Mexico Student Information System Market Size, Share, Trends and Forecast by Component, Deployment Type, End-User, and Region, 2025-2033

Mexico Student Information System Market Overview:

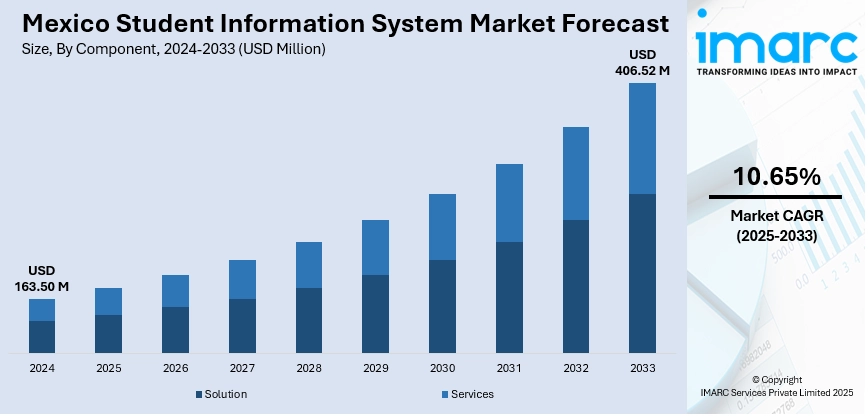

The Mexico student information system market size reached USD 163.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 406.52 Million by 2033, exhibiting a growth rate (CAGR) of 10.65% during 2025-2033. Digital education reforms and SEP mandates, the elevating adoption of hybrid and remote learning, growing demand for cloud-based, analytics-driven platforms, rising private and international school enrollments seeking bilingual and customizable solutions, and integrations with edtech tools and ERP systems are strengthening the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 163.50 Million |

| Market Forecast in 2033 | USD 406.52 Million |

| Market Growth Rate 2025-2033 | 10.65% |

Mexico Student Information System Market Trends:

Migration to Cloud-Native and SaaS-Based Student Information Systems (SIS) Platforms

Mexico’s SIS market is undergoing a rapid transformation as institutions shift from on-premises setups to cloud-native and SaaS-based delivery models. This change is driven by national digital education mandates and the growing need for scalable, resilient infrastructure. Schools and universities are increasingly adopting cloud solutions for their pay-as-you-grow flexibility and remote-access capabilities, aligning with Mexico’s broader cloud computing surge. The country’s public cloud market is projected to reach USD 10.27 billion in 2024. Between 2024 and 2025, the adoption of cloud-based SIS platforms in K-12 and higher education rose, fueled by district-level implementations focused on hybrid learning and real-time reporting. Mexico’s SaaS market is expected to grow rapidly, as institutions invest in turnkey SIS platforms that unify enrollment, grading, attendance, and finance. These systems deliver resilience during closures, cost efficiency through OpEx-based models, and rapid innovation via continuous feature updates, making SaaS-first deployments the new standard across Mexico’s expanding education sector.

To get more information on this market, Request Sample

Integration of Artificial Intelligence (AI)-Driven Analytics and Predictive Insights

Another factor impelling the market growth is the integration of AI and advanced analytics, which is enabling a shift from reactive reporting to proactive student support. Schools nationwide are deploying AI-enabled SIS modules that analyze performance trends and flag at-risk students before academic issues escalate. In higher education, major vendors such as PowerSchool and Ellucian have introduced AI-driven features, including Contextual AI modules and predictive analytics dashboards, highlighting AI’s growing role in SIS strategies. A majority of institutions consider AI essential for improving operational efficiency and enhancing the student experience over the next five years. Key features gaining adoption include early-warning systems that use machine learning to predict drop-out risks, personalized academic pathways tailored to individual strengths, and predictive models that optimize class sizes, faculty assignments, and room allocations. By embedding AI into SIS workflows, Mexican institutions can bridge achievement gaps, streamline advising, and improve resource management, boosting the demand for analytics-first, next-gen SIS platforms.

Mexico Student Information System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, deployment type, and end-user.

Component Insights:

- Solution

- Enrollment

- Academics

- Financial Aid

- Billing

- Services

- Professional Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution (enrollment, academics, financial aid, and billing) and services (professional services and managed services).

Deployment Type Insights:

- On-premises

- Cloud

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes on-premises and cloud.

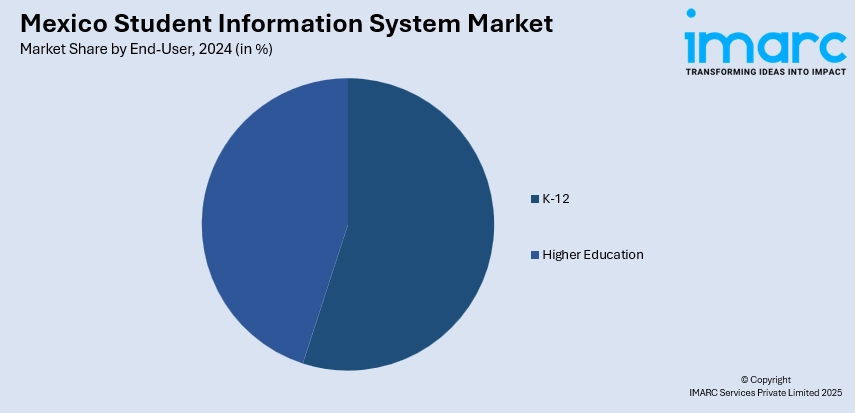

End-User Insights:

- K-12

- Higher Education

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes K-12 and higher education.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Student Information System Market News:

- May 2025: The Mexican government announced plans to expand its education system through the Universidades para el Bienestar Benito Juárez García (UBBJ) initiative with the aim of increasing access to higher education for young people across the country. The Ministry of Education plans to open 20 additional campuses by the 2025-2026 academic year, with a goal of reaching 300 campuses nationwide. This would positively impact the requirement for student information systems in Mexico.

- March 2025: Mexico's government announced an investment of MXN 2.5 billion (USD 124.58 million) to develop its national educational infrastructure. MXN 1.215 billion (USD 60.54 million) will reportedly be allocated for the construction of 18 new high school campuses across 12 states, serving 16,200 students. Such infrastructure upgrades would propel demand for student information systems.

Mexico Student Information System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Types Covered | On-premises, Cloud |

| End-Users Covered | K-12, Higher Education |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico student information system market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico student information system market on the basis of component?

- What is the breakup of the Mexico student information system market on the basis of deployment type?

- What is the breakup of the Mexico student information system market on the basis of end-user?

- What is the breakup of the Mexico student information system market on the basis of region?

- What are the various stages in the value chain of the Mexico student information system market?

- What are the key driving factors and challenges in the Mexico student information system market?

- What is the structure of the Mexico student information system market and who are the key players?

- What is the degree of competition in the Mexico student information system market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico student information system market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico student information system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico student information system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)