Mexico Powder Coatings Market Size, Share, Trends and Forecast by Resin Type, Coating Method, Application, and Region, 2025-2033

Mexico Powder Coatings Market Overview:

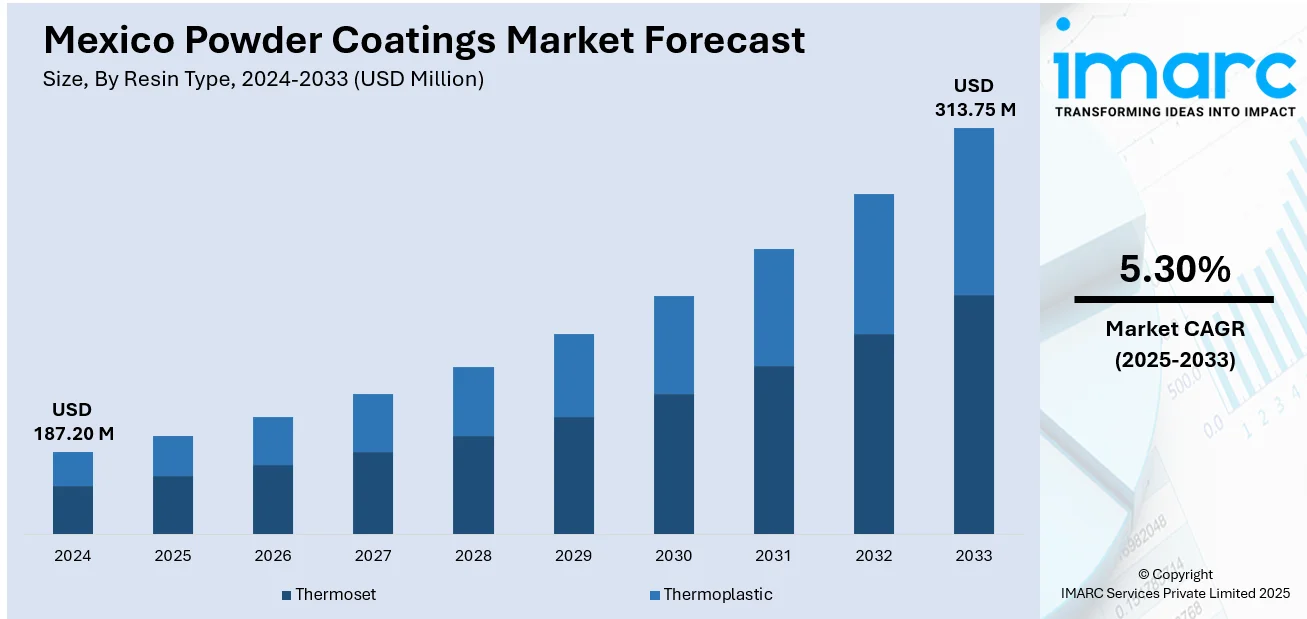

The Mexico powder coatings market size reached USD 187.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 313.75 Million by 2033, exhibiting a growth rate (CAGR) of 5.30% during 2025-2033. The market is driven by the growing demand from the country's construction and automotive sectors, which increasingly require durable and cost-effective coating solutions. Along with this, environmental regulations are pushing manufacturers to adopt powder coatings over solvent-based alternatives due to lower emissions and waste. Additionally, rising domestic manufacturing and foreign investments in industrial production continue to boost consumption across appliances, agriculture equipment, and general metals, further augmenting the Mexico powder coatings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 187.20 Million |

| Market Forecast in 2033 | USD 313.75 Million |

| Market Growth Rate 2025-2033 | 5.30% |

Mexico Powder Coatings Market Trends:

Growth in Domestic Appliance and Consumer Goods Manufacturing

The rising demand for powder coatings in Mexico is closely tied to the expansion of domestic manufacturing, especially in the home appliance and consumer goods sectors. As more manufacturers set up or scale operations locally, surface finishing requirements for products such as refrigerators, washing machines, microwaves, have become increasingly critical to maintaining product quality, durability, and visual appeal. According to an industry reports, the home appliances market in Mexico is expected to reach USD 12.7 Billion by 2033, exhibiting a growth rate (CAGR) of 5.9% during 2025-2033. The growth underscores a rising production output that directly contributes to increased demand for powder coating technologies across the sector. Moreover, global companies are relocating or expanding production facilities in Mexico to benefit from the country's trade agreements, skilled labor, and strategic proximity to the United States. This trend is further supported by the nation's participation in regional value chains under agreements like the USMCA, which have encouraged greater investment in localized sourcing and assembly. As production volumes rise, manufacturers are focusing on cost-effective and efficient surface finishing methods that meet export standards. Powder coatings, due to their operational efficiency and minimal rework rates, offer a significant advantage in high-throughput manufacturing environments. Additionally, the trend toward customization and color variety in consumer products is pushing coating suppliers to develop more flexible and responsive solutions for appliance manufacturers.

To get more information on this market, Request Sample

Expansion of the Automotive and Transportation Sectors

The expansion of the automotive industry and the growth of original equipment manufacturing (OEM) and aftermarket services, is positively impacting the Mexico powder coatings market growth. Moreover, the country is one of the top global vehicle exporters and hosts numerous production plants for major automakers and tier suppliers. Powder coatings are widely used in the finishing of vehicle frames, wheels, suspension components, and various under-the-hood parts due to their resistance to abrasion, chemicals, and weathering. As automotive platforms become more modular and lightweight, the demand for specialized coatings that provide protection without adding significant mass is increasing. Powder coatings meet these needs while offering excellent appearance and durability. Moreover, EV components such as battery casings, charging stations, and internal chassis parts are also coated using powder technologies. Industry projections indicate that Mexico plans to eliminate fossil fuel-powered vehicles from its market by 2035. Meanwhile, the shift toward cleaner transportation is already underway. As per industry reports, sales of electrified vehicles, which include hybrids and fully electric models, increased by 41.1% by the end of 2024, reaching a total of 12,147 units. With rising EV vehicle ownership and export volumes, the sector continues to expand application opportunities for functional and decorative powder coatings.

