Mexico Q-Commerce Market Size, Share, Trends and Forecast by Product Type, Platform, and Region, 2026-2034

Mexico Q-Commerce Market Summary:

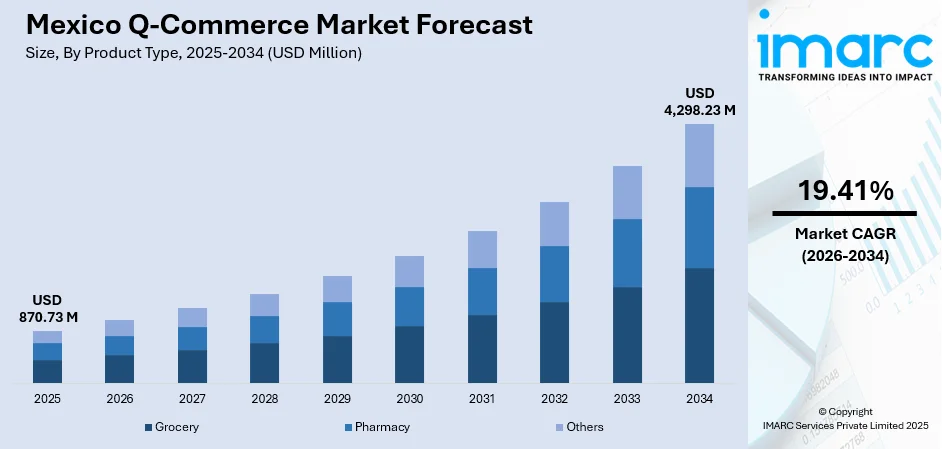

The Mexico Q-commerce market size was valued at USD 870.73 Million in 2025 and is projected to reach USD 4,298.23 Million by 2034, growing at a compound annual growth rate of 19.41% from 2026-2034.

The market is experiencing rapid expansion driven by increasing smartphone penetration, rising digital payment adoption, and evolving preferences for ultra-fast delivery services. Strategic partnerships between major e-commerce platforms and delivery service providers are enhancing operational capabilities through dark store networks and advanced logistics infrastructure. Urban concentration in major metropolitan areas combined with growing mobile commerce penetration is accelerating market development, positioning Mexico as a key growth market for quick commerce services across the Mexico Q-commerce market share.

Key Takeaways and Insights:

-

By Product Type: Grocery dominates the market with a share of 60% in 2025, driven by consumer demand for fresh produce and essential household items through convenient mobile ordering platforms.

-

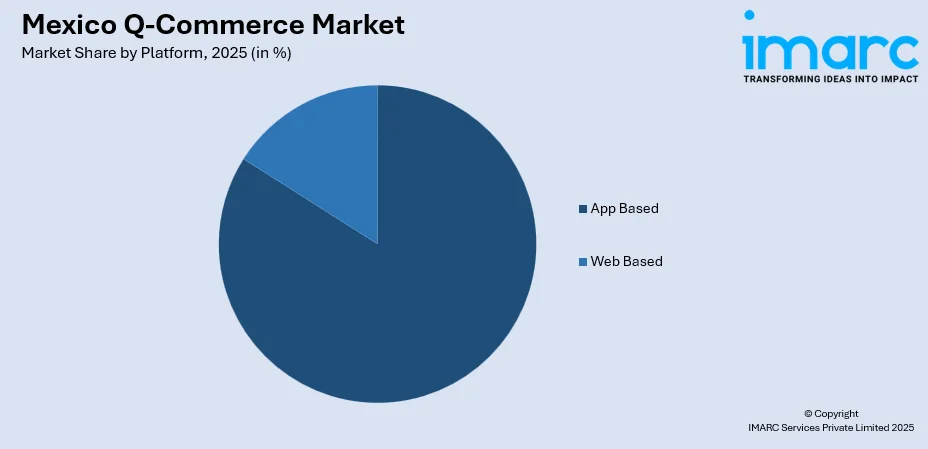

By Platform: App based leads the market with a share of 84% in 2025, owing to widespread smartphone adoption reaching 78% mobile commerce penetration, superior user experience through intuitive interfaces, and seamless integration with digital payment systems.

-

Key Players: The Mexico Q-commerce market exhibits intense competitive dynamics, with international platforms and emerging partnerships between international and local delivery services competing alongside regional players. Companies are differentiating through delivery speed commitments, dark store network expansion, and strategic technology investments.

