Mexico Two-Wheeler Market Size, Share, Trends and Forecast by Type, Technology, Transmission, Engine Capacity, Fuel Type, Distribution Channel, End User, and Region, 2026-2034

Mexico Two-Wheeler Market Summary:

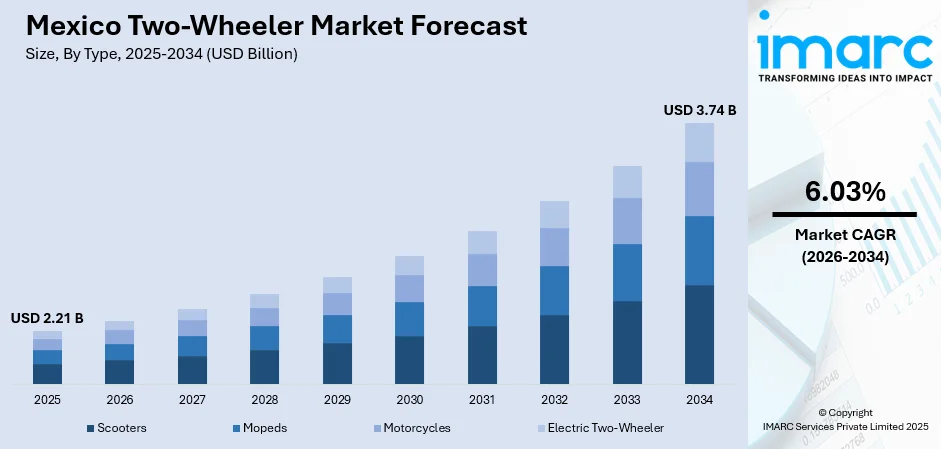

The Mexico two-wheeler market size was valued at USD 2.21 Billion in 2025 and is projected to reach USD 3.74 Billion by 2034, growing at a compound annual growth rate of 6.03% from 2026-2034.

Mexico's two-wheeler market is experiencing robust expansion driven by rapid urbanization, escalating traffic congestion in major metropolitan areas, and growing demand for affordable personal transportation solutions. The increasing adoption of motorcycles for last-mile delivery services complemented by the rise of e-commerce platforms is strengthening market dynamics. Additionally, the presence of domestic manufacturers and new entrants from Asia is intensifying competition while expanding consumer choices across the Mexico two-wheeler market share.

Key Takeaways and Insights:

-

By Type: Motorcycle dominates the market with a share of 70% in 2025, attributed to its widespread utility across personal commuting, commercial delivery operations, and rural transportation needs, supported by extensive dealership networks and accessible financing options.

-

By Technology: ICE holds the largest share of 96% in 2025, underpinned by comprehensive fuel distribution infrastructure, established maintenance ecosystems, and consumer preference for proven powertrain reliability over emerging electric alternatives.

-

By Transmission: Manual leads the market with a share of 82% in 2025, reflecting rider preferences for enhanced vehicle control, superior fuel economy, and reduced long-term maintenance costs compared to automatic counterparts.

-

By Engine Capacity: The 126-180cc dominates the market with a share of 25% in 2025, offering the ideal combination of adequate power for highway commuting, competitive fuel efficiency, and affordable pricing for mainstream consumers.

-

By Fuel Type: Petrol leads the market with a share of 46% in 2025, driven by ubiquitous fuel station availability across urban and rural regions, competitive pump prices, and well-established engine servicing capabilities nationwide.

