Mexico Skin Care Products Market Size, Share, Trends and Forecast by Product Type, Ingredient, Gender, Distribution Channel, and Region, 2025-2033

Mexico Skin Care Products Market Overview:

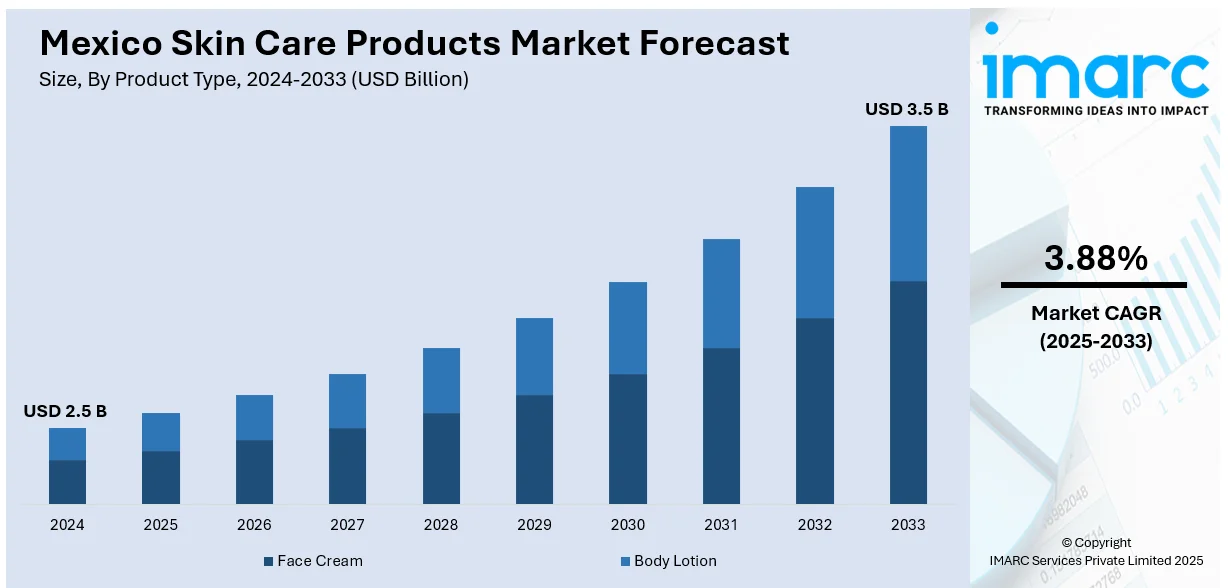

The Mexico Skin Care Products Market size reached USD 2.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.5 Billion by 2033, exhibiting a growth rate (CAGR) of 3.88% during 2025-2033. Rising consumer awareness of natural ingredients, rapid growth in e-commerce platforms, and increasing demand for personalized, inclusive skin care solutions are key drivers of the Mexico skin care products market outlook. Local brands leveraging traditional botanicals and digital engagement strategies are gaining value, while tech integration enhances consumer experiences and purchasing decisions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 3.5 Billion |

| Market Growth Rate 2025-2033 | 3.88% |

Mexico Skin Care Products Market Trends:

Growing Demand for Natural and Organic Products

Mexican consumers are becoming more attracted to skin care products that focus on natural and organic ingredients. Increased concern regarding the dangers of strong chemicals has spurred a movement toward clean beauty, with paraben-free, sulfate-free, and artificial-free products thus bolstering the Mexico skin care products market growth. This follows a larger trend toward greater concern for sustainability, with consumers choosing brands that are environmentally friendly, use biodegradable packaging, and have responsibly sourced ingredients. Locally sourced products with classic botanical extracts such as aloe vera, avocado oil, and nopal (cactus) are well-received by the market, providing both cultural recognition and documented skin benefits. As consumers grow more ingredient-focused, brands are responding by embracing transparency and clean-label ingredients to address the increasing demand for safe and ethical skin care solutions.

Digital Transformation and E-Commerce Expansion

Digitalization is transforming the Mexico skin care market outlook, with social media and e-commerce revolutionizing how consumers discover and purchase products. Increased mobile device usage and internet access have enabled shoppers to explore and buy skin care items online with ease. Platforms like TikTok, Instagram, and YouTube play a major role in influencing consumer choices, particularly through beauty influencers and tutorial content. Notably, Mexican micro-influencers (10,000–100,000 followers) are highly active in beauty, shopping, and lifestyle categories, making them powerful drivers of trends. Brands are taking advantage of this transition by investing in influencer marketing, improving digital presence, and providing AI-enabled features such as virtual try-ons and customized product suggestions. While convenience and customization online become the new norm, both local and international businesses are employing targeted digital approaches to enhance participation, create loyalty, and increase sales further aiding the Mexico skin care products market share.

Emphasis on Personalization and Inclusivity

The Mexico skin care market is experiencing a shift toward personalized and inclusive beauty solutions. Consumers are increasingly looking for products that address specific skin concerns such as acne, hyperpigmentation, or sensitivity. Brands are responding with customized routines, skin analysis tools, and targeted formulations designed for individual needs. At the same time, there is a growing demand for inclusivity, with consumers expecting diverse product ranges that accommodate various skin tones, types, and cultural backgrounds. This inclusive approach is expanding representation in advertising and product development, strengthening consumer trust. Brands that offer tailored solutions while celebrating diversity are gaining an edge in the competitive market by fostering stronger emotional connections with their audience.