To get more information on this market Request Sample

The Mexican Q-commerce landscape is characterized by aggressive infrastructure investments and technological innovation as companies race to establish market leadership in ultra-fast delivery services. Major metropolitan areas including Mexico City, Guadalajara, and Monterrey serve as primary battlegrounds where delivery platforms deploy sophisticated dark store networks to achieve sub-30-minute delivery commitments. The November 2024 launch of Amazon Now through partnership with Rappi marked a watershed moment, introducing 15-minute delivery for over 5,000 products across ten major cities, fundamentally reshaping customer expectations for immediacy in online shopping. This development accelerated competitive pressures as established players rushed to match or exceed these service standards through enhanced logistics capabilities and product assortments, thereby expanding the Mexico Q-commerce market.

Mexico Q-Commerce Market Trends:

Ultra-Fast Delivery Service Proliferation

The Q-commerce sector is witnessing a transformative shift toward ultra-fast delivery commitments as companies deploy sophisticated dark store networks to achieve sub-20-minute fulfillment times. Strategic urban positioning of micro-fulfillment centers enables inventory placement within two-kilometer delivery radiuses of high-density consumer populations. Technology platforms leverage AI-driven demand forecasting and route optimization algorithms to maximize delivery efficiency while minimizing operational costs. The competitive landscape intensified following the 2024 launch of three-hour delivery by Walmart Mexico for specific home and tech items purchased online, aiming to outpace e-commerce competitor Amazon.com Inc in fast shipping. Walmart de Mexico's new service encompasses around 12,000 products of specific dimensions delivered across Mexico, including laptops, mobile phones, TVs, and clothing irons, the company stated.

Mobile Commerce Platform Dominance

Q-commerce transactions are overwhelmingly migrating to mobile application interfaces as smartphones become the primary gateway for quick commerce interactions. Mobile platforms deliver superior user experiences through location-based services, push notification engagement, and integrated digital wallet functionality that streamlines checkout processes. Application-based interfaces enable personalized product recommendations powered by machine learning (ML) algorithms that analyze historical purchase patterns and browsing behavior. The mobile-first approach aligns with Mexico's broader e-commerce evolution where mobile devices now account for 78% of online transactions, reflecting fundamental shifts in consumer shopping behaviors and preferences for on-demand accessibility.

Strategic Partnership Ecosystem Development

The market is experiencing consolidation through strategic alliances that combine complementary capabilities of established e-commerce platforms with specialized delivery service providers. These partnerships enable rapid market entry and scale expansion without requiring extensive capital investments in logistics infrastructure. Collaborative models leverage existing delivery networks, warehouse facilities, and technology platforms while providing mutual benefits through expanded customer reach and enhanced service offerings. In January 2025, TikTok disclosed that is broadening its e-commerce activities in Mexico, identifying the nation as the primary site in its expansion into the Latin American market. The initiative is a component of TikTok’s larger plan to create an international foothold in the eCommerce sector, providing fresh prospects for local enterprises and shoppers.

Market Outlook 2026-2034:

The Mexico Q-commerce market is positioned for sustained expansion as infrastructure investments mature and consumer adoption accelerates across urban centers. The market generated a revenue of USD 870.73 Million in 2025 and is projected to reach a revenue of USD 4,298.23 Million by 2034, growing at a compound annual growth rate of 19.41% from 2026-2034. Technology platform sophistication will advance through artificial intelligence integration, autonomous delivery experimentation, and enhanced payment infrastructure that reduces friction in transaction processes.

Mexico Q-Commerce Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Grocery |

60% |

|

Platform |

App Based |

84% |

Product Type Insights:

- Grocery

- Pharmacy

- Others

Grocery dominates with a market share of 60% of the total Mexico Q-commerce market in 2025.

The Grocery segment commands the largest market share within Mexico's Q-commerce ecosystem as consumers increasingly prioritize convenience for everyday food and household purchases. Rising demand for fresh produce, meat, dairy products, and pantry staples through mobile platforms reflects fundamental shifts in shopping behaviors accelerated by urban lifestyles and time constraints. Strategic partnerships between e-commerce platforms and delivery services have expanded product assortments to include premium organic offerings, international specialty items, and private-label brands that enhance value propositions. In 2024, Amazon Mexico has revealed a partnership with Jüsto, a digital grocery store in the area, to provide fresh produce and essential items. The collaboration will enable Amazon users in certain regions of Mexico City to purchase fruits, vegetables, dairy, meat, and other perishable goods via the marketplace, with delivery assured in four hours.

Grocery infrastructure specifically designed for grocery fulfillment enables sophisticated cold chain management and quality control systems that preserve product freshness throughout the delivery process. Advanced inventory management systems powered by artificial intelligence optimize stock levels based on real-time demand patterns while minimizing waste through precise replenishment algorithms. The segment benefits from high purchase frequency and strong customer retention rates as grocery shopping represents recurring consumption needs rather than discretionary purchases, creating sustainable revenue streams and predictable demand patterns that support continued infrastructure investments and service improvements.

