Mexico Women Apparel Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Region, 2025-2033

Mexico Women Apparel Market Overview:

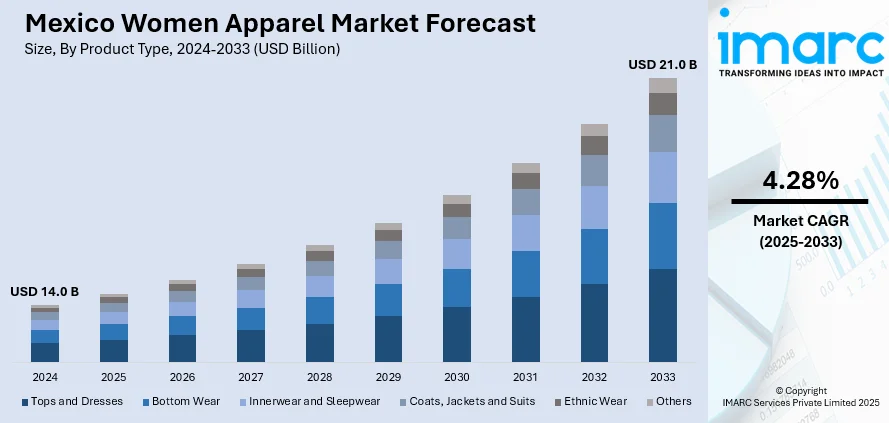

The Mexico women apparel market size reached USD 14.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 21.0 Billion by 2033, exhibiting a growth rate (CAGR) of 4.28% during 2025-2033. The market is driven by the increasing disposable income, evolving fashion preferences, growing urbanization, and the rise of online shopping. Additionally, cultural influences, a shift toward sustainability, and the demand for comfort-driven styles like athleisure are shaping consumer behavior and Mexico women apparel market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 14.0 Billion |

| Market Forecast in 2033 | USD 21.0 Billion |

| Market Growth Rate 2025-2033 | 4.28% |

Mexico Women Apparel Market Trends:

Sustainable Fashion

Sustainability is an emerging trend in the Mexican women's clothing market, with consumers becoming more environmentally conscious. Brands are turning to eco-friendly materials, responsible production methods, and minimizing waste. Mexican consumers are increasingly conscious of the environmental cost of fast fashion and are choosing products that reflect their values. This has created an increase in the appeal of brands that incorporate organic cotton, recycled, and other eco-friendly practices. Artisans and fashion designers at home are also returning to traditional methods, supporting cultural heritage and minimizing environmental impacts. Sustainable fashion is thus regarded as a moral choice as well as a fashionable one, appealing to consumers who care for aesthetics and ethical production. This further drives a change in the Mexico women apparel market outlook toward ethical fashion sourcing.

Athleisure and Comfort

The athleisure market, a combination of athletic and leisurewear, is booming in Mexico. Women are increasingly seeking functional clothing that offers comfort, style, and usability. With the increasing trend of remote work, fitness-oriented lifestyles, and outdoor active pursuits, athleisure has emerged as the favorite wardrobe option. Mexican women prefer clothes such as leggings, sports bras, and loose-fitting hoodies that can be used both at the gym and in everyday wear. This has been further strengthened due to the partnerships between sportswear and leading fashion companies, thus making athleisure more stylish. Besides, consumers are also looking for comfort without compromising on style, requiring light fabrics and loose silhouettes, which further contributes toward increasing the Mexico women apparel market share.

Digital Shopping and E-commerce Growth

With the growing digital environment in Mexico, women's clothing shopping online is gaining popularity. The ease of shopping and browsing from home, along with the emergence of social media influencers, has made e-commerce a market leader. Women in Mexico are interacting with brands on platforms such as Instagram, Facebook, and TikTok, where they find new fashion and shop directly. The convenience of access to global and domestic brands on the internet has enabled a wider variety of clothing choices, ranging from streetwear to high-end products. The move toward online retail is also fueling the development of fashion apps, virtual try-on technology, and tailored shopping experiences, responding to the needs of digitally savvy consumers.

Mexico Women Apparel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, season, and distribution channel.

Product Type Insights:

- Tops and Dresses

- Bottom Wear

- Innerwear and Sleepwear

- Coats, Jackets and Suits

- Ethnic Wear

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes tops and dresses, bottom wear, innerwear and sleepwear, coats, jackets and suits, ethnic wear, and others.

Season Insights:

- Summer Wear

- Winter Wear

- All Season Wear

The report has provided a detailed breakup and analysis of the market based on the season. This includes summer wear, winter wear, and all season wear.

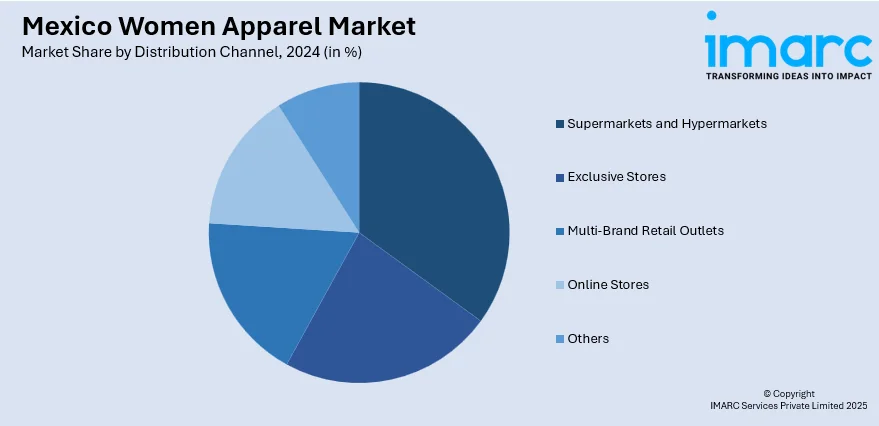

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Exclusive Stores

- Multi-Brand Retail Outlets

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, exclusive stores, multi-brