Mexico Power Plant Equipment Market Size, Share, Trends and Forecast by Technology, Power Plant Type, and Region, 2026-2034

Mexico Power Plant Equipment Market Summary:

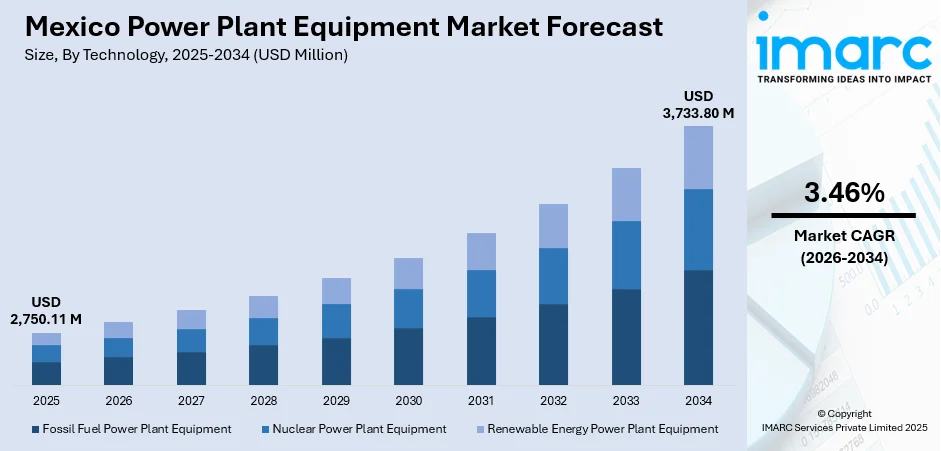

The Mexico power plant equipment market size reached USD 2,750.11 Million in 2025 and is projected to reach USD 3,733.80 Million by 2034, growing at a compound annual growth rate of 3.46% from 2026-2034.

The Mexico power plant equipment market is experiencing steady growth driven by the country's ongoing energy transformation initiatives and infrastructure modernization programs. The market encompasses a diverse range of technologies, including fossil fuel-based generation systems, renewable energy components, and hybrid power solutions designed to enhance grid flexibility. Rising investments in utility-scale generation projects, combined with the imperative to replace aging power infrastructure, are creating sustained demand across equipment categories throughout the forecast period.

Key Takeaways and Insights:

- By Technology: Fossil fuel power plant equipment dominates the market with a share of 52% in 2025, driven by Mexico's substantial reliance on natural gas-fired combined cycle plants for baseload power generation and the ongoing modernization of existing thermal facilities across the country.

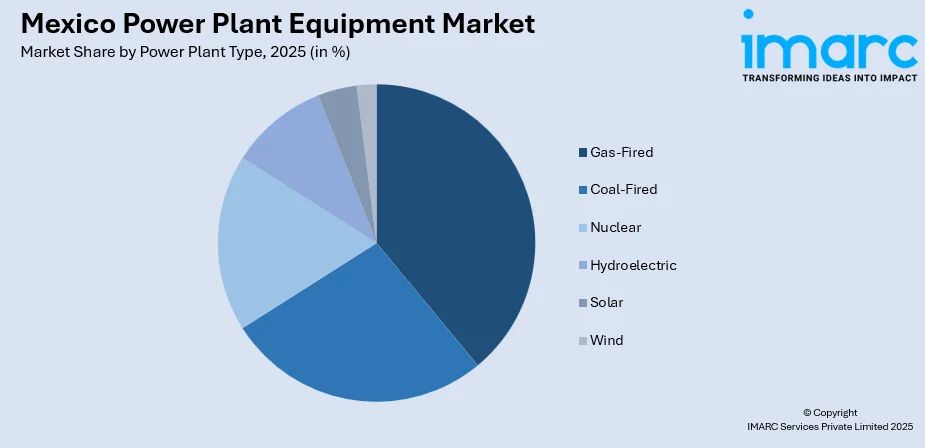

- By Power Plant Type: Gas-fired leads the market with a share of 39% in 2025, owing to the abundant supply of imported natural gas from the United States via cross-border pipelines and the superior efficiency of modern combined cycle gas turbine technology.

- Key Players: The Mexico power plant equipment market exhibits moderate competitive intensity, characterized by the presence of global equipment manufacturers competing alongside regional suppliers. Market participants are focused on providing advanced turbine technologies, digital control systems, and grid integration solutions to address the country's evolving energy requirements.

