Mexico Refrigerant Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2026-2034

Mexico Refrigerant Market Overview:

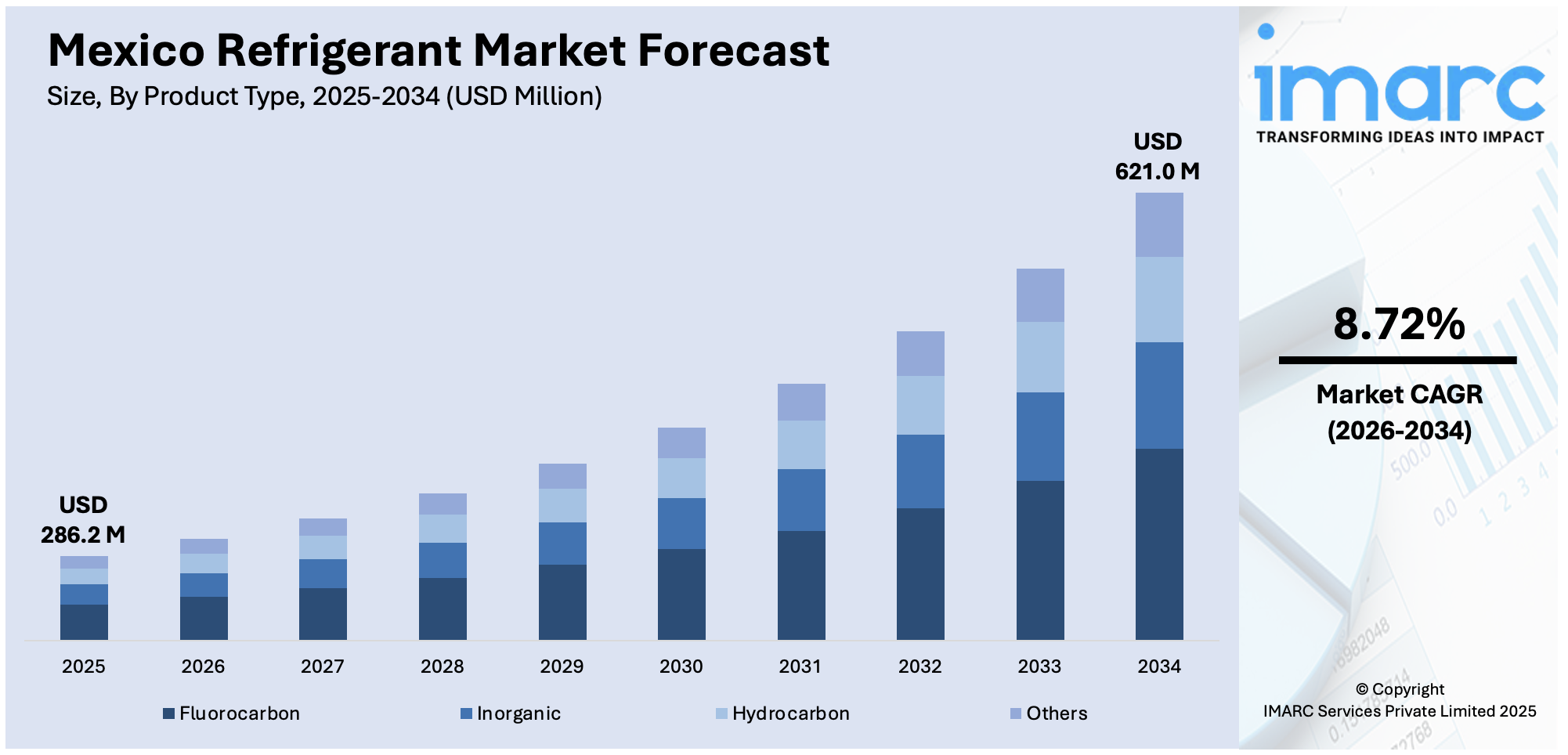

The Mexico refrigerant market size reached USD 286.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 621.0 Million by 2034, exhibiting a growth rate (CAGR) of 8.72% during 2026-2034. The market is driven by growing demand for air conditioning and refrigeration in residential, commercial, and industrial sectors, urbanization, rising temperatures, and regulatory push for low-GWP alternatives. Increased infrastructure development, appliance penetration, and alignment with international environmental protocols further stimulate market expansion across multiple refrigerant categories.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 286.2 Million |

|

Market Forecast in 2034

|

USD 621.0 Million |

| Market Growth Rate 2026-2034 | 8.72% |

Mexico Refrigerant Market Trends:

