Mexico Sports and Fitness Goods Market Size, Share, Trends and Forecast by Product Type, Fitness Goods, Cardiovascular Training Goods, End Use, and Region, 2025-2033

Mexico Sports and Fitness Goods Market Overview:

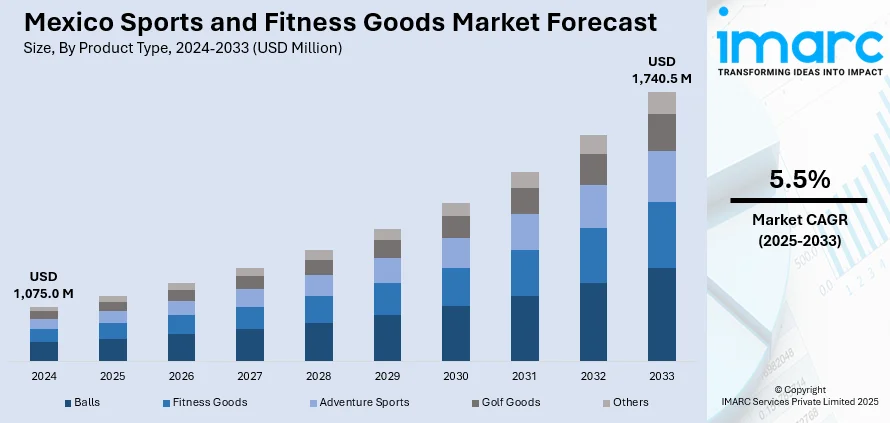

The Mexico sports and fitness goods market size reached USD 1,075.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,740.5 Million by 2033, exhibiting a growth rate (CAGR) of 5.5% during 2025-2033. The market is fueled by growing health awareness, urban lifestyle changes, physical activity participation, and rising influence of social media and sports influencers. Changing technology, athleisure wear fashion popularity, and better availability of fitness centers also fuel growing consumer interest and market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,075.0 Million |

| Market Forecast in 2033 | USD 1,740.5 Million |

| Market Growth Rate 2025-2033 | 5.5% |

Mexico Sports and Fitness Goods Market Trends:

Increasing Health Consciousness and Lifestyle Changes

The Mexican sports and fitness goods market outlook has experienced significant change over the past few years, mainly due to increasing cultural focus on health and wellbeing. Mexicans are increasingly adopting active lifestyles, motivated by enhanced health, physical appearance, and psychological well-being. For example, recently, in September 2024, Pure Barre, the leading barre fitness brand and part of Xponential Fitness, revealed its launch in Mexico. The initial site is set to launch in the first quarter of 2025 in Mexico City, with additional sites expected afterward. This signifies Pure Barre’s second international expansion beyond North America, as the brand's initial site in Japan is scheduled to open later this year. Consequently, there's an increasing need for fitness routine-supporting products like yoga mats, resistance bands, home gym gear, and sportswear. The trend is popular among the young, the adults and even the elderly as they all enthusiastically take part in diverse physical activity. Walking, running, group exercise, and functional training fitness have become the norm. These changes in lifestyle are encouraging families and individuals to invest in products that add value to their fitness experience, resulting in growing interest in quality, durable, and even brand-name equipment. This visible interest in health has also been encouraged by online information and influencer culture, which has further pushed fitness as an aspirational lifestyle.

Fashion Meets Function in Sportswear

In the Mexican marketplace, sportswear has progressed well beyond its historical function as mere athletic apparel. Sportswear is now considered a fashion statement, mixing function with everyday fashion. The trend has spawned a boom in "athleisure," in which leggings, sports bras, hoodies, and sneakers are worn to the gym and also in casual, everyday environments. As consumers grow increasingly style-oriented, the visual appeal of sports and fitness wear has a key part to play in buying decisions. Brand identity, design, comfort, and fit are becoming just as relevant as the technical performance of the apparel. Consumers are also growing increasingly particular about their choices, tending to favor brands that share their values—such as those focused on sustainability or fair manufacturing. This fusion of style, functionality, and community responsibility continues to redefine the sports apparel category as a dynamic, changing segment within the larger dynamics of the Mexico sports and fitness goods market share.