Platform Insights:

Access the comprehensive market breakdown Request Sample

- App Based

- Web Based

App based leads with a share of 84% of the total Mexico Q-commerce market in 2025.

The App based platform segment dominates quick commerce transactions as smartphones become the primary interface for on-demand shopping experiences across Mexican consumers. Mobile applications deliver superior functionality through GPS-enabled location services, real-time order tracking capabilities, and integrated digital wallet systems that streamline payment processes. User interface design optimized for mobile screens combined with intuitive navigation patterns reduces friction in product discovery and checkout completion, driving higher conversion rates compared to desktop alternatives. The widespread availability of affordable smartphones coupled with expanding 4G and 5G network coverage has democratized access to quick commerce services across socioeconomic segments. In 2024, Mexican operator América Móvil, which runs under the Telcel brand, reached 125 cities with its 5G network.

Application-based platforms leverage push notification technology to drive user engagement through personalized promotional campaigns, order status updates, and targeted product recommendations based on purchase history analysis. Native mobile features including biometric authentication, camera-based barcode scanning, and voice search capabilities enhance user convenience while building habitual usage patterns. The concentration of quick commerce activity within mobile applications creates valuable data ecosystems that enable continuous platform optimization through behavioral analytics, A/B testing frameworks, and machine learning algorithms that refine user experiences. This technical sophistication combined with network effects from growing user bases creates substantial competitive advantages for established app-based platforms.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico benefits from proximity to United States markets and robust cross-border trade infrastructure that facilitates logistics operations. Major cities including Monterrey and Tijuana serve as strategic hubs with advanced warehousing facilities and established distribution networks supporting quick commerce fulfillment.

Central Mexico, anchored by Mexico City and surrounding metropolitan areas, represents the largest concentration of Q-Commerce activity driven by dense urban populations and high smartphone penetration. The capital region accounts for substantial market share through extensive dark store networks and competitive delivery service coverage.

Southern Mexico shows emerging potential as infrastructure investments improve connectivity and smartphone adoption accelerates across mid-sized cities. Growing middle-class populations in states like Jalisco with Guadalajara as a commercial center are driving expansion of quick commerce services.

Market Dynamics:

Growth Drivers:

Why is the Mexico Q-Commerce Market Growing?

Digital Payment Infrastructure Expansion Accelerating Transaction Convenience

Mexico's financial technology sector is experiencing transformative growth as digital payment infrastructure matures, and consumer adoption accelerates across demographic segments. Various government-backed initiatives complement existing systems, which processes over three million daily transactions, creating robust real-time payment capabilities that reduce friction in quick commerce checkout processes. Strategic partnerships between fintech platforms and Q-commerce providers enable seamless integration of payment solutions including buy-now-pay-later options that expand purchasing power among consumers with limited credit card access. In 2024, Nu México, a clear, humane, and transparent digital finance firm, revealed the integration of its application with Dinero Móvil (Dimo), the new transfer platform from Banco de México (Banxico), to streamline digital transactions. This method allows users to send and receive money by referencing the ten digits of the recipient's mobile number without incurring any fees or charges.

Smartphone Penetration and Mobile Commerce Proliferation

Mexico's telecommunications infrastructure evolution is fundamentally reshaping consumer access to digital commerce services as smartphone adoption reaches critical mass across urban and suburban populations. Internet penetration has expanded to 83.2% as of early 2024, encompassing 107.3 million users who increasingly rely on mobile devices as their primary gateway to online services and e-commerce platforms. Mobile commerce now accounts for 78% of Mexico's e-commerce transactions, demonstrating clear consumer preferences for smartphone-based shopping experiences over desktop alternatives, with this trend particularly pronounced among younger demographic cohorts who exhibit near-universal mobile device usage. The proliferation of affordable data plans and expanding 4G coverage across major metropolitan areas has democratized access to bandwidth-intensive applications including video-based product browsing and real-time order tracking features that enhance Q-commerce user experiences.

Strategic E-Commerce Partnership Formations Expanding Market Reach

The Mexico Q-commerce landscape is witnessing accelerated consolidation as major e-commerce platforms forge strategic alliances with specialized delivery service providers to achieve rapid market penetration without extensive capital commitments. The November 2024 launch of Amazon Now through partnership with Rappi represents a watershed development, combining Amazon's vast product catalog and Prime membership ecosystem with Rappi's established last-mile delivery infrastructure spanning 110 cities and over 30,000 restaurant partnerships. Rappi's parallel expansion commitments including 110 million dollar investments announced in 2024 underscore competitive intensity as regional champions defend market positions against international platform incursions through accelerated infrastructure buildout and service enhancement initiatives across Mexican cities.

