Mexico Sports Nutrition Market Size, Share, Trends and Forecast by Product Type, Raw Material, Distribution Channel, and Region, 2025-2033

Mexico Sports Nutrition Market Overview:

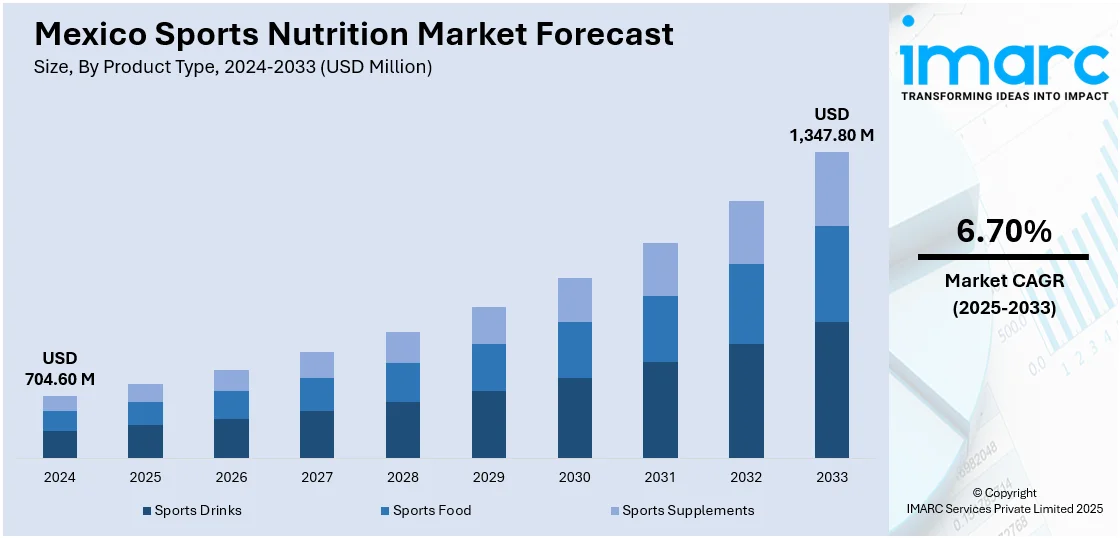

The Mexico sports nutrition market size reached USD 704.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,347.80 Million by 2033, exhibiting a growth rate (CAGR) of 6.70% during 2025-2033. The market is bolstered by growing health awareness, higher participation in fitness activities, and increasing demand for protein-rich and functional products. Additionally, the expansion of the middle-class population and the rising popularity of sports supplements among young consumers are further driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 704.60 Million |

| Market Forecast in 2033 | USD 1,347.80 Million |

| Market Growth Rate 2025-2033 | 6.70% |

Mexico Sports Nutrition Market Trends:

Expansion of E‑Commerce and Digital Platforms

The rise of online sales channels has revolutionized how Mexican consumers access sports nutrition products, offering convenience, a broader selection, and direct-to-consumer (DTC) models. In response, major retailers and digital players have optimized their logistics networks, collaborating with last-mile couriers to ensure cold chain integrity for temperature-sensitive products like protein powders and ready-to-drink (RTD) supplements. Additionally, social commerce, driven by fitness influencers on platforms like TikTok and Instagram, is significantly boosting impulse purchases. Brands using shoppable posts have reported conversion rates higher than traditional e-commerce websites, capitalizing on the engagement and trust influencers generate among their followers. This shift in purchasing behavior is reshaping the sports nutrition landscape in Mexico.

Surge in Plant‑Based and Clean‑Label Sports Nutrition

Health- and sustainability-conscious Mexican consumers are increasingly opting for plant-derived and "clean label" formulations over traditional whey or soy protein blends. Local producers are responding by launching protein lines made from peas, rice, and hemp to meet this evolving demand. Clean label certification, characterized by minimal processing and the absence of artificial colors or sweeteners, has become a critical purchase driver, with a growing number of Mexican sports nutrition shoppers citing it as a key factor in their buying decisions. To cater to this trend, brands are innovating with hybrid blends, such as pea-whey isolates, and incorporating functional additives like adaptogens and MCTs to boost both performance and the appeal of clean-label products. As this trend continues to gain momentum, suppliers who can verify ingredient provenance and sustainability claims are positioned to secure premium market positioning in a segment poised to outpace overall industry growth.

