Mexico Tractors Market Size, Share, Trends and Forecast by Horsepower, Wheel Drive, and Region, 2026-2034

Mexico Tractors Market Summary:

The Mexico tractors market size was valued at USD 668.67 Million in 2025 and is projected to reach USD 954.37 Million by 2034, growing at a compound annual growth rate of 4.03% from 2026-2034.

The Mexico tractors market is experiencing substantial expansion, driven by accelerating agricultural mechanization and modernization initiatives across the country. Rising demand for enhanced farm productivity, coupled with favorable government policies supporting equipment acquisition, fuels market development. The transition from traditional farming methods towards mechanized solutions continues to reshape agricultural operations nationwide. Increasing adoption of advanced farming technologies and growing export-oriented agricultural activities further propel the market share.

Key Takeaways and Insights:

- By Horsepower: 50-100 HP dominates the market with a share of 27% in 2025, owing to its versatility for medium-sized farming operations and commercial agricultural activities. This horsepower range provides optimal balance between power output and fuel efficiency, enabling farmers to perform multiple tasks, including plowing, tilling, and harvesting operations efficiently.

- By Wheel Drive: 2-wheel-drive leads the market with a share of 55% in 2025. This dominance is driven by affordability, ease of maintenance, and suitability for flatland agricultural operations. Small and medium-scale farmers prefer these tractors for routine farming activities due to lower operational costs and simplified mechanical requirements.

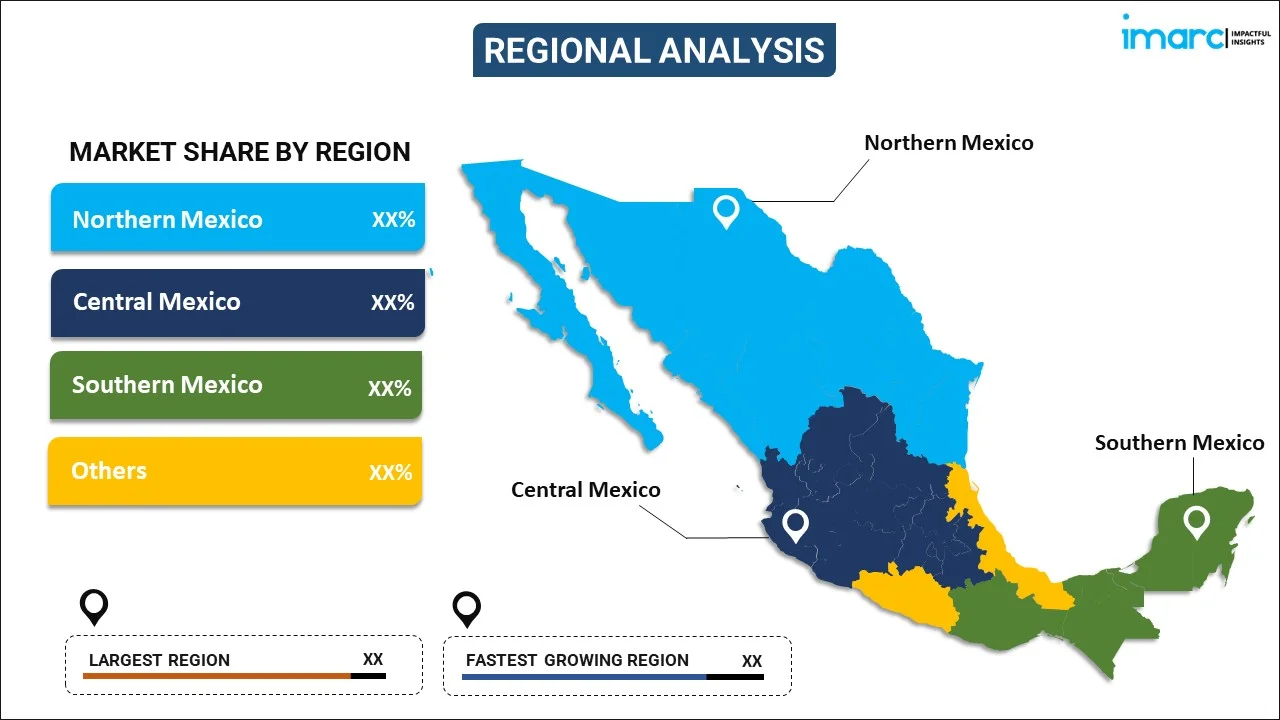

- By Region: Northern Mexico comprises the largest region with 35% share in 2025, fueled by concentration of large-scale commercial farming operations in states like Sinaloa, Sonora, and Chihuahua. Export-oriented agriculture and advanced irrigation infrastructure support high-capacity machinery demand across the region.