-

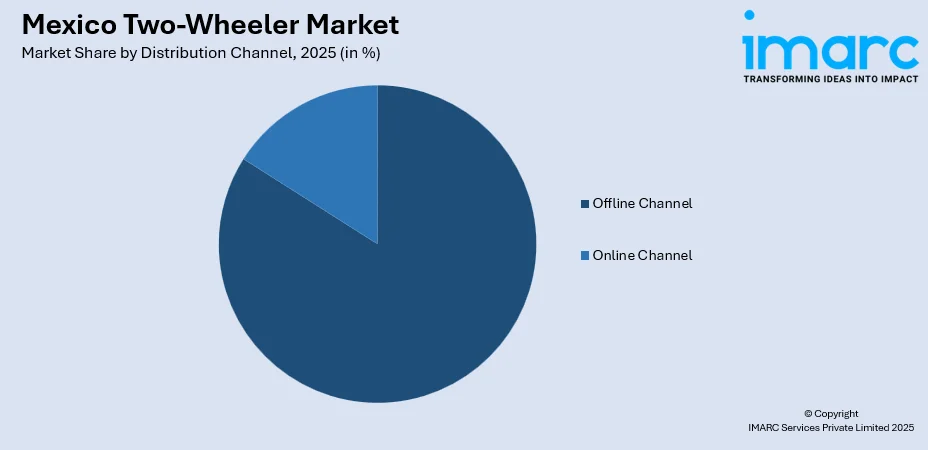

By Distribution Channel: Offline channels dominate with 84% market share in 2025, as consumers prioritize physical vehicle inspection, test ride experiences, and face-to-face financing negotiations before committing to purchase decisions.

-

By End User: Personal leads the market with a share of 92% in 2025, fueled by rising demand for cost-effective daily commuting solutions among students, working professionals, and suburban residents seeking alternatives to congested public transit.

-

By Region: Central Mexico dominates the market with a share of 41% in 2025, propelled by the concentration of economic activity and population density in Mexico City metropolitan area alongside severe urban traffic congestion driving two-wheeler adoption.

-

Key Players: The Mexico two-wheeler market demonstrates a dynamic competitive landscape characterized by established domestic manufacturers competing alongside expanding Asian entrants. Market participants differentiate through pricing strategies, distribution reach, financing partnerships, and after-sales service quality.

To get more information on this market Request Sample

The Mexico two-wheeler market is undergoing significant transformation propelled by changing consumer mobility preferences and favorable demographic trends. In fact, Mexican motorcycle leader Italika reported its 20th consecutive year of record sales in 2024, achieving approximately 1.3 million registrations, underscoring strong local demand and brand dominance. Students and young professionals increasingly prefer scooters and lightweight motorcycles for their cost-effectiveness and maneuverability through congested urban streets. The expanding middle class coupled with easier access to financing options is enabling broader consumer segments to purchase two-wheelers. Infrastructure development in secondary cities is further extending market reach beyond traditional urban centers. Government initiatives focused on road safety and rider certification requirements demonstrate regulatory attention toward enhancing standards for two-wheeler users across the country.

Mexico Two-Wheeler Market Trends:

Rising Adoption of Electric Two-Wheelers

Mexico is seeing steady growth in electric two-wheeler adoption, fueled by environmental awareness and supportive policies to curb urban air pollution. In 2025, Mexico City updated its Mobility Law with licensing and regulations for electric motorcycles and scooters, promoting safer adoption. Urban consumers are favoring electric models for lower operational costs and minimal maintenance. Advances in battery technology and expanded charging infrastructure are further accelerating the shift toward electric mobility across metropolitan areas.

Expansion of Last-Mile Delivery Services

The rapid growth of e-commerce and food delivery in Mexico is driving strong demand for two-wheelers in urban areas. Delivery companies are expanding fleets to meet consumer expectations for fast service. In 2025, Cabify added motorcycles to its Delivery service, emphasizing low-cost, low-emission, and electric options. Electric two-wheelers reduce fuel and maintenance costs, prompting major ride-hailing and delivery platforms to build and electrify motorcycle fleets, enhancing operational efficiency while meeting growing demand and minimizing environmental impact.

Growing Presence of Asian Manufacturers

The Mexican two-wheeler market is facing rising competition from Asian manufacturers, especially China and India, introducing affordable models for price-conscious consumers. New entrants are setting up local assembly and distribution networks to cut costs and enhance accessibility. This competitive landscape is expanding consumer choices and pushing established players to improve value offerings. Indian firms like TVS, Bajaj, and Hero MotoCorp are increasing local presence through assembly and distribution partnerships. International brands are showing confidence by investing heavily in local production facilities.

