Mexico Smart Factory Automation Market Size, Share, Trends and Forecast by Technology, Component, Deployment Mode, Industry Vertical, and Region, 2025-2033

Mexico Smart Factory Automation Market Overview:

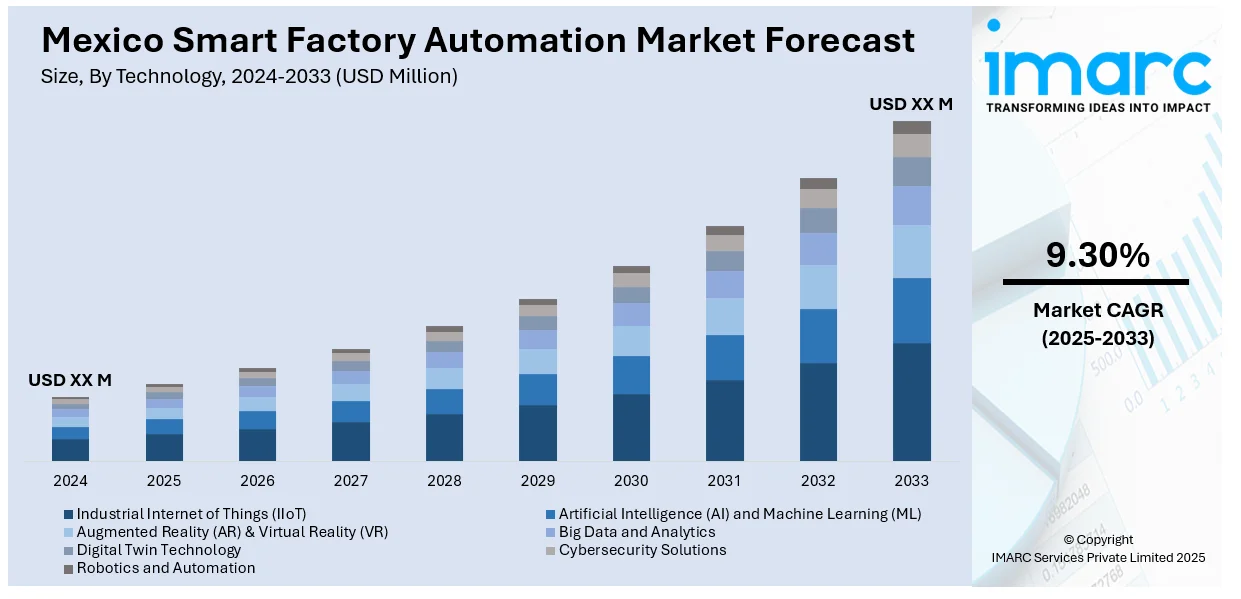

The Mexico smart factory automation market size is projected to exhibit a growth rate (CAGR) of 9.30% during 2025-2033. The adoption of the Industrial Internet of Things (IIoT), and government-backed Industry 4.0 initiatives are fueling the market growth. Additionally, rising focus on energy-efficient production, increasing use of artificial intelligence (AI)-based predictive maintenance, expanding deployment of collaborative robots (cobots), and need for higher productivity and cost control are favoring the market growth. Apart from this, the implementation of machine vision systems, development of skilled local automation solution providers, and escalating demand for real-time data monitoring are boosting the Mexico smart factory automation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 9.30% |

Mexico Smart Factory Automation Market Trends:

Growing Adoption of Industrial Internet of Things (IIoT)

The widespread integration of IIoT technologies is a core driver of smart factory automation in Mexico. Manufacturers are increasingly implementing sensors, edge devices, and data platforms to collect real-time information from equipment, enabling better monitoring, predictive maintenance, and streamlined production workflows. This adoption is particularly visible in sectors like automotive and electronics, where operational efficiency and precision are top priorities. IIoT systems help reduce machine downtime, improve energy usage, and enhance product quality by allowing data-driven decision-making. Moreover, the ability to remotely monitor assets and track performance across multiple facilities has gained importance, especially for multinational firms operating in different regions of Mexico. In a notable development, Bosch Mexico announced in May 2024 the deployment of a digital twin and IIoT-enabled control system at its Toluca plant to optimize assembly line efficiency and reduce maintenance costs. As digital literacy improves within industrial teams and integration costs become more manageable, IIoT investments are expanding beyond large corporations to include mid-sized manufacturers.