- Key Players: Key players drive the Mexico tractors market by expanding manufacturing facilities, improving precision farming technologies, and strengthening nationwide distribution networks. Their investments in financing options, after-sales support, and partnerships with agricultural cooperatives boost awareness, accelerate adoption, and ensure consistent product availability across diverse farming segments.

The Mexico tractors market is propelled by accelerating agricultural mechanization, as farmers transition towards modern farming practices to enhance productivity and reduce labor dependency. Growing export-oriented commercial agriculture creates sustained demand for powerful tractors capable of handling large-scale farming operations efficiently. Government initiatives through the Secretariat of Agriculture and Rural Development (SADER) provide critical support, with the 2024 SADER budget reaching USD 4.3 Billion, representing a 5% increase from 2023. Financial assistance programs and subsidies facilitate equipment acquisition among small and medium-scale producers, driving tractor adoption nationwide. The country's expanding agricultural exports, particularly in fruits and vegetables, necessitate reliable mechanized solutions for timely cultivation and harvesting. Rising awareness regarding advanced agricultural equipment benefits among farming communities stimulates investments in modern tractors equipped with improved features.

Mexico Tractors Market Trends:

Integration of Precision Agriculture Technologies

Mexican farmers are increasingly adopting tractors equipped with global positioning system (GPS) guidance tools, telematics, and automated steering technologies to optimize field operations. The Mexico precision agriculture market reached USD 111.8 Million in 2024 and is projected to reach USD 284.9 Million by 2033 at a 9.80% CAGR. These technologies enable farmers to maximize fuel efficiency, minimize resource wastage, and enhance soil quality through data-driven decision-making and precise application control.

Expansion of Manufacturing Investments

Global tractor manufacturers are expanding their production footprint within Mexico to strengthen local market presence and reduce import dependency. In June 2024, AGCO Mexico invested USD 45 Million to expand agricultural equipment manufacturing facilities in Corregidora, Queretaro. These investments enhance after-sales support capabilities and enable customization of products for local agricultural requirements. This localization strategy also improves supply chain resilience by shortening lead times and lowering logistics costs for original equipment manufacturers (OEMs) and dealers.

Rising Adoption of Compact and Utility Tractors

The demand for compact and utility tractors is increasing among smallholder farmers and specialty crop producers across Mexico. These versatile machines address the needs of diversified farming activities, including horticulture, greenhouse operations, and livestock management. Rising mechanization awareness and access to flexible financing options are encouraging first-time tractor purchases in rural areas. Compact tractors also offer lower operating and maintenance costs, making them attractive for cost-sensitive farmers. Furthermore, their compatibility with multiple attachments enhances productivity across seasonal and multi-crop farming operations.

Market Outlook 2026-2034:

The Mexico tractors market outlook remains optimistic with steady growth anticipated throughout the forecast period. Continued agricultural modernization efforts, combined with expanding commercial farming operations and supportive government policies, will sustain market momentum. The market generated a revenue of USD 668.67 Million in 2025 and is projected to reach a revenue of USD 954.37 Million by 2034, growing at a compound annual growth rate of 4.03% from 2026-2034. The integration of smart technologies, government mechanization programs, and rising agricultural exports will drive adoption across diverse farming segments. Manufacturers focusing on affordable financing solutions and localized production will capitalize on emerging opportunities throughout the forecast period.

Mexico Tractors Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Horsepower |

50-100 HP |

27% |

|

Wheel Drive |

2-Wheel-Drive |

55% |

|

Region |

Northern Mexico |

35% |

Horsepower Insights:

To get detailed segment analysis of this market Request Sample

- Less Than 50 HP

- 50-100 HP

- 101-150 HP

- 151-250 HP

- Above 250 HP

50-100 HP dominates with a market share of 27% of the total Mexico tractors market in 2025.

50-100 HP maintains dominance in the Mexico tractors market owing to its versatility across diverse agricultural applications and suitability for medium-sized farming operations. These tractors deliver optimal balance between power output and fuel efficiency, enabling farmers to perform multiple tasks, including plowing, tilling, sowing, and harvesting, efficiently. In October 2024, TAFE established a Mexican subsidiary to serve growing demand for medium-horsepower tractors, reflecting market preference for this segment. Commercial agricultural producers increasingly favor this horsepower range for its operational flexibility.