Market Outlook 2026-2034:

The Mexico two-wheeler market is expected to witness sustained growth throughout the forecast period, driven by favorable demographic trends, increasing urban congestion, and a growing preference for cost-effective and flexible transportation solutions. The market outlook is further boosted by rising adoption of electric two-wheelers and expanding opportunities in last-mile delivery services. Shifting consumer preferences toward sustainable, efficient, and convenient mobility solutions are likely to support continued market expansion across urban and semi-urban regions. The market generated a revenue of USD 2.21 Billion in 2025 and is projected to reach a revenue of USD 3.74 Billion by 2034, growing at a compound annual growth rate of 6.03% from 2026-2034.

Mexico Two-Wheeler Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Motorcycle | 70% |

| Technology | ICE | 96% |

| Transmission | Manual | 82% |

| Engine Capacity | 126-180cc | 25% |

| Fuel Type | Petrol | 46% |

| Distribution Channel | Offline Channels | 84% |

| End User | Personal | 92% |

| Region | Central Mexico | 41% |

Type Insights:

- Scooters

- Mopeds

- Motorcycle

- Electric Two-Wheeler

The motorcycle dominates with a market share of 70% of the total Mexico two-wheeler market in 2025.

Motorcycles represent the backbone of Mexico's two-wheeler industry, serving as versatile transportation solutions for diverse consumer needs ranging from daily commuting to commercial applications. In 2025, Vento Motorcycles U.S.A. launched an omnichannel retail platform in Mexico to strengthen its presence in major cities like Mexico City, Guadalajara, and Monterrey, improving nationwide customer experience. The segment benefits from established dealership networks, comprehensive after-sales service infrastructure, and strong brand loyalty among Mexican consumers.

Fuel efficiency advantages and lower acquisition costs compared to four-wheelers continue driving preference among price-sensitive buyers seeking practical mobility solutions. The segment's dominance is reinforced by growing demand from delivery service providers and small business operators who rely on motorcycles for efficient goods transportation. Rural areas particularly favor motorcycles for their ability to navigate unpaved roads and challenging terrain while maintaining operational reliability. The enduring appeal of motorcycles is evidenced by consistent sales growth, with motorcycle purchases increasingly outpacing automobile acquisitions among budget-conscious consumers.

Technology Insights:

- ICE

- Electric

The ICE leads with a share of 96% of the total Mexico two-wheeler market in 2025.

Internal combustion engine (ICE) two-wheelers continue to dominate the Mexican market, driven by their cost-effectiveness, quick refueling, and extensive availability of spare parts. In 2025, Mexico’s motorcycle market was expected to grow 10–15 %, with ICE models from Italika, Bajaj, Honda, and Yamaha driving expansion by meeting growing demand for affordable personal and delivery transport. Many consumers prefer ICE vehicles for their proven durability and ease of maintenance, making them a reliable option for both daily commuting and commercial purposes.

Strong brand loyalty and extensive dealership networks continue to bolster ICE dominance in Mexico. Established after-sales services and consumer familiarity with engine technology enhance confidence in long-term performance. Consequently, ICE two-wheelers remain the primary choice for personal mobility and last-mile delivery, effectively supporting transportation needs across urban, suburban, and rural regions, and maintaining their position as a reliable backbone of the country’s two-wheeler market. In regions where charging infrastructure for electric vehicles is sparse, traditional motorcycles and scooters remain the most practical choice.

Transmission Insights:

- Manual

- Automatic

The manual dominates with a market share of 82% of the total Mexico two-wheeler market in 2025.

