Mexico Sports Betting Market Size, Share, Trends and Forecast by Platform, Betting Type, Sports Type, and Region, 2026-2034

Mexico Sports Betting Market Summary:

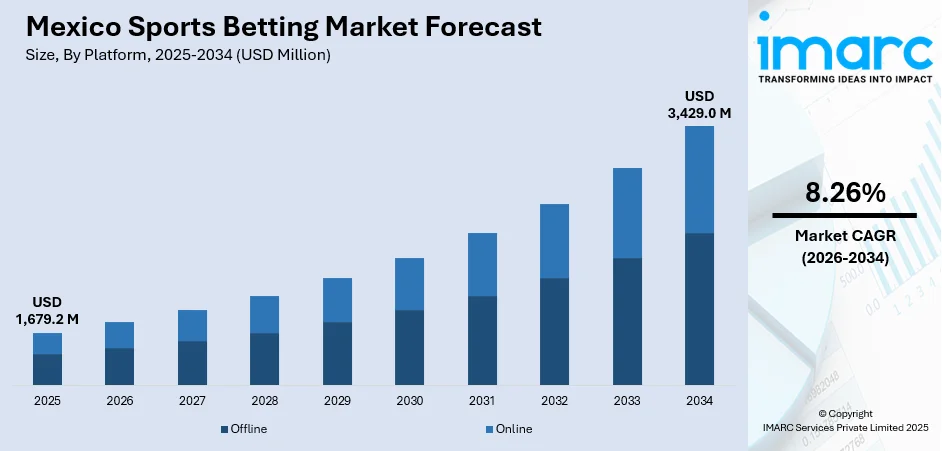

The Mexico sports betting market size was valued at USD 1,679.2 Million in 2025 and is projected to reach USD 3,429.0 Million by 2034, growing at a compound annual growth rate of 8.26% from 2026-2034.

Mexico's sports betting market is experiencing robust growth driven by widespread smartphone adoption, expanding internet connectivity, and a deeply rooted sports culture dominated by football enthusiasm. The regulatory framework governed by the Federal Gaming and Raffles Law enables licensed operators to offer both land-based and digital betting services. Growing interest from younger demographics and technological innovations in mobile betting platforms are reshaping consumer engagement presents significant opportunities for market expansion across the Mexico sports betting market share.

Key Takeaways and Insights:

-

By Platform: Online dominates the market with a share of 78% in 2025, driven by high smartphone penetration rates exceeding 82% and affordable mobile data plans enabling convenient access to betting services.

-

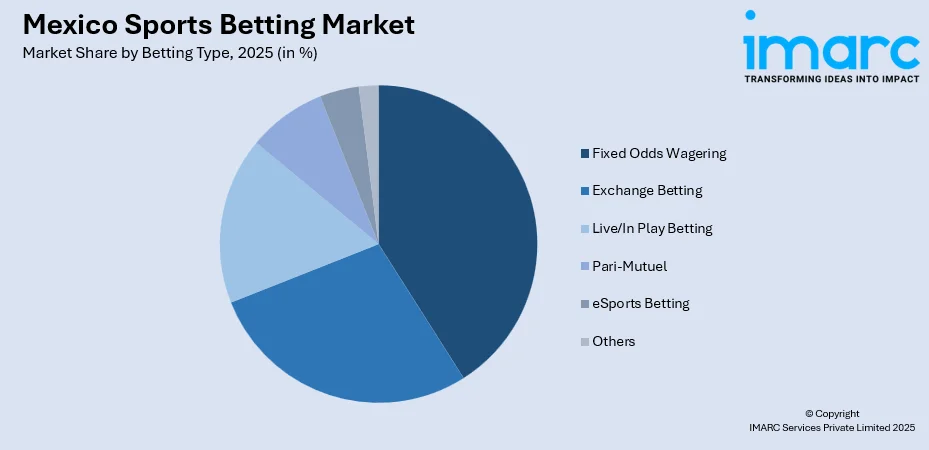

By Betting Type: Fixed odds wagering leads the market with a share of 41% in 2025, attributed to its straightforward wagering structure and predictable payout mechanisms appealing to traditional bettors.

-

By Sports Type: Football represents the largest segment with a market share of 56% in 2025, reflecting the nation's passionate football culture with Liga MX attracting over 60 million television viewers annually.