Mexico Skin Care Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, ingredient, gender, and distribution channel.

Product Type Insights:

- Face Cream

- Skin Brightening Cream

- Anti-Aging Cream

- Sun Protection Cream

- Body Lotion

- Mass Body Care

- Premium Body Care

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes face cream (skin brightening cream, anti-aging cream, sun protection cream), body lotion (mass body care, premium body care, others).

Ingredient Insights:

- Chemical

- Natural

A detailed breakup and analysis of the market based on the ingredient have also been provided in the report. This includes chemical and natural.

Gender Insights:

- Male

- Female

- Unisex

The report has provided a detailed breakup and analysis of the market based on the gender. This includes male, female, and unisex.

Distribution Channels Insights:

- Supermarkets and Hypermarkets

- Beauty Parlours and Salons

- Multi Branded Retail Stores

- Online

- Exclusive Retail Stores

- Others

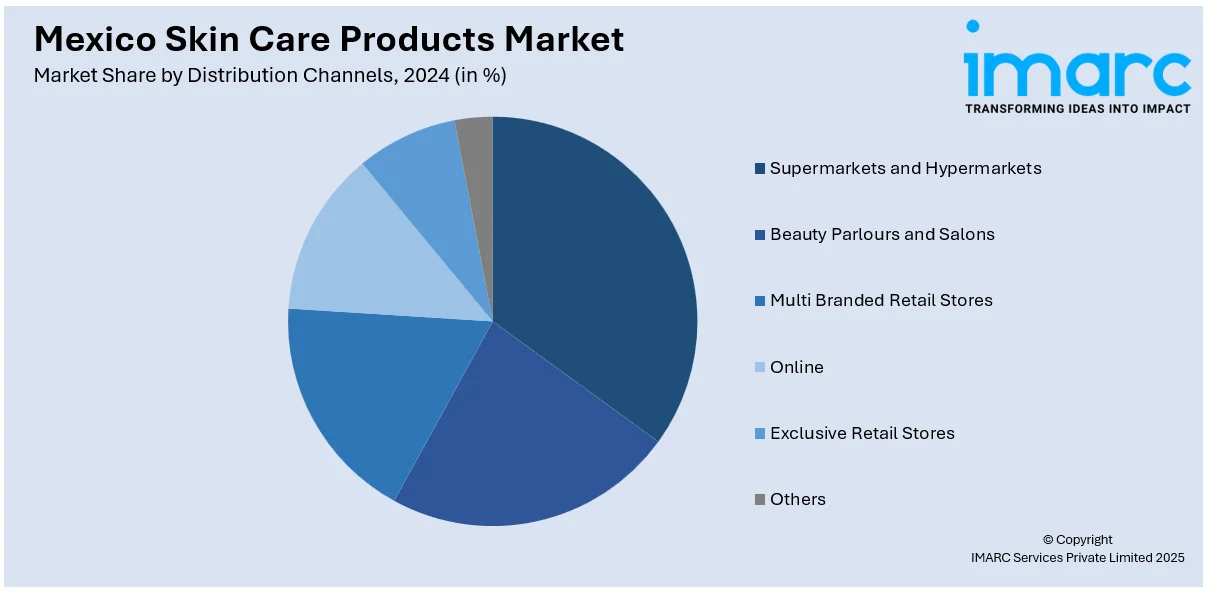

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, beauty parlours and salons, multi branded retail stores, online, exclusive retail stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern, Central, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Skin Care Products Market News:

- In October 2024, E.L.F. Cosmetics officially launched in Sephora Mexico, both in-store and online, expanding access to its best-selling products at affordable prices. The move marks a major milestone, aligning with E.L.F.’s mission of inclusivity and quality. Shoppers can now find viral favorites like Power Grip Primer, Halo Glow Liquid Filter, and Lash XTNDR Mascara at Sephora Mexico locations and online at sephora.com.mx.

- In March 2024, Ulta Beauty is set to enter the Mexican market in 2025 through a joint venture with Grupo Axo, a leading operator of global beauty and fashion brands in Latin America. This marks Ulta's first major international expansion, aiming to bring its unique retail experience and value proposition to Mexico. The move follows postponed Canadian plans, with Ulta now focusing on strategic global growth and enhanced omnichannel operations.

Mexico Skin Care Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Bllion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Ingredients Covered | Chemical, Natural |

| Genders Covered | Male, Female, Unisex |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Beauty Parlours and Salons, Multi Branded Retail Stores, Online, Exclusive Retail Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico skin care products market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico skin care products market on the basis of product type?

- What is the breakup of the Mexico skin care products market on the basis of ingredient?

- What is the breakup of the Mexico skin care products market on the basis of gender?

- What is the breakup of the Mexico skin care products market on the basis of distribution channel?

- What is the breakup of the Mexico skin care products market on the basis of region?

- What are the various stages in the value chain of the Mexico skin care products market?

- What are the key driving factors and challenges in the Mexico skin care products market?

- What is the structure of the Mexico skin care products market and who are the key players?

- What is the degree of competition in the Mexico skin care products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico skin care products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico skin care products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico skin care products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)