Mexico Pre-Owned Car Market Size, Share, Trends and Forecast by Vehicle Type, Vendor Type, Fuel Type, Sales Channel, and Region, 2025-2033

Mexico Pre-Owned Car Market Overview:

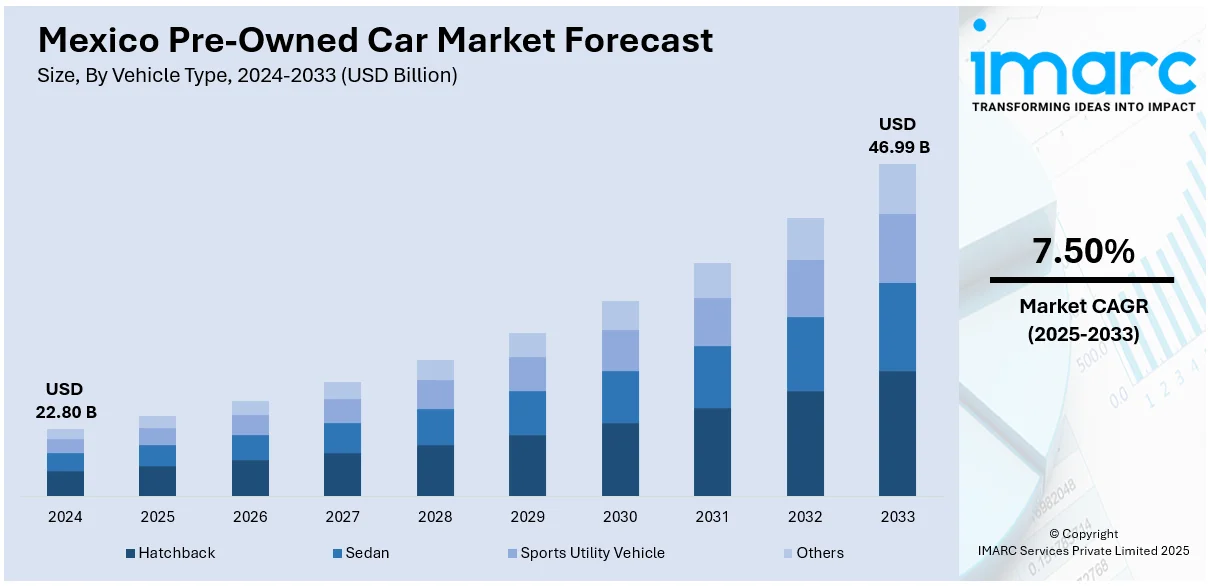

The Mexico pre-owned car market size reached USD 22.80 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 46.99 Billion by 2033, exhibiting a growth rate (CAGR) of 7.50% during 2025-2033. The market is fueled by rising affordability, better financing options, and the growth of digital platforms. Consumers are expressing strong demand for certified, fuel-efficient, and environmentally compliant vehicles. Technological advancements, including virtual showrooms and blockchain for ownership verification, are enhancing consumer confidence and the transparency of transactions. These changes point to a wider shift toward sustainable and reliable mobility solutions, which are fueling the continued growth in Mexico pre-owned car market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 22.80 Billion |

| Market Forecast in 2033 | USD 46.99 Billion |

| Market Growth Rate 2025-2033 | 7.50% |

Mexico Pre-Owned Car Market Trends:

Increasing Affordability and Financial Inclusion Spurring Pre-Owned Car Sales

The heightened demand for pre-owned vehicles in Mexico is due mainly to their affordability and rising availability of consumer-friendly financing products. With new vehicle prices still on the rise, a majority of customers, especially from the lower and middle-income groups, are finding pre-owned vehicles as an option that offers value along with reliability. Financial institutions and web-based marketplaces now provide pre-owned car financing packages in the form of lower interest rates, zero down payment, and longer repayment periods. These innovations have enhanced access to ownership of cars even among first-time car buyers. Further, low insurance premiums and depreciation rates for pre-owned cars make them an economically viable option. Increased inventory through dealerships as well as online platforms further accommodates consumer demand. According to the reports, in March of 2023, used cars propelled the recovery of car sales in Querétaro as dealerships revalued used vehicles with new shortages in inventory, increasing market confidence and provoking a certified digital sales platform. Moreover, with ongoing economic uncertainty, pre-owned vehicles are emerging as a solid option for individual transportation. These combined elements are directly responsible for the market growth, displaying robust resilience and flexibility in the automobile ecosystem.

To get more information on this market, Request Sample

Technological developments redesigning purchaser behavior and market nature

Technological innovation is significantly altering the behavior of purchasers toward the pre-owned car market in Mexico. Online platforms have brought in transparency and ease to the purchasing process with services like 360-degree virtual tours, artificial intelligence-based vehicle evaluations, online loan applications, and test drive scheduling enabled with GPS. These technologies enable buyers to make informed choices without stepping into dealerships. Blockchain is also being researched to minimize title fraud and validate vehicle documents, building consumer confidence. Concurrently, mobile apps offer real-time listings, price comparison functionality, and condition check functionality, making the buying process more efficient. In addition, websites make it easier to transfer ownership and view maintenance history, boosting the demand for certified pre-owned cars. Overall, digitization of services has lowered transaction time and expenses and enhanced customer satisfaction. This transformation towards technology integration is one of the most important drivers of Mexico pre-owned car market trends, facilitating greater market engagement and operational efficiency along the value chain.

