Mexico Wealth Management Market Size, Share, Trends and Forecast by Business Model, Provider, End User, and Region, 2026-2034

Mexico Wealth Management Market Summary:

The Mexico wealth management market size was valued at USD 92.51 Million in 2025 and is projected to reach USD 244.53 Million by 2034, growing at a compound annual growth rate of 11.40% from 2026-2034.

Mexico's wealth management sector reflects the country's evolving financial sophistication, driven by expanding affluent demographics, financial market liberalization, and increasing awareness of diversified investment strategies. Apart from this, the market encompasses advisory services ranging from traditional human-guided portfolios to technology-enabled robo-advisory platforms, serving both retail investors and high-net-worth individuals across distinct regional economic zones, thereby expanding the Mexico wealth management market share.

Key Takeaways and Insights:

- By Business Model: Human advisory dominates the market with a share of 62% in 2025, attributed to established trust relationships and preference for personalized financial guidance among Mexican investors.

- By Provider: Banks lead the market with a share of 40% in 2025, leveraging extensive branch networks and existing customer relationships for wealth management service cross-selling.

- By End User: Retail represents the largest segment with a market share of 52% in 2025, reflecting the broadening middle-class wealth accumulation and democratization of investment products.

- Key Players: The Mexico wealth management market demonstrates fragmented competitive dynamics, with established banking institutions competing alongside emerging FinTech platforms and traditional wealth managers, each targeting distinct client segments through differentiated service models and pricing strategies tailored to local investor preferences.

Mexico's wealth management landscape has transformed considerably as economic stabilization encourages long-term savings behavior and regulatory reforms facilitate market participation. The nearshoring phenomenon has created new wealth corridors in northern industrial regions, particularly in states like Nuevo León and Chihuahua, where manufacturing executives and automotive sector professionals accumulate substantial investment portfolios requiring sophisticated asset allocation strategies. Mexico City's financial district, specifically the Paseo de la Reforma corridor, concentrates ultra-high-net-worth services with specialized family offices managing multi-generational wealth preservation. Digital literacy improvements enable younger demographics to engage with hybrid and robo-advisory models, complementing the traditional relationship-driven approach preferred by established wealth holders. The market benefits from remittance inflows that gradually convert to investable assets, alongside growing pension fund sophistication through the AFORE system that creates demand for professional portfolio management across multiple asset classes. Recent regulatory changes by the Comisión Nacional Bancaria y de Valores have streamlined cross-border investment compliance, enabling Mexican wealth managers to offer diversified international exposure within locally-domiciled portfolios, particularly benefiting clients seeking dollar-denominated assets as inflation hedges. In 2025, Wise Plc, the London-based international payments company, began its operations in Mexico in an effort to gain a share of the nation's extensive remittance market. Wise users can transfer money from Mexico to over 40 currencies and 160 countries, including converting Mexican pesos to US dollars, according to a statement.

Mexico Wealth Management Market Trends:

Integration of Artificial Intelligence (AI) in Portfolio Management

Wealth management providers increasingly deploy machine learning (ML) algorithms for portfolio optimization, risk assessment, and client behavior prediction. These systems analyze macroeconomic indicators, market sentiment, and individual risk tolerance to generate personalized investment recommendations, reducing operational costs while enhancing decision-making precision. The technology enables real-time portfolio rebalancing and automated tax-loss harvesting strategies that were previously accessible only to institutional investors. In 2025, Salesforce, the leading AI CRM globally, announced its intention to invest $1 billion in its operations in Mexico over the upcoming five years. This declaration emphasizes Salesforce’s dedication to Mexico's economic and social advancement and aims to assist companies nationwide and across the wider region in evolving into Agentic Enterprises, where humans and AI agents collaborate to enhance customer success.

