Mexico Smartphones Market Size, Share, Trends and Forecast by Operating System, Display Technology, Ram Capacity, Price Range, Distribution Channel, and Region, 2025-2033

Mexico Smartphones Market Overview:

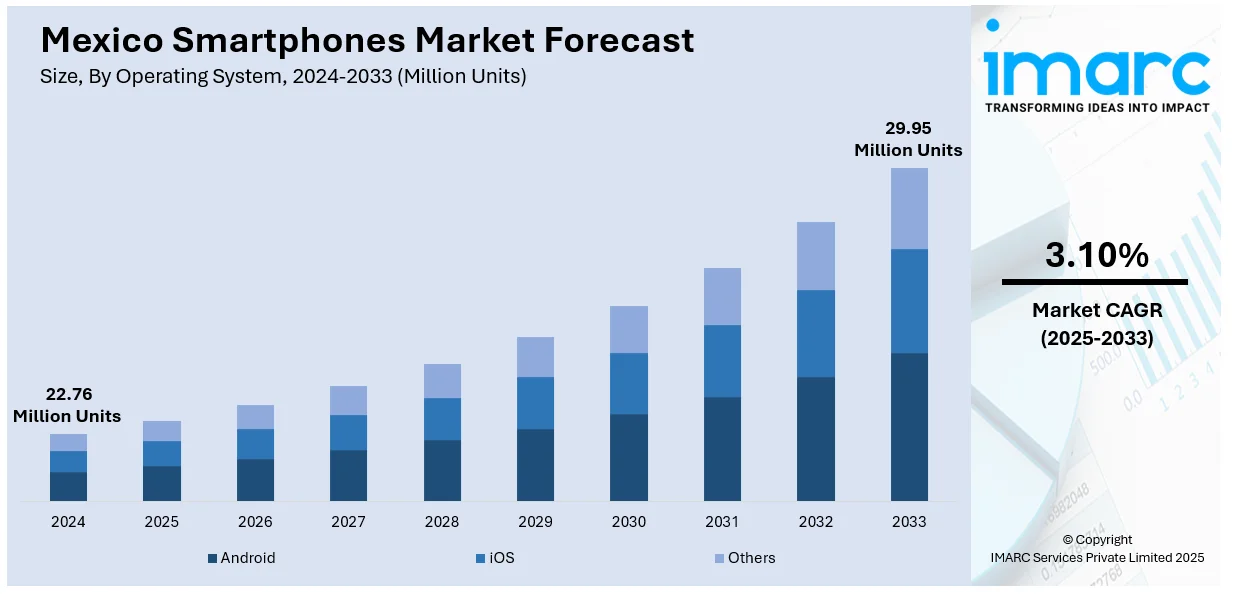

The Mexico smartphones market size reached 22.76 Million Units in 2024. Looking forward, IMARC Group expects the market to reach 29.95 Million Units by 2033, exhibiting a growth rate (CAGR) of 3.10% during 2025-2033. The market is driven by increasing digital connectivity, expanding e-commerce platforms, and rising consumer demand for advanced features like 5G, AI, and improved cameras. The youthful population and growing reliance on mobile banking and social media further fuel smartphone adoption, contributing to increasing Mexico smartphones market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 22.76 Million Units |

| Market Forecast in 2033 | 29.95 Million Units |

| Market Growth Rate 2025-2033 | 3.10% |

Mexico Smartphones Market Trends:

Growing Internet and Mobile Data Penetration

The increasing penetration of high-speed internet and affordable mobile data services is a major factor driving Mexico's smartphones market. As mobile network coverage improves, even in semi-urban and rural areas, more consumers are adopting smartphones to access digital services, entertainment, and social media. The rollout of 4G and expanding 5G infrastructure has further boosted demand for devices compatible with these networks, encouraging consumers to upgrade to more advanced smartphones. Additionally, the affordability of mobile data plans from local telecom operators has made internet access via smartphones more accessible. This combination of improved connectivity and data affordability has accelerated smartphone adoption across demographic segments, contributing significantly to market growth in Mexico.

E-commerce and Omnichannel Retail Expansion

The rapid expansion of e-commerce platforms and omnichannel retail strategies has fueled smartphone sales in Mexico. Online marketplaces and direct-to-consumer channels provide consumers with a wider variety of smartphone brands, models, and deals, enhancing convenience and price transparency. Promotions, flash sales, and financing options on popular platforms attract both first-time buyers and those upgrading their devices. Additionally, traditional electronics retailers are integrating online and offline sales channels to improve customer reach and experiences. This seamless shopping environment has enabled consumers from urban and rural areas to access the latest smartphones, stimulating demand and competition among brands. The strong growth of e-commerce and retail innovation continues to be a key driver of smartphone adoption in Mexico.

Demand for Affordable and Feature-Rich Smartphones

The necessity for cost-effective but feature-packed smartphones remains a critical growth factor in Mexico’s market. Many consumers seek devices that offer a balance between price, performance, and functionality, such as large displays, high-resolution cameras, and long battery life, at accessible price points. This has encouraged both global and regional smartphone brands to introduce competitively priced models with premium features. Additionally, the popularity of refurbished and second-hand smartphones has broadened market access for budget-conscious consumers. The focus on affordability does not compromise the demand for advanced features, as consumers expect devices to support gaming, social media, and mobile payments. This consumer preference for value-driven devices sustains the momentum in the Mexico smartphones market growth.

