Mexico Waste-to-Energy Technology Market Size, Share, Trends and Forecast by Technology, Waste Type, and Region, 2025-2033

Mexico Waste-to-Energy Technology Market Overview:

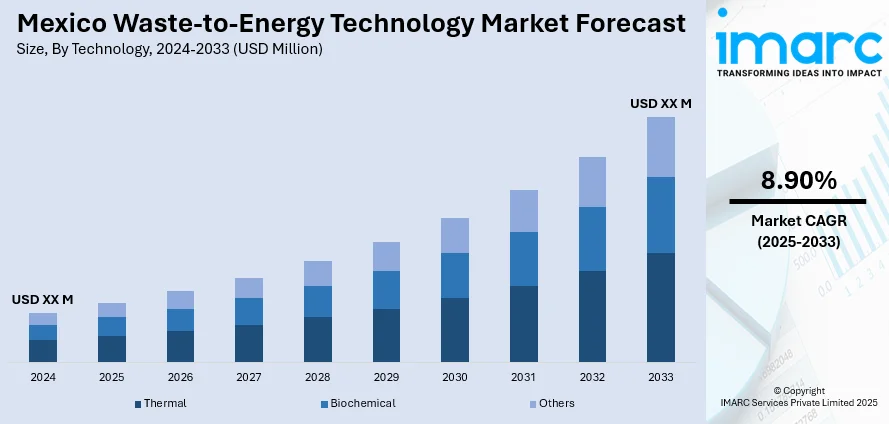

The Mexico waste-to-energy technology market size is projected to exhibit a growth rate (CAGR) of 8.90% during 2025-2033. Growing municipal solid waste generation, shrinking landfill availability, and increasing urbanization are supporting the market growth. Moreover, updating existing waste management systems, government policies promoting renewable energy and stricter environmental regulations, and rising electricity demand are facilitating the market growth. Apart from this, circular economy initiatives, public-private collaborations, foreign funding for green energy, and national goals to reduce methane and carbon emissions are some of the factors fueling the Mexico waste-to-energy technology market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 8.90% |

Mexico Waste-to-Energy Technology Market Trends:

Rising Municipal Solid Waste (MSW) Generation

Mexico is generating increasing amounts of municipal solid waste, with recent estimates indicating over 118 million tons across the country in 2023. Rapid urbanization, population growth, and changing consumption habits have led to a steady rise in waste volumes, especially in urban centers. For instance, Mexico City alone produces more than 13,000 tons of waste per day, putting a strain on existing waste management infrastructure. This growing waste output creates both a challenge and an opportunity, particularly for waste-to-energy (WtE) technologies that can convert non-recyclable waste into electricity or heat. As more waste is produced, there is greater potential to harness it as a resource, supporting energy needs while reducing the burden on landfills. WtE systems are becoming a viable part of the waste management strategy in response to this surge in waste production, especially in states where traditional disposal methods are reaching their limit, which is further propelling the Mexico waste-to-energy technology market growth.

Limited Landfill Capacity in Urban Zones

Umpteen major Mexican cities are approaching landfill saturation, with limited land available for new dumping sites. In urban regions like the State of Mexico, Guadalajara, and Puebla, landfills have either closed or operate under high pressure due to overcapacity. This situation pushes local governments to seek alternatives to traditional landfilling, and waste-to-energy solutions offer a promising option. Moreover, these technologies help reduce the volume of waste going into landfills by converting a portion into energy, decreasing the environmental footprint. With urban expansion leaving little room for new disposal sites, investing in WtE systems becomes a practical step for municipal administrations facing growing waste management challenges, which is further bolstering the market growth.

Government Support for Renewable Energy Integration

Mexico’s government is actively promoting renewable energy adoption, including waste-to-energy as part of its broader clean energy agenda. Through policies under the Energy Transition Law and the General Law on Climate Change, WtE is being positioned as a renewable solution that aligns with national energy targets. The country aims to generate 35% of its electricity from clean sources by 2030. Waste-to-energy fits within this framework by converting urban and industrial waste into usable energy while cutting down on methane emissions from landfills. Moreover, financial incentives and collaboration between federal agencies and local governments are making it easier for WtE projects to gain approvals and funding. These policies demonstrate a strong institutional push toward integrating sustainable technologies into the national grid, helping to drive market growth and encourage private sector participation.

Mexico Waste-to-Energy Technology Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology and waste type.

Technology Insights:

- Thermal

- Incineration

- Pyrolysis

- Gasification

- Biochemical

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes thermal (incineration, pyrolysis, and gasification), biochemical and others.

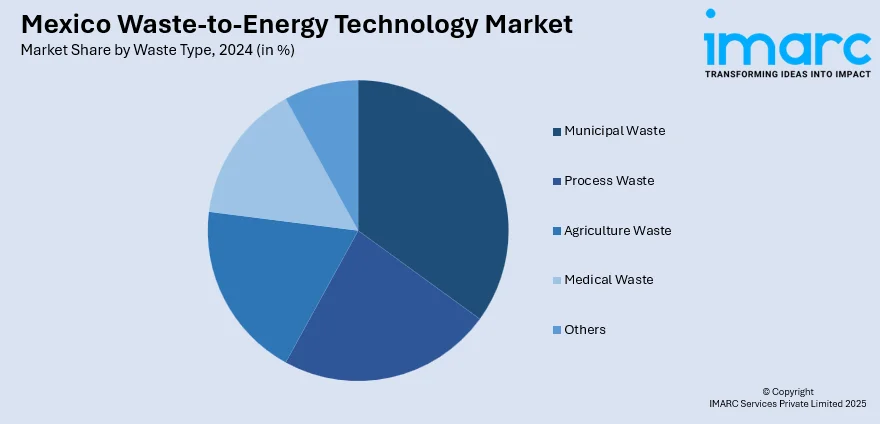

Waste Type Insights:

- Municipal Waste

- Process Waste

- Agriculture Waste

- Medical Waste

- Others

A detailed breakup and analysis of the market based on the waste type have also been provided in the report. This includes municipal waste, process waste, agriculture waste, medical waste, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Waste-to-Energy Technology Market News:

- In 2025, Mexican startup Petgas developed a pyrolysis-based machine in Boca del Río that converts 1.5 tons of plastic waste into 1,350 liters of fuel weekly. The process, which becomes self-sustaining after initiation, produces low-sulfur fuels and supports local services with donated fuel.

- In 2023, Greenback Recycling Technologies launched Mexico's first chemical recycling plant in La Perseverancia. The facility processes post-consumer flexible plastics into pyrolysis oil, enabling the production of food-grade plastics and promoting a circular economy.

Mexico Waste-to-Energy Technology Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered |

|

| Waste Types Covered | Municipal Waste, Process Waste, Agriculture Waste, Medical Waste, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico waste-to-energy technology market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico waste-to-energy technology market on the basis of technology?

- What is the breakup of the Mexico waste-to-energy technology market on the basis of waste type?

- What is the breakup of the Mexico waste-to-energy technology market on the basis of region?

- What are the various stages in the value chain of the Mexico waste-to-energy technology market?

- What are the key driving factors and challenges in the Mexico waste-to-energy technology?

- What is the structure of the Mexico waste-to-energy technology market and who are the key players?

- What is the degree of competition in the Mexico waste-to-energy technology market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico waste-to-energy technology market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico waste-to-energy technology market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico waste-to-energy technology industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)