Expansion of Environmental, Social, and Governance Investment Products

Mexican investors demonstrate heightened interest in sustainable investment vehicles that align financial returns with social impact objectives. Wealth managers respond by developing specialized funds focused on renewable energy projects, responsible corporate governance, and community development initiatives. This trend reflects generational wealth transfer to younger investors who prioritize ethical considerations alongside traditional performance metrics when constructing investment portfolios. Mexico’s Climate Change and Sustainability Commission held a policy forum in 2025 to promote environmental, social, and governance (ESG) standards in both public and private sectors, emphasizing the necessity for clearer regulations, increased funding, and wider social engagement to bolster the nation’s sustainability initiatives.

Proliferation of Hybrid Advisory Models

Service providers increasingly combine human expertise with digital platforms to deliver scalable personalized advice. These models offer algorithm-driven portfolio construction with periodic human advisor consultations for complex financial planning scenarios. The approach addresses cost sensitivity among mass affluent segments while maintaining the relationship element valued in Mexican financial culture, creating a middle ground between fully automated and traditional high-touch services. In 2024, Americana Partners, an independent registered investment advisor (RIA) managing more than $7 billion in assets, revealed its entry into the Latin American market with the establishment of Americana Partners International, aimed at delivering family office services to ultra-high net worth individuals in the area.

Market Outlook 2026-2034:

Mexico's wealth management sector anticipates robust expansion as financial inclusion initiatives bring previously unbanked populations into formal investment channels and regulatory modernization attracts international service providers. The growing sophistication of Mexico's capital markets, evidenced by the Bolsa Mexicana de Valores introducing new derivative instruments and alternative investment vehicles, provides wealth managers with expanded product arsenals for client portfolio diversification. The market generated a revenue of USD 92.51 Million in 2025 and is projected to reach a revenue of USD 244.53 Million by 2034, growing at a compound annual growth rate of 11.40% from 2026-2034. Additionally, the maturation of Mexico's entrepreneurial ecosystem, particularly in technology and renewable energy sectors, creates wealth creation events requiring exit strategy planning and subsequent asset management services.

Mexico Wealth Management Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Business Model |

Human Advisory |

62% |

|

Provider |

Banks |

40% |

|

End User |

Retail |

52% |

Business Model Insights:

To get detailed segment analysis of this market Request Sample

- Human Advisory

- Robo Advisory

- Hybrid Advisory

Human advisory dominates with a market share of 62% of the total Mexico wealth management market in 2025.

Human advisory services maintain market leadership through deeply embedded relationship banking traditions and cultural preferences for face-to-face financial consultations. Mexican investors, particularly those managing substantial portfolios, value the nuanced understanding that experienced advisors bring to complex tax planning, estate structuring, and multi-generational wealth transfer strategies. The personalized nature of human advisory proves especially relevant when navigating Mexico's evolving regulatory landscape and volatile currency dynamics that require contextual expertise beyond algorithmic capabilities.

The segment benefits from established trust networks where advisors often serve entire family units across decades, creating switching costs that insulate providers from competitive pressure. Affluent Mexican clients frequently maintain banking relationships spanning generations, with advisors functioning as confidential counselors on matters extending beyond pure investment management. This holistic approach encompasses real estate transactions, business succession planning, and philanthropic structuring, creating comprehensive engagement that automated platforms struggle to replicate despite technological advancement.

Provider Insights:

- FinTech Advisors

- Banks

- Traditional Wealth Managers

- Others

Banks leads with a share of 40% of the total Mexico wealth management market in 2025.

Banking institutions leverage unparalleled distribution advantages through extensive physical branch networks and existing deposit relationships that facilitate wealth management service introduction. Apart from this, people in the country demonstrate strong brand affinity toward established financial institutions, perceiving banks as stable custodians during economic uncertainty. This institutional trust, combined with regulatory compliance infrastructure and capital reserves, positions banks favorably when clients seek comprehensive financial solutions integrating lending, investment, and transactional banking within unified relationships.

Banks capitalize on data advantages derived from observing customer cash flows, spending patterns, and life events that trigger wealth management needs. When salary accounts reveal income increases or deposit patterns suggest liquidity accumulation, relationship managers proactively introduce investment products tailored to observed financial behaviors. The cross-selling efficiency inherent in existing customer relationships reduces client acquisition costs substantially compared to standalone wealth managers who must build trust from initial contact, creating sustainable competitive advantages in cost-sensitive market segments.