Innovation and the Emergence of Smart Fitness

Technology continues to influence the attitude of Mexican consumers toward fitness, prompting new expectations for the sports and fitness goods sector. From fitness trackers and smartwatches to app-enabled exercise equipment and wearable technology, the market is witnessing a definite shift toward more connected, digital solutions. Consumers want products that will make their workout more efficient, give them feedback, and provide a customized fitness experience. These range from smart yoga mats that monitor posture, virtual personal trainers, and even gamified fitness equipment. The digitalization of fitness, particularly among young and tech-savvy professionals, is transforming the way consumers approach their health ambitions. Meanwhile, outdoor and social fitness activities like boot camps, bike groups, and park workouts are fueling interest in portable, rugged, and easy-to-use equipment. Fitness equipment innovation, coupled with the region’s shifting wellness culture, keeps the market vibrant, innovative, and ripe with opportunity for brands that are prepared to evolve, which in turn further fuels the Mexico sports and fitness goods market growth.

Mexico Sports and Fitness Goods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, fitness goods, cardiovascular training goods, and end use.

Product Type Insights:

- Balls

- Fitness Goods

- Adventure Sports

- Golf Goods

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes balls, fitness goods, adventure sports, golf goods, and others.

Fitness Goods Insights:

- Cardiovascular Training Goods

- Strength Training Goods

The report has provided a detailed breakup and analysis of the market based on the fitness goods. This includes cardiovascular training goods and strength training goods.

Cardiovascular Training Goods Insights:

- Treadmills

- Stationary Bikes

- Rowing Machines

- Ellipticals

- Others

A detailed breakup and analysis of the market based on the cardiovascular training goods have also been provided in the report. This includes treadmills, stationary bikes, rowing machines, ellipticals, and others.

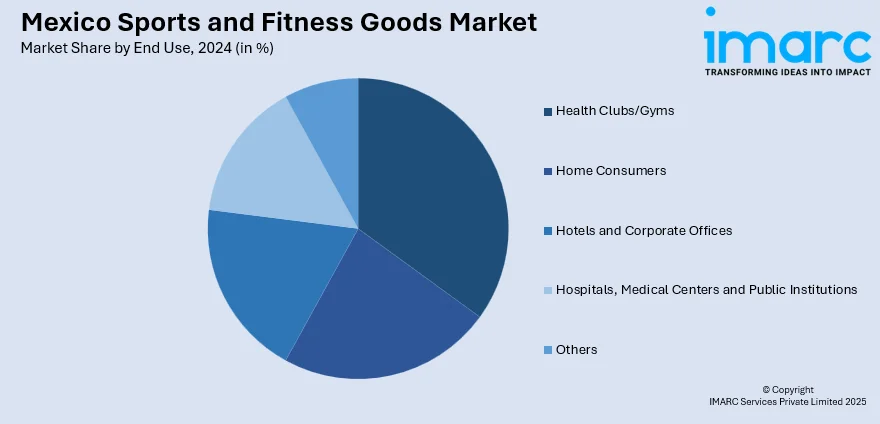

End Use Insights:

- Health Clubs/Gyms

- Home Consumers

- Hotels and Corporate Offices

- Hospitals, Medical Centers and Public Institutions

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes health clubs/gyms, home consumers, hotels and corporate offices, hospitals, medical centers and public institutions, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Sports and Fitness Goods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Balls, Fitness Goods, Adventure Sports, Golf Goods, Others |

| Fitness Goods Covered | Cardiovascular Training Goods, Strength Training Goods |

| Cardiovascular Training Goods Covered | Treadmills, Stationary Bikes, Rowing Machines, Ellipticals, Others |

| End Uses Covered | Health Clubs/Gyms, Home Consumers, Hotels and Corporate Offices, Hospitals, Medical Centers and Public Institutions, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico and Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico sports and fitness goods market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico sports and fitness goods market on the basis of product type?

- What is the breakup of the Mexico sports and fitness goods market on the basis of fitness goods?

- What is the breakup of the Mexico sports and fitness goods market on the basis of cardiovascular training goods?

- What is the breakup of the Mexico sports and fitness goods market on the basis of end use?

- What is the breakup of the Mexico sports and fitness goods market on the basis of region?

- What are the various stages in the value chain of the Mexico sports and fitness goods market?

- What are the key driving factors and challenges in the Mexico sports and fitness goods market?

- What is the structure of the Mexico sports and fitness goods market and who are the key players?

- What is the degree of competition in the Mexico sports and fitness goods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico sports and fitness goods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico sports and fitness goods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico sports and fitness goods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)