Mexico Prepaid Cards Market Size, Share, Trends and Forecast by Card Type, Purpose, Vertical, and Region, 2026-2034

Mexico Prepaid Cards Market Summary:

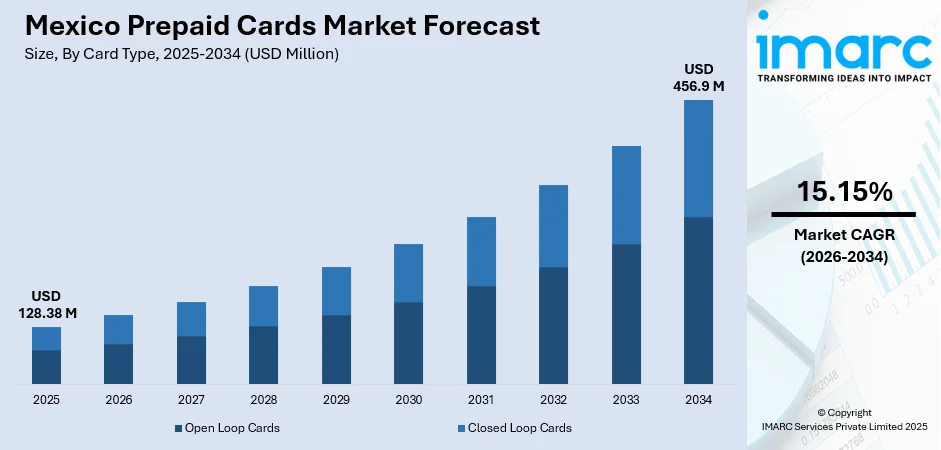

The Mexico prepaid cards market size was valued at USD 128.38 Million in 2025 and is projected to reach USD 456.9 Million by 2034, growing at a compound annual growth rate of 15.15% from 2026-2034.

The Mexico prepaid cards market is experiencing robust expansion driven by increasing digital payment adoption and the country's substantial unbanked population seeking accessible financial solutions. The proliferation of e-commerce platforms, growing smartphone penetration among the population, and government-led financial inclusion initiatives are accelerating prepaid card usage across diverse consumer segments. Additionally, the integration of prepaid solutions with mobile wallets and the expansion of remittance-linked payment services are reinforcing the Mexico prepaid cards market share.

Key Takeaways and Insights:

-

By Card Type: Open loop cards dominate the market with a share of 69% in 2025, driven by their universal acceptance across payment networks and flexibility for diverse transaction types including retail purchases and online payments.

-

By Purpose: General Purpose Reloadable (GPR) cards lead the market with a share of 42% in 2025, owing to their versatility as banking alternatives for unbanked populations and their growing adoption for payroll disbursements.

-

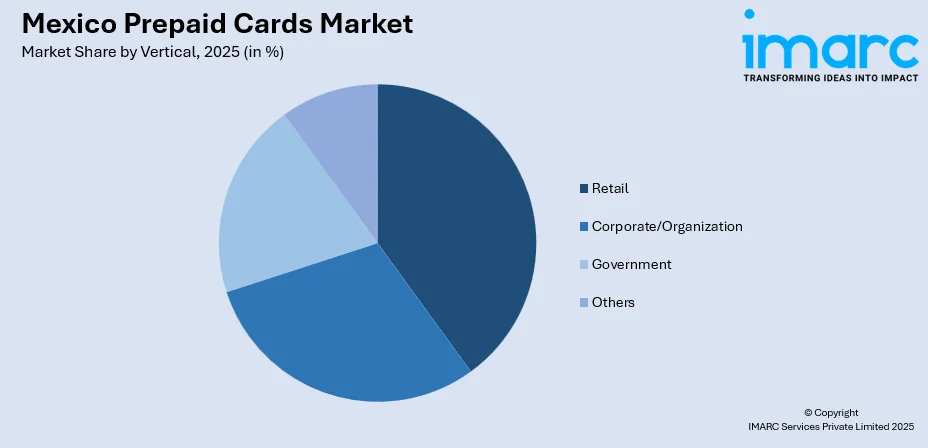

By Vertical: Retail represents the largest segment with a market share of 36% in 2025, attributed to the widespread deployment of gift cards and loyalty programs across convenience stores and department chains nationwide.

-

Key Players: The Mexico prepaid cards market exhibits a moderately consolidated competitive structure, with global payment networks collaborating alongside domestic financial institutions and retail chains. Major international payment providers compete with regional fintech companies and banking entities offering innovative prepaid solutions tailored to local consumer preferences and regulatory requirements.

