Mexico Reinsurance Market Size, Share, Trends and Forecast by Type, Mode, Distribution Channel, Application, and Region, 2025-2033

Mexico Reinsurance Market Overview:

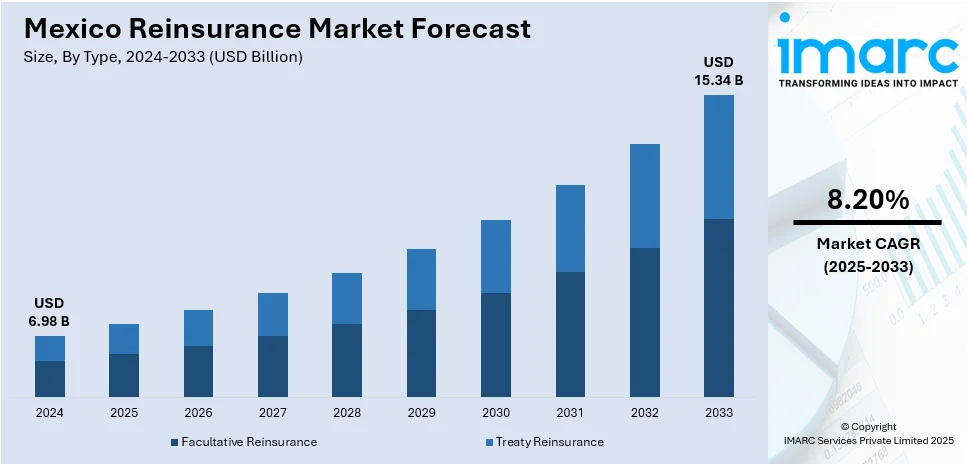

The Mexico reinsurance market size reached USD 6.98 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 15.34 Billion by 2033, exhibiting a growth rate (CAGR) of 8.20% during 2025-2033. Increased catastrophic risk, tailored disaster models, and public-private risk pooling are enhancing disaster resilience. Regulatory modernization, international alignment, and improved capital adequacy standards are reshaping market structure. In addition to this, competitive liberalization, product specialization, and improved digital transaction frameworks are some of the major factors augmenting the Mexico reinsurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.98 Billion |

| Market Forecast in 2033 | USD 15.34 Billion |

| Market Growth Rate 2025-2033 | 8.20% |

Mexico Reinsurance Market Trends:

Heightened Climate Risk and Catastrophic Exposure

Mexico’s geographic vulnerability to natural disasters, including hurricanes, earthquakes, and floods, has created an imperative for robust risk transfer mechanisms. With climate volatility increasing the frequency and intensity of catastrophic events, insurers are seeking comprehensive risk mitigation strategies that protect capital reserves and ensure claims-paying capacity. This has led to deeper reliance on reinsurance arrangements, particularly for high-exposure property and casualty lines. Recent events such as Hurricane Otis and regional seismic activity have highlighted the systemic risks to infrastructure and agriculture, reinforcing the need for financial resilience mechanisms across sectors. On April 3, 2025, AM Best affirmed the A (Excellent) Financial Strength Rating and the "a" (Excellent) Long-Term Issuer Credit Rating for Lion Reinsurance Company Limited, a Bermuda-based reinsurer. Lion Re, a subsidiary of ASSA Tenedora, which has operations in Mexico and across Central America, plays a crucial role in providing reinsurance capacity to ASSA’s affiliates, supporting various business lines, including property, auto, and health. The ratings reflect Lion Re’s very strong balance sheet and its strategic role in the region, particularly aiding risk management and supporting ASSA Tenedora’s growth. Reinsurers are responding by developing tailored catastrophe models specific to Mexico’s risk profile, incorporating localized data and hazard mapping. Additionally, government-sponsored risk pools and disaster risk financing programs, such as FONDEN (Natural Disaster Fund), are incorporating facultative and treaty reinsurance structures to improve liquidity in emergency scenarios. These developments not only strengthen national recovery capacity but also reinforce private sector confidence in underwriting. As institutional and market-level responses become more integrated and data-driven, they are increasingly contributing to Mexico reinsurance market growth by elevating the role of advanced risk-sharing frameworks in disaster preparedness.

