Mexico Power Transmission Equipment Market Size, Share, Trends and Forecast by Equipment Type, Voltage Type, Application, and Region, 2025-2033

Mexico Power Transmission Equipment Market Overview:

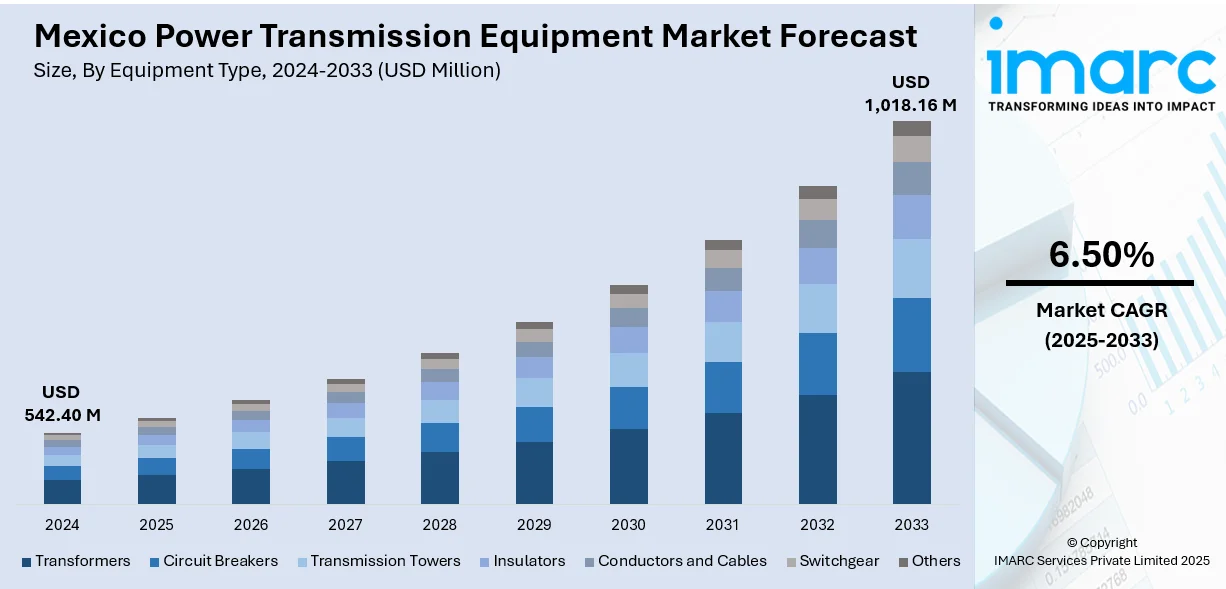

The Mexico power transmission equipment market size reached USD 542.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,018.16 Million by 2033, exhibiting a growth rate (CAGR) of 6.50% during 2025-2033. The market is driven by rising electricity demand due to urbanization and industrial growth, prompting major grid expansion and modernization efforts. The country's push towards renewable energy integration requires advanced transmission solutions to handle variable power flows and ensure grid stability. Additionally, growing investment in smart grid technologies including automation, real-time monitoring, and predictive maintenance is transforming the transmission network, enhancing efficiency and reliability while supporting Mexico power transmission equipment market share goals for a cleaner, more resilient, and future-ready power infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 542.40 Million |

| Market Forecast in 2033 | USD 1,018.16 Million |

| Market Growth Rate 2025-2033 | 6.50% |

Mexico Power Transmission Equipment Market Trends:

Growing Electricity Demand and Infrastructure Expansion

Mexico's economic development and urbanization are demanding electricity to unprecedented levels. Industrial zones, residential complexes, and technological parks are being rapidly developed, putting tremendous pressure on the national grid to provide constant power. All these demand considerable improvements and widening of the transmission network connecting remote power generation sites with central consumption points. The government and independent energy players are investing in constructing new high-voltage lines, substations, and related equipment to avoid congestion and blackouts. The suppliers of transmission equipment are seeing consistent demand for transformers, insulators, and switchgear as part of these projects. Mexico power transmission equipment market growth is being driven by this sustained infrastructure expansion, which not only meets existing demands but also positions the system to handle future industrial and digital loads, keeping the capacity and dependability of the grid in step with Mexico's socio-economic aspirations.

To get more information on this market, Request Sample

Shift Toward Renewable Energy Integration

Mexico’s strong push toward renewable energy, especially solar and wind, is reshaping its power transmission infrastructure. With more energy coming from geographically dispersed and variable renewable sources, the grid requires advanced solutions to manage fluctuating power flows. Utilities are increasingly adopting specialized transformers, flexible AC transmission systems (FACTS), and grid management software to ensure voltage stability, power factor correction, and efficient energy storage. This need is further emphasized by the rapid rise in distributed generation, which reached 3.89 GW capacity with nearly 461,000 interconnection contracts by mid‑2024. Such growth reflects widespread adoption of rooftop solar and other small-scale systems feeding power into the grid. To accommodate these changes, Mexico’s transmission network is undergoing modernization to seamlessly integrate both large-scale renewables and distributed energy sources. Equipment manufacturers are developing solutions tailored to meet the technical challenges of this evolving, cleaner, and more complex energy landscape.

