Mexico Toys Market Size, Share, Trends and Forecast by Product Type, Age Group, Sales Channel, and Region, 2025-2033

Mexico Toys Market Overview:

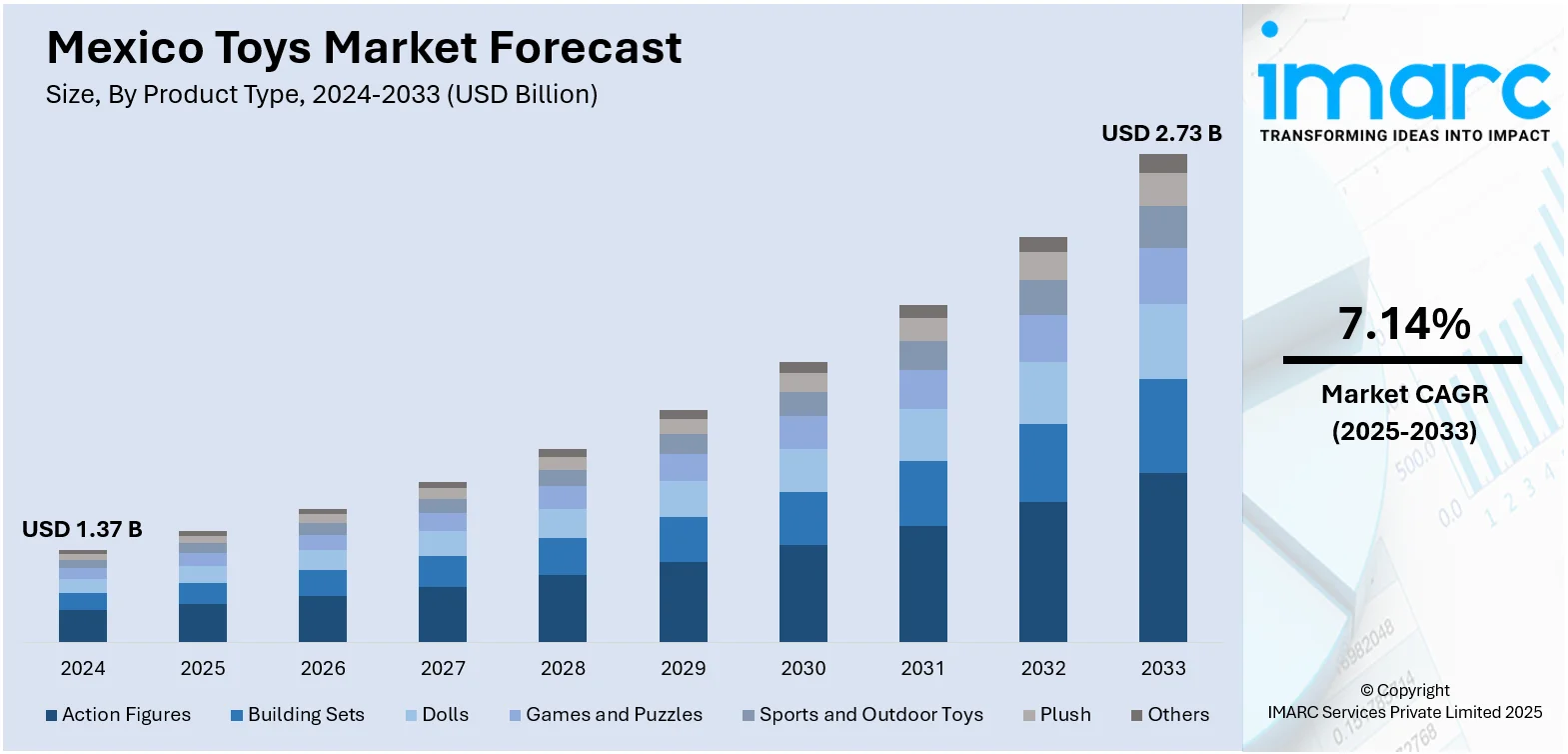

The Mexico toys market size reached USD 1.37 Billion in 2024. The market is projected to reach USD 2.73 Billion by 2033, exhibiting a growth rate (CAGR) of 7.14% during 2025-2033. The market is fueled by the restoration of traditional handcrafted toys. Growing emphasis on early childhood development and online influence, specifically from social media and streaming services, is also highly influential in shaping the market. Expanding e-commerce platforms also enhances convenience and accessibility for consumers, further contributing to the growth of the Mexico toys market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.37 Billion |

| Market Forecast in 2033 | USD 2.73 Billion |

| Market Growth Rate 2025-2033 | 7.14% |

Mexico Toys Market Trends:

