Mexico Toys and Games Market Size, Share, Trends and Forecast by Product Type, Distribution Channel and Region, 2026-2034

Mexico Toys and Games Market Overview:

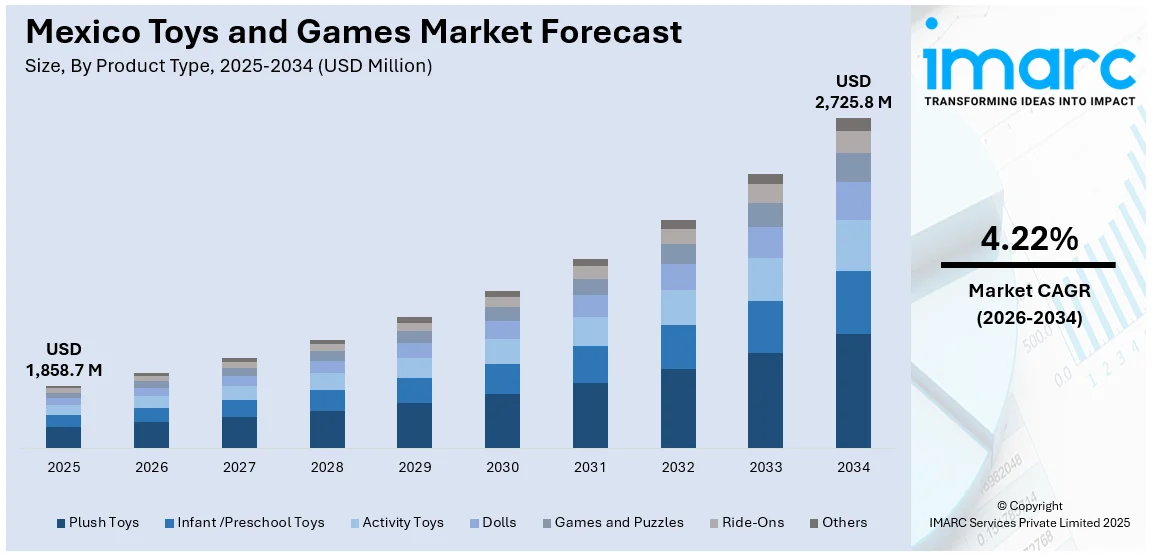

The Mexico toys and games market size reached USD 1,858.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,725.8 Million by 2034, exhibiting a growth rate (CAGR) of 4.22% during 2026-2034. The market is driven by increased consumer expenditure, a young population, and increasing knowledge of developmental play. Demand ranges from traditional toys to electronic games, indicating changing tastes and contemporary lifestyles, with manufacturers responding to innovation and varying consumer needs nationwide.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,858.7 Million |

| Market Forecast in 2034 | USD 2,725.8 Million |

| Market Growth Rate 2026-2034 | 4.22% |

Mexico Toys and Games Market Trends:

Digital Integration Maximizing Play Value

The integration of digital components into conventional toys is transforming the manner in which children engage with playthings in Mexico. Toys that incorporate augmented reality (AR), app connectivity, and interactive digital content are becoming more popular among technology-conscious parents looking for educational and entertaining options for their kids. This convergence of physical and digital play has resulted in increased perceived value for toys, as manufacturers focus on characteristics that induce both enjoyment and cognitive advancement. The change is aided by accelerating smartphone and internet penetration among Mexican consumers, impacting purchasing decisions even among younger consumers. For instance, in April 2025, Moose Toys unveiled a direct-to-retail expansion into Mexico, including the MrBeast Lab collectibles and action figures, amidst 4% YoY growth in the country's toy industry. Moreover, Mexico toys and games market outlook is bright as digital incorporation propels product innovation and attractiveness. This trend will continue to grow as newer technologies become more affordable and accessible, offering immersive experiences that enrich both individual and group play for kids in different age segments.

To get more information on this market Request Sample

Educational Toys Gaining Preference

There is significant growth in the demand for developmental skill and cognitive learning educational toys among consumers in Mexico. More parents are opting for products supporting early childhood learning, such as language skills development, problem-solving, and coordination of motor. This trend tracks with heightened concern for child developmental milestones and how structured play will help reinforce school-readiness. Educational toys—particularly those that involve interactive, sensory, and STEM-oriented elements—are gaining mounting space on specialty and department store shelves throughout the nation. Furthermore, spurred by an expanding emphasis on learning-driven play, Mexico toys and games market growth continues to demonstrate consumer demand for purposeful, knowledge-driven products. As educational standards change and academic achievement becomes a priority in homes, toys that serve as dual-purpose learning tools are set up for long-term viability and growth in the larger market environment.