Government Initiatives Promoting Industry 4.0 Transformation

Mexico’s federal and state governments have introduced various initiatives to accelerate the adoption of Industry 4.0 technologies across manufacturing sectors. Programs like Prosoft, which supports software and IT development for industrial use, and broader digital transformation roadmaps have encouraged automation upgrades through financial incentives, training, and infrastructure development. These efforts are particularly focused on enhancing the global competitiveness of Mexico’s manufacturing sector by promoting innovation, technology integration, and smart factory models. Public-private partnerships and collaborations with academic institutions are also helping to build skilled talent pools and increase awareness of automation benefits. As part of broader economic strategies, regional governments are aligning policies with global trends to support export-driven industries in meeting international production standards. These supportive frameworks reduce entry barriers for automation adoption, especially among small and medium enterprises (SMEs), helping create a more balanced industrial ecosystem, which is further fostering the Mexico smart factory automation market growth.

Reshoring of Supply Chains from Asia to North America

The shift of supply chains from Asia to North America, driven by global trade disruptions, higher freight costs, and rising geopolitical tensions, has become a major factor boosting factory automation in Mexico. As companies look to bring production closer to end markets like the United States, Mexico stands out as a preferred destination due to its skilled labor, geographic proximity, and trade advantages under USMCA. However, to meet the expectations of global brands regarding efficiency, quality, and scalability, local manufacturers are investing in smart automation systems. These systems help standardize output, improve traceability, and reduce reliance on manual labor, which is crucial for meeting the performance metrics of international buyers. The reshoring trend is also pushing new investments in automated assembly lines, robotics, and real-time production control solutions across industrial parks in border states and central manufacturing hubs.

Mexico Smart Factory Automation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, component, deployment mode, and industry vertical.

Technology Insights:

- Industrial Internet of Things (IIoT)

- Artificial Intelligence (AI) and Machine Learning (ML)

- Augmented Reality (AR) and Virtual Reality (VR)

- Big Data and Analytics

- Digital Twin Technology

- Cybersecurity Solutions

- Robotics and Automation

The report has provided a detailed breakup and analysis of the market based on the technology. This includes industrial internet of things (IIoT), artificial intelligence (AI) and machine learning (ML), augmented reality (AR) and virtual reality (VR), big data and analytics, digital twin technology, cybersecurity solutions, and robotics and automation.

Component Insights:

- Sensors and Actuators

- Industrial Robots

- Human-Machine Interface (HMI)

- Industrial Control Systems

- SCADA

- PLC

- DCS

- Networking and Communication Systems

- Software and Cloud Solutions

The report has provided a detailed breakup and analysis of the market based on the component. This includes sensors and actuators, industrial robots, human-machine interface (HMI), industrial control systems (SCADA, PLC, and DCS), networking and communication systems, and software and cloud solutions.

Deployment Mode Insights:

- On-Premises

- Cloud-Based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

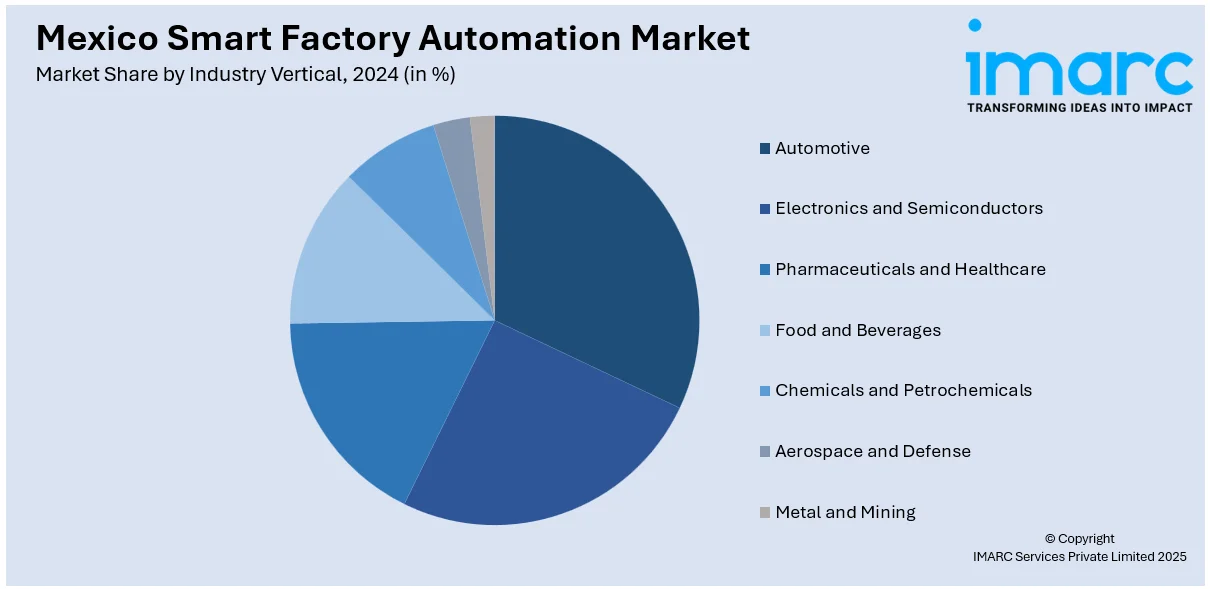

Industry Vertical Insights:

- Automotive

- Electronics and Semiconductors

- Pharmaceuticals and Healthcare

- Food and Beverages

- Chemicals and Petrochemicals

- Aerospace and Defense

- Metal and Mining

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes automotive, electronics and semiconductors, pharmaceuticals and healthcare, food and beverages, chemicals and petrochemicals, aerospace and defense, and metal and mining.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Smart Factory Automation Market News:

- In 2025, Foxconn is investing USD 900 million to build the world’s largest assembly facility for Nvidia’s GB200 superchips in Mexico. The plant will ramp up AI server production for Nvidia’s Blackwell platform, reinforcing Mexico’s position as a hub for advanced electronics and smart manufacturing infrastructure.

Mexico Smart Factory Automation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Industrial Internet of Things (IIoT), Artificial Intelligence (AI) and Machine Learning (ML), Augmented Reality (AR) and Virtual Reality (VR), Big Data and Analytics, Digital Twin Technology, Cybersecurity Solutions, Robotics and Automation |

| Components Covered |

|

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Industry Verticals Covered | Automotive, Electronics and Semiconductors, Pharmaceuticals and Healthcare, Food and Beverages, Chemicals and Petrochemicals, Aerospace and Defense, Metal and Mining |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico smart factory automation market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico smart factory automation market on the basis of technology?

- What is the breakup of the Mexico smart factory automation market on the basis of component?

- What is the breakup of the Mexico smart factory automation market on the basis of deployment mode?

- What is the breakup of the Mexico smart factory automation market on the basis of industry vertical?

- What is the breakup of the Mexico smart factory automation market on the basis of region?

- What are the various stages in the value chain of the Mexico smart factory automation market?

- What are the key driving factors and challenges in the Mexico smart factory automation market?

- What is the structure of the Mexico smart factory automation market and who are the key players?

- What is the degree of competition in the Mexico smart factory automation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico smart factory automation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico smart factory automation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico smart factory automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)