Market Restraints:

What Challenges the Mexico Q-Commerce Market is Facing?

Transportation Infrastructure Limitations Constraining Delivery Efficiency

Mexico's logistics sector confronts significant infrastructure constraints, creating operational challenges that increase transportation costs and delivery time variability. Road network deterioration is particularly acute in rural areas where maintenance deficiencies cause vehicle damage, fuel inefficiency, and unreliable transit times that complicate fulfillment planning. Port congestion at major facilities including Veracruz and Manzanillo compounds supply chain pressures, with increasing import volumes straining capacity and creating bottlenecks.

Cash-Dominated Payment Culture Hindering Digital Transaction Adoption

Traditional payment preferences remain deeply entrenched across Mexican consumers as cash transactions account for a significant part of all payments and retail transactions despite expanding digital alternatives. Cultural factors including trust concerns around electronic payments, limited banking penetration affecting credit card availability, and habitual cash usage patterns create friction in online commerce adoption. Low credit card penetration affecting only 10% of adult Mexicans limits seamless digital payment experiences that enable frictionless quick commerce transactions.

Last-Mile Delivery Complexity in Dense Urban Environments

Metropolitan areas present multifaceted operational challenges including severe traffic congestion that extends delivery times, fragmented demand patterns requiring sophisticated route optimization, and security concerns affecting courier safety in certain neighborhoods. Mexico City's 60% concentration of small retail outlets maintaining only one-two days inventory exemplifies demand fragmentation that complicates fulfillment planning and inventory positioning. Limited availability of strategically located real estate for dark store placement combined with zoning restrictions constrains infrastructure expansion in high-density areas.

Competitive Landscape:

The Mexico Q-commerce competitive landscape features intense rivalry between international platforms and regional specialists as companies compete through delivery speed commitments, technology sophistication, and strategic partnerships. Key market players are maintaining market leadership through extensive dark store networks and multi-vertical service offerings spanning groceries, pharmacy items, and restaurant delivery across Mexican cities. Emerging domestic players leverage specialized grocery expertise and technology capabilities to carve defensible market positions through superior fresh product quality and customer service differentiation. Competition centers on infrastructure density, delivery speed guarantees, product assortment breadth, and integrated payment solutions that reduce transaction friction.

Recent Developments:

-

In April 2025, Sparkle launched a new PoP in Querétaro, Mexico, expanding its Tier-1 IP backbone Seabone. The move enhanced low-latency IP transit and DDoS protection services, boosting Mexico’s Q-commerce market with greater infrastructure redundancy and advanced virtual connectivity solutions.

-

In February 2025, Alibaba Cloud, the technology and intelligence backbone of Alibaba Group, announced the official launch of its inaugural cloud region in Mexico, signifying a vital step in its dedication to speeding up Mexico’s digital transformation and promoting innovation throughout Latin America. The updated infrastructure will enable companies, startups, developers, and organizations in Latin America to access secure, robust, and scalable cloud services, fostering greater growth and innovation prospects while enhancing Mexico’s role as a premier tech hub in the region.

Mexico Q-Commerce Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Grocery, Pharmacy, Others |

| Platforms Covered | App Based, Web Based |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico Q-commerce market size was valued at USD 870.73 Million in 2025.

The Mexico Q-commerce market is expected to grow at a compound annual growth rate of 19.41% from 2026-2034 to reach USD 4,298.23 Million by 2034.

The grocery segment dominated the market with approximately 60% revenue share, driven by consumer demand for fresh produce and essential household items delivered through convenient mobile ordering platforms. Dark store infrastructure enables rapid fulfillment while strategic partnerships between e-commerce platforms and delivery services expand product assortments and enhance value propositions for Mexican consumers.

Key factors driving the Mexico Q-Commerce market include expanding digital payment infrastructure with platforms achieving huge number of registered accounts, surging smartphone penetration rising, and strategic partnerships collaboration launching fast delivery services. Rising mobile commerce accounts for a major portion of e-commerce transactions combined with growing consumer preferences for ultra-fast delivery services accelerate market development.

Major challenges include infrastructure limitations with reduced number of roads in good condition causing delivery delays and increased costs, cash-dominated payment culture where a significant part of retail transactions remain cash-based hindering digital adoption, and last-mile delivery complexity in dense urban areas with severe traffic congestion. Security concerns affecting courier safety, limited availability of strategically located real estate for dark stores, and fragmented demand patterns requiring sophisticated logistics optimization present ongoing operational challenges.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)