To get more information on this market Request Sample

The Mexican prepaid cards industry is positioned at the intersection of digital transformation and financial inclusion, serving as a critical bridge for millions of consumers lacking traditional banking access. With the population remaining financially excluded according to the National Survey of Financial Inclusion (ENIF), prepaid cards have emerged as essential instruments for economic participation. The government's utilization of prepaid solutions for social welfare disbursements, including pensions and subsidies, has further legitimized these products while expanding their reach to remote communities. For instance, the Financiera para el Bienestar (Finabien) program launched government-backed prepaid cards with Mastercard support in 2024, enabling Mexican citizens in the United States to send 9,471 remittances at reduced costs while providing recipients direct access to funds through retail locations nationwide.

Mexico Prepaid Cards Market Trends:

Integration of Prepaid Cards with Digital Wallet Ecosystems

The convergence of prepaid cards with mobile wallet platforms is reshaping consumer payment behaviors across Mexico. Financial technology companies are enabling seamless linkages between physical prepaid cards and digital applications, allowing users to conduct transactions, monitor balances, and manage spending without carrying physical cards. This integration is particularly pronounced among the country's digitally-savvy younger demographic, who prefer unified platforms for managing multiple payment options within single applications.

Expansion into Gaming and Digital Entertainment Sectors

Prepaid cards are experiencing substantial growth within gaming and digital entertainment industries as localized payment solutions gain traction among younger consumers. The demand for digital gift cards denominated in Mexican Peso is accelerating, driven by the popularity of online gaming platforms and virtual goods marketplaces. This trend reflects broader shifts toward digital consumption patterns, with prepaid cards becoming essential payment instruments for accessing virtual currencies and in-game purchases.

Growth of Remittance-Linked Prepaid Payment Solutions

The expansion of prepaid cards as remittance collection instruments is gaining momentum as Mexico continues receiving substantial inflows from abroad. Prepaid cards are becoming preferred mechanisms for fund distribution to beneficiaries, offering immediate access to transferred funds without requiring traditional banking relationships. Traditional money transfer services are increasingly partnering with prepaid card providers, creating integrated solutions that combine cross-border transfers with domestic spending capabilities for recipient families.

Market Outlook 2026-2034:

The Mexico prepaid cards market is poised for sustained expansion as digital payment infrastructure matures and financial inclusion efforts intensify across the country. The continued deployment of prepaid solutions for government benefit disbursements, coupled with rising corporate adoption for payroll and expense management applications, will drive transaction volumes upward. Furthermore, the integration of blockchain-based stablecoin wallets with traditional prepaid cards is creating alternative pathways for cost-effective cross-border payments. The market generated a revenue of USD 128.38 Million in 2025 and is projected to reach a revenue of USD 456.9 Million by 2034, growing at a compound annual growth rate of 15.15% from 2026-2034.

Mexico Prepaid Cards Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Card Type | Open Loop Cards | 69% |

| Purpose | General Purpose Reloadable (GPR) Cards | 42% |

| Vertical | Retail | 36% |

Card Type Insights:

- Open Loop Cards

- Closed Loop Cards

The open loop cards segment dominates with a market share of 69% of the total Mexico prepaid cards market in 2025.

Open loop prepaid cards have established dominance in the Mexican market due to their universal acceptance across Visa and Mastercard payment networks, enabling consumers to conduct transactions at millions of merchant locations domestically and internationally. These cards serve as functional banking alternatives for the country's substantial unbanked population, providing access to digital payment infrastructure without requiring traditional account relationships. In March 2024, Mercado Pago has issued over a million credit cards in Mexico, with 30% of those cards going to those who had never had a credit card before. With an average of 100,000 cards issued each month, the digital account has maintained a consistent approval rate month after month.

The flexibility of open loop cards extends beyond point-of-sale transactions to encompass online purchases, bill payments, and ATM withdrawals, positioning them as comprehensive financial tools for everyday commerce. Financial institutions and fintech companies continue expanding their open loop card portfolios to capture market share among consumers seeking alternatives to cash-based transactions. The segment's growth trajectory is further supported by corporate adoption for employee expense management and payroll disbursements, with organizations leveraging open loop cards to streamline administrative processes while providing employees flexible spending capabilities.

Purpose Insights:

- Payroll/Incentive Cards

- Travel Cards

- General Purpose Reloadable (GPR) Cards

- Remittance Cards

- Others

The General Purpose Reloadable (GPR) cards lead with a share of 42% of the total Mexico prepaid cards market in 2025.

