Mexico Truck Market Size, Share, Trends and Forecast by Vehicle Type, Tonnage Capacity, Fuel Type, Application, and Region, 2025-2033

Mexico Truck Market Size, Share & Analysis

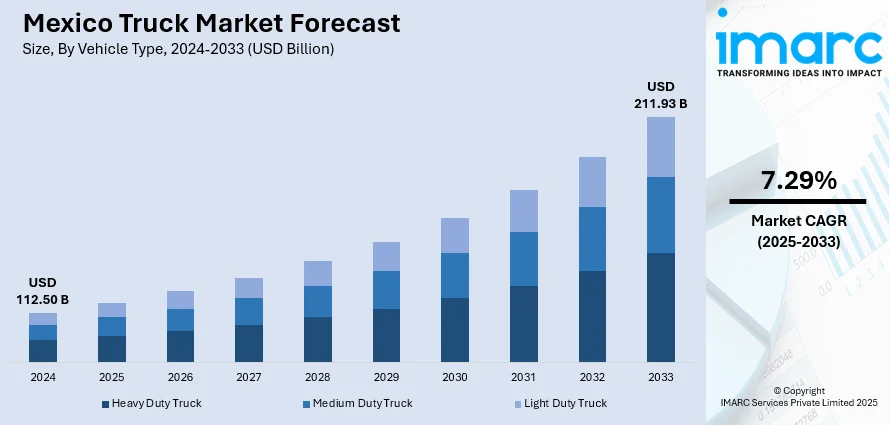

The Mexico truck market size reached USD 112.50 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 211.93 Billion by 2033, exhibiting a growth rate (CAGR) of 7.29% during 2025-2033. The market is driven by expanding logistics and e-commerce sectors, along with increasing cross-border trade with the U.S. Government infrastructure investments and demand for fuel-efficient, technologically advanced trucks further boost market growth, while environmental regulations are encouraging the shift toward electric and hybrid models.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 112.50 Billion |

| Market Forecast in 2033 | USD 211.93 Billion |

| Market Growth Rate 2025-2033 | 7.29% |

Mexico Truck Market Trends:

Rising Adoption of Electric and Hybrid Trucks

The Mexico truck market share is increasingly adopting cleaner technologies, with growing interest in electric and hybrid models driven by environmental awareness, government policies, and global decarbonization efforts. In 2024, hybrid and electric vehicle (EVs) sales surged by 26.3%, reaching 12,225 units in March alone, reflecting a broader trend towards cleaner transport. For the first quarter, sales totaled 33,360 units, marking a 30.1% year-on-year increase. Logistics companies and fleet operators are embracing these vehicles to cut fuel costs and meet evolving sustainability standards. Even as infrastructure such as charging networks remains under development, demand for electric trucks is on the up, particularly for urban last-mile delivery where their reduced emissions and lower noise levels are especially valuable. Leading automakers are changing in response to the market, making this movement toward cleaner freight options.

Light Truck Growth Driven by E-Commerce and Urban Logistics

As online shopping remains on the rise in Mexico, there's increasing demand for effective urban logistics, driving demand for light trucks. Light trucks are perfect for navigating city traffic and making frequent, short-haul deliveries. Retailers, delivery companies, and small businesses are using light trucks to increase their responsiveness and decrease delivery times. The trend is also driven by the increasing express shipping services and the growth of urban populations. Imports are also playing a great role, with numerous brands importing models that are suitable for local conditions. Light trucks are currently a key component in supply chains, particularly as cities are adjusting to quicker and more agile delivery expectations further aiding the Mexico truck market growth.

Nearshoring Boosts Truck Demand

Mexico’s truck market is undergoing a significant transformation driven by nearshoring, as manufacturers relocate operations closer to the U.S. to reduce supply chain risks. This trend is fueling strong demand for commercial and heavy-duty trucks to support expanding logistics needs. In 2023, the number of Mexican trucking companies transporting goods to the U.S. rose by 2.5%, while their fleets expanded by 14%, reflecting increased cross-border activity. Companies are adding more fleets to handle the increased number of goods shuttling between industrial parks and across the border. Major logistics corridors, especially along the northern border, are seeing all-time-high activity. With production and warehousing increasing across the country, trucks are becoming prime freight assets. While infrastructure is getting better, the industry continues to grapple with skilled labor shortages and regulatory complexity. The Mexico truck market outlook remains strong, with momentum likely to continue as nearshoring accelerates and cross-border logistics evolve.

Mexico Truck Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on vehicle type, tonnage capacity, fuel type, and application.

Vehicle Type Insights:

- Heavy Duty Truck

- Medium Duty Truck

- Light Duty Truck

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes heavy duty truck, medium duty truck, and light duty truck.