Mexico Powder Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on resin type, coating method, and application.

Resin Type Insights:

- Thermoset

- Epoxy

- Polyester

- Epoxy Polyester Hybrid

- Acrylic

- Thermoplastic

- Polyvinyl Chloride (PVC)

- Nylon

- Polyolefin

- Polyvinylidene Fluoride (PVDF)

The report has provided a detailed breakup and analysis of the market based on the resin type. This includes thermoset (epoxy, polyester, epoxy polyester hybrid, and acrylic) and thermoplastic [polyvinyl chloride (PVC), nylon, polyolefin, and polyvinylidene fluoride (PVDF)].

Coating Method Insights:

- Electrostatic Spray

- Fluidized Bed

A detailed breakup and analysis of the market based on the coating method have also been provided in the report. This includes electrostatic spray and fluidized bed.

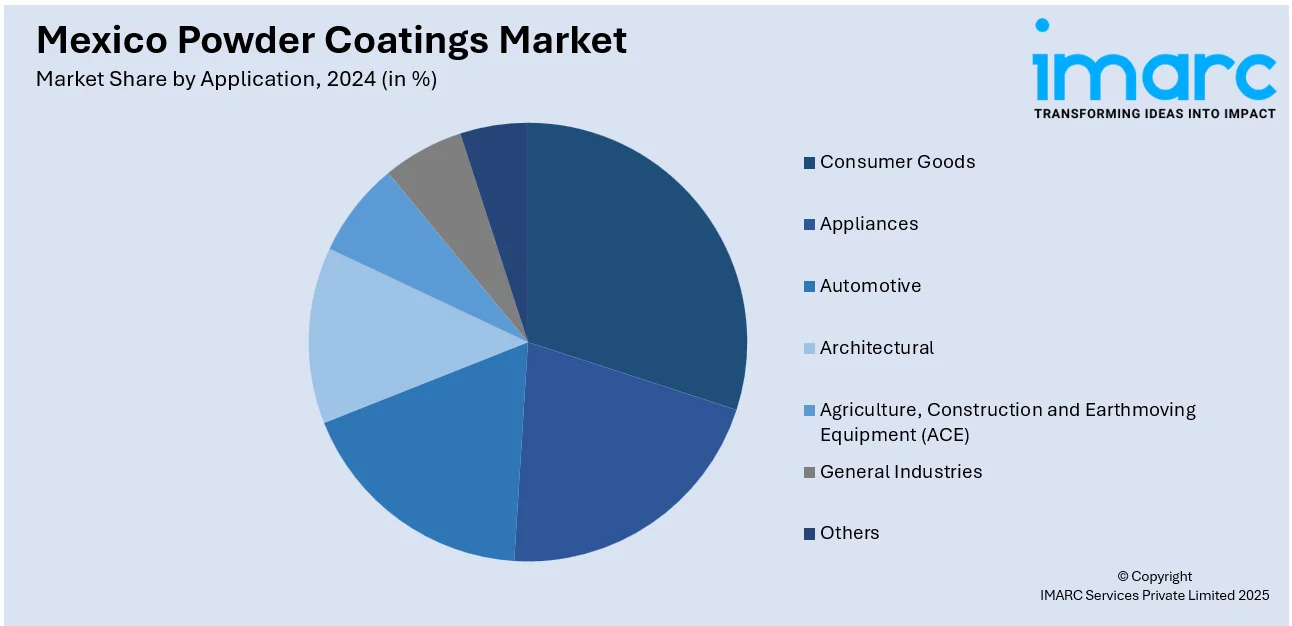

Application Insights:

- Consumer Goods

- Appliances

- Automotive

- Architectural

- Agriculture, Construction and Earthmoving Equipment (ACE)

- General Industries

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes consumer goods, appliances, automotive, architectural, agriculture, construction and earthmoving equipment (ACE), general industries, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Powder Coatings Market News:

- On March 14, 2025, Neuce announced a USD 600 Million investment to build a new coatings plant in Tlaxcala, Mexico, as part of its global expansion strategy targeting key sectors such as automotive, aluminum extrusion, and construction materials. The facility will feature 10 production lines with a daily capacity of 280 tons each and is expected to be operational by the end of 2025.

Mexico Powder Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered |

|

| Coating Methods Covered | Electrostatic Spray, Fluidized Bed |

| Applications Covered | Consumer Goods, Appliances, Automotive, Architectural, Agriculture, Construction and Earthmoving Equipment (ACE), General Industries, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico powder coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico powder coatings market on the basis of resin type?

- What is the breakup of the Mexico powder coatings market on the basis of coating method?

- What is the breakup of the Mexico powder coatings market on the basis of application?

- What is the breakup of the Mexico powder coatings market on the basis of region?

- What are the various stages in the value chain of the Mexico powder coatings market?

- What are the key driving factors and challenges in the Mexico powder coatings market?

- What is the structure of the Mexico powder coatings market and who are the key players?

- What is the degree of competition in the Mexico powder coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico powder coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico powder coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico powder coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)