Regulatory Shift Toward Low-GWP Alternatives

A notable trend in Mexico’s refrigerant market is the increasing alignment with international environmental standards, particularly under the Kigali Amendment to the Montreal Protocol. This regulatory shift is accelerating the phase-down of high-global warming potential (GWP) refrigerants like R-134a and R-404A, pushing manufacturers and end users to transition toward hydrofluoroolefins (HFOs), natural refrigerants, and other low-GWP alternatives. Government incentives and revised labeling standards for HVAC systems are reinforcing compliance. As importers and equipment manufacturers adapt to these evolving rules, the market is witnessing a growing preference for R-600a and R-290 in domestic and light commercial applications. This transition is also influencing procurement policies across industrial sectors, creating a structured pathway for sustainable refrigerant adoption in the years ahead. For instance, at AHR Mexico 2023, Tecumseh Products Company showcased its expanded portfolio of refrigeration systems, including the new Tauri Slimline and PAC3 condensing units, as well as updates to its Argus platform. These solutions support medium and low-temperature applications and are optimized for R-290 and other low-GWP refrigerants, aligning with global sustainability goals. Tecumseh also introduced its energy-efficient AL compressor, alongside a range of compressors for commercial refrigeration.

To get more information on this market Request Sample

Expansion of Cold Chain and Logistics Infrastructure

The expansion of Mexico’s cold chain infrastructure, particularly in response to growth in the pharmaceutical, food processing, and export-oriented agriculture sectors, is creating new demand for specialized refrigerant systems. Facilities for cold storage, transport refrigeration, and temperature-sensitive warehousing increasingly require high-performance refrigerants that offer reliability under varied operating conditions. Industrial users are shifting toward ammonia and CO₂-based systems due to their thermal efficiency and low environmental impact. This trend is further reinforced by foreign direct investment and supply chain modernization efforts linked to nearshoring. As the logistics network scales to meet domestic and international distribution needs, the adoption of technically advanced and environmentally compliant refrigerants is becoming a critical operational requirement across Mexico’s cold chain ecosystem. For instance, in November 2024, FEMSA completed the divestiture of its refrigeration and foodservice equipment operations, Imbera and Torrey, to Mill Point Capital for 8 billion pesos on a cash-free, debt-free basis. This move aligns with FEMSA’s strategic focus on core businesses in retail, health, and beverage sectors, covering operations in Mexico, Colombia, and Brazil.

Mexico Refrigerant Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2026-2034. Our report has categorized the market based on product type and application.

Product Type Insights:

- Fluorocarbon

- Inorganic

- Hydrocarbon

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes fluorocarbon, inorganic, hydrocarbon, and others.

