Mexico Snacks Market Size, Share, Trends and Forecast by Product, Packaging, Distribution Channel, and Region, 2026-2034

Mexico Snacks Market Summary:

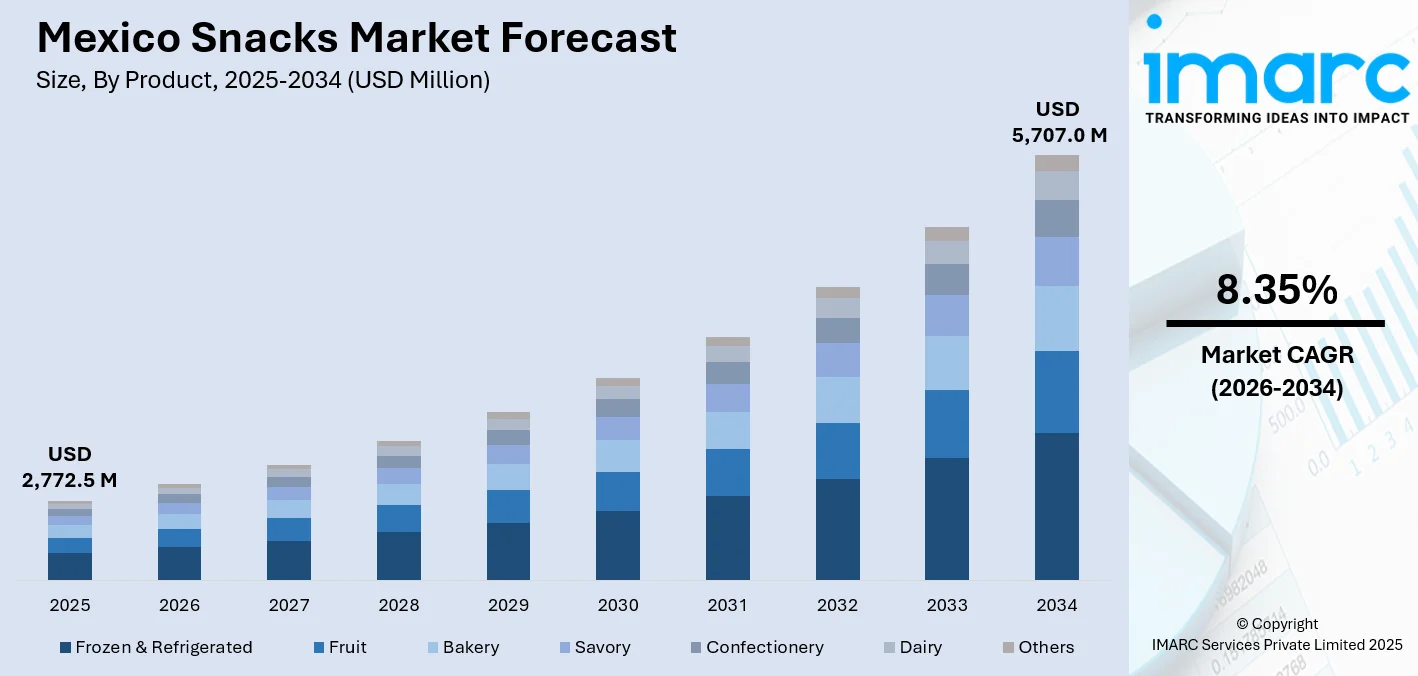

The Mexico snacks market size was valued at USD 2,772.5 Million in 2025 and is projected to reach USD 5,707.0 Million by 2034, growing at a compound annual growth rate of 8.35% from 2026-2034.

The Mexico snacking industry is witnessing healthy growth as it keeps pace with changing lifestyle patterns and eating habits in the country. The increasing number of people in urban areas and busy working patterns of these populations have triggered demand for snacking foods that match these lifestyle changes. The growing demand in Mexico has produced favorable cultural preferences for snacking foods with typical Mexican taste such as chili, lime, and tamarind.

Key Takeaways and Insights:

-

By Product: Savory dominate the market with a share of 33% in 2025, driven by the strong cultural affinity for traditional corn-based snacks, tortilla chips, and extruded snacks that align with Mexican culinary preferences for bold, spicy flavors.

- By Packaging: Bag and pouches lead the market with a share of 45% in 2025, owing to their convenience, portability, and cost-effectiveness for single-serve and family-sized portions that accommodate diverse consumption occasions.