Tonnage Capacity Insights:

- 3.5 – 7.5 Tons

- 7.5 – 16 Tons

- 16 – 30 Tons

- Above 30 Tons

A detailed breakup and analysis of the market based on the tonnage capacity have also been provided in the report. This includes 3.5 – 7.5 tons, 7.5 – 16 tons, 16 – 30 tons, and above 30 tons.

Fuel Type Insights:

- Diesel

- Petrol

- CNG & LNG

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes diesel, petrol, and CNG & LNG.

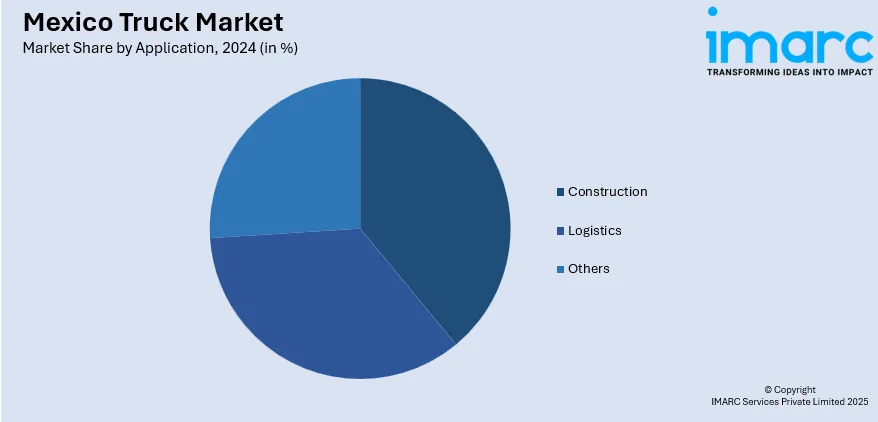

Application Insights:

- Construction

- Logistics

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes construction, logistics, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Truck Market News:

- In February 2025, Huawei launched its first electric truck charging station in Latin America, located in Tultitlán, State of Mexico. Featuring 12 multi-connector chargers, it supports Chinese, European, and American EVs. This move addresses Mexico's lagging charging infrastructure despite rising EV adoption. Huawei aims to expand in the region by supplying technology, not operating stations directly, as it already does for over 100,000 stations across Asia and Europe through strategic partners.

- In February 2025, Transportes Marva is set to deploy 120 electric semi-trailers along the Monterrey-Texas trade route, aiming to reduce CO₂ emissions and boost road safety. Partnering with its subsidiary BY Deléctrico and Chinese EV maker BYD, the company is piloting electric transport for 250–300 km routes. Deléctrico also provides charging infrastructure. The initiative highlights Marva’s commitment to sustainable logistics and innovation within Mexico’s freight industry.

- In October 2024, Yutong Mexico launched the T5 electric truck to meet rising last-mile delivery demands fueled by e-commerce. Now operating in cities like Mexico City and Guadalajara, the T5 offers a 250 km range and comes in three configurations. With 50 units available, Yutong also provides charging solutions and after-sales support across Mexico. Future plans include for a seven-ton T7 truck later that year and an electric vehicle in March 2025.

- In August 2024, Daimler Truck Mexico will launch the e360 electric truck in 2025, offering full leasing and free consultancy to enhance fleet efficiency. Additionally, it unveiled Enlace Freightliner 3.0, a telematics system driven by AI that has capabilities like weapon detection and facial recognition. Rolling out in October, it will become standard in 2025 Freightliner models. The upgrade aims to improve safety, efficiency, and vehicle uptime for Mexican transporters, supporting over 34,000 units nationwide.

Mexico Truck Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Heavy Duty Truck, Medium Duty Truck, Light Duty Truck |

| Tonnage Capacities Covered | 3.5 – 7.5 Tons, 7.5 – 16 Tons, 16 – 30 Tons, Above 30 Tons |

| Fuel Types Covered | Diesel, Petrol, CNG & LNG |

| Applications Covered | Construction, Logistics, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico truck market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico truck market on the basis of vehicle type?

- What is the breakup of the Mexico truck market on the basis of tonnage capacity?

- What is the breakup of the Mexico truck market on the basis of fuel type?

- What is the breakup of the Mexico truck market on the basis of application?

- What is the breakup of the Mexico truck market on the basis of region?

- What are the various stages in the value chain of the Mexico truck market?

- What are the key driving factors and challenges in the Mexico truck market?

- What is the structure of the Mexico truck market and who are the key players?

- What is the degree of competition in the Mexico truck market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico truck market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico truck market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico truck industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)