To get more information on this market Request Sample

The Mexico power plant equipment market is undergoing significant transformation as the country balances energy security priorities with sustainability objectives. The state-owned Comisión Federal de Electricidad continues to drive major infrastructure investments, with plans to add substantial generation capacity through combined cycle natural gas plants while simultaneously expanding renewable energy installations. The federal government's Plan for Strengthening and Expansion of the National Electric System outlines investments exceeding twenty billion dollars through the end of the decade to add 22,674 MW of new capacity. This comprehensive development program encompasses the construction of new combined cycle facilities in states including Guanajuato, Hidalgo, Sinaloa, and Baja California Sur, alongside transmission network upgrades to address bottlenecks in high-demand industrial corridors. The nearshoring trend has intensified electricity demand, particularly in northern border states where manufacturing investment has surged, further accelerating equipment procurement across the power generation value chain.

Mexico Power Plant Equipment Market Trends:

Combined Cycle Technology Expansion

Mexico is witnessing a substantial deployment of advanced combined cycle gas turbine technology to address growing electricity demand while improving generation efficiency. Modern combined cycle plants offer superior flexibility to support grid operations during peak demand periods and provide essential backup for intermittent renewable generation. The introduction of advanced turbine models capable of rapid startup and hydrogen-blending compatibility positions the market for future energy transition requirements while maintaining baseload reliability.

Renewable Integration Equipment Adoption

The market is experiencing increased demand for equipment supporting renewable energy integration into the national grid. The Mexico renewable energy market size reached 35.42 GW in 2024. Looking forward, the market is expected to reach 84.64 GW by 2033, exhibiting a growth rate (CAGR) of 9.40% during 2025-2033. Solar photovoltaic installations and wind power projects require sophisticated inverters, grid synchronization systems, and energy management platforms to ensure stable operations. Battery energy storage systems are gaining traction as regulatory requirements mandate storage capacity equivalent to a specified percentage of renewable installed capacity, creating new equipment demand categories.

Grid Modernization and Smart Infrastructure

Transmission and distribution infrastructure modernization is driving demand for advanced substation equipment, automation systems, and monitoring technologies. The national power system development program emphasizes smart grid deployment, including remote operation capabilities, advanced metering infrastructure, and control center modernization. Digital transformation initiatives are enhancing equipment specifications to incorporate predictive maintenance capabilities and real-time performance optimization features. The Mexico grid modernization market size reached USD 568.18 Million in 2024. Looking forward, the market is expected to reach USD 3,070.87 Million by 2033, exhibiting a growth rate (CAGR) of 20.62% during 2025-2033.

Market Outlook 2026-2034:

The Mexico power plant equipment market demonstrates favorable growth prospects throughout the forecast period, supported by government-led infrastructure expansion programs and private sector participation in renewable energy development. The national strategy targeting significant clean energy contributions to the generation mix by the end of the decade creates sustained demand for both conventional and renewable equipment categories. Industrial electricity consumption growth driven by manufacturing investment and nearshoring activity adds further momentum to capacity expansion plans. The market generated a revenue of USD 2,750.11 Million in 2025 and is projected to reach a revenue of USD 3,733.80 Million by 2034, growing at a compound annual growth rate of 3.46% from 2026-2034.

Mexico Power Plant Equipment Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Technology | Fossil Fuel Power Plant Equipment | 52% |

| Power Plant Type | Gas-Fired | 39% |

Technology Insights:

- Fossil Fuel Power Plant Equipment

- Nuclear Power Plant Equipment

- Renewable Energy Power Plant Equipment

The fossil fuel power plant equipment segment dominates with a market share of 52% of the total Mexico power plant equipment market in 2025.

Fossil fuel power plant equipment maintains its dominant position in the Mexico market, reflecting the country's continued reliance on thermal generation for baseload electricity supply. Natural gas-fired combined cycle plants represent the primary application for this equipment category, with gas turbines, heat recovery steam generators, and auxiliary systems comprising the bulk of procurement activity. The ongoing replacement of aging thermal facilities with modern high-efficiency units drives equipment demand, as operators seek to extend asset lifecycles while reducing operational costs and environmental footprints through technology upgrades.

The segment benefits from Mexico's strategic position as a major importer of natural gas from the United States, with pipeline infrastructure enabling cost-effective fuel supply for gas-fired generation. Combined cycle technology offers operational flexibility essential for supporting renewable energy integration while maintaining grid stability during demand fluctuations. Manufacturers are adapting to evolving market needs by rolling out next-generation turbine technologies designed for faster startup, higher efficiency, and operational flexibility. These upgraded models also support hydrogen-fuel blending, positioning them to align with long-term decarbonization strategies and future clean-energy transitions.