General purpose reloadable cards have emerged as the preferred prepaid solution in Mexico, functioning as practical banking substitutes for consumers excluded from traditional financial services. These versatile instruments allow repeated fund loading through diverse channels including bank transfers, cash deposits at retail locations, and electronic transfers, providing ongoing utility beyond single-use applications. According to the National Survey of Financial Inclusion (ENIF) 2023, approximately 40% of the Mexican population remains financially excluded, creating substantial demand for accessible payment instruments that GPR cards effectively address.

The segment's expansion is accelerated by government initiatives utilizing GPR cards for social welfare disbursements and pension payments, introducing millions of citizens to prepaid payment functionality. Employers across various industries are increasingly adopting GPR cards for payroll distribution, particularly for workers in the informal economy lacking conventional banking relationships. The reloadable nature of these cards encourages sustained usage patterns, driving higher transaction volumes and customer retention compared to disposable prepaid alternatives while supporting broader financial inclusion objectives.

Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Corporate/Organization

- Retail

- Government

- Others

The retail segment exhibits a clear dominance with a 36% share of the total Mexico prepaid cards market in 2025.

The retail vertical commands the largest share of Mexico's prepaid cards market through extensive deployment of gift cards, loyalty programs, and promotional payment solutions across diverse merchant categories. Major retail chains including convenience stores, department stores, and supermarkets have integrated prepaid card offerings into their customer engagement strategies, leveraging these instruments to drive sales and enhance brand loyalty. In May 2024, Ópticas Lux partnered with Givex to introduce physical and digital gift cards across over 100 branches nationwide, exemplifying how traditional retailers are expanding prepaid card presence to capture consumer spending.

The ubiquity of convenience store networks throughout Mexico provides critical distribution infrastructure for retail prepaid cards, with chains operating thousands of locations serving as both card sales points and reload destinations. The Mexican gift card industry is reflecting strong consumer acceptance of prepaid instruments for gifting occasions and personal purchases. E-commerce growth further propels retail prepaid card adoption, as digital gift cards become preferred payment methods for online shopping transactions among Mexican consumers seeking secure alternatives to credit-based payments.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a significant market for prepaid cards, driven by the region's industrial economy, proximity to the United States border, and strong remittance flows from Mexican workers abroad. Major cities including Monterrey, Tijuana, and Ciudad Juárez serve as economic hubs with advanced digital payment infrastructure and higher fintech adoption rates compared to national averages.

Central Mexico witnesses high demand for prepaid cards, anchored by Mexico City's metropolitan area which hosts the country's largest consumer market and most sophisticated financial services ecosystem. The region's concentration of retail networks, corporate headquarters, and government institutions drives substantial prepaid card transaction volumes across consumer and business applications.

Southern Mexico presents growing opportunities for prepaid card expansion, particularly through government-led financial inclusion programs targeting underserved rural communities. States including Chiapas, Oaxaca, and Guerrero receive significant remittance inflows and benefit from social welfare disbursements distributed via prepaid card instruments.

Market Dynamics:

Growth Drivers:

Why is the Mexico Prepaid Cards Market Growing?

Accelerating Financial Inclusion Initiatives and Unbanked Population Access

Mexico's substantial unbanked and underbanked population creates persistent demand for accessible payment solutions that prepaid cards effectively address. According to government surveys. with Mexican adults lacking formal financial service access, prepaid cards serve as critical instruments for economic participation among excluded populations. Fintech platforms have accelerated this trend, with digital banking solutions like Spin by OXXO. In an effort to speed up digital payments in Mexico, Spin by OXXO and Visa have extended their collaboration for a further eight years. With over 9 million users and growing transaction volumes, Spin is backed by OXXO's 24,000-store network. Its Spin Premia program has 27 million members. With Mexico's digital payments market expected to reach $125 Billion by 2025, the coalition hopes to increase safe, cashless transactions.

Rapid E-Commerce Expansion and Digital Payment Adoption

The explosive growth of e-commerce in Mexico is driving prepaid card adoption as consumers seek secure payment methods for online transactions. As per the IMARC Group, the Mexico e-commerce sector to reach USD 175.8 Billion by 2034, exhibiting a growth rate (CAGR) of 13.92% during 2026-2034. Mobile commerce dominates the landscape, with substantial percentage of online purchases occurring through smartphone devices. Prepaid cards offer consumers protection against fraud risks associated with sharing traditional card credentials online while providing merchants guaranteed payment settlement. The integration of prepaid solutions with major e-commerce platforms and digital marketplaces further reinforces their position as preferred payment instruments for Mexico's expanding digital economy.

