Mexico Stearic Acid Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

Mexico Stearic Acid Market Overview:

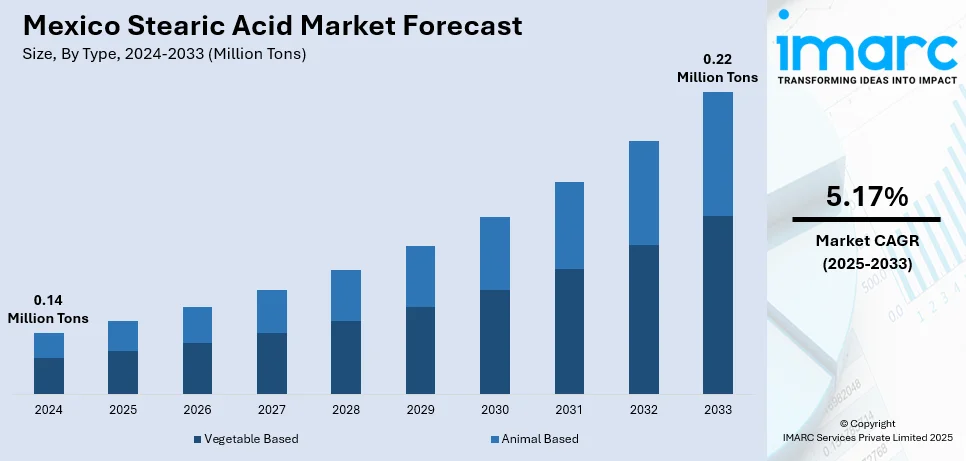

The Mexico stearic acid market size reached 0.14 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 0.22 Million Tons by 2033, exhibiting a growth rate (CAGR) of 5.17% during 2025-2033. The market is driven by rising demand from the personal care and cosmetics sector, fueled by growing consumer awareness of skincare and hygiene. Additionally, the shift toward sustainable, plant-based stearic acid sources, such as palm and coconut oil, is gaining traction due to environmental regulations and eco-conscious trends. Expanding industrial applications and export opportunities are further augmenting the Mexico stearic acid market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 0.14 Million Tons |

| Market Forecast in 2033 | 0.22 Million Tons |

| Market Growth Rate 2025-2033 | 5.17% |

Mexico Stearic Acid Market Trends:

Increasing Demand from the Personal Care and Cosmetics Industry

The market is experiencing significant growth due to rising demand from the personal care and cosmetics industry. According to a research report published by the IMARC Group, the Mexican beauty and personal care industry was worth USD 10.6 Billion in 2024. It is expected to reach USD 17.6 Billion by 2033 at a compound annual growth rate (CAGR) of 5.42% during 2025-2033. Stearic acid possesses an emulsifying and thickening property and plays a crucial role in the production of soaps, creams, lotions, and shampoos. Customers are prioritizing health and hygiene, which leads to businesses producing more products, further increasing the demand for stearic acid. Moreover, due to the trend towards natural and organic cosmetics, vegetable stearic acid is replacing animal stearic acid. The Mexican beauty industry is witnessing significant growth in both domestic and foreign markets. The personal care industry will have great development, due to the growth of disposable income and rapid urbanization.

Shift Toward Sustainable and Bio-Based Stearic Acid Sources

The escalating shift toward sustainable and bio-based sourcing is significantly supporting the Mexico stearic acid market growth. Environmental concerns and stricter regulations are pushing manufacturers to adopt eco-friendly production methods. Traditionally, stearic acid was derived from animal fats, but there is now a growing preference for plant-based sources, including palm oil and coconut oil. According to industry reports, following the 2023 version of the 'Healthy and Sustainable Dietary Guidelines for the Mexican Population' can lower diet costs by 21%, reduce land use by 30%, and lower carbon footprint by 34%. This is possible mainly through a shift to plant foods and lowering consumption of animal foods. In the case of regions such as Mexico City, food costs can be lowered by up to 33.8%. Also, this shift toward plant-based feedstocks is consonant with global sustainability goals. It offers opportunities for Mexico's stearic acid sector to be part of fostering more sustainable food production amid rising regulatory requirements. In addition to this, Mexico's strategic location, with numerous palm oil-producing countries, places it at the center of the production and acquisition of bio-based stearic acid, which is cheaper. In most parts of the globe, firms are investing in the production of environmentally friendly products to meet the demands of global and environmentally conscious consumers. Thereby, this also applies to the upcoming product. This trend is part of the wider concept of green chemistry and circular economy in the chemical industry. Stearic acid forms an important aspect of the market as the push towards sustainability grows, shaping the market's future trajectory.

Mexico Stearic Acid Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end user.

Type Insights:

- Vegetable Based

- Animal Based

The report has provided a detailed breakup and analysis of the market based on the type. This includes vegetable based and animal based.

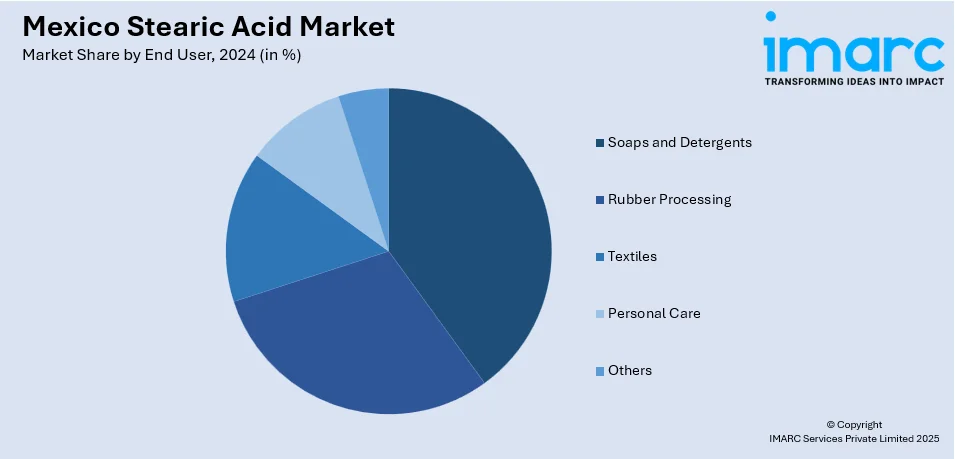

End User Insights:

- Soaps and Detergents

- Rubber Processing

- Textiles

- Personal Care

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes soaps and detergents, rubber processing, textiles, personal care, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Stearic Acid Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Vegetable Based, Animal Based |

| End Users Covered | Soaps and Detergents, Rubber Processing, Textiles, Personal Care, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico stearic acid market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico stearic acid market on the basis of type?

- What is the breakup of the Mexico stearic acid market on the basis of end user?

- What is the breakup of the Mexico stearic acid market on the basis of region?

- What are the various stages in the value chain of the Mexico stearic acid market?

- What are the key driving factors and challenges in the Mexico stearic acid market?

- What is the structure of the Mexico stearic acid market and who are the key players?

- What is the degree of competition in the Mexico stearic acid market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico stearic acid market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico stearic acid market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico stearic acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)