Power Plant Type Insights:

Access the comprehensive market breakdown Request Sample

- Coal-Fired

- Gas-Fired

- Nuclear

- Hydroelectric

- Solar

- Wind

The gas-fired segment leads with a share of 39% of the total Mexico power plant equipment market in 2025.

Gas-fired power plant equipment commands the largest share of the Mexico market, driven by the substantial expansion of combined cycle capacity across the country. Natural gas accounts for the majority of electricity generation on any given day, establishing gas turbines and associated equipment as essential components of the national power infrastructure. The state utility's generation expansion plan includes multiple combined cycle projects in various states, creating sustained procurement activity for turbines, generators, heat recovery systems, and digital control platforms.

The segment's growth trajectory reflects favorable economics of natural gas generation relative to alternative fuel sources, supported by expanding cross-border pipeline capacity from Texas and offshore Gulf of Mexico infrastructure developments. Modern gas-fired equipment incorporates advanced features, including distributed control systems enabling real-time performance optimization and predictive maintenance capabilities. The ability of combined cycle plants to provide grid flexibility through rapid ramping and load following operations positions gas-fired equipment as complementary to renewable energy expansion rather than competitive with it.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico’s power-plant equipment demand is propelled by rapid industrial expansion, maquiladora activity, and strong electricity trade with the United States. Extensive deployment of utility-scale solar and wind assets increases the need for turbines, inverters, transformers, and grid-balancing systems. The region’s reliance on natural-gas-fired generation also supports procurement of combined-cycle components, high-pressure boilers, and gas turbines, alongside investments in transmission upgrades to integrate remote renewable clusters.

Central Mexico’s market is driven by dense urban populations, heavy commercial activity, and aging thermal infrastructure requiring modernization. High electricity consumption across the Mexico City–State of Mexico corridor pushes demand for upgraded turbines, boilers, substation automation, and efficient distribution transformers. Growing electrification, digital industry expansion, data center development, and grid-reliability challenges also encourage investments in control systems, smart grid technologies, and flexible generation equipment.

Southern Mexico’s equipment demand is influenced by abundant renewable resources in states like Oaxaca, Chiapas, and Veracruz. Large wind corridors, hydropower basins, and geothermal prospects fuel requirements for wind turbines, hydro-mechanical systems, geothermal units, and advanced power-electronics. Long-distance transmission projects to move renewable output northward intensify needs for high-voltage lines, substations, and step-up transformers. Limited local industrial capacity further drives demand for turnkey EPC equipment packages and specialized installation solutions.

Market Dynamics:

Growth Drivers:

Why is the Mexico Power Plant Equipment Market Growing?

National Infrastructure Expansion Programs

The Mexico power plant equipment market benefits significantly from comprehensive government-led infrastructure expansion initiatives aimed at addressing electricity supply constraints and supporting economic development objectives. For instance, in October 2025, Mexico’s National Energy Commission (CNE) and the Ministry of Energy (SENER) issued a notice in the Official Journal inviting proposals for new energy developments. The call focuses on projects starting from 0.7 MW that must obtain generation and interconnection approvals while complying with the technical, geographic, and operational requirements outlined in the binding planning’s technical annex. The federal administration has outlined substantial investment commitments for new generation capacity and transmission network enhancements through the end of the decade. These programs encompass the construction of multiple combined cycle facilities across various states, the rehabilitation and modernization of existing hydroelectric plants, and the development of renewable energy installations to diversify the generation portfolio. The state utility's expanded mandate to maintain a majority generation share creates predictable demand for equipment procurement across project categories. Infrastructure investment extends beyond generation to include critical transmission and distribution upgrades addressing bottlenecks in high-demand industrial corridors where nearshoring activity has intensified electricity requirements.

Industrial Electricity Demand Growth

Rising industrial electricity consumption driven by manufacturing investment and supply chain reconfiguration creates sustained demand for power generation equipment throughout Mexico. The nearshoring trend has attracted substantial foreign direct investment to the manufacturing sector, with industrial parks and production facilities requiring reliable electricity supply for operations. Northern border states and central industrial regions have experienced particularly strong demand growth as companies establish or expand manufacturing operations. This industrial expansion has exposed constraints in existing generation and transmission capacity, prompting accelerated investment in new power plants and grid reinforcement projects. Equipment suppliers benefit from procurement requirements across the generation value chain, including turbines, generators, transformers, switchgear, and control systems necessary to support increased industrial loads.