Manual transmission two-wheelers remain the preferred choice among Mexican riders due to superior fuel efficiency, lower maintenance requirements, and enhanced rider control over vehicle performance. For instance, in 2025, the Italika FT150, a 5‑speed manual motorcycle, remained a top seller in Mexico, highlighting strong consumer preference for traditional gearbox models among commuters and delivery riders. Traditional riding culture in Mexico favors manual gearbox operation, with many riders valuing the engaged driving experience and cost advantages.

Automatic transmission vehicles are steadily gaining popularity, especially among urban commuters and new riders who prioritize ease of use in congested traffic. The growing scooter segment is a key driver of this trend, as manufacturers launch user-friendly models tailored for first-time buyers and female riders. These vehicles offer a convenient, low-maintenance alternative to manual bikes, appealing to consumers seeking comfort, practicality, and modern design while navigating city streets.

Engine Capacity Insights:

- <100cc

- 100-125cc

- 126-180cc

- 181-250cc

- 251-500cc

- 501-800cc

- 801-1600cc

- >1600cc

The 126-180cc leads with a share of 25% of the total Mexico two-wheeler market in 2025.

The 126-180cc engine capacity segment represents the optimal balance between power output, fuel efficiency, and affordability for Mexican consumers. This displacement range adequately serves both urban commuting requirements and occasional highway travel while maintaining competitive fuel economy and manageable insurance costs. Recent industry trends indicate that mid-capacity motorcycles, especially around 150 cc, are gaining strong consumer traction in comparable markets, appealing to riders who desire better performance than entry-level models without higher costs or complexity.

Manufacturers focus heavily on this segment, launching models with improved features, performance, and styling to appeal to riders seeking reliable daily transportation. It attracts working professionals and experienced motorcyclists looking to upgrade from entry-level bikes, while still being affordable and accessible to first-time buyers with moderate budgets. By balancing practicality, style, and cost, this segment serves a wide range of consumers who value performance and convenience for both commuting and occasional longer rides.

Fuel Type Insights:

- Gasoline

- Petrol

- Diesel

- LPG/CNG

- Battery

The petrol dominates with a market share of 46% of the total Mexico two-wheeler market in 2025.

Petrol-powered two-wheelers remain the dominant choice in Mexico, driven by extensive fueling infrastructure, competitive fuel costs, and dependable engine performance. The widespread presence of petrol stations across urban and rural regions provides riders with convenient refueling options, ensuring uninterrupted mobility. This accessibility, combined with the proven reliability of petrol engines, makes these motorcycles a practical and popular option for daily commuting, work-related travel, and longer journeys, sustaining their strong foothold in the Mexican two-wheeler market.

In addition, manufacturers continue to prioritize petrol-powered models in their product lineups, offering motorcycles with improved fuel efficiency, enhanced safety features, and modern styling to cater to diverse consumer needs. This segment appeals to both first-time buyers seeking affordable, reliable transport and experienced riders upgrading from entry-level bikes. With a balance of performance, cost-effectiveness, and convenience, petrol two-wheelers maintain widespread popularity, reinforcing their dominance amid emerging alternatives like electric motorcycles.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline Channels

- Online Channels

The offline channels leads with a share of 84% of the total Mexico two-wheeler market in 2025.

Traditional dealership networks and authorized retail outlets remain the preferred choice for consumers in Mexico’s two-wheeler market. Shoppers appreciate the opportunity to physically examine motorcycles, take test rides, and discuss financing options directly with sales representatives. This hands-on approach not only builds buyer confidence but also allows for personalized guidance, ensuring that customers make informed decisions. As a result, dealerships continue to play a central role in shaping purchase behavior and sustaining market trust.

Offline channels continue to thrive in Mexico’s two-wheeler market due to established trust and robust after-sales support, including maintenance, warranty services, and access to genuine spare parts. Dealers also play a key role in facilitating financing, linking buyers with lending institutions to enable convenient installment payment options. This combination of reliable service and financial assistance reinforces consumer confidence, making offline dealerships a vital component of the purchase and ownership experience for two-wheeler buyers.

