Mexico Specialty Food Ingredients Market Size, Share, Trends and Forecast by Product Type, Source, Application, Distribution Channel, and Region, 2026-2034

Mexico Specialty Food Ingredients Market Overview:

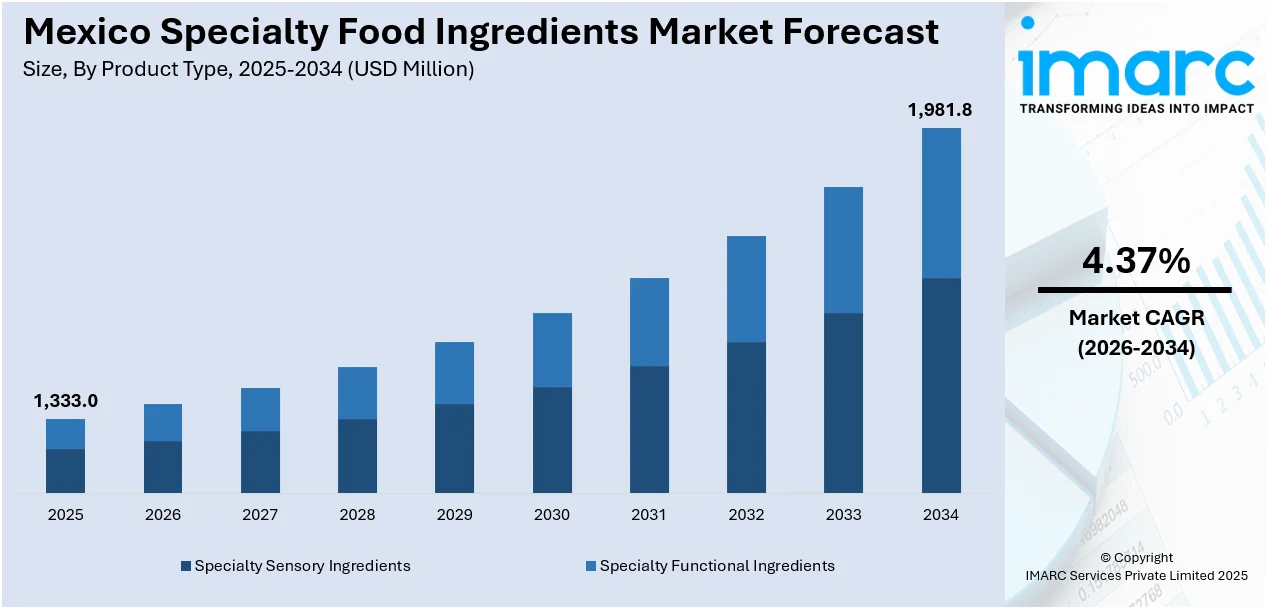

The Mexico specialty food ingredients market size reached USD 1,333.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,981.8 Million by 2034, exhibiting a growth rate (CAGR) of 4.37% during 2026-2034. The market is driven by rising health awareness, demand for clean-label and fortified products, growth in processed and functional foods, and urban lifestyle changes. Expanding middle-class consumption, supportive regulations for food innovation, and increased interest in natural flavors, plant proteins, and low-calorie ingredients also contribute to Mexico specialty food ingredients market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,333.0 Million |

| Market Forecast in 2034 | USD 1,981.8 Million |

| Market Growth Rate 2026-2034 | 4.37% |

Mexico Specialty Food Ingredients Market Trends:

Functional Ingredients in Traditional Mexican Foods

An emerging trend in Mexico involves the integration of functional ingredients into traditional food and beverage products. Brands are fortifying items such as tortillas, tamales, and aguas frescas with added fibers, prebiotics, and plant-based proteins to enhance nutritional value without altering cultural familiarity. This approach resonates with health-conscious consumers who prefer familiar formats but seek added benefits like digestive health, immune support, and satiety. The rise in non-communicable diseases such as obesity and diabetes has accelerated the demand for fortified alternatives to everyday staples. As a result, local ingredient producers are collaborating with food technologists to preserve taste and texture while improving health profiles. This blending of heritage and health reflects a unique opportunity for innovation rooted in cultural relevance and dietary evolution. For instance, in July 2024, PepsiCo introduced the 2024 Greenhouse Accelerator Program: Juntos Crecemos, spotlighting health-focused and sustainable food and beverage innovations inspired by Hispanic culture. The selected finalists represent a diverse range of emerging brands creating products such as plant-based snacks, sodas sweetened with agave, cactus-based drinks, Latin American staples, and handcrafted sauces. The initiative aims to support companies that align with shifting consumer preferences and cultural authenticity.

To get more information on this market Request Sample

Expansion of Specialty Ingredients for Plant-Based Alternatives

The rising adoption of plant-based diets in the country is propelling the demand for specialty ingredients that replicate the taste, texture, and nutritional profile of animal-based products. This shift is evident in the development of plant-based cheeses, yogurts, and meats utilizing specialty starches, hydrocolloids, pea proteins, and texturized vegetable proteins. Additionally, the Mexican government's health initiatives, such as the 2023 dietary recommendations advocating a 40% reduction in meat consumption, are encouraging the reformulation of traditional dishes like tacos and quesadillas with plant-based ingredients. The Mexico specialty food ingredients market growth is further supported by the increasing availability of plant-based options in retail and foodservice sectors, targeting health-conscious and environmentally aware consumers.

Mexico Specialty Food Ingredients Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type, source, application, and distribution channel.