End User Insights:

- Retail

- High Net Worth Individuals (HNIs)

Retail exhibits a clear dominance with a 52% share of the total Mexico wealth management market in 2025.

Retail investors represent the market's volume foundation as Mexico's expanding middle class accumulates discretionary savings and seeks returns exceeding traditional bank deposits. Financial literacy initiatives and simplified digital onboarding processes lower entry barriers, enabling younger professionals and small business owners to access investment products previously reserved for affluent segments. The democratization of wealth management through reduced minimum investment thresholds and fractional share purchasing creates addressable market expansion that outpaces high-net-worth segment growth in absolute participant numbers.

The retail segment benefits from increasing pension awareness as Mexico's aging demographics prompt younger workers to supplement mandatory retirement systems with voluntary investment accounts. Educational campaigns by providers and government agencies emphasize long-term wealth accumulation strategies, shifting cultural attitudes from short-term speculation toward disciplined portfolio construction. Digital platforms enable retail investors to initiate and manage relationships without branch visits, particularly appealing to urban professionals whose work schedules conflict with traditional banking hours, thereby removing friction that historically limited market participation.

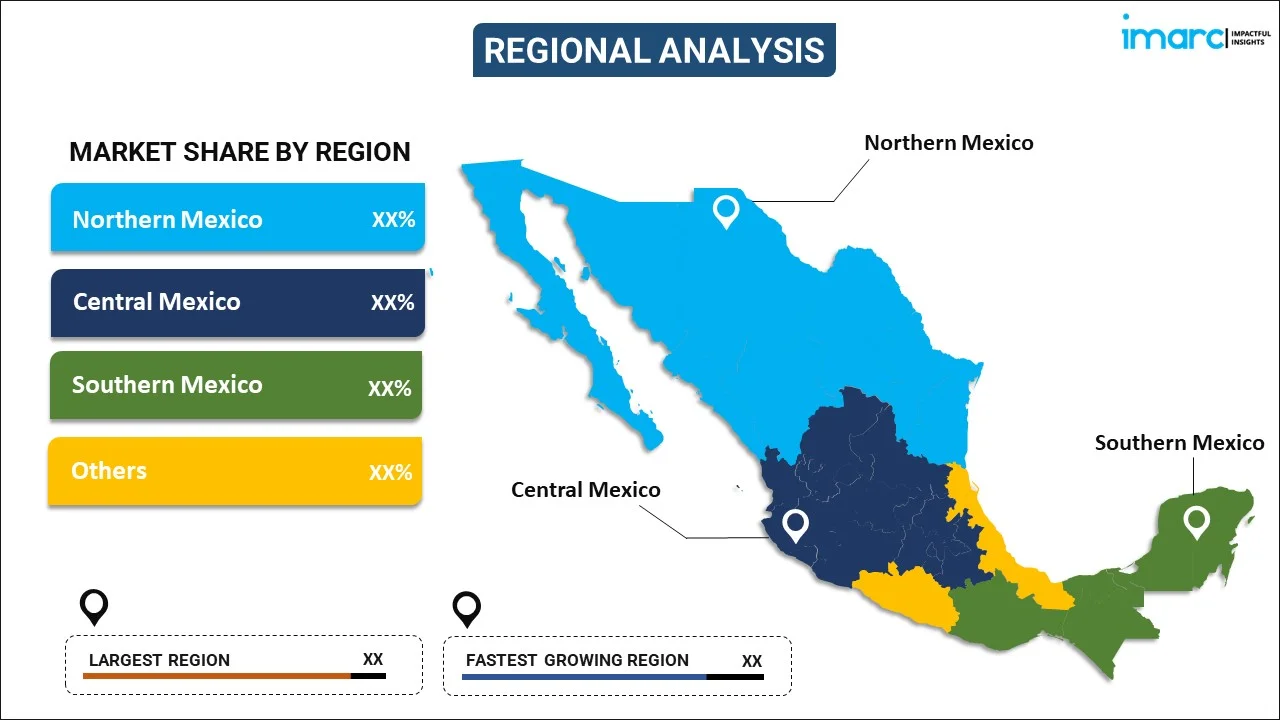

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico benefits from proximity to United States border markets and concentrated manufacturing activity driven by nearshoring investments. Industrial executives, supply chain professionals, and cross-border entrepreneurs accumulate substantial wealth requiring cross-currency portfolio management and international diversification strategies that address binational financial planning complexities.

Central Mexico dominates wealth management activity through Mexico City's concentration of corporate headquarters, financial institutions, and ultra-high-net-worth families. The region's established banking infrastructure, sophisticated investor base, and access to specialized advisory services support complex estate planning, alternative investments, and multi-generational wealth transfer strategies unavailable in peripheral markets.

Southern Mexico represents an emerging opportunity characterized by agricultural wealth, tourism-related prosperity, and growing professional services sectors. The region faces infrastructure limitations and lower financial literacy rates, yet digital platforms enable wealth managers to reach underserved affluent segments seeking portfolio diversification beyond traditional real estate holdings.

Other regions encompass coastal resort areas and emerging economic zones where tourism development, retirement communities, and expatriate populations create specialized wealth management needs. These markets demand bilingual advisory services, international tax expertise, and cross-border estate planning capabilities that address unique circumstances of geographically mobile client bases.

Market Dynamics:

Growth Drivers:

Why is the Mexico Wealth Management Market Growing?

Accelerating High-Net-Worth Population Growth