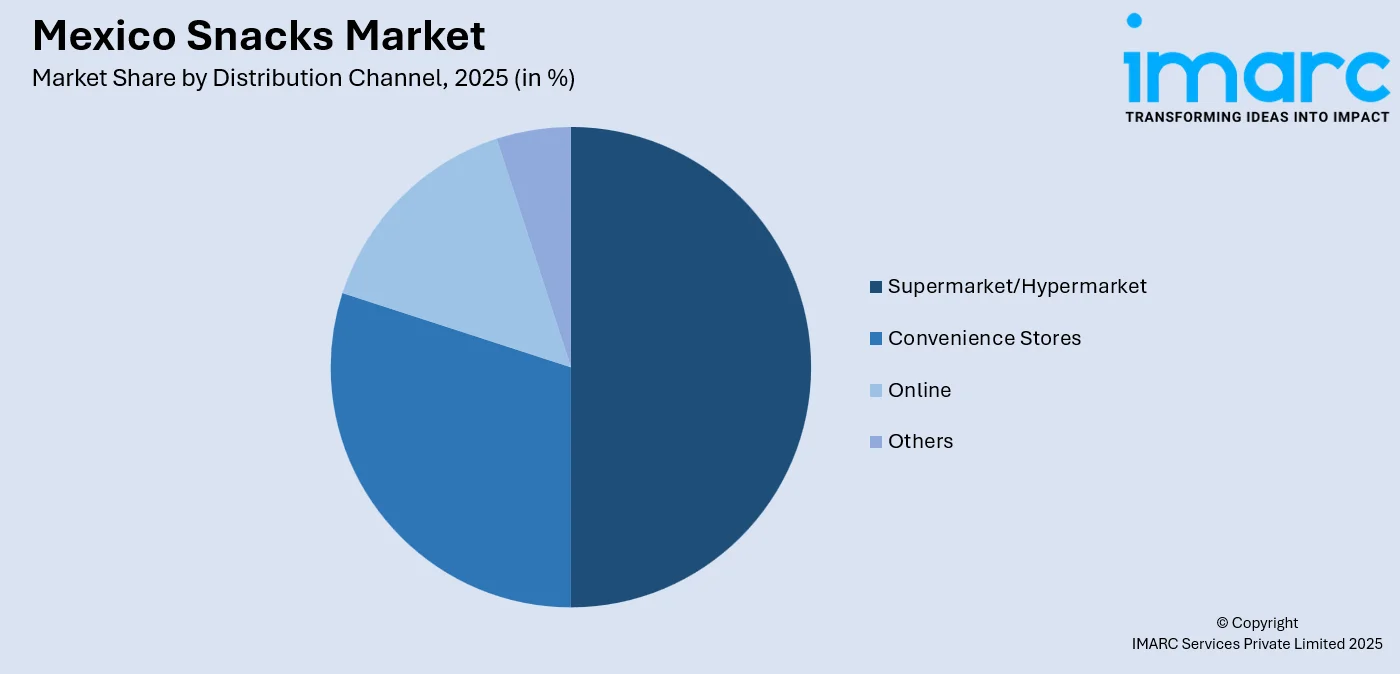

- By Distribution Channel: Supermarket/hypermarket represents the largest segment with a market share of 50% in 2025, attributed to their extensive product variety, competitive pricing, and the growing preference for one-stop shopping experiences among Mexican consumers.

- By Region: Central Mexico dominates the market with a share of 41% revenue share in 2025, driven by the high population density in major metropolitan areas such as Mexico City and neighboring states, coupled with elevated disposable income levels and well-established retail infrastructure.

- Key Players: The Mexico snacks market exhibits moderate to high competitive intensity, characterized by the presence of established multinational corporations alongside regional manufacturers competing across various price segments and product categories throughout the country.

To get more information on this market Request Sample

The Mexican snacks industry continues to evolve rapidly, reflecting broader shifts in consumer behavior and lifestyle patterns. Rising disposable incomes coupled with expanding urbanization have created a favorable environment for snack consumption across all demographics. For example, in 2024 Mission Foods Mexico announced a major investment of 792 million pesos to build a new snacks plant in Puebla to expand production capacity and meet growing demand across central and southern regions of the country. Health and wellness trends are reshaping product development strategies, with manufacturers increasingly focusing on nutritious alternatives that incorporate natural ingredients and clean-label formulations. The expansion of modern retail channels and e-commerce platforms has enhanced product accessibility, allowing consumers to explore diverse snacking options. Traditional Mexican flavors remain central to product innovation, with companies successfully blending authentic taste profiles with contemporary formats to capture consumer attention in an increasingly competitive marketplace.