End User Insights:

- Personal

- Commercial

The personal dominates with a market share of 92% of the total Mexico two-wheeler market in 2025.

Personal use continues to be the main driver of two-wheeler demand in Mexico, as consumers look for cost-effective alternatives to public transportation and private cars. Increasing fuel prices and urban traffic congestion encourage individuals to adopt motorcycles for daily commuting, providing both time efficiency and lower transportation expenses. Motorcycles offer a practical solution for navigating crowded streets, making them an attractive choice for those seeking affordable, convenient, and flexible mobility across cities and suburban areas.

Young professionals, students, and suburban residents form the core demographic for personal two-wheeler use, appreciating motorcycles for their practicality, fuel efficiency, and low operating costs. Meanwhile, the commercial segment, though smaller, is growing rapidly due to the expansion of delivery services. The rise of e-commerce platforms and food delivery applications across Mexican cities has increased demand for motorcycles in logistics, making them an essential tool for businesses requiring cost-effective, agile, and reliable last-mile transportation.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Central Mexico exhibits a clear dominance with a 41% share of the total Mexico two-wheeler market in 2025.

Central Mexico leads regional two-wheeler demand, fueled by the dense population and economic activity concentrated in the Mexico City metropolitan area and neighboring states such as the State of Mexico, Puebla, and Queretaro. Severe traffic congestion in these urban centers makes motorcycles an appealing choice for commuters seeking faster, more flexible transportation. Two-wheelers provide a practical solution for navigating crowded streets, allowing riders to save time while maintaining cost-effective mobility in one of the country’s busiest regions.

In addition, the high concentration of commercial activities in Central Mexico further drives two-wheeler demand, as businesses increasingly rely on motorcycles for deliveries and quick urban logistics. Rising e-commerce and food delivery services have amplified the need for agile vehicles that can efficiently navigate congested streets. Coupled with growing consumer awareness of fuel-efficient and low-maintenance transportation options, motorcycles have become an integral part of both personal and commercial mobility solutions in this densely populated and economically vibrant region.

Market Dynamics:

Growth Drivers:

Why is the Mexico Two-Wheeler Market Growing?

Rising Urbanization and Traffic Congestion

Mexico's accelerating urbanization is creating substantial demand for compact and efficient transportation solutions capable of navigating increasingly congested city streets. Major metropolitan areas including Mexico City, Guadalajara, and Monterrey experience severe traffic bottlenecks that extend average commute times and reduce productivity. Two-wheelers offer practical alternatives enabling riders to weave through traffic and reach destinations significantly faster than conventional vehicles. In 2025, Mexico City received an honorable mention in the Sustainable Transport Awards for expanding cycling and transit infrastructure, including bike‑share systems and networks improving accessibility and reducing congestion. The urban population concentration is intensifying pressure on existing road infrastructure, making nimble two-wheeled transportation increasingly attractive to time-conscious commuters.

Affordable Personal Transportation Demand

Economic considerations remain paramount for Mexican consumers seeking personal mobility solutions, with two-wheelers offering substantially lower acquisition and operational costs compared to automobiles. Entry-level motorcycles provide accessible transportation options for students, young professionals, and lower-middle-income households unable to afford four-wheeled vehicles. Fuel efficiency advantages translate to meaningful daily savings for regular commuters traveling significant distances. The availability of attractive financing schemes and installment payment options from dealers and manufacturers is enabling broader consumer segments to purchase two-wheelers. Competitive pricing strategies from domestic and Asian manufacturers are continuously improving value propositions while expanding market accessibility.

Growth in E-commerce and Delivery Services

The explosive expansion of online commerce and food delivery platforms is generating substantial commercial demand for two-wheelers in Mexican urban centers. Delivery companies require agile vehicles capable of fulfilling orders quickly while maintaining operational cost efficiency. Two-wheelers perfectly match these requirements offering speed, maneuverability, and lower fuel consumption compared to larger vehicles. Major delivery platforms are actively building motorcycle fleets to serve growing consumer demand for rapid delivery services. With Mexico’s e-commerce platform market reaching USD 168.34 million in 2025 and projected to hit USD 829.8 million by 2034, growing at a CAGR of 19.39% during 2026–2034, the sector’s growth trajectory is creating employment opportunities for riders while simultaneously driving vehicle sales as both platforms and independent contractors expand their fleet capacities.