Mexico's affluent demographic expands steadily as entrepreneurial success, professional services growth, and equity participation in growing enterprises create new wealth concentrations. Mexico has launched Plan México 2024‑2030, aimed at changing the nation’s production model by boosting national value added, promoting regional development, enhancing science and technology, speeding up the energy transition, and upgrading infrastructure. Its objectives encompass elevating Mexico to the 10th largest economy globally by 2030, maintaining investment rates above 25% of GDP, generating 1.5 million jobs in key sectors, enhancing national content in global value chains by 15%, and encouraging sustainable investments. The nearshoring trend particularly benefits northern regions where manufacturing executives and supply chain professionals accumulate significant assets requiring sophisticated management. Family-owned businesses transitioning to second and third generations seek professional wealth preservation strategies to navigate inheritance complexities and diversify holdings beyond operational enterprises, creating sustained demand for comprehensive advisory services.

Regulatory Reforms Enhancing Market Accessibility

Financial authorities implement progressive regulatory frameworks that facilitate market entry for innovative service providers while strengthening investor protections. Recent reforms streamline licensing requirements for robo-advisors and clarify fiduciary standards, building consumer confidence in emerging advisory models. Pension system modernization creates individual account structures requiring active investment decisions, transforming previously passive retirement savers into engaged market participants who require guidance navigating asset allocation choices across domestic and international instruments. A major revision of Mexico’s pension system was put into effect in May 2024. Under the individual account plan, the policy update assured a full 100% replacement rate for pensions given to low-income workers; however, the creation of the Welfare Pension Fund, or WPF, would initially incur the extra financial strain. This is not a standalone reform; the country’s retirement system has recently undergone several changes intended to enhance and fortify the defined contribution plan.

Digital Infrastructure Expansion Enabling Remote Service Delivery

Broadband penetration and smartphone adoption reach critical thresholds enabling sophisticated wealth management platform deployment across geographic regions previously underserved by physical advisory presence. Video conferencing capabilities allow advisors to maintain personalized client relationships without proximity constraints, economically extending premium services to secondary cities and prosperous rural areas. Digital identity verification and electronic signature frameworks eliminate documentation barriers that historically required in-person transactions, reducing onboarding friction and enabling rapid account establishment that accelerates market growth. In 2024, Plata, a Mexican FinTech platform dedicated to digital financial services and banking infrastructure, secured a financing facility of up to $500 million via Nomura Securities International, representing the largest investment ever attained by a Mexican digital financial services firm. The latest funding was obtained to assist Plata's swift expansion plans as it gets ready to operate as a regulated bank. The FinTech was granted approval for its banking license in December 2024.