Sustainability and Certification Shape Consumer Choice

Environmental awareness and quality certification are highly influencing consumer choice for pre-owned vehicles in Mexico. Consumers are highly inclined towards certified pre-owned vehicles featuring verified performance levels, longer warranties, and reduced emissions. They usually get multi-point checking to conform with environmental and safety standards, an aspect that supports the government initiative towards cleaner modes of transport. City emission-control regulations are also motivating people to buy environmentally friendly vehicles that meet current environmental standards. Fuel efficiency and eco-labeling, therefore, have emerged as key factors in consumer choice. Moreover, the market value of certified low-emission vehicles continues to be high, supporting their demand. Dealerships and websites have, in turn, accelerated their certified inventories to meet this demand. This shift towards environmentally friendly and quality-checked automobile choices is a sign of an evolving auto consumer base. Therefore, these choices are instrumental in developing the Mexico pre-owned car market growth, more so in urbanized and environmentally conscious areas.

Mexico Pre-Owned Car Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on vehicle type, vendor type, fuel type, and sales channel.

Vehicle Type Insights:

- Hatchback

- Sedan

- Sports Utility Vehicle

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes hatchback, sedan, sports utility vehicle, and others.

Vendor Type Insights:

- Organized

- Unorganized

A detailed breakup and analysis of the market based on the vendor type have also been provided in the report. This includes organized and unorganized.

Fuel Type Insights:

- Gasoline

- Diesel

- Others

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes gasoline, diesel, and others.

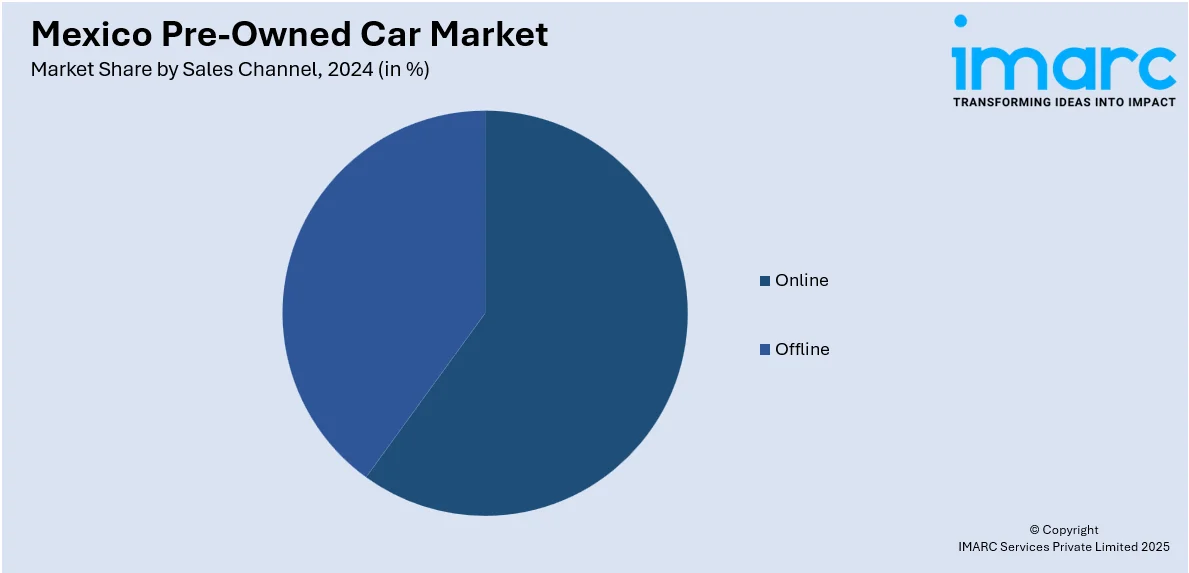

Sales Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes online and offline.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Pre-Owned Car Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Hatchback, Sedan, Sports Utility Vehicle, Others |

| Vendor Types Covered | Organized, Unorganized |

| Fuel Types Covered | Gasoline, Diesel, Others |

| Sales Channels Covered | Online, Offline |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico pre-owned car market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico pre-owned car market on the basis of vehicle type?

- What is the breakup of the Mexico pre-owned car market on the basis of vendor type?

- What is the breakup of the Mexico pre-owned car market on the basis of fuel type?

- What is the breakup of the Mexico pre-owned car market on the basis of sales channel?

- What is the breakup of the Mexico pre-owned car market on the basis of region?

- What are the various stages in the value chain of the Mexico pre-owned car market?

- What are the key driving factors and challenges in the Mexico pre-owned car?

- What is the structure of the Mexico pre-owned car market and who are the key players?

- What is the degree of competition in the Mexico pre-owned car market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico pre-owned car market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico pre-owned car market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico pre-owned car industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)