Mexico Snacks Market Trends:

Resurgence of Traditional Mexican Flavors and Authentic Ingredients

There is a growing consumer preference for snacks that celebrate Mexico's vibrant culinary heritage. For example, in 2025 Zambos teamed up with iconic Mexican seasoning brand Tajín to launch Zambos with Tajín premium plantain chips, combining the classic chile‑lime flavor profile with a crunchy new snack format to attract flavor‑seeking consumers. Flavor profiles incorporating chili, lime, tamarind, and traditional sauces are gaining significant traction as consumers prioritize authenticity in their snacking choices. Manufacturers are leveraging regional ingredients and time-honored recipes to create distinctive products that evoke cultural nostalgia while appealing to consumers seeking bold and adventurous taste experiences.

Growing Demand for Health-Conscious and Clean-Label Snacking Options

Health awareness is fundamentally reshaping snacking preferences across Mexico, with consumers increasingly seeking products that align with wellness-oriented lifestyles. For example, major snack multinational PepsiCo announced plans in 2025 to rebrand its flagship Lay’s and Tostitos brands to remove artificial dyes and flavors and focus on cleaner, more natural ingredients to better align with rising demand for healthier snacks. The market is witnessing rising interest in low-calorie, gluten-free, organic, and plant-based snack alternatives. Clean-label products featuring transparent ingredient lists and natural formulations are gaining traction, particularly among younger demographics who prioritize nutritional content and ingredient transparency in their purchasing decisions.

Digital Commerce Expansion and Omnichannel Retail Integration

The retail landscape for snacks in Mexico is undergoing significant transformation driven by e-commerce growth and digital adoption. Online platforms are becoming increasingly important distribution channels, offering convenience, personalized promotions, and broader product accessibility. In 2025, Mercado Libre reported strong online sales growth for Mexican food products, including high‑search items such as pork rinds and regional snack favorites, highlighting how digital marketplaces are driving broader visibility and demand for local snack brands across the country. Smartphone penetration and improved internet connectivity are accelerating online snack purchases, particularly in urban areas where consumers value convenience and variety in their shopping experiences.

Market Outlook 2026-2034:

The Mexico snacks market is poised to witness positive growth during the forecast period on account of favorable demographic trends and consumption shifts. Additionally, the increasingly urbanized and growing middle class in Mexico, driven by changes in lifestyle choices, continues to propel the demand for convenient snacking options. Enhancements in product formats and flavors and advancements in packaging will be the game-changers for companies operating in this marketplace. The development of healthier product options and incorporating true flavors from Mexico will be other defining features in this marketplace. The market generated a revenue of USD 2,772.5 Million in 2025 and is projected to reach a revenue of USD 5,707.0 Million by 2034, growing at a compound annual growth rate of 8.35% from 2026-2034.

Mexico Snacks Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Savory |

33% |

|

Packaging |

Bag and Pouches |

45% |

|

Distribution Channel |

Supermarket/Hypermarket |

50% |

|

Region |

Central Mexico |

41% |

Product Insights:

- Frozen & Refrigerated

- Fruit

- Bakery

- Savory

- Confectionery

- Dairy

- Others

The savory dominates with a market share of 33% of the total Mexico snacks market in 2025.

Savory snacks command the largest market share in Mexico, reflecting the nation's strong culinary heritage and consumer preference for bold, flavorful taste experiences. Tortilla chips, extruded snacks, potato chips, and corn-based products form the foundation of this segment, with consumers demonstrating notable loyalty to traditional Mexican flavor profiles such as chili-lime, jalapeño, and tamarind seasonings. The enduring popularity of these flavors highlights the deep cultural connection Mexican consumers maintain with authentic, locally-inspired snacking options.

This category performs well under various consumption occasions, such as occasions of snacking and spending time with others and with meal occasions. Innovation is being fueled by manufacturers who are launching baked and air-popped versions of products besides fried versions to cater to the increasing requirement for healthier savory snacks but with classical flavors that Mexican consumers are accustomed to. Eating occasions and innovation being an integral aspect of this particular category ensure that this category grows considerably throughout the forecasted period.

Packaging Insights:

- Bag and Pouches

- Boxes

- Cans

- Jars

- Others

The bag and pouches lead with a share of 45% of the total Mexico snacks market in 2025.

