Mexico Sports Utility Vehicle Market Size, Share, Trends and Forecast by Type, Fuel Type, Seating Capacity and Region, 2025-2033

Mexico Sports Utility Vehicle Market Overview:

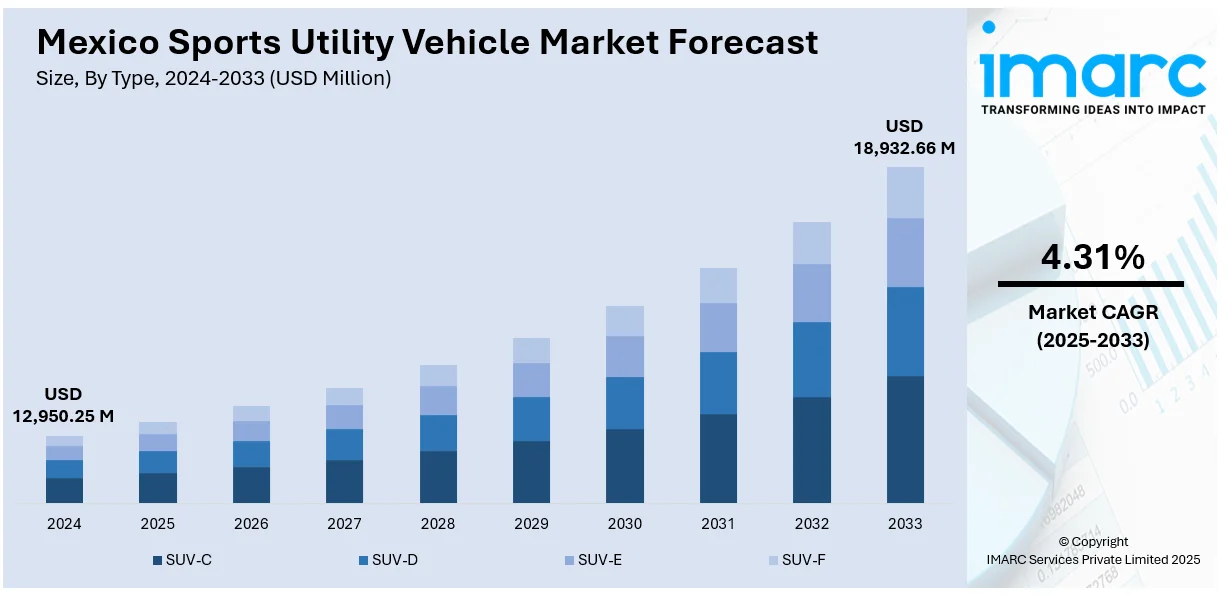

The Mexico sports utility vehicle market size reached USD 12,950.25 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 18,932.66 Million by 2033, exhibiting a growth rate (CAGR) of 4.31% during 2025-2033. The market is driven by the growing need for hybrid and electric variants, the growing popularity of compact SUVs as a result of urbanization, and the adoption of advanced in-vehicle technologies. These trends are indicative of shifting consumer behavior towards more sustainable, convenient, and connected mobility solutions. As these trends continue to shape purchasing behavior, the Mexico sports utility vehicle market share is expected to grow in the coming years.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12,950.25 Million |

| Market Forecast in 2033 | USD 18,932.66 Million |

| Market Growth Rate 2025-2033 | 4.31% |

Mexico Sports Utility Vehicle Market Trends:

Increased Demand for Hybrid and Electric SUVs

The Mexico sports utility vehicle market is also experiencing a serious shift towards hybrid and electric vehicles due to heightened environmental consciousness and encouragement from government policies. Fuel efficiency and reduced emissions are becoming top priorities among consumers, and therefore the automobile manufacturers have been mounting their green SUV options. The trend has been paralleled globally and also represents a wider movement in Mexico's auto tastes. Infrastructural developments, such as a growth in electric charging points in big cities, are accelerating uptake further. Older purchasers, especially in urban areas, exhibit increased interest in SUVs that offer a balance of performance and eco-friendliness. Therefore, hybrid and electric SUVs are highly featuring as a highlight in new car registrations. For instance, in November 2024, the 2025 GMC Hummer EV Pickup and SUV officially debuted in Mexico, becoming the second international market to introduce the all-electric SUV lineup following the Middle East. Moreover, the outlook for Mexico sports utility vehicle market growth is to remain robust, with electric and hybrid variants set to take an accelerating proportion of future demand, underlining the country's determination to provide environmentally friendly mobility solutions.

Urbanization Driving Compact SUV Demand

Mexico's fast pace of urbanization has been behind the rising demand for compact sports utility vehicles. These models provide the perfect combination of city drivability, interior space, and higher ground clearance, which makes them suitable for urban environments. For example, in November 2024, Chinese electric vehicle startup NETA Auto will introduce its subcompact SUV, the NETA X, in Mexico with the goal of competing in the electric vehicle market with cutting-edge technology and a range of up to 501 km. Furthermore, increasing middle-class incomes and shifting lifestyle choices are making many buyers opt for compact SUVs over conventional sedans or hatchbacks. Better road connectivity and advances in urban infrastructure have also made SUVs more convenient for everyday driving. In addition, having advanced safety features and contemporary infotainment systems compactly integrated is appealing to a wide age group, ranging from young professionals to compact families. The Mexico sports utility vehicle expansion is evident where compact models dominate volume sales, an indication of changing consumer tastes and the need for versatility at no cost of efficiency. This segment is set to maintain pace over the next few years as urban expansion continues and consumer preferences adapt accordingly.