Revival of Traditional Mexican Toys

The restoration of traditional handcrafted toys, an initiative referred to as `juguetes tradicionales', has been gaining momentum through Mexico. Such toys, usually made from various raw materials like wood, fabric, and papier-mâché, have cultural importance and are an indispensable part of Mexican heritage. Artisans in considerable numbers of Oaxaca, Guanajuato, and Jalisco still make such products, some examples being alebrijes (colorful wooden figures), Lupita dolls (papier-mâché dolls), and small scenes of market life. Artisans are supported by institutions such as FONART (National Fund for the Promotion of Arts and Crafts), which promote the products and revive the old methods of craft. These handcrafted toys were once competing with cheap, plastic, mass-produced toys, but today, massive handicraft toys are gaining popularity among consumers and collectors seeking culturally relevant and environmentally friendly alternatives. This indicates the growing respect for handcrafted artistry and cultural heritage in the country, and aids in the Mexico toys market growth.

To get more information on this market, Request Sample

Emergence of Educational and STEM Toys

Several parents in Mexico are searching for toys that enhance learning and growth. There appears to be a growing trend in toys that promote creativity, STEM, and problem-solving skills. This is because of a heightened awareness of childhood education and the realization that toys also spur on mental and cognitive development. Companies, in turn, have responded to this by introducing an array of products that strike a balance between entertainment and education, such as building kits, puzzles, and interactive games. The demand for these toys is also strengthened by carious e-commerce websites where parents are easily able to search for more educational products. This cultural transformation from educating through play is keeping the Mexican toy industry on trend with global movements focused on learning through play.

Influence of E-Commerce and Online Media

The Mexican toy industry is going through dramatic changes with the growth of e-commerce and digital media. According to the IMARC Group, the Mexico e-commerce market size reached USD 47.5 Billion in 2024, and is further expected to reach USD 176.6 Billion by 2033, exhibiting a growth rate (CAGR) of 14.5% during 2025-2033. Internet-based platforms such as Amazon Mexico and MercadoLibre have turned out to be significant retailing channels that provide consumers with the convenience of home shopping and broader assortment of products available. This is especially pronounced in urban regions with increased penetration of the internet. Moreover, online media, such as social media channels and streaming services, also generate a significant impact on children's preferences for toys. Telly characters, film series, and internet shows tend to rule the toy market, resulting in high demand for authorized merchandise. This online power is forcing companies to revamp their marketing tactics and product lines in accordance with the contemporary consumer's interests and habits. Therefore, the Mexican toy industry is becoming ever more dynamic and responsive to the latest technological developments and digital trends.

Mexico Toys Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, age group, and sales channel.

Product Type Insights:

- Action Figures

- Building Sets

- Dolls

- Games and Puzzles

- Sports and Outdoor Toys

- Plush

- Others

A detailed breakup and analysis of the market based on the product type has also been provided in the report. This includes action figures, building sets, dolls, games and puzzles, sports and outdoor toys, plush, and others.

Age Group Insights:

- Up to 5 Years

- 5 to 10 Years

- Above 10 Years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes up to 5 years, 5 to 10 years, and above 10 years.