Bag and pouches packaging dominates the Mexico snacks market due to its practical advantages in terms of convenience, cost-effectiveness, and product protection. This packaging format accommodates various portion sizes from single-serve sachets to family-sized bags, catering to diverse consumption needs across different consumer segments and occasions throughout the country. In June 2025 at ExpoPack Guadalajara, packaging innovators showcased a wave of sustainable and high‑performance flexible pouch solutions, including recyclable PE and compostable pouches, specifically tailored for snack brands seeking to meet evolving consumer preferences for convenience and environmental responsibility.

The flexible nature of pouches and bags allows for the integration of designs that are aesthetically appealing, re-sealing capabilities, and colorful prints that can boost sales through increased consumer appeal and also improve brand recognition. Advancements in consumer consciousness regarding sustainability among the people of Mexico have led to the implementation of eco-friendly packaging solutions for bag and pouch packaging, thereby dispelling concerns about product freshness and quality while ensuring that these elements are retained.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarket/Hypermarket

- Convenience Stores

- Online

- Others

The supermarket/hypermarket dominates with a market share of 50% of the total Mexico snacks market in 2025.

Supermarkets & Hypermarkets act as the chief distribution channel for snacks in the Mexican market, giving consumers an opportunity to have a complete range of products at an affordable price point. Both formats have special snack shelves that contain an entire range of products, right from local brands to overseas brands, within different price segments. The availability of such retail formats throughout urban & semi-urban centers has encouraged Mexican households to make purchases at these stores.

The spread of modern retail infrastructure in Mexican cities and towns has been continually improving this marketing channel’s leadership position in the market. The promotional events, loyalty cards, and strategic product placements in these retail stores accelerate impulse purchases, which in turn improve brand awareness. In addition, the adoption of e-commerce functionality in retail store chains has enabled hybrid purchasing experiences.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Central Mexico exhibits a clear dominance with a 41% share of the total Mexico snacks market in 2025.

Central Mexico holds the largest regional share, supported by high population density across major urban centers, including the Mexico City metropolitan area, which constitutes the nation's primary consumer market. The region benefits from robust retail infrastructure, elevated disposable income levels, and advanced distribution networks ensuring widespread product availability across various retail formats. Additionally, the concentration of key manufacturing and logistics facilities in this region enables efficient supply chain operations and optimal product freshness.

Consumers in Central Mexico show a preference for premium and innovative snacking products, reflecting the urban population's familiarity with global food trends and openness to trying new offerings. The presence of key manufacturing facilities and logistics hubs in this region enables efficient supply chain operations and optimal product freshness, cementing its position as the leading regional market for snacks. This favorable ecosystem of consumer demand and operational efficiency drives sustained market growth.

Market Dynamics:

Growth Drivers:

Why is the Mexico Snacks Market Growing?

Urbanization and Evolving Lifestyle Patterns Driving On-the-Go Consumption

Rapid urbanization across Mexico is fundamentally reshaping consumer lifestyles and eating habits, creating substantial demand for convenient snacking solutions. As more Mexicans migrate to urban centers and adopt faster-paced routines characterized by extended work hours and lengthy commutes, the need for portable, ready-to-consume food options has intensified significantly. The Mexico on-the-go healthy snacks market size reached USD 1.3 billion in 2024, highlighting strong demand for convenient snack solutions. Looking forward, IMARC Group expects the market to reach USD 2.5 billion by 2033, reflecting continued growth driven by urban lifestyles. Modern urban dwellers increasingly rely on snacks to bridge meal gaps, maintain energy levels throughout demanding schedules, and satisfy cravings during limited break times.

Rising Health Consciousness and Demand for Nutritious Snacking Alternatives

Growing awareness of nutrition and wellness among Mexican consumers is creating new market opportunities for health-oriented snack products. Consumers are increasingly scrutinizing ingredient labels, seeking products with natural components, reduced sodium content, and functional benefits that align with healthier dietary choices. In March 2025, Latino snack company Santana Snacks launched MOSA, a USDA‑certified organic corn chip line inspired by classic Mexican street snacks, offering a gluten‑free, vegan, and dairy‑free better‑for‑you alternative that reflects this shift toward wellness‑oriented eating. This shift in consumer mindset has prompted manufacturers to reformulate existing products and introduce new lines featuring organic ingredients, whole grains, plant-based proteins, and reduced-calorie formulations.