Product Type Insights:

- Specialty Sensory Ingredients

- Enzymes

- Emulsifiers

- Flavors

- Colorants

- Others

- Specialty Functional Ingredients

- Vitamins

- Minerals

- Antioxidants

- Preservatives

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes specialty sensory ingredients (enzymes, emulsifiers, flavors, colorants, and others) and specialty functional ingredients (vitamins, minerals, antioxidants, preservatives, and others).

Source Insights:

- Natural

- Synthetic

The report has provided a detailed breakup and analysis of the market based on the source. This includes natural and synthetic.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Beverages

- Bakery and Confectionery

- Dairy Products

- Processed Foods

- Meat Products

- Savory and Sweet Snacks

- Others

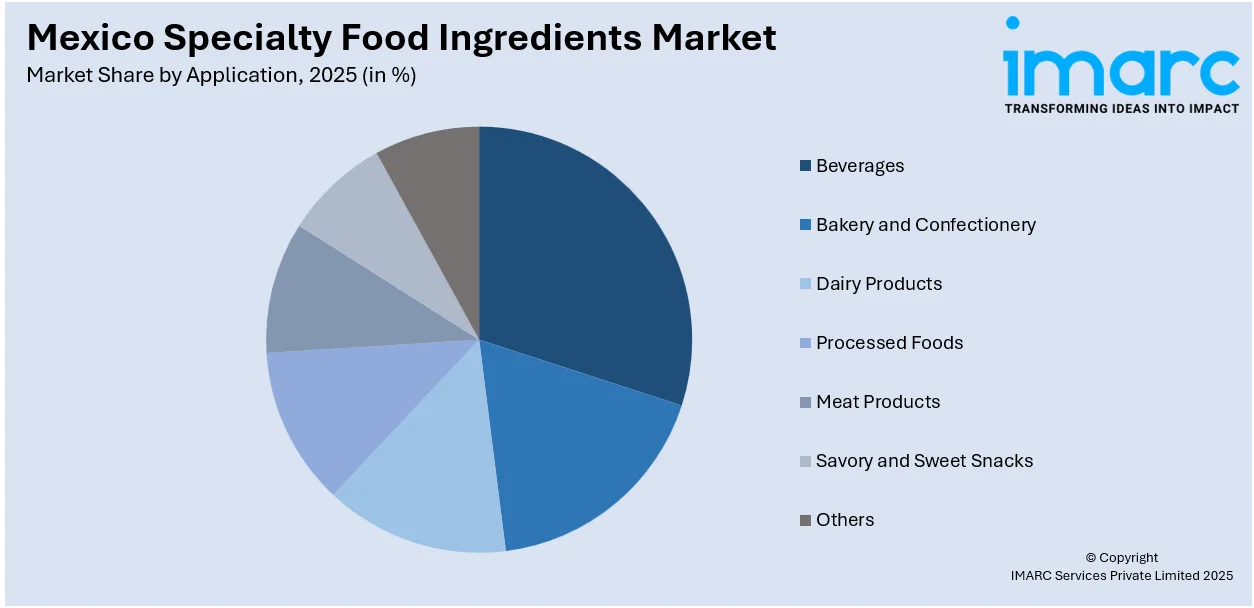

The report has provided a detailed breakup and analysis of the market based on the application. This includes beverages, bakery and confectionery, dairy products, processed foods, meat products, savory and sweet snacks, and others.

Distribution Channel Insights:

- Distributors

- Manufacturers

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes distributors and manufacturers.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, and Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Specialty Food Ingredients Market News:

- In August 2024, Nouryon signed a strategic distribution agreement with Brenntag Specialties to expand the reach of its household, industrial, and institutional cleaning ingredients in Mexico. This partnership leverages Brenntag’s strong local network and technical expertise to deliver sustainable, high-performance solutions tailored to the Mexican market. The collaboration supports Nouryon’s growth strategy and includes products like surfactants, chelates, and specialty polymers. Notably, Nouryon recently launched Berol Nexus, a multifunctional hydrotrope designed for sustainable, low-temperature laundry applications in home care.

- In April 2024, MegaMex Foods, a joint venture of Hormel Foods and Herdez del Fuerte, launched DOÑA MARIA Mole Rojo for the foodservice sector. Crafted in Mexico, this authentic mole paste features ingredients like ancho and poblano peppers, sesame seeds, and real chocolate. Designed for convenience, it comes in a resealable, chef-friendly container.

Mexico Specialty Food Ingredients Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Sources Covered | Natural, Synthetic |

| Applications Covered | Beverages, Bakery and Confectionery, Dairy Products, Processed Foods, Meat Products, Savory and Sweet Snacks, Others |

| Distribution Channel Covered | Distributors, Manufacturers |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico specialty food ingredients market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico specialty food ingredients market on the basis of product type?

- What is the breakup of the Mexico specialty food ingredients market on the basis of source?

- What is the breakup of the Mexico specialty food ingredients market on the basis of application?

- What is the breakup of the Mexico specialty food ingredients market on the basis of distribution channel?

- What is the breakup of the Mexico specialty food ingredients market on the basis of region?

- What are the various stages in the value chain of the Mexico specialty food ingredients market?

- What are the key driving factors and challenges in the Mexico specialty food ingredients market?

- What is the structure of the Mexico specialty food ingredients market and who are the key players?

- What is the degree of competition in the Mexico specialty food ingredients market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico specialty food ingredients market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico specialty food ingredients market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico specialty food ingredients industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)