-

Key Players: The Mexico sports betting market exhibits moderate competitive intensity with established domestic operators and international entrants competing across market segments. Market concentration remains relatively balanced with major players leveraging strategic partnerships and localized marketing campaigns to capture consumer engagement.

To get more information on this market Request Sample

The Mexico sports betting market benefits from a well-established regulatory framework under the Secretaría de Gobernación (SEGOB), which oversees licensing and compliance requirements. The market has witnessed increasing consolidation as operators invest in technology upgrades and platform enhancements to meet evolving consumer preferences. Digital transformation initiatives, including mobile-first betting applications and live streaming integration, are reshaping the competitive landscape. In August 2024, the San Francisco 49ers expanded their partnership with Mexico-based Foliatti Casino, marking the first international legalized sports betting deal for an NFL team in history, demonstrating growing cross-border commercial interest in Mexico's sports betting sector. The regulatory environment continues to evolve with anticipated legislative modernization to address online gambling specifically.

Mexico Sports Betting Market Trends:

Accelerating Mobile-First Betting Adoption

The proliferation of mobile betting platforms is fundamentally transforming consumer engagement patterns across Mexico's sports betting landscape. Operators are prioritizing mobile application development with features including live streaming, real-time odds updates, and seamless payment integration. The convenience of placing wagers through smartphones resonates particularly with younger demographics seeking interactive entertainment experiences. This mobile-first approach enables operators to expand their reach beyond traditional urban markets into previously underserved communities nationwide.

Integration of Advanced Technology Solutions

Technological innovation is reshaping operational capabilities across the Mexican sports betting ecosystem. Machine learning algorithms enable real-time behavioral analysis to identify problem gambling patterns and enhance responsible gaming initiatives. Chatbot implementations efficiently resolve substantial customer inquiry volumes while maintaining high satisfaction ratings. Virtual reality casino experiences are emerging in metropolitan areas, with immersive gaming facilities attracting growing user engagement. Blockchain technology adoption is also gaining traction, improving transaction transparency and accelerating withdrawal processing times for consumers.

Expansion of International Sports Partnerships

Strategic collaborations between betting operators and international sports organizations are intensifying consumer engagement opportunities. Sports sponsorships serve as primary marketing channels, with operators securing partnerships with Liga MX clubs and international football organizations. Caliente.mx maintains its position as Official Betting House of the Mexican National Team through 2026, providing exclusive fan engagement opportunities including contest access to national team matches and World Cup qualifying events.

Market Outlook 2026-2034:

The Mexico sports betting market demonstrates strong growth momentum supported by favorable demographic trends, technological advancements, and anticipated regulatory modernization. The upcoming FIFA World Cup 2026, with Mexico hosting matches in Mexico City, Guadalajara, and Monterrey, is expected to generate substantial economic benefits with estimates suggesting USD 5-7 billion in direct economic impact and significant sports betting revenue contribution. In August 2025, IGT announced a multi-year sports betting technology and services agreement with Hipodromo de Agua Caliente SA de CV and Distribuidora Internacional de Equipos de Juego, S. De R.L. De C.V. to establish IGT PlaySports-powered retail sportsbooks across Mexico, representing significant infrastructure investment. The market generated a revenue of USD 1,679.2 Million in 2025 and is projected to reach a revenue of USD 3,429.0 Million by 2034, growing at a compound annual growth rate of 8.26% from 2026-2034.

Mexico Sports Betting Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Platform |

Online |

78% |

|

Betting Type |

Fixed Odds Wagering |

41% |

|

Sports Type |

Football |

56% |

Platform Insights:

- Offline

- Online

The online segment dominates with a market share of 78% of the total Mexico sports betting market in 2025.

The online platform segment's dominance reflects Mexico's ongoing digital transformation across the gambling sector, supported by widespread internet connectivity and smartphone adoption. Online betting platforms offer comprehensive wagering options including pre-match and live betting across multiple sports categories. Mobile applications have become the primary engagement channel, enabling bettors to access real-time odds, live streaming, and in-play wagering options from anywhere, fundamentally reshaping consumer engagement patterns throughout the country.

Digital operators continue investing in platform enhancements to capture growing consumer demand, incorporating features including personalized user experiences, multi-language support, and integrated payment solutions. The regulatory requirement for SEGOB licensing ensures operational legitimacy while creating barriers to entry for unlicensed operators. Leading platforms differentiate through loyalty programs, enhanced promotional offerings, and strategic partnerships with popular sports leagues that strengthen brand credibility and drive sustained customer acquisition across demographic segments.