Technology Integration Driving Consumer Preference

The incorporation of advanced technologies in sports utility vehicles is contributing significantly to influencing consumer preferences within Mexico. Options like adaptive cruise control, lane-keeping system, parking aid, and voice-controlled infotainment systems are no longer limited to high-end models but become more common among mid-range SUVs. The technological democratization adds to vehicle appeal, particularly among tech-aware consumers who seek convenience and security. Enhanced connectivity and effortless integration with smartphones continue to enrich driving experience, improving the appeal of SUVs for contemporary users. Automakers are constantly innovating to add the newest digital tools and intelligent functionalities, creating new standards for in-car technology. Mexico sports utility vehicle share is growing as models with advanced features experience boosting demand among various consumer segments. This trend is likely to intensify as digital lifestyles become increasingly common, rendering technology integration a major differentiator in buying decisions.

Mexico Sports Utility Vehicle Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, fuel type, and seating capacity.

Type Insights:

- SUV-C

- SUV-D

- SUV-E

- SUV-F

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes XSUV-C, SUV-D, SUV-E, and SUV-F.

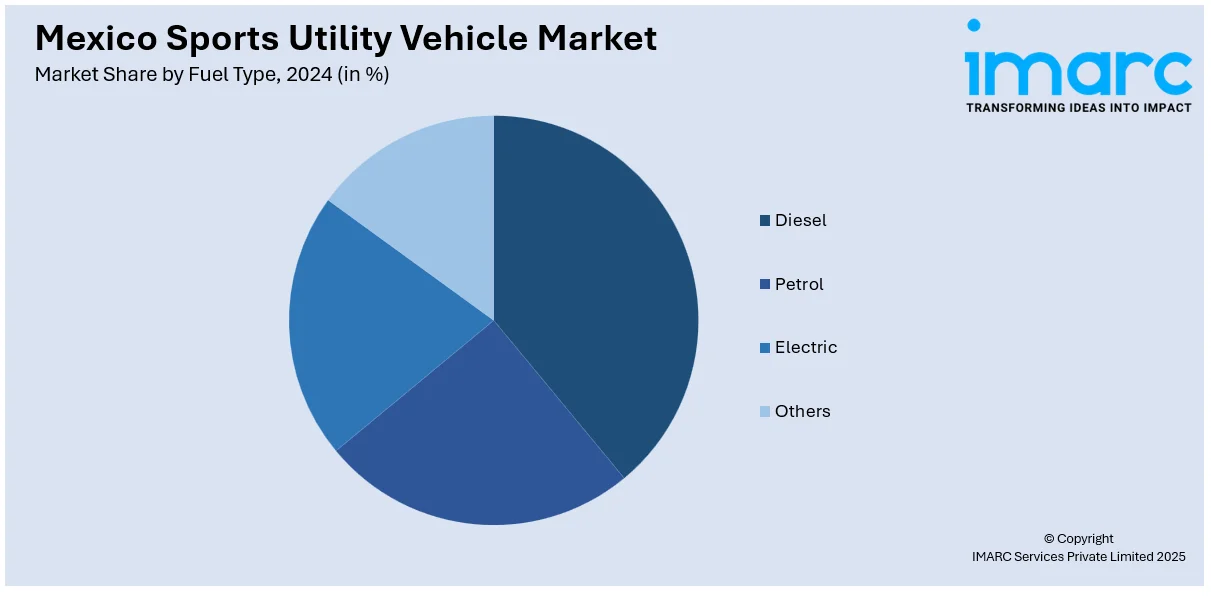

Fuel Type Insights:

- Diesel

- Petrol

- Electric

- Others

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes diesel, petrol, electric, and others.

Seating Capacity Insights:

- 5-Seater

- 7-Seater

- 8-Seater and Above

A detailed breakup and analysis of the market based on the seating capacity have also been provided in the report. This includes 5-seater, 7-seater, and 8-seater and above.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Sports Utility Vehicle Market News:

- In March 2025, Lamborghini launched the Urus SE, its first plug-in hybrid Super SUV, in Mexico City. With an 800-CV hybrid powertrain, 60 km electric range, and 3.4-second 0-100 km/h, deliveries are scheduled to start in Q2 2025. This is Lamborghini's entry into electrifying luxury performance SUVs.

- In July 2024, Zeekr introduced the Zeekr 001 shooting brake and Zeekr X compact SUV in Mexico, its initial foray in the Latin American market. It is part of Zeekr's global strategy to internationalize, after announcing a tie-up with Geely Auto to speed up vehicle distribution. Zeekr's launch in Mexico holds importance for the brand, with the country viewed as a starting point for increased expansion in Latin America.

- In August 2023, General Motors officially introduced the 2024 Buick Envista in Mexico, after its North American debut. The crossover is offered in two trims: Sport Touring (ST) and Avenir. The Envista is powered by a turbocharged 1.2L engine, front-wheel drive, and high-tech features, representing Buick's foray into the value crossover market.

Mexico Sports Utility Vehicle Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | SUV-C, SUV-D, SUV-E, SUV-F |

| Fuel Types Covered | Diesel, Petrol, Electric, Others |

| Seating Capacities Covered | 5-Seater, 7-Seater, 8-Seater and Above |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico sports utility vehicle market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico sports utility vehicle market on the basis of type?

- What is the breakup of the Mexico sports utility vehicle market on the basis of fuel type?

- What is the breakup of the Mexico sports utility vehicle market on the basis of seating capacity?

- What is the breakup of the Mexico sports utility vehicle market on the basis of region?

- What are the various stages in the value chain of the Mexico sports utility vehicle market?

- What are the key driving factors and challenges in the Mexico sports utility vehicle?

- What is the structure of the Mexico sports utility vehicle market and who are the key players?

- What is the degree of competition in the Mexico sports utility vehicle market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico sports utility vehicle market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico sports utility vehicle market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico sports utility vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)