Market Restraints:

What Challenges the Mexico Two-Wheeler Market is Facing?

Limited Electric Charging Infrastructure

The underdeveloped electric vehicle charging network poses significant barriers to electric two-wheeler adoption across Mexico. Range anxiety concerns and limited public charging station availability particularly affect potential buyers in suburban and rural areas where infrastructure investment lags behind urban centers. Residential charging access remains constrained for apartment dwellers without dedicated parking facilities.

Road Safety Concerns and Accident Rates

High accident and fatality rates in the two-wheeler segment raise consumer concerns and attract regulatory attention, impacting market growth. Poor road infrastructure, such as potholes and absence of dedicated motorcycle lanes, increases rider risk. Safety considerations particularly affect family decisions for younger riders, potentially restricting adoption among cautious consumer groups.

Economic Uncertainty and Trade Policy Impacts

Macroeconomic instability and uncertain trade policies make consumers hesitant about significant purchases, including vehicles. Fluctuating currency rates can raise the cost of imported components, driving up retail prices and reducing affordability. Additionally, changing interest rates affect financing options and loan terms, influencing purchasing decisions among buyers who rely on credit, thereby impacting overall market demand.

Competitive Landscape:

The Mexico two-wheeler market features a diverse competitive environment with domestic manufacturers maintaining significant market presence alongside international brands. Local companies leverage established distribution networks and brand recognition while Asian manufacturers introduce cost-competitive offerings targeting price-sensitive consumer segments. The market structure encourages continuous innovation as players compete across performance, pricing, and service dimensions. Strategic investments in local assembly operations are reducing costs while improving market responsiveness. Competition intensifies with new entrants expanding model portfolios and enhancing value propositions through financing partnerships and after-sales service improvements.

Recent Developments:

-

In December 2025, Can‑Am, the Canadian brand under BRP, has launched its first fully electric motorcycles in Mexico: the Pulse (urban electric bike) and Origin (dual-purpose model). Both are now available for riders seeking sustainable mobility and high performance. The launch strengthens Can‑Am’s presence in Mexico’s growing electric two-wheeler market.

Mexico Two-Wheeler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Scooters, Mopeds, Motorcycle, Electric Two-Wheeler |

| Technologies Covered | ICE, Electric |

| Transmissions Covered | Manual, Automatic |

| Engine Capacities Covered | <100cc, 100-125cc, 126-180cc, 181-250cc, 251-500cc, 501-800cc, 801-1600cc, >1600cc |

| Fuel Types Covered | Gasoline, Petrol, Diesel, LPG/CNG, Battery |

| Distribution Channels Covered | Offline Channels, Online Channels |

| End Users Covered | Personal, Commercial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico two-wheeler market size was valued at USD 2.21 Billion in 2025.

The Mexico two-wheeler market is expected to grow at a compound annual growth rate of 6.03% from 2026-2034 to reach USD 3.74 Billion by 2034.

Motorcycle dominates the Mexico two-wheeler market with a 70% share, driven by its versatility for both personal commuting and commercial applications, established dealership networks, and strong brand loyalty among Mexican consumers.

Key factors driving the Mexico two-wheeler market include rising urbanization and traffic congestion, growing demand for affordable personal transportation, expansion of e-commerce and last-mile delivery services, and increasing presence of Asian manufacturers offering competitive pricing.

Major challenges include limited electric charging infrastructure particularly in rural areas, road safety concerns and high accident rates, economic uncertainty affecting consumer purchasing decisions, and regulatory compliance requirements increasing operational complexity for manufacturers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)