Energy Security and Grid Reliability Imperatives

The imperative to enhance energy security and grid reliability drives equipment investment as Mexico addresses challenges exposed by demand surges and generation shortfalls. Periods of peak electricity consumption during extreme weather events have revealed vulnerability in the national power system, prompting prioritization of capacity additions and infrastructure modernization. The government strategy emphasizes maintaining adequate operational reserve margins to prevent supply interruptions during demand spikes and equipment outages. This reliability focus supports procurement of generation equipment including gas turbines capable of rapid deployment and flexible operation, as well as grid infrastructure components enhancing system resilience. Investments in transmission capacity and substation equipment address congestion in critical network segments, enabling more efficient distribution of generated electricity to load centers. The combination of reliability requirements and capacity expansion objectives creates favorable conditions for sustained equipment market growth.

Market Restraints:

What Challenges the Mexico Power Plant Equipment Market is Facing?

Regulatory Framework Uncertainty

The Mexico power plant equipment market faces challenges from evolving regulatory frameworks affecting private sector participation in the electricity sector. Recent constitutional amendments redefining the roles of state and private entities introduce uncertainty regarding investment conditions and market access for independent power producers. Equipment procurement patterns may be affected by shifts in project development timelines and financing structures as market participants adapt to revised regulatory requirements.

Transmission Infrastructure Constraints

Existing transmission network limitations constrain the pace of new generation capacity deployment in certain regions of Mexico. Grid congestion in high-demand industrial corridors can delay interconnection of new power plants, affecting equipment delivery schedules and project economics. The significant investment required for transmission expansion creates potential bottlenecks for generation equipment demand in regions where grid capacity lags behind planned additions.

Global Equipment Supply Chain Pressures

The Mexico market experiences effects of global supply chain pressures affecting availability and pricing of specialized power generation equipment. Extended lead times for gas turbines and other critical components may impact project implementation schedules. Rising equipment costs resulting from supply-demand imbalances in global markets influence project economics and potentially affect procurement decisions by power generators.

Competitive Landscape:

The Mexico power plant equipment market exhibits a moderately fragmented competitive structure characterized by participation of established multinational equipment manufacturers alongside regional engineering and procurement contractors. Market dynamics favor suppliers capable of delivering integrated solutions encompassing equipment supply, engineering services, and after-market support. Technology leadership in gas turbine efficiency and flexibility represents a key competitive differentiator, with advanced combined cycle configurations commanding premium positioning. The market demonstrates growing emphasis on digitalization capabilities, with equipment featuring integrated monitoring, control, and predictive maintenance functionality gaining preference among power generators. Strategic partnerships between global equipment suppliers and local engineering firms facilitate market access and project execution. Competitive intensity has increased as capacity expansion programs attract participation from diverse supplier categories, while established relationships between equipment manufacturers and the state utility influence procurement patterns.

Recent Developments:

- In January 2024, the Topolobampo III combined cycle power plant commenced commercial operations in Sinaloa state, featuring advanced gas turbine technology representing the first deployment of its model in Mexico and providing generation capacity sufficient to supply electricity to over one million households.

Mexico Power Plant Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Fossil Fuel Power Plant Equipment, Nuclear Power Plant Equipment, Renewable Energy Power Plant Equipment |

| Power Plant Types Covered | Coal-Fired, Gas-Fired, Nuclear, Hydroelectric, Solar, Wind |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico power plant equipment market size was valued at USD 2,750.11 Million in 2025.

The Mexico power plant equipment market is expected to grow at a compound annual growth rate of 3.46% from 2026-2034 to reach USD 3,733.80 Million by 2034.

Fossil fuel power plant equipment dominates the technology segment with 52% in 2025, commanding the largest share of the Mexico power plant equipment market, driven by Mexico's continued reliance on gas-fired combined cycle plants for baseload electricity generation and ongoing thermal facility modernization programs.

Key factors driving the Mexico power plant equipment market include national infrastructure expansion programs, rising industrial electricity demand from nearshoring-driven manufacturing growth, energy security imperatives requiring capacity additions, and grid modernization initiatives enhancing transmission and distribution capabilities.

Major challenges include evolving regulatory frameworks affecting private sector participation, transmission infrastructure constraints limiting capacity deployment in certain regions, global equipment supply chain pressures extending lead times, and coordination requirements between generation expansion and grid reinforcement investments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)