Mexico Sports Nutrition Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, raw material, and distribution channel.

Product Type Insights:

- Sports Drinks

- Sports Food

- Sports Supplements

The report has provided a detailed breakup and analysis of the market based on the product type. This includes sports drinks, sports food, and sports supplements.

Raw Material Insights:

- Animal Derived

- Plant-Based

- Mixed

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes animal derived, plant-based, and mixed.

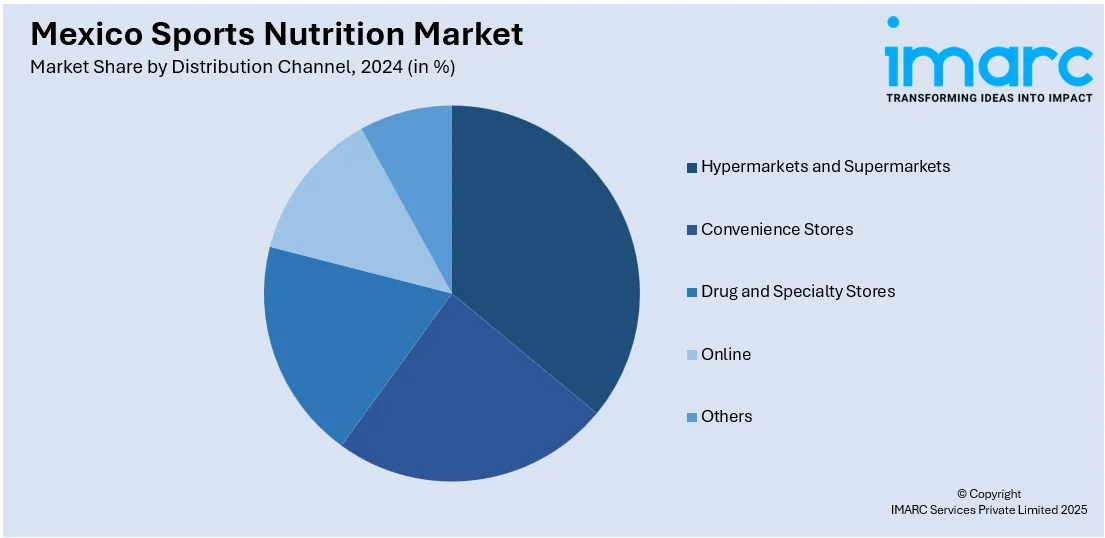

Distribution Channel Insights:

- Hypermarkets and Supermarkets

- Convenience Stores

- Drug and Specialty Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes hypermarkets and supermarkets, convenience stores, drug and specialty stores, online, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Sports Nutrition Market News:

- October 2024: Duas Rodas launched their new offerings, including Vitamin-Ace®, AnthoPower™, and the HYDRATE+ Collection, at The Food Tech Summit & Expo in Mexico. These products offer natural and functional solutions for the sports nutrition and supplements industry.

- April 2024: NutriLeads BV announced a new distribution deal in Mexico with Safe Iberoamericana. The partnership introduces BeniCaros, a carrot-derived ingredient with potential immune-boosting and prebiotic properties, to the Mexican market.

Mexico Sports Nutrition Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sports Drinks, Sports Food, Sports Supplements |

| Raw Materials Covered | Animal Derived, Plant-Based, Mixed |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Stores, Drug and Specialty Stores, Online, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico sports nutrition market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico sports nutrition market on the basis of product type?

- What is the breakup of the Mexico sports nutrition market on the basis of raw material?

- What is the breakup of the Mexico sports nutrition market on the basis of distribution channel?

- What are the various stages in the value chain of the Mexico sports nutrition market?

- What are the key driving factors and challenges in the Mexico sports nutrition market?

- What is the structure of the Mexico sports nutrition market and who are the key players?

- What is the degree of competition in the Mexico sports nutrition market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico sports nutrition market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico sports nutrition market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico sports nutrition industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)