Preference for Licensed and Character-Based Toys

Character toys licensed from mass media such as animated movies, TV shows, and digital series have been growing in popularity among Mexican young consumers. The products based on a character from media provide the familiar and excitement appeal, covering the space between play and entertainment. With greater access to foreign media franchises due to online resources and streaming channels, demand for recognizable character-based merchandise has picked up. This has generated a run on toy categories like action figures, dolls, puzzles, and even themed ride-ons with these characters. Mexico toys and games market share has taken a significant gain from the longstanding popularity of licensed products, which solidifies brand loyalty and invites repeat business. For example, in April 2023, WHP Global teamed up with El Puerto de Liverpool to introduce Toys 'R' Us into Mexico, opening flagship stores and an ecommerce platform to drive the brand's growth in Latin America. Furthermore, this trend is also likely to be robust, with content consumption trends still driving toy preferences, new character launches continuing to refresh lines and drive sales in different formats of retailing.

Mexico Toys and Games Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Plush Toys

- Infant /Preschool Toys

- Activity Toys

- Dolls

- Games and Puzzles

- Ride-Ons

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes plush toys, infant /preschool toys, activity toys, dolls, games and puzzles, ride-ons, and others.

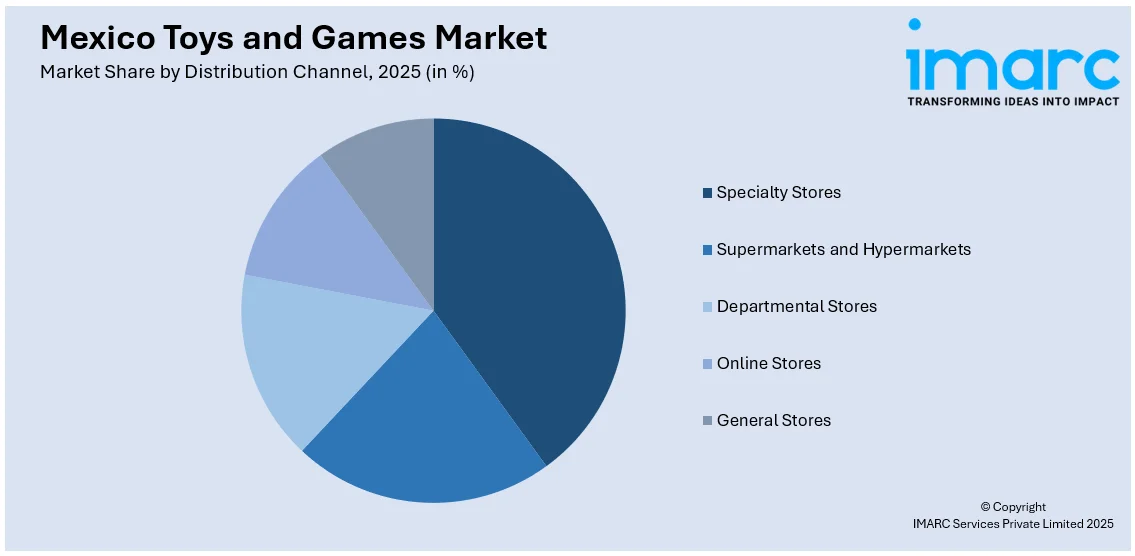

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Specialty Stores

- Supermarkets and Hypermarkets

- Departmental Stores

- Online Stores

- General Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes specialty stores, supermarkets and hypermarkets, departmental stores, online stores, and general stores.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Toys and Games Market News:

- In April 2025, Mexican toy chain Grupo Juguetron collaborated with RELEX Solutions to integrate AI-based demand forecasting and replenishment solutions. This is aimed at streamlining its supply chain and improving planning for holiday occasions and promotions, facilitating increased efficiency and better customer satisfaction in its stores and distribution facilities.

Mexico Toys and Games Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Plush Toys, Infant /PreSchool Toys, Activity Toys, Dolls, Games and Puzzles, Ride-Ons, Others |

| Distribution Channels Covered | Specialty Stores, Supermarkets and Hypermarkets, Departmental Stores, Online Stores, General Stores |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico toys and games market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico toys and games market on the basis of product type?

- What is the breakup of the Mexico toys and games market on the basis of distribution channel?

- What is the breakup of the Mexico toys and games market on the basis of region?

- What are the various stages in the value chain of the Mexico toys and games market?

- What are the key driving factors and challenges in the Mexico toys and games?

- What is the structure of the Mexico toys and games market and who are the key players?

- What is the degree of competition in the Mexico toys and games market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico toys and games market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico toys and games market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico toys and games industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)