Mexico Smart Manufacturing Software Market Size, Share, Trends and Forecast by Software Type, Enterprise Size, Deployment Mode, Industry Vertical, and Region, 2025-2033

Mexico Smart Manufacturing Software Market Overview:

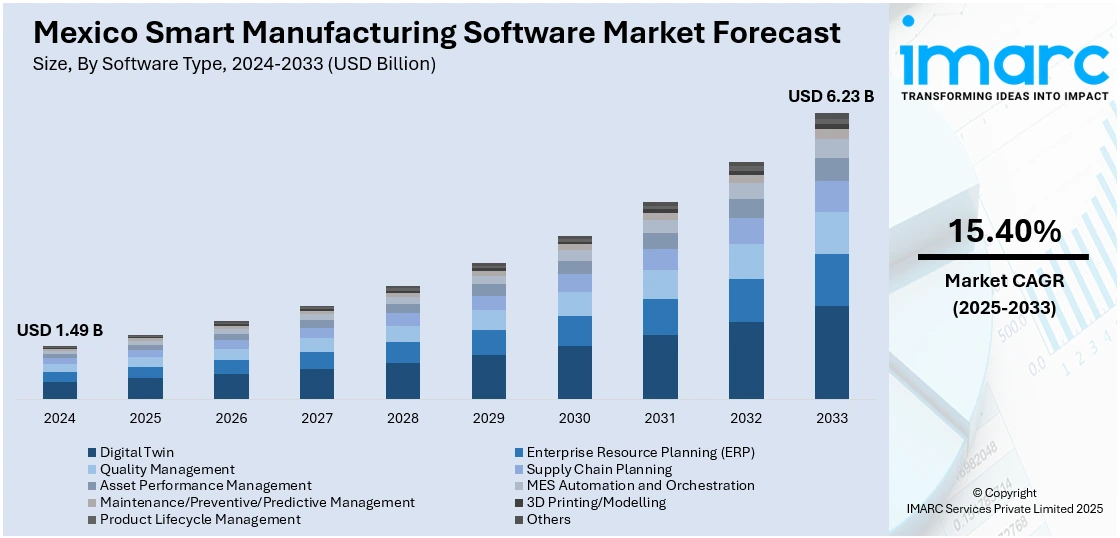

The Mexico smart manufacturing software market size reached USD 1.49 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.23 Billion by 2033, exhibiting a growth rate (CAGR) of 15.40% during 2025-2033. Increasing industrial automation, government policies favoring Industry 4.0 implementation, and increasing demand for operational efficiency drive the market. Demand for real-time data analysis and cost optimization by integrating IoT and AI into manufacturing systems also helps drive Mexico smart manufacturing software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.49 Billion |

| Market Forecast in 2033 | USD 6.23 Billion |

| Market Growth Rate 2025-2033 | 15.40% |

Mexico Smart Manufacturing Software Market Trends:

Integration of AI-Driven Predictive Analytics in Manufacturing Operations

A prominent trend shaping the Mexico Smart Manufacturing Software market is the growing integration of artificial intelligence (AI)-driven predictive analytics into manufacturing processes. Manufacturers are increasingly utilizing advanced data models to forecast equipment failures, production delays, and supply chain disruptions. This shift is enabling companies to transition from reactive to proactive maintenance strategies, significantly reducing unplanned downtime and maintenance costs. Predictive analytics tools, when combined with machine learning algorithms, can analyze historical and real-time data to offer actionable insights, enhancing productivity and operational continuity. The demand for these intelligent tools is particularly evident in sectors like automotive and electronics manufacturing, where precision and uninterrupted workflows are crucial. For instance, in February 2025, Foxconn and the Government of Sonora, Mexico signed a memorandum of understanding to collaborate on Smart City development, marking the Taiwanese tech giant’s first such initiative outside of Taiwan. The partnership aims to deploy digital infrastructure, AI-enabled urban governance, and smart mobility solutions—particularly in electric vehicles and public transport. With Foxconn’s advanced integration of software, AI, and IoT technologies, the project is expected to accelerate adoption of smart manufacturing platforms across Sonora, creating ripple effects in automation, predictive maintenance, and real-time analytics across industries.

Customization of Software Solutions for SMEs

The increasing emphasis on scalable and cost-effective software solutions tailored for small and mid-sized enterprises (SMEs) represents a significant trend in the Mexico smart manufacturing software market growth. While large corporations have traditionally led the adoption of smart manufacturing technologies, SMEs are now becoming key stakeholders due to the availability of modular, cloud-based platforms. These solutions allow smaller manufacturers to adopt digital tools incrementally, aligning with their budget constraints and operational requirements. Vendors are also offering industry-specific features and localized interfaces to accommodate the unique needs of Mexican SMEs across sectors such as food processing, textiles, and light manufacturing. The democratization of smart manufacturing technologies is enabling SMEs to improve quality control, streamline supply chains, and remain competitive in an increasingly digitized global market. For instance, in January 2024, Jabil Inc. expanded its digital commerce capabilities at a newly enlarged Center of Manufacturing Excellence in Chihuahua, Mexico. This third plant in the region enhances Jabil’s manufacturing portfolio with over one million square feet of production space, supporting retail automation, AI, robotics, and additive manufacturing. Collaborations with companies like Ocado and VusionGroup demonstrate Jabil’s ability to scale smart retail solutions.

Mexico Smart Manufacturing Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on software type, enterprise size, deployment mode, and industry vertical.