Grid Modernization and Technological Advancements

Mexico is upgrading its power transmission infrastructure by adopting smart technologies to enhance efficiency, reliability, and management. Utilities are moving from conventional grid elements to smart transformers, digital switchgear, and automated substations with real-time monitoring and remote control. This upgradation enables the grid to react rapidly to faults, balance loads effectively, and minimize energy losses. The demand for smart grid solutions is further fueled by the requirement to become resilient against system breakdowns and weather disturbances. Transmission companies are putting their money into equipment that combines data analysis, Internet of Things (IoT) functionality, and condition-based maintenance. Mexico power transmission equipment market trends reflect this wider shift toward digitalization and automation, making Mexico's energy sector increasingly adaptable, sustainable, and ready for new technologies such as electric cars and distributed resources.

Mexico Power Transmission Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on equipment type, voltage level, and application.

Equipment Type Insights:

- Transformers

- Circuit Breakers

- Transmission Towers

- Insulators

- Conductors and Cables

- Switchgear

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes transformers, circuit breakers, transmission towers, insulators, conductors and cables, switchgear, and others.

Voltage Level Insights:

- High Voltage (HV)

- Extra High Voltage (EHV)

- Ultra High Voltage (UHV)

A detailed breakup and analysis of the market based on the voltage level have also been provided in the report. This includes high voltage (HV), extra high voltage (EHV), and ultra high voltage (UHV).

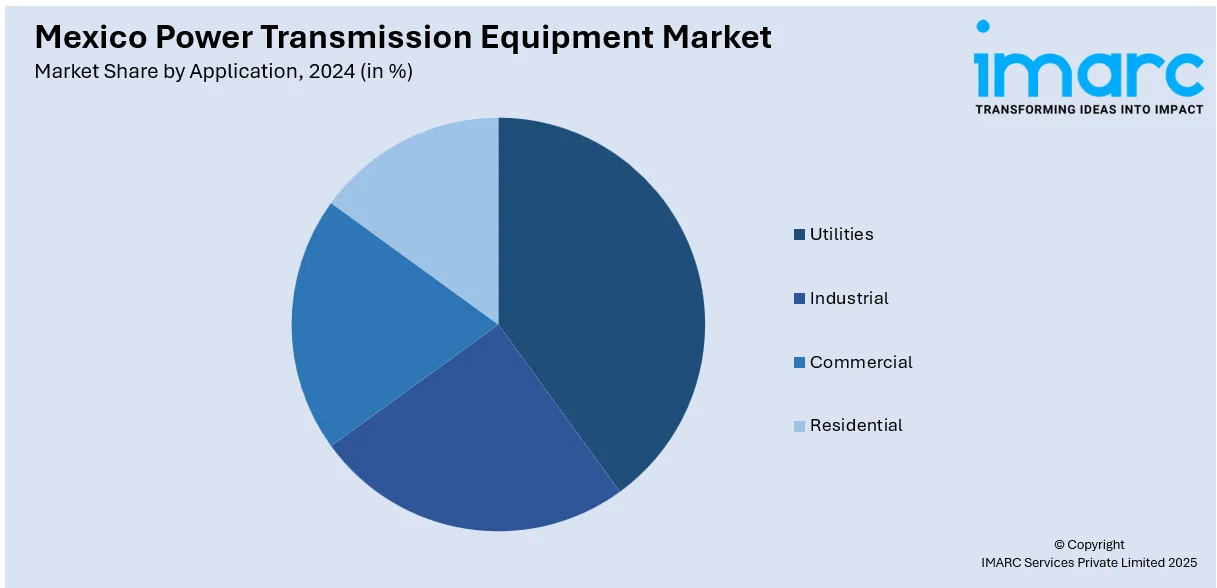

Application Insights:

- Utilities

- Industrial

- Commercial

- Residential

The report has provided a detailed breakup and analysis of the market based on the application. This includes utilities, industrial, commercial, and residential.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Power Transmission Equipment Market News:

- In August 2024, CFE will invest MX$2.903 billion (US$170.76 million) from 2024 to 2026 to maintain 399 transmission and 678 sub-transmission lines nationwide and acquire operational vehicles to reduce grid downtime. This effort addresses private sector calls for stronger transmission infrastructure, essential for supporting renewable energy growth and nearshoring demands. Despite past maintenance successes, experts warn that persistent underinvestment in transmission and distribution remains a key cause of blackouts and grid inefficiencies in Mexico.

- In January 2024, New Mexico’s largest electric utility, PNM Resources, announced the termination of its proposed $4.3 billion merger with Connecticut-based Avangrid, a subsidiary of energy giant Iberdrola. The deal, which would have expanded renewable energy development and job creation in New Mexico, was canceled by Avangrid. PNM expressed disappointment, highlighting the missed opportunity to enhance energy efficiency and serve customers through the merger.

Mexico Power Transmission Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Transformers, Circuit Breakers, Transmission Towers, Insulators, Conductors and Cables, Switchgear, Others |

| Voltage Types Covered | High Voltage (HV), Extra High Voltage (EHV), Ultra High Voltage (UHV) |

| Applications Covered | Utilities, Industrial, Commercial, Residential. |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico power transmission equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico power transmission equipment market on the basis of equipment type?

- What is the breakup of the Mexico power transmission equipment market on the basis of voltage type?

- What is the breakup of the Mexico power transmission equipment market on the basis of application?

- What is the breakup of the Mexico power transmission equipment market on the basis of region?

- What are the various stages in the value chain of the Mexico power transmission equipment market?

- What are the key driving factors and challenges in the Mexico power transmission equipment market?

- What is the structure of the Mexico power transmission equipment market and who are the key players?

- What is the degree of competition in the Mexico power transmission equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico power transmission equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico power transmission equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico power transmission equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)