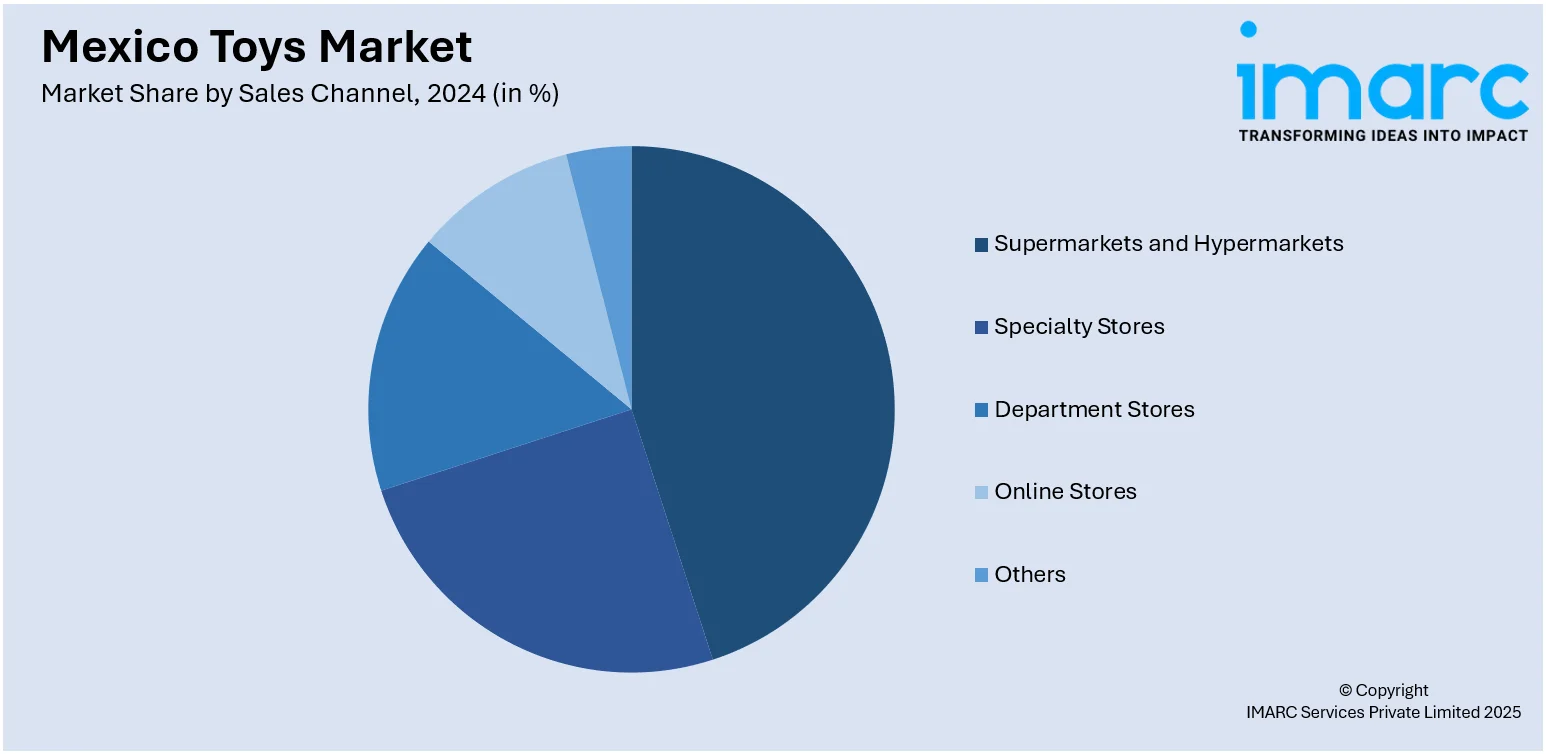

Sales Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Department Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes supermarkets and hypermarkets, specialty stores, department stores, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Toys Market News:

- In November 2024, Moose Toys included Mexico in its list of direct-to-retail markets, featuring the MrBeast Lab toy line as part of the broadened selection available to retail and consumers in 2025.

Mexico Toys Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Action Figures, Building Sets, Dolls, Games and Puzzles, Sports and Outdoor Toys, Plush, Others |

| Age Groups Covered | Up to 5 Years, 5 to 10 Years, Above 10 Years |

| Sales Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Department Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico toys market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico toys market on the basis of product type?

- What is the breakup of the Mexico toys market on the basis of age group?

- What is the breakup of the Mexico toys market on the basis of sales channel?

- What is the breakup of the Mexico toys market on the basis of region?

- What are the various stages in the value chain of the Mexico toys market?

- What are the key driving factors and challenges in the Mexico toys market?

- What is the structure of the Mexico toys market and who are the key players?

- What is the degree of competition in the Mexico toys market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico toys market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico toys market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico toys industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)