The segment's popularity stems from widespread availability of financing options and strong after-sales support networks across Mexico's agricultural regions. Government mechanization programs specifically target small and medium-scale producers, facilitating acquisition of tractors within this horsepower range through subsidies and low-interest financing. Tractors in the 100 HP to 150 HP range provide improved fuel efficiency and enhanced plowing ability while supporting multiple farm implements. With growing acceptance of precision farming technologies, tractors in this segment are increasingly equipped with automated steering and digital monitoring systems for enhanced operational efficiency.

Wheel Drive Insights:

- 2-Wheel-Drive

- 4-Wheel-Drive

2-wheel-drive leads with a share of 55% of the total Mexico tractors market in 2025.

2-wheel-drive maintains market leadership, driven by affordability advantages and suitability for flatland agricultural operations predominant across Mexico's farming regions. These tractors offer lower acquisition costs and simplified maintenance requirements, making them preferred choices among small and medium-scale farmers for routine farming activities. Their ease of operation and maneuverability in standard field conditions contribute to sustained demand across diverse agricultural applications. Government-led subsidy programs and dealer-led demonstration initiatives are further accelerating adoption among small and marginal farmers.

The segment benefits from established dealer networks providing comprehensive service support and readily available spare parts throughout Mexico's agricultural regions. Reduced operational costs, including lower fuel consumption and minimal maintenance expenses, enhance the value proposition for cost-conscious farmers. The segment finds particular favor in areas with relatively flat terrains where the additional traction capabilities of 4-wheel-drive systems remain unnecessary. Improved availability of localized spare parts and service networks also increases farmer confidence in long-term ownership and usage.

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico exhibits a clear dominance with a 35% share of the total Mexico tractors market in 2025.

Northern Mexico maintains market leadership, driven by concentration of large-scale commercial farming operations across states, including Sinaloa, Sonora, and Chihuahua. These regions specialize in export-oriented agriculture requiring high-capacity mechanization for efficient cultivation and timely harvesting. Advanced irrigation infrastructure and favorable agricultural conditions support sustained demand for powerful tractors. Additionally, the dominance of cash crops, such as wheat, corn, vegetables, and forage crops, necessitates reliable, high-horsepower tractors capable of handling intensive field operations.

Farmers in Northern Mexico are early adopters of modern agricultural technologies, including precision seeding, automated spraying, and soil preparation equipment, which further drives demand for advanced tractor models. Strong availability of financing, leasing options, and manufacturer-backed credit programs also supports higher purchasing capacity in the region. Well-developed dealer networks ensure quick access to maintenance services, spare parts, and technical support, minimizing equipment downtime. Moreover, cross-border trade linkages and exposure to global farming practices encourage continuous fleet upgrades, reinforcing Northern Mexico’s leadership in tractor adoption and market value growth.

Market Dynamics:

Growth Drivers:

Why is the Mexico Tractors Market Growing?

Accelerating Agricultural Mechanization and Modernization

The Mexico tractors market is experiencing substantial growth, driven by accelerating agricultural mechanization as farmers transition from traditional farming methods towards modern mechanized solutions. Rising labor costs and shortages drive the shift towards mechanization, with farmers seeking efficient equipment to enhance productivity and reduce operational expenses. The trend of mechanized farming reduces labor dependency while increasing crop yields and improving farm profitability across diverse agricultural segments. Government programs supporting farm equipment subsidies, including credit assistance and tax benefits, significantly boost tractor adoption among both smallholders and agribusinesses. Additionally, expanding cultivation of high-value crops increases demand for specialized and mid-horsepower tractors suited to varied farming needs. Growing awareness about precision agriculture and smart farming technologies is further influencing purchasing decisions.

Government Support and Favorable Agricultural Policies

The Mexican government has introduced a wide range of initiatives to promote agricultural mechanization through financial incentives, subsidies, and capacity-building programs. Support is channeled through national agricultural authorities that facilitate access to tractors and farm machinery, strengthening overall market penetration. Subsidy-driven schemes targeting irrigation equipment and mechanized tools are helping farmers overcome geographical and resource-related challenges, encouraging gradual adoption of modern farming practices. Budgetary prioritization of agriculture reflects a strong policy commitment to improving productivity and rural livelihoods, with a major focus on supporting small and marginal producers. Assistance programs emphasize in-kind benefits, such as access to equipment, inputs, and technical guidance, rather than direct cash transfers, ensuring practical on-ground impact. Training initiatives further enhance effective machinery utilization and maintenance. Collectively, these sustained policy measures reduce financial barriers, build farmer confidence, and create a supportive ecosystem that continues to drive long-term growth of the tractors market across Mexico.