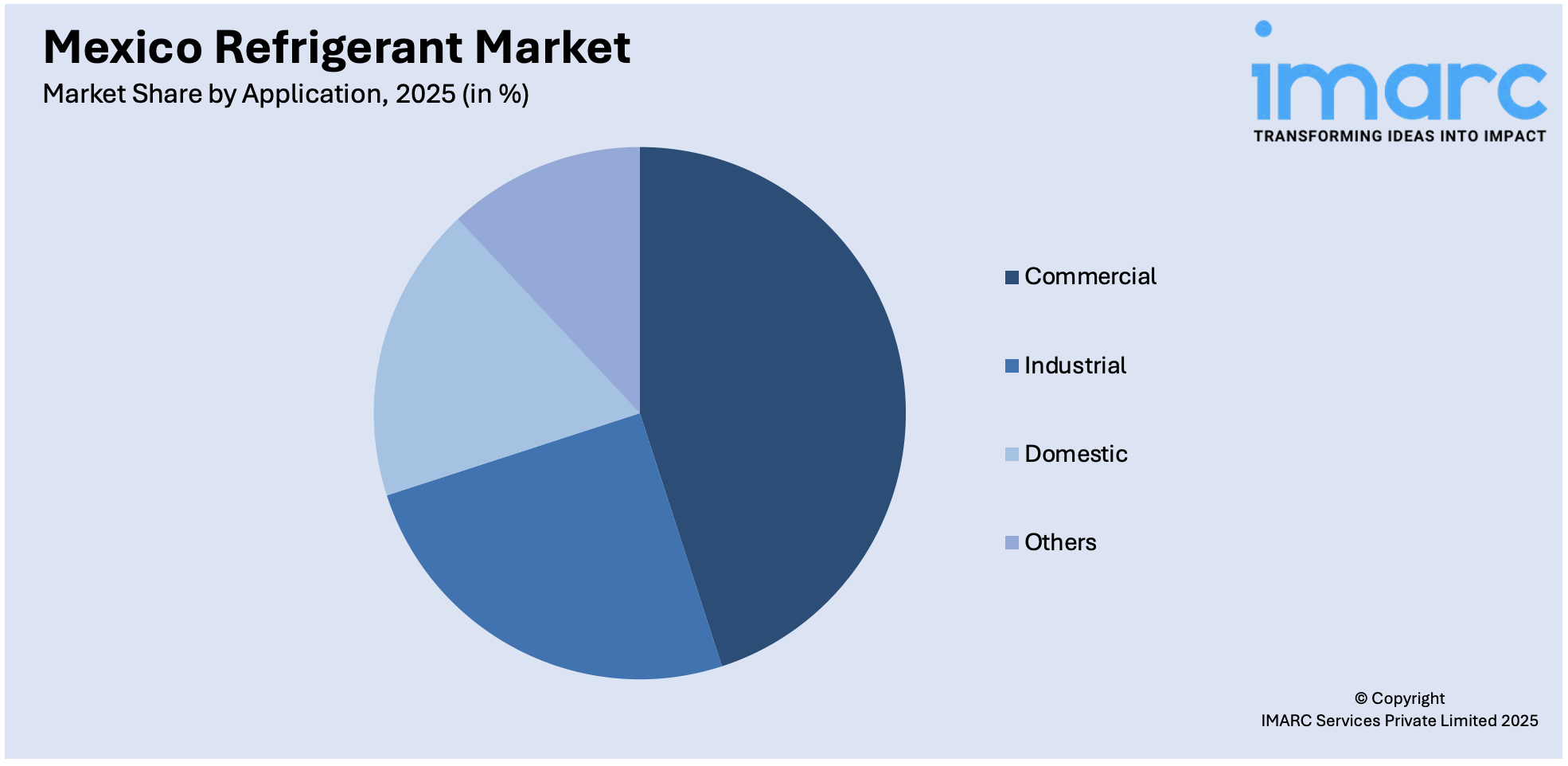

Application Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Industrial

- Domestic

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial, industrial, domestic, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Refrigerant Market News:

- In December 2024, South Korean automotive supplier Doowon Refrigeration invested USD 43 Million to establish a vehicle cooling systems manufacturing facility in Apodaca, Nuevo León, Mexico. This strategic move enhances Doowon's footprint in North America, aligning with Mexico's growing automotive sector.

- In August 2024, BSH Hausgeräte GmbH opened its first refrigeration factory in Monterrey, Mexico, marking a strategic expansion in North America. The facility will produce Bosch and Thermador double-door refrigerators for the U.S. and Canadian markets. Designed for scalability, it operates using solar power and water-saving systems, aligning with BSH’s carbon-neutral goals. The factory strengthens BSH’s presence in the premium appliance segment and supports sustainable, high-performance refrigerator manufacturing in the region.

Mexico Refrigerant Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fluorocarbon, Inorganic, Hydrocarbon, Others |

| Applications Covered | Commercial, Industrial, Domestic, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico refrigerant market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico refrigerant market on the basis of product type?

- What is the breakup of the Mexico refrigerant market on the basis of application?

- What is the breakup of the Mexico refrigerant market on the basis of region?

- What are the various stages in the value chain of the Mexico refrigerant market?

- What are the key driving factors and challenges in the Mexico refrigerant market?

- What is the structure of the Mexico refrigerant market and who are the key players?

- What is the degree of competition in the Mexico refrigerant market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico refrigerant market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico refrigerant market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico refrigerant industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)