Market Restraints:

What Challenges the Mexico Wealth Management Market is Facing?

Persistent Financial Literacy Gaps

Significant portions of Mexico's population lack fundamental investment knowledge, creating reluctance to engage with wealth management services beyond basic savings accounts. Complex product structures, unfamiliar terminology, and limited personal finance education in school curricula perpetuate information asymmetries that inhibit market participation. This knowledge deficit makes potential clients vulnerable to inappropriate product recommendations and creates hesitancy that slows adoption despite increasing disposable income availability.

Economic Volatility and Currency Fluctuations

Mexico's exposure to external economic shocks through trade dependencies and capital flow sensitivity creates periodic market disruptions that undermine investor confidence. Peso depreciation episodes erode portfolio values for domestically-focused investments, while political uncertainty surrounding trade relationships introduces unpredictability that discourages long-term commitment. These cyclical volatility patterns prompt conservative asset allocation preferences favoring liquid instruments over diversified portfolios that wealth managers typically recommend for optimal returns.

High Service Costs Relative to Income Levels

Wealth management fee structures often remain prohibitive for mass market segments despite growing interest in professional advice. Minimum account thresholds and percentage-based advisory charges consume disproportionate shares of modest portfolios, making services economically unviable for middle-income investors. While digital platforms reduce cost structures, sustainable business models require fee levels that still exceed what emerging affluent segments willingly allocate, limiting addressable market expansion despite demographic tailwinds.

Competitive Landscape:

The Mexico wealth management market exhibits moderate consolidation with banking institutions maintaining dominant positions through distribution advantages and customer relationship depth, while specialized wealth managers capture ultra-high-net-worth segments requiring bespoke services. FinTech entrants disrupt traditional models by offering low-cost digital-first platforms targeting younger investors and mass affluent segments underserved by conventional providers. Competition intensifies across client segments as traditional players develop digital capabilities to defend market share while new entrants struggle to build trust and regulatory credibility. Strategic differentiation increasingly focuses on technology integration, personalized service models, and specialized expertise in areas such as cross-border wealth planning and alternative investments that address sophisticated client needs.

Recent Developments:

- In March 2025, Mendel, a spend management platform from Latin America, has raised $35 million in a Series B funding round headed by Base10 Partners. The round included involvement from PayPal Ventures, along with current investors Infinity Ventures, Industry Ventures, Hi.vc, and Endeavor Catalyst. The company based in Mexico offers an extensive platform for major organizations to handle expenses, payments, and business travel. In contrast to rivals that depend on interchange income or lending-oriented frameworks, Mendel sets itself apart with a software-centric strategy, enabling it to produce ongoing SaaS revenue.

Mexico Wealth Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Business Models Covered | Human Advisory, Robo Advisory, Hybrid Advisory |

| Providers Covered | FinTech Advisors, Banks, Traditional Wealth Managers, Others |

| End Users Covered | Retail, High Net Worth Individuals (HNIs) |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico wealth management market size was valued at USD 92.51 Million in 2025.

The Mexico wealth management market is expected to grow at a compound annual growth rate of 11.40% from 2026-2034 to reach USD 244.53 Million by 2034.

Human advisory dominated the Mexico wealth management market with a 62% share in 2025, driven by cultural preferences for personalized financial guidance and established trust relationships between advisors and clients across generations.

Key factors driving the Mexico wealth management market include accelerating high-net-worth population growth from entrepreneurial success and nearshoring benefits, regulatory reforms enhancing market accessibility, and digital infrastructure expansion enabling remote service delivery.

Major challenges include persistent financial literacy gaps limiting market participation, economic volatility and currency fluctuations undermining investor confidence, and high service costs relative to income levels that restrict addressable market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)