Regulatory Modernization and Market Liberalization

Mexico’s reinsurance sector has undergone significant structural transformation, led by modernization efforts from the Comisión Nacional de Seguros y Fianzas (CNSF). These reforms have increased transparency, improved solvency monitoring, and aligned operational standards with international regulatory frameworks such as Solvency II. Enhanced capital adequacy requirements and risk-based supervision have encouraged primary insurers to adopt more sophisticated reinsurance programs, particularly in the life and health segments. On May 30, 2024, Everest announced the launch of its operations in Mexico, following regulatory approval from the Comisión Nacional de Seguros y Fianzas. The new entity, Compañía de Seguros Generales Everest México S.A. de C.V., will be headquartered in Mexico City and aims to become a market leader in property, casualty, marine, and financial lines across the growing Mexican market. With its global network and financial strength, Everest is well-positioned to capitalize on Mexico's economic growth and increasing demand for comprehensive insurance solutions. At the same time, the relaxation of market entry barriers and updated licensing provisions have encouraged the participation of global reinsurers, leading to a more competitive and diversified landscape. Cross-border transactions have become more streamlined through digitalization and regulatory harmonization with trade partners, improving the efficiency of capital allocation. These factors have allowed local insurers to tailor coverage more precisely and manage retained risk more effectively. As a result, reinsurers operating in the Mexican market are offering increasingly specialized products, including structured covers and parametric solutions. These regulatory and structural shifts are playing a pivotal role in Mexico reinsurance market, enabling more resilient underwriting practices and improving sector-wide financial health.

Mexico Reinsurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, mode, distribution channel, and application.

Type Insights:

- Facultative Reinsurance

- Treaty Reinsurance

- Proportional Reinsurance

- Non-proportional Reinsurance

The report has provided a detailed breakup and analysis of the market based on the type. This includes facultative reinsurance and treaty reinsurance (proportional reinsurance and non-proportional reinsurance).

Mode Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the mode. This includes online and offline.

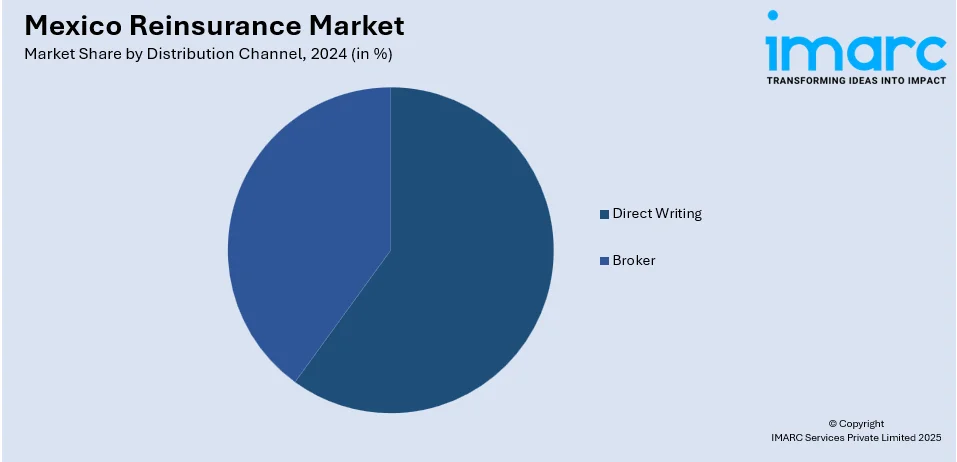

Distribution Channel Insights:

- Direct Writing

- Broker

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct writing and broker.

Application Insights:

- Property and Casualty Reinsurance

- Life and Health Reinsurance

- Disease Insurance

- Medical Insurance

The report has provided a detailed breakup and analysis of the market based on the application. This includes property and casualty reinsurance and life and health reinsurance (disease insurance and medical insurance).

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Reinsurance Market News:

- On September 4, 2023, Seguros Atlas and Generali España formalized a reinsurance agreement to enhance their corporate and multinational business operations in Mexico. This partnership will enable Generali to bolster its reinsurance capacity in the corporate segment, while Seguros Atlas gains access to greater resources and expertise, further expanding its market reach.

Mexico Reinsurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Modes Covered | Online, Offline |

| Distribution Channels Covered | Direct Writing, Broker |

| Applications Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico reinsurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico reinsurance market on the basis of type?

- What is the breakup of the Mexico reinsurance market on the basis of mode?

- What is the breakup of the Mexico reinsurance market on the basis of distribution channel?

- What is the breakup of the Mexico reinsurance market on the basis of application?

- What is the breakup of the Mexico reinsurance market on the basis of region?

- What are the various stages in the value chain of the Mexico reinsurance market?

- What are the key driving factors and challenges in the Mexico reinsurance?

- What is the structure of the Mexico reinsurance market and who are the key players?

- What is the degree of competition in the Mexico reinsurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico reinsurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico reinsurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico reinsurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)