Betting Type Insights:

Access the comprehensive market breakdown Request Sample

- Fixed Odds Wagering

- Exchange Betting

- Live/In Play Betting

- Pari-Mutuel

- eSports Betting

- Others

The fixed odds wagering segment leads with a share of 41% of the total Mexico sports betting market in 2025.

Fixed odds wagering maintains its market leadership position through its straightforward betting structure where odds are established at the time of wager placement, providing bettors with predictable potential returns. This betting format appeals particularly to traditional sports bettors who value transparency and simplicity in wagering mechanics. The segment benefits from widespread availability across both land-based sportsbooks and online platforms, with operators offering competitive odds across popular sporting events. Mexican bettors demonstrate preference for fixed odds formats when wagering on football matches, particularly Liga MX fixtures and international tournaments.

Live and in-play betting represents the fastest-growing betting type segment as operators enhance real-time wagering capabilities with improved streaming technology and dynamic odds adjustment systems. Live dealer games have experienced substantial year-over-year growth with major platform providers reporting significant monthly user engagement for Mexico-specific gaming offerings. In April 2024, Playtech partnered with bet365 to launch the Super Mega Ultra live game show across multiple regions including Mexico, expanding live betting entertainment options for Mexican consumers.

Sports Type Insights:

- Football

- Basketball

- Baseball

- Horse Racing

- Cricket

- Hockey

- Others

The football segment exhibits clear dominance with a 56% share of the total Mexico sports betting market in 2025.

Football's commanding market position reflects Mexico's deep-rooted passion for the sport, with Liga MX ranking as the fourth most attended football league globally. The domestic league's unique format featuring two championships annually (Apertura and Clausura) creates continuous betting engagement opportunities throughout the year. International tournaments including UEFA Champions League and Copa América drive additional wagering volumes during major competition periods.

The approaching 2026 event, with Mexico serving as co-host alongside the United States and Canada, is anticipated to generate unprecedented football betting activity. Mexico will host matches in three iconic venues including Estadio Azteca in Mexico City, representing significant opportunities for operators to capture increased wagering volumes. Operators are strategically positioning their platforms with enhanced football-specific features, including comprehensive Liga MX coverage, international match streaming, and promotional offers tied to national team performance during qualifying campaigns.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico demonstrates strong sports betting engagement driven by proximity to United States markets and significant remittance flows from cross-border employment. The region shows pronounced preference for sports betting with particular affinity for MLB and NFL wagering alongside Liga MX fixtures. Industrial centers including Monterrey benefit from robust telecommunications infrastructure supporting digital platform adoption.

Central Mexico is benefiting from dense population concentration, elevated income levels, and comprehensive LTE coverage. Mexico City's metropolitan area captures substantial market revenue supported by widespread internet access and established banking infrastructure. Strategic partnerships with Liga MX clubs enable operators to implement localized loyalty initiatives and promotional campaigns targeting regional consumer preferences.

Southern Mexico represents an emerging growth opportunity as government connectivity initiatives including the "Internet para Todos" program expand rural broadband access. The region's cash-based economy supports deposit integration through convenience store networks, enabling market participation among previously underserved demographics. Tourism destinations including Quintana Roo contribute to gambling revenue through integrated resort offerings attracting both domestic and international visitors.

Market Dynamics:

Growth Drivers:

Why is the Mexico Sports Betting Market Growing?

Expanding Digital Infrastructure and Mobile Penetration

Mexico's rapidly expanding digital infrastructure serves as a fundamental growth catalyst for the sports betting market. The widespread availability of affordable smartphones combined with competitive mobile data pricing has democratized access to online betting platforms across diverse socioeconomic segments. Telecommunications investments continue extending high-speed connectivity beyond major urban centers into secondary cities and rural communities. This robust digital foundation enables operators to reach previously underserved demographics while enhancing user experiences through mobile-optimized platforms featuring real-time odds updates, live streaming capabilities, and seamless payment integrations.

