Mexico Vegan Food Market Size, Share, Trends and Forecast by Product, Source, Distribution Channel, and Region, 2025-2033

Mexico Vegan Food Market Overview:

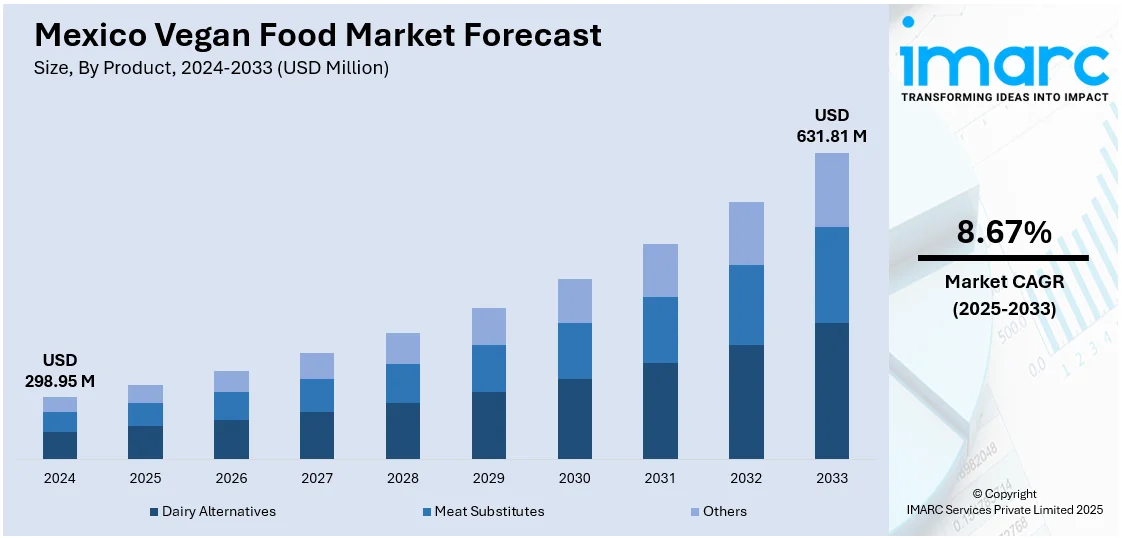

The Mexico vegan food market size reached USD 298.95 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 631.81 Million by 2033, exhibiting a growth rate (CAGR) of 8.67% during 2025-2033. Rising health awareness, ethical concerns over animal welfare, growing environmental consciousness, and increasing availability of innovative plant-based products are collectively driving the Mexico vegan food market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 298.95 Million |

| Market Forecast in 2033 | USD 631.81 Million |

| Market Growth Rate 2025-2033 | 8.67% |

Mexico Vegan Food Market Trends:

Rising Health Consciousness and Need for Lifestyle-Related Disease Prevention

One of the strongest impulses behind the expansion of the vegan food market in Mexico is the growing health and nutritional awareness of consumers. Mexico experienced a sudden spike in lifestyle diseases, most notably obesity, diabetes, and cardiovascular disease, during the last ten years. As per the statistics of the OECD, Mexico has one of the highest adult obesity rates in the world. In response to this escalating health emergency, an increasing number of Mexicans are adopting fruit and vegetable diets in order to fight against these diseases and minimize risk factors. Plant-based food is increasingly being viewed as an effect means to adopt a healthy lifestyle. Vegan food is usually lower in cholesterol and saturated fats, and high in dietary fiber, antioxidants, and micronutrients. Mexican consumers, particularly urban residents, are extensively concerned with preventive healthcare and overall wellness, compelling them to rethink their diets and seek cleaner, more natural foods. This has encouraged brands to create innovative vegan versions of classic Mexican dishes, such as tamales, tacos, and enchiladas, with familiar flavors using healthier ingredients.

Environmental and Ethical Awareness Among Younger Generations

Another key market driver is the escalating environmental and ethics awareness, primarily among millennials and Gen Z. These generations have become more cognizant about the environmental erosion caused by animal agriculture, citing greenhouse emissions, deforestation, and large-scale water waste. Climate change reports and documentaries on factory farms and animal abuses have profoundly shaped these consumers towards making lifestyle transitions that support the sustainable and humane approach. Social media has also made it possible for social and environmental activists, groups, and even influencers to bring persuasive messages regarding the environmental impact of animal agriculture. Movements like "Lunes Sin Carne" (Meatless Mondays) are picking up popularity in schools, workplaces, and communities and popularize the idea that even minor, regular dietary alterations can make a sizeable environmental differences.