Mexico Smartphones Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on operating system, display technology, RAM capacity, price range, and distribution channel.

Operating System Insights:

- Android

- iOS

- Others

The report has provided a detailed breakup and analysis of the market based on the operating system. This includes Android, iOS, and others.

Display Technology Insights:

- LCD Technology

- OLED Technology

A detailed breakup and analysis of the market based on the display technology have also been provided in the report. This includes LCD technology and OLED technology.

RAM Capacity Insights:

- Below 4GB

- 4GB - 8GB

- Over 8GB

A detailed breakup and analysis of the market based on the RAM capacity have also been provided in the report. This includes below 4 GB, 4 GB – 8 GB, and over 8 GB.

Price Range Insights:

- Ultra-Low-End (Less Than $100)

- Low-End ($100-<$200)

- Mid-Range ($200-<$400)

- Mid- to High-End ($400-<$600)

- High-End ($600-<$800)

- Premium ($800-<$1000) and Ultra-Premium ($1000 and Above)

A detailed breakup and analysis of the market based on the price range have also been provided in the report. This includes ultra-low-end (less than $100), low-end ($100-<$200), mid-range ($200-<$400), mid- to high-end ($400-<$600), high-end ($600-<$800), and premium ($800-<$1000) and ultra-premium ($1000 and above).

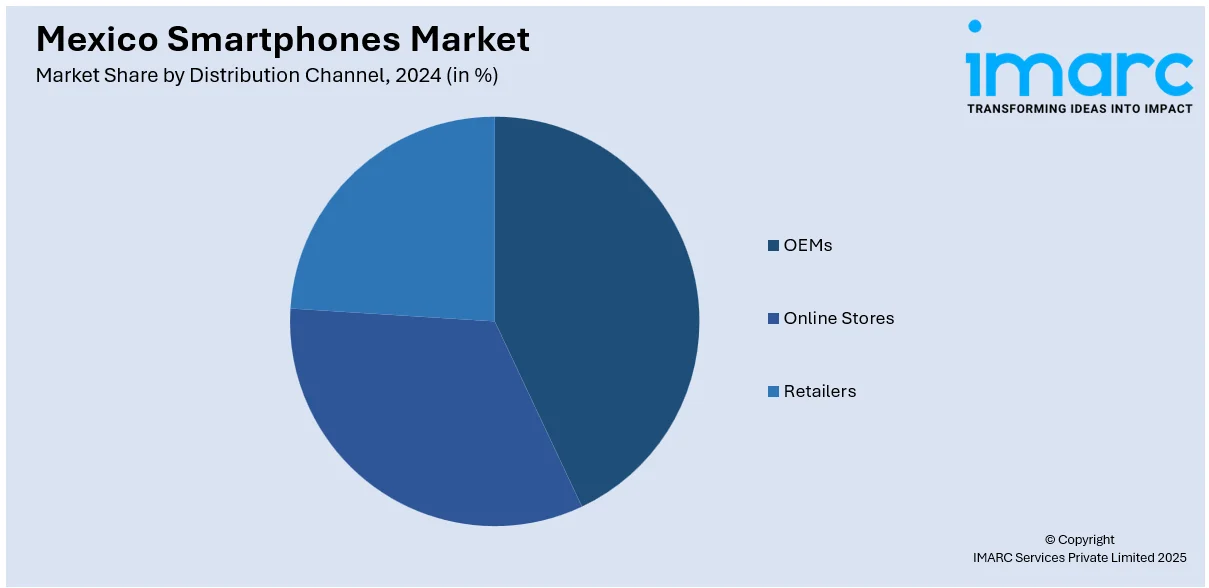

Distribution Channel Insights:

- OEMs

- Online Stores

- Retailers

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes OEMs, online stores, and retailers.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Smartphones Market News:

- In October 2023, Samsung Electronics Co., Ltd. declares the opening of its worldwide self-repair initiative in the markets of Mexico and Brazil. The goal of this program is to give customers a repair option that will improve convenience, allow them to retain their Galaxy devices for as long as feasible, extend the product's life cycle if it is fixed correctly, and reduce electronic waste.

Mexico Smartphones Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Units |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Operating Systems Covered | Android, Ios, Others |

| Display Technologies Covered | LCD Technology, OLED Technology |

| RAM Capacities Covered | Below 4GB, 4GB - 8GB, Over 8GB |

| Price Ranges Covered | Ultra-Low-End (Less Than $100), Low-End ($100-<$200), Mid-Range ($200-<$400), Mid- to High-End ($400-<$600), High-End ($600-<$800), Premium ($800-<$1000) and Ultra-Premium ($1000 And Above) |

| Distribution Channels Covered | OEMs, Online Stores, Retailers |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico smartphones market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico smartphones market on the basis of operating system?

- What is the breakup of the Mexico smartphones market on the basis of display technology?

- What is the breakup of the Mexico smartphones market on the basis of RAM capacity?

- What is the breakup of the Mexico smartphones market on the basis of price range?

- What is the breakup of the Mexico smartphones market on the basis of distribution channel?

- What is the breakup of the Mexico smartphones market on the basis of region?

- What are the various stages in the value chain of the Mexico smartphones market?

- What are the key driving factors and challenges in the Mexico smartphones market?

- What is the structure of the Mexico smartphones market and who are the key players?

- What is the degree of competition in the Mexico smartphones market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico smartphones market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico smartphones market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico smartphones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)