Mexico Tube Packaging Market Size, Share, Trends and Forecast by Type, Material Type, Application, and Region, 2025-2033

Mexico Tube Packaging Market Overview:

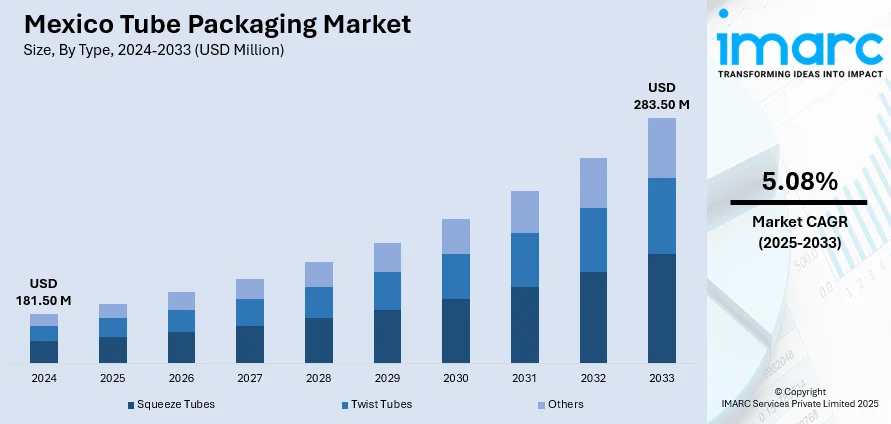

The Mexico tube packaging market size reached USD 181.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 283.50 Million by 2033, exhibiting a growth rate (CAGR) of 5.08% during 2025-2033. The market is experiencing steady growth, driven by increasing demand across industries such as cosmetics, pharmaceuticals, and food. Sustainability trends and consumer preference for convenient, lightweight packaging solutions are fueling innovation in materials and design. Local manufacturers are focusing on recyclable and eco-friendly tubes to meet evolving market needs. The competitive landscape continues to evolve, shaping future opportunities for growth in Mexico Tube Packaging share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 181.50 Million |

| Market Forecast in 2033 | USD 283.50 Million |

| Market Growth Rate 2025-2033 | 5.08% |

Mexico Tube Packaging Market Trends:

Sustainability and Eco-Friendly Materials:

The demand for environmentally friendly packaging solutions in the Mexican tube packaging industry is growing fast. Brands are moving away from conventional plastic tubes towards sustainable alternatives, like biodegradable or recyclable material, as consumers become increasingly aware of the environment and sustainability issues. Cosmetic and personal care industry leaders are turning to paper-based or biodegradable tubes in order to reduce plastic waste. Pressure from regulators also compels companies to develop and seek greener alternatives. The shift towards green materials not only complements the sustainability goals but also appeals to consumers who place high value on their environmental responsibility while making purchase decisions. This is likely to continue growing as more industries embrace sustainability practices, eventually influencing the future of the market.

Technological Integration in Packaging:

Technology is revolutionizing Mexico's tube packaging industry by adding intelligent features that improve consumer engagement and product tracing. Features such as quick response (QR) codes, Near-field communication (NFC) chips, and Radio-Frequency Identification (RFID) tags are increasingly popular, enabling consumers to view product details, authenticate the product, or trace the journey of the product from manufacture to delivery. This trend is especially significant in sectors such as FMCG, where packaging is vital in building trust and loyalty among consumers. Smart packaging provides more than convenience to the consumer; it also establishes brands as pioneers in a competitive environment by providing more functionality and enhancing the customer experience overall. These attributes will become increasingly embedded as technology develops.

Customization and Personalization:

The customization and personalization trend in tube packaging is bolstering the Mexico tube packaging market growth, especially within the beauty and personal care industries. The 2023 Vogue Business Beauty Index indicates that 76% of consumers want customized beauty products, but just 23% of brands make them available at the moment. This identifies a massive opportunity for brands to take advantage of increasing demand for customized packaging. Packaging is key to meeting individual customer preferences, with new printing technologies allowing for distinctive designs, colors, and messages. Personalized packaging not only differentiates brands but also boosts customer interaction and brand loyalty. With packaging serving as part of a brand's identity, consumers become emotionally attached to the products they buy, leading to lasting brand success in Mexico's competitive marketplace.

Mexico Tube Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, material type, and application.

Type Insights:

- Squeeze Tubes

- Twist Tubes

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes squeeze tubes, twist tubes, and others.

Material Type Insights:

- Plastics

- Paper

- Aluminum

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes plastics, paper, aluminum, and others.

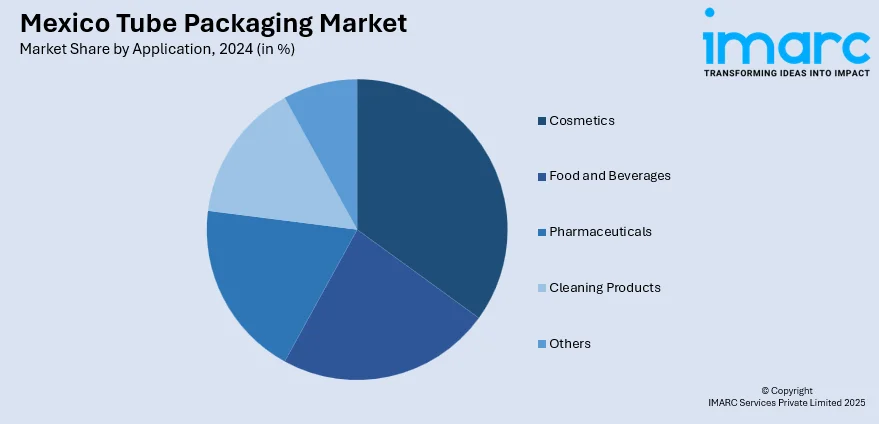

Application Insights:

- Cosmetics

- Food and Beverages

- Pharmaceuticals

- Cleaning Products

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes cosmetics, food and beverages, pharmaceuticals, cleaning products, and others

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Tube Packaging Market News:

- In March 2025, Nefab Group expanded its manufacturing capacity in Mexico by opening a new 58,000-square-foot facility in Zapopan, near Guadalajara. The plant focuses on producing sustainable plastic packaging for industries such as data communications, electronics, and automotive. This move doubles Nefab’s capacity and incorporates thin-gauge thermoforming technology to meet the growing demand for eco-friendly packaging solutions.

- In January 2025, Albéa Tubes launched the 'Metamorphosis' paper-based cosmetic tube at its Queretaro plant in Mexico, aiming to meet the growing demand for sustainable packaging solutions in North America. The tube, featuring up to 50% FSC-certified paper and paired with the EcoFusion Top, reduces plastic use significantly. This innovation offers an 80% weight reduction in comparison to traditional packaging, supporting North American brands' sustainability goals while minimizing environmental impact.

Mexico Tube Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Squeeze Tubes, Twist Tubes, Others |

| Material Types Covered | Plastics, Paper, Aluminum, Others. |

| Applications Covered | Cosmetics, Food and Beverages, Pharmaceuticals, Cleaning Products, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico tube packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico tube packaging market on the basis of type?

- What is the breakup of the Mexico tube packaging market on the basis of material type?

- What is the breakup of the Mexico tube packaging market on the basis of application?

- What is the breakup of the Mexico tube packaging market on the basis of region?

- What are the various stages in the value chain of the Mexico tube packaging market?

- What are the key driving factors and challenges in the Mexico tube packaging market?

- What is the structure of the Mexico tube packaging market and who are the key players?

- What is the degree of competition in the Mexico tube packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico tube packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico tube packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico tube packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)