Mexico Vegan Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, source, and distribution channel.

Product Insights:

- Dairy Alternatives

- Cheese

- Desserts

- Snacks

- Others

- Meat Substitutes

- Tofu

- Texturized Vegetable Protein (TVP)

- Seiten

- Quorn

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes dairy alternatives (cheese, desserts, snacks, and others), meat substitutes (tofu, texturized vegetable protein (TVP), seiten, Quorn, and others), and others.

Source Insights:

- Almond

- Soy

- Oats

- Wheat

- Others

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes almond, soy, oats, wheat, and others.

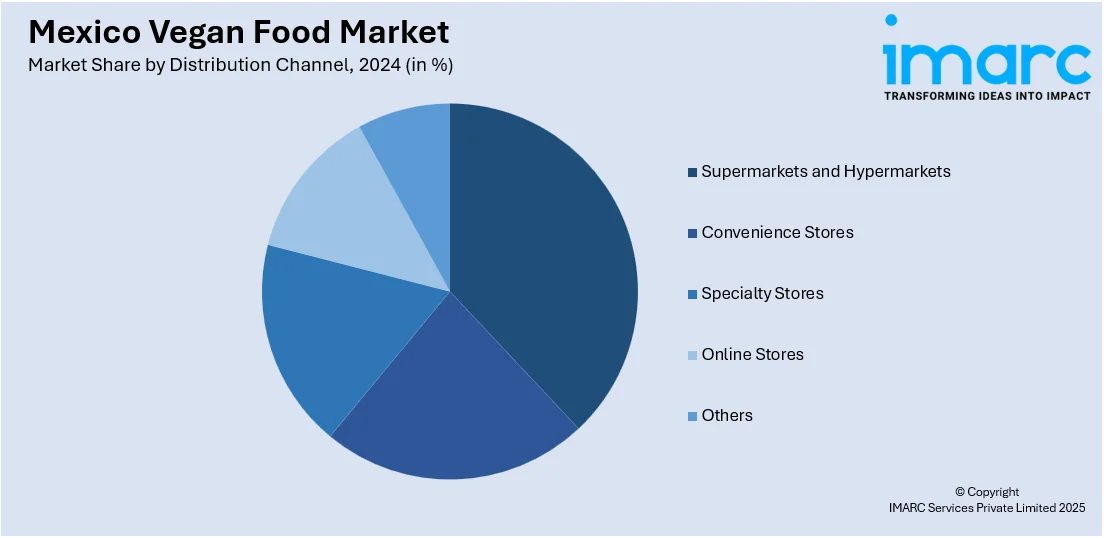

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Vegan Food Market News:

- February 2025: Heura Foods introduced Tex Mex Chunks, a high-protein, additive-free meat alternative designed specifically for Mexican cuisine. This launch is part of Heura's strategy to expand its product range in 2025, catering to the elevating demand for plant-based options across Latin America.

- January 2025: More than 140 brands across Latin America, including Mexico, joined “Veganuary 2025” (a 31-day challenge to go vegan) by launching new plant-based products and offering special promotions. In Mexico, department store Liverpool introduced four new vegan dishes in collaboration with EligeVeg, which provides plant-based consulting for food companies, thereby enhancing the availability of plant-based options nationwide.

Mexico Vegan Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Sources Covered | Almond, Soy, Oats, Wheat, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico vegan food market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico vegan food market on the basis of product?

- What is the breakup of the Mexico vegan food market on the basis of source?

- What is the breakup of the Mexico vegan food market on the basis of distribution channel?

- What are the various stages in the value chain of the Mexico vegan food market?

- What are the key driving factors and challenges in the Mexico vegan food market?

- What is the structure of the Mexico vegan food market and who are the key players?

- What is the degree of competition in the Mexico vegan food market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico vegan food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico vegan food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico vegan food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)