experiences and along with consumers who ae willing to pay more for greater flavor and craft-manufactured products.

Expansion of Potato Chips in Online and Convenience Retail Channels

Mexico potato chips market share is also experiencing a tremendous change in the distribution channels, with convenience stores and online channels becoming more relevant. As shopping behavior changes among consumers and e-commerce expands, an increasing number of Mexican consumers are buying potato chips and snacks online from e-retailers. Several manufacturers are also entering into alliances with large e-commerce sites, providing direct-to-consumer sales and delivery services. In addition, convenience stores, providing instant access to numerous snacks, have increased their presence, making potato chips more accessible to the consumer. The growth in quick-service retailing formats, including mini-marts and vending machines, also contributes to the need for single-serve or on-the-go snack packaging. The trend is a reflection of changing lifestyles in which consumers are looking for convenience and instant access to their preferred snacks. As convenience stores and digital sales keep expanding, these channels are likely to have a major influence on the future of Mexico's potato chips market.

Mexico Potato Chips Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, and distribution channel.

Product Type Insights:

- Plain

- Flavored

The report has provided a detailed breakup and analysis of the market based on the product type. This includes plain and flavored.

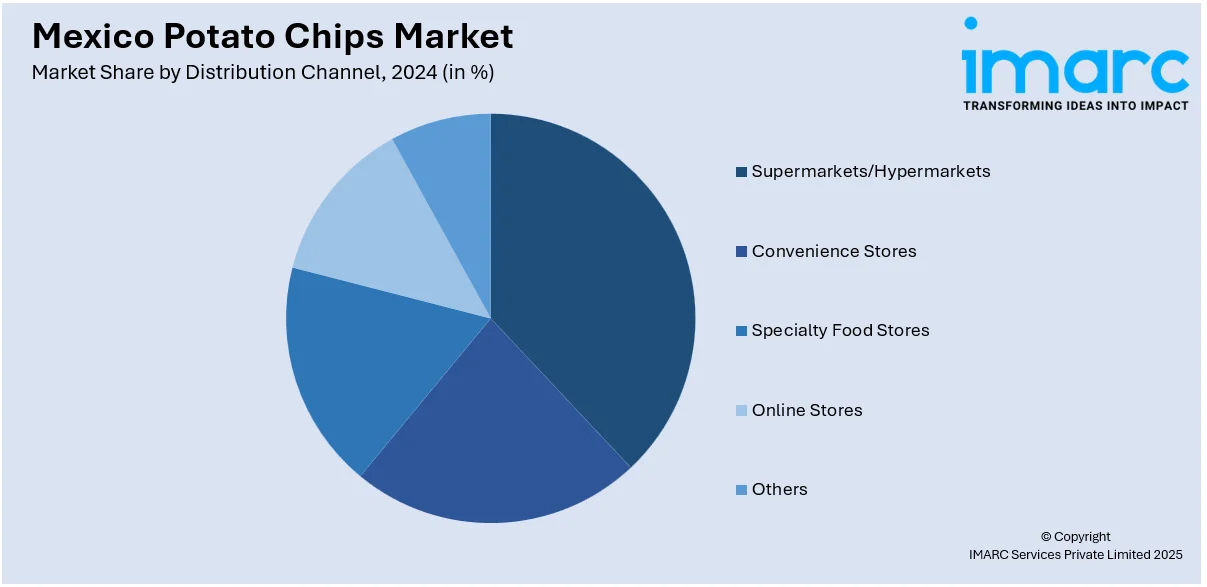

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Food Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, specialty food stores, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Potato Chips Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Plain, Flavored |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Food Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico potato chips market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico potato chips market on the basis of product type?

- What is the breakup of the Mexico potato chips market on the basis of distribution channel?

- What is the breakup of the Mexico potato chips market on the basis of region?

- What are the various stages in the value chain of the Mexico potato chips market?

- What are the key driving factors and challenges in the Mexico potato chips market?

- What is the structure of the Mexico potato chips market and who are the key players?

- What is the degree of competition in the Mexico potato chips market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico potato chips market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico potato chips market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico potato chips industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)