Expansion of Modern Retail Infrastructure and E-commerce Channels

The continued expansion of organized retail and digital commerce platforms is significantly enhancing snack product accessibility across Mexico. Supermarkets, hypermarkets, and convenience store chains are extending their geographic footprint, bringing diverse snack assortments to previously underserved markets and populations. For example, in 2025 Wal‑Mart de México announced a $6 billion investment to expand its network of stores and build modern distribution centers, which will broaden the reach of consumer goods, including snacks, across urban, suburban, and regional areas. Simultaneously, e-commerce platforms are democratizing access to specialty and premium snack products, enabling consumers in remote areas to explore options previously available only in major metropolitan centers. Omnichannel retail, blending stores with digital ordering and delivery, creates seamless shopping, boosting snack purchases and expanding consumer reach nationwide.

Market Restraints:

What Challenges the Mexico Snacks Market is Facing?

Fluctuating Raw Material Costs and Supply Chain Pressures

Volatility in raw material prices, particularly for corn, wheat, vegetable oils, and other essential ingredients, presents ongoing challenges for snack manufacturers in Mexico. These price fluctuations significantly impact production costs and profit margins, compelling companies to balance cost management with maintaining product quality and competitive pricing. This economic pressure requires manufacturers to adopt strategic sourcing and operational efficiencies to sustain profitability.

Regulatory Environment and Health-Related Restrictions

Stringent regulatory requirements related to nutritional labeling, health warnings, and restrictions on snack sales in educational institutions pose compliance challenges for market participants. These regulations compel manufacturers to invest in product reformulation, packaging redesign, and marketing strategy adjustments to maintain market access. Adapting to evolving regulatory frameworks demands continuous monitoring and resource allocation, adding operational complexity for both domestic and international snack producers operating in Mexico.

Competition from Traditional and Homemade Snacking Options

The deep-rooted tradition of preparing homemade snacks and the widespread presence of street food vendors across Mexico create competitive pressures for packaged snack manufacturers. Many consumers continue to prefer freshly prepared traditional snacks for their perceived authenticity and value, particularly in price-sensitive segments. This preference for fresh, affordable alternatives challenges packaged snack producers to differentiate through quality, convenience, and innovation.

Competitive Landscape:

The Mexico snacks market demonstrates a moderately concentrated competitive structure, characterized by the presence of established multinational corporations operating alongside domestic manufacturers and regional players. Market leaders maintain their positions through continuous product innovation, extensive distribution networks, and significant marketing investments that build brand recognition and consumer loyalty. Competition intensifies across multiple dimensions, including product quality, flavor innovation, pricing strategies, and distribution reach. Companies are increasingly focusing on portfolio diversification, health-oriented product development, and sustainable packaging initiatives to differentiate their offerings. Strategic partnerships, acquisitions, and capacity expansions remain key competitive tactics as market participants seek to strengthen their positions and capture emerging growth opportunities throughout the country.

Recent Developments:

- In November 2025, Mexican snack brand Chuza launched a new line of bold trail mixes, including Barrio Mix and Tropical Mix, inspired by authentic flavors. The products debuted at select Whole Foods Market locations, expanding Chuza’s portfolio of spicy dried fruit snacks.

Mexico Snacks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Frozen & Refrigerated, Fruit, Bakery, Savory, Confectionery, Dairy, Others |

| Packagings Covered | Bag and Pouches, Boxes, Cans, Jars, Others |

| Distribution Channels Covered | Supermarket/Hypermarket, Convenience Stores, Online, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico snacks market size was valued at USD 2,772.5 Million in 2025.

The Mexico snacks market is expected to grow at a compound annual growth rate of 8.35% from 2026-2034 to reach USD 5,707.0 Million by 2034.

The savory dominated the market with a 33% share, driven by strong consumer demand for traditional Mexican flavors such as chili-lime, jalapeño, and corn-based snacks that embody the country's rich culinary traditions.

Key factors driving the Mexico snacks market include rapid urbanization creating demand for convenient on-the-go options, rising health consciousness fueling interest in nutritious alternatives, strong cultural preferences for traditional Mexican flavors, and the expansion of modern retail and e-commerce distribution channels enhancing product accessibility.

Major challenges include fluctuating raw material costs affecting production margins, stringent health regulations and restrictions on junk food sales in schools, competition from traditional homemade snacks and street food vendors, and the need for continuous product innovation to meet evolving consumer preferences.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)