Expanding Agricultural Exports and Commercial Farming Operations

Mexico's position as a global agricultural powerhouse drives substantial demand for efficient farming machinery, including tractors capable of supporting large-scale production. The country ranks among the world's leading exporters of agricultural products, including avocados, berries, tomatoes, and fresh produce, requiring reliable mechanization. In 2024, Mexico emerged as a prominent exporter of chilies, broccoli, cauliflower, lemons, and cucumbers according to the Ministry of Agriculture and Rural Development. Trade agreements, particularly the USMCA, provide zero-tariff machinery imports and strengthen market access for agricultural products. The growth of large-scale commercial farms necessitates demand for powerful tractors accommodating expansive farming operations across Northern Mexico's agricultural regions. Foreign investments in Mexico's agricultural sector boost utilization of advanced tractors with improved features enhancing efficiency and lowering operational costs. Export-oriented agribusiness expansion creates sustained requirements for modern mechanized solutions, supporting timely cultivation and harvesting.

Market Restraints:

What Challenges the Mexico Tractors Market is Facing?

High Acquisition Costs for Advanced Tractors

The high upfront capital required to acquire advanced tractors poses significant challenges for small and medium-sized farmers throughout Mexico. Most farmers continue to use conventional farming techniques owing to machinery expenses, maintenance costs, and spare parts availability concerns. Even with available financing options, affordability issues persist hampering widespread adoption, particularly in rural areas. Limited access to credit facilities and unfavorable loan terms further constrain purchasing capabilities among resource-constrained farming communities.

Skilled Operator and Technician Shortages

The lack of skilled operators and technicians capable of managing contemporary agricultural tractors represents a growing challenge across Mexico's farming sector. Farmers remain unfamiliar with modern GPS-based, sensor-enabled, and automated tractors, limiting the ability to utilize technology to its full potential. Training programs and awareness campaigns require significant investment to fill knowledge gaps and achieve effective tractor usage and maintenance. Inadequate technical education infrastructure, particularly in rural regions, compounds these skilled labor availability constraints.

Infrastructure Limitations and Land Fragmentation

Mechanization faces substantial challenges in southern states, including Chiapas and Oaxaca, owing to land fragmentation and mountainous terrain characteristics. Poor road conditions and inadequate storage facilities in rural areas affect transportation and maintenance of tractors, constraining market penetration. Fragmented landholdings limit economies of scale achievable through tractor utilization, reducing investment incentives among smallholder farmers. Limited after-sales service availability, particularly in remote agricultural regions, further discourages equipment purchases.

Competitive Landscape:

The Mexico tractors market exhibits moderate concentration with established global manufacturers maintaining significant market presence. Major players compete through product differentiation, distribution network expansion, and financing solutions. Companies maintain competitive positioning through strategic manufacturing investments, precision technology development, and comprehensive after-sales service networks. Captive financing options enhance customer accessibility to premium equipment. The market has witnessed increased foreign direct investment (FDI) as manufacturers establish local production facilities to serve domestic demand and regional export markets. Competition intensifies through mergers, acquisitions, technological innovations, and product extensions, addressing evolving farmer requirements across diverse agricultural segments.

Recent Developments:

- In August 2025, TAFE launched its combined tractor assembly facility and experience center in Aguascalientes, Mexico with a USD 15 Million investment. The facility marked the company's initial manufacturing operation in the country, concentrating on equipment assembly, enhancing customer experiences, and providing technical training to improve after-sales support in Mexican agricultural areas.

Mexico Tractors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Horsepowers Covered | Less Than 50 HP, 50-100 HP, 101-150 HP, 151-250 HP, Above 250 HP |

| Wheel Drives Covered | 2-Wheel-Drive, 4-Wheel-Drive |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico tractors market size was valued at USD 668.67 Million in 2025.

The Mexico tractors market is expected to grow at a compound annual growth rate of 4.03% from 2026-2034 to reach USD 954.37 Million by 2034.

50-100 HP dominated the market with a share of 27%, owing to versatility for medium-sized farming operations and commercial agricultural activities requiring balanced power output and fuel efficiency.

Key factors driving the Mexico tractors market include accelerating agricultural mechanization, government support through subsidies and financing programs, expanding agricultural exports, and rising adoption of precision farming technologies.

Major challenges include high upfront acquisition costs for advanced tractors, limited access to financing options, shortage of skilled operators and technicians, infrastructure limitations in rural areas, and land fragmentation in southern regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)