Growing Remittance Market Utilizing Prepaid Distribution Channels

Mexico's position as one of the world's largest remittance recipients creates substantial opportunities for prepaid card integration into money transfer ecosystems. The country received a record USD 64.7 Billion in remittances during 2024 according to Federal Reserve Bank of Dallas. Millions of Mexican households, particularly those in the poorest areas, rely heavily on these remittances. Prepaid cards enable remittance recipients to access funds immediately upon transfer completion without requiring traditional bank account relationships. The government's Finabien Paisano card program, launched with Mastercard backing, specifically targets remittance flows by providing Mexican citizens abroad low-cost transfer mechanisms while offering recipients prepaid card access at thousands of retail locations nationwide.

Market Restraints:

What Challenges the Mexico Prepaid Cards Market is Facing?

Persistent Cash Dominance and Cultural Payment Preferences

Despite digital payment growth, cash remains deeply embedded in Mexican transaction culture, particularly among lower-income demographics and informal economy participants. Industry surveys indicate that cash transactions still account substantial percent of all payments, with many consumers expressing pride in cash-based purchasing behaviors. This cultural preference creates resistance to prepaid card adoption among segments most likely to benefit from alternative payment instruments.

Limited Digital Infrastructure in Rural and Remote Regions

Uneven distribution of internet connectivity and point-of-sale terminals across Mexico constrains prepaid card utility in underserved areas. Mexicans lack reliable internet access, limiting their ability to manage prepaid cards through digital applications or conduct online transactions. Rural communities face particular challenges accessing card reload locations and merchants equipped with electronic payment acceptance capabilities.

Cybersecurity Concerns and Fraud Prevention Challenges

Rising cybersecurity threats targeting digital payment systems generate consumer hesitation toward prepaid card adoption. Mexico experienced malware attack attempts against businesses, highlighting persistent vulnerabilities within digital payment ecosystems. Approximately one in five Mexican users has experienced payment fraud, creating trust deficits that prepaid card providers must address through enhanced security measures and consumer education initiatives.

Competitive Landscape:

The Mexico prepaid cards market features a moderately consolidated competitive structure characterized by collaboration between global payment networks and domestic financial institutions. International card schemes provide infrastructure enabling prepaid card acceptance across merchant networks while partnering with local issuers to expand market penetration. Traditional banking institutions offer prepaid solutions alongside core services, while fintech companies increasingly capture market share through innovative digital-first offerings targeting underserved segments. Retail chains leverage their extensive physical distribution networks to compete in gift card and closed-loop prepaid segments, creating multi-channel competition across consumer payment categories.

Recent Developments:

-

December 2024: Blackhawk Network launched Roblox digital gift cards in Mexican Peso (MXN), expanding its gift card offering with Roblox to provide Mexican consumers a seamless e-commerce experience for gaming platform purchases, reinforcing prepaid cards as preferred payment instruments for digital entertainment.

-

September 2024: MercadoLibre secured USD 250 Million in financing from JPMorgan to expand Mercado Pago's credit offerings in Mexico, signaling commitment to supporting small and medium enterprises through enhanced financial services and prepaid payment solutions.

Mexico Prepaid Cards Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Card Types Covered | Closed Loop Cards, Open Loop Cards |

| Purposes Covered | Payroll/Incentive Cards, Travel Cards, General Purpose Reloadable (GPR) Cards, Remittance Cards, Others |

| Verticals Covered | Corporate/Organization, Retail, Government, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico prepaid cards market size was valued at USD 128.38 Million in 2025.

The Mexico prepaid cards market is expected to grow at a compound annual growth rate of 15.15% from 2026-2034 to reach USD 456.9 Million by 2034.

Open loop cards dominated the Mexico prepaid cards market with a 69% share in 2025, driven by their universal acceptance across Visa and Mastercard payment networks and versatility as banking alternatives for unbanked populations.

Key factors driving the Mexico prepaid cards market include accelerating financial inclusion initiatives targeting the substantial unbanked population, rapid e-commerce expansion requiring secure payment alternatives, growing remittance market utilizing prepaid distribution channels, and government adoption for social welfare disbursements.

Major challenges include persistent cash dominance and cultural payment preferences among lower-income demographics, limited digital infrastructure in rural and remote regions constraining prepaid card utility, cybersecurity concerns generating consumer hesitation, and regulatory compliance requirements for card issuers and payment processors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)