FIFA World Cup 2026 Hosting Opportunity

Mexico's role as co-host for the tournament presents a transformative opportunity for the sports betting market. The tournament marks the first 48-team World Cup format and Mexico's historic third time hosting the competition. FIFA and Mexican government estimates project the country will welcome up to 5 million visitors during the tournament, resulting in the Mexican economy receiving an infusion of about US$ 3 Billion. Match hosting in Mexico City, Guadalajara, and Monterrey will concentrate betting activity in key metropolitan markets. The event timeline through mid-2026 provides operators with extended planning horizons to develop targeted marketing campaigns and promotional offerings aligned with tournament milestones.

Young Demographics and Cultural Sports Enthusiasm

Mexico's demographic composition strongly supports sports betting market expansion, with a substantial young population demonstrating high digital engagement and sports interest. The nation's deeply embedded football culture, evidenced by Liga MX's position as the fourth most attended football league globally, creates natural engagement pathways for betting operators. As per the industry reports, Gen Z and Millennial bettors accounted for the majority of the rise (34% and 42%, respectively), particularly those who made speculative financial investments. This generational affinity for both sports content and digital platforms establishes sustainable long-term market growth fundamentals.

Market Restraints:

What Challenges the Mexico Sports Betting Market is Facing?

Prevalence of Unlicensed Operators

The significant presence of unlicensed operators poses substantial challenges to Mexico's regulated sports betting market. A considerable portion of online gambling platforms operate without proper SEGOB authorization, creating unfair competitive dynamics. Unlicensed operators avoid taxation and compliance costs, enabling aggressive promotional offerings that undercut licensed competitors while draining substantial revenue from legitimate market participants.

Regulatory Framework Modernization Requirements

Mexico's current gambling regulatory framework, rooted in decades-old legislation, requires comprehensive modernization to address contemporary online betting operations effectively. The Federal Gaming and Raffles Law lacks specific provisions for digital gambling activities, creating regulatory ambiguity that complicates compliance and enforcement efforts. State-level taxation disparities add operational complexity, with varying gross gaming revenue levy structures across jurisdictions hindering market efficiency.

Cybersecurity Vulnerabilities and Data Protection Concerns

Cybersecurity threats represent ongoing operational risks for sports betting operators in Mexico. High-profile security incidents, including data breaches affecting player databases, have prompted regulatory responses requiring enhanced security protocols including SSL encryption mandates and breach disclosure requirements. Rural infrastructure limitations, with limited high-speed connectivity in certain regional markets, create additional technology deployment challenges for operators seeking nationwide service consistency.

Competitive Landscape:

The Mexico sports betting market exhibits moderate competitive intensity characterized by established domestic operators competing alongside international entrants across both land-based and digital channels. Market concentration remains relatively balanced with no single operator commanding dominant market share. Strategic differentiation occurs through technology investment, sports partnership cultivation, and localized marketing campaigns. Operators are actively expanding service portfolios through strategic alliances combining casino gaming and sports betting capabilities. The regulatory requirement for SEGOB licensing creates meaningful barriers to entry while favoring established operators with compliance infrastructure and operational track records.

Recent Developments:

-

March 2025: Mobile Streams Plc launched Estadio Gana, a new online casino and sportsbook platform tailored specifically for Mexican sports fans, featuring live sports updates, global news coverage, and comprehensive betting options strategically timed ahead of the FIFA World Cup 2026.

Mexico Sports Betting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platforms Covered | Offline, Online |

| Betting Types Covered | Fixed Odds Wagering, Exchange Betting, Live/In Play Betting, Pari-Mutuel, eSports Betting, Others |

| Sports Types Covered | Football, Basketball, Baseball, Horse Racing, Cricket, Hockey, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico sports betting market size was valued at USD 1679.2 Million in 2025.

The Mexico sports betting market is expected to grow at a compound annual growth rate of 8.26% from 2026-2034 to reach USD 3429.0 Million by 2034.

The online platform segment dominated the Mexico sports betting market with a 78% share in 2025, driven by widespread smartphone penetration, affordable mobile data plans, and convenient access enabling users to place wagers through mobile applications and responsive websites.

Key factors driving the Mexico sports betting market include expanding digital infrastructure, upcoming FIFA World Cup 2026 hosting opportunity, deeply rooted football culture with Liga MX viewership, young tech-savvy demographics, and increasing operator investments in technology and strategic partnerships.

Major challenges include the significant presence of unlicensed operators, outdated regulatory framework requiring modernization for digital operations, cybersecurity vulnerabilities, state-level taxation disparities creating operational complexity, and regional infrastructure limitations in rural areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)