Software Type Insights:

- Digital Twin

- Enterprise Resource Planning (ERP)

- Quality Management

- Supply Chain Planning

- Asset Performance Management

- MES Automation and Orchestration

- Maintenance/Preventive/Predictive Management

- 3D Printing/Modelling

- Product Lifecycle Management

- Others

The report has provided a detailed breakup and analysis of the market based on the software type. This includes digital twin, enterprise resource planning (ERP), quality management, supply chain planning, asset performance management, MES automation and orchestration, maintenance/preventive/predictive management, 3D printing/modelling, product lifecycle management, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Mid-sized Enterprises (SMEs)

The report has provided a detailed breakup and analysis of the market based on enterprise size. This includes large enterprises and small and mid-sized enterprises (SMEs).

Deployment Mode Insights:

- Cloud based

- On-premises

The report has provided a detailed breakup and analysis of the market based on deployment mode. This includes cloud-based and on-premises.

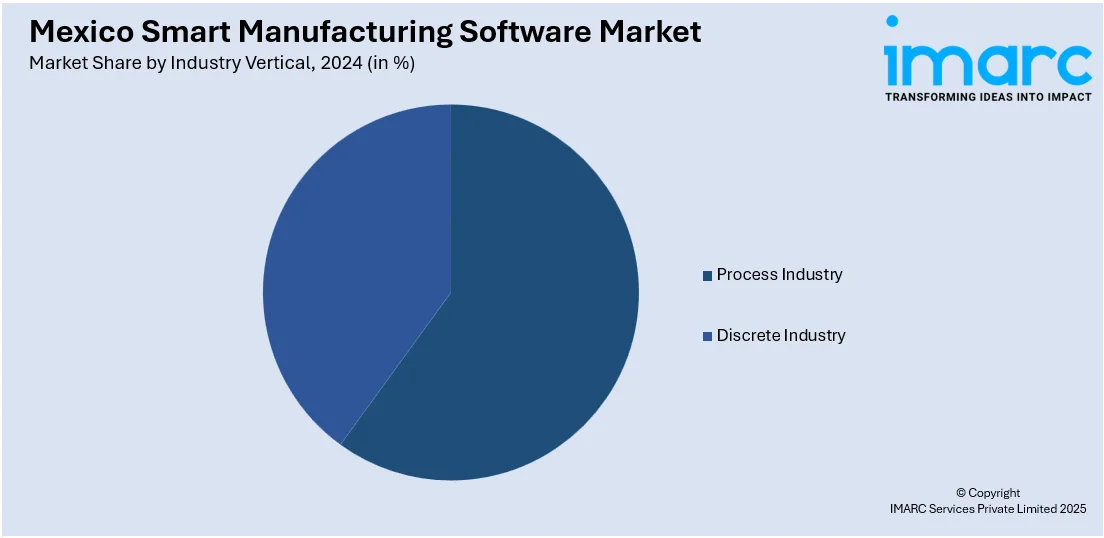

Industry Vertical Insights:

- Process Industry

- Oil and Gas

- Power and Energy

- Chemicals

- Pharmaceuticals

- Food and Beverages

- Metal and Mining

- Others

- Discrete Industry

- Automotive

- Electronics and Manufacturing

- Industrial Manufacturing

- Aerospace and Defense

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes process industry (oil and gas, power and energy, chemicals, pharmaceuticals, food and beverages, metal and mining, and others) and discrete industry (automotive, electronics and manufacturing, industrial manufacturing, aerospace and defense, and others).

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Smart Manufacturing Software Market News:

- In August 2024, ECI Software Solutions, a Westlake-based provider of cloud business management tools, acquired ERP provider ProfitKey International to enhance its smart manufacturing software offerings. With offices in Mexico and globally, ECI aims to deepen support for small and mid-sized manufacturers. ProfitKey’s integration will strengthen ECI’s manufacturing division, offering customers added resources while maintaining existing platforms.

- In June 2024, Rockwell Automation expanded its collaboration with NVIDIA to enhance the development of autonomous mobile robots (AMRs) for smarter manufacturing. By integrating NVIDIA's Isaac robotics platform, Rockwell aims to improve performance and efficiency in industrial environments. This partnership will also integrate NVIDIA Omniverse Cloud with Rockwell’s Emulate3D software, enabling digital twin simulations for better production system designs. With AI set to drive significant business outcomes, this collaboration aims to boost automation and sustainability in manufacturing operations globally.

Mexico Smart Manufacturing Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Software Types Covered | Digital Twin, Enterprise Resource Planning (ERP), Quality Management, Supply Chain Planning, Asset Performance Management, MES Automation and Orchestration, Maintenance/Preventive/Predictive Management, 3D Printing/Modelling, Product Lifecycle Management, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Mid-Sized Enterprises (SMEs) |

| Deployment Modes Covered | Cloud-Based, On-Premises |

| Industry Verticals Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico smart manufacturing software market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico smart manufacturing software market on the basis of software type?

- What is the breakup of the Mexico smart manufacturing software market on the basis of enterprise size?

- What is the breakup of the Mexico smart manufacturing software market on the basis of deployment mode?

- What is the breakup of the Mexico smart manufacturing software market on the basis of industry vertical?

- What is the breakup of the Mexico smart manufacturing software market on the basis of region?

- What are the various stages in the value chain of the Mexico smart manufacturing software market?

- What are the key driving factors and challenges in the Mexico smart manufacturing software market?

- What is the structure of the Mexico smart manufacturing software market and who are the key players?

- What is the degree of competition in the Mexico smart manufacturing software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico smart manufacturing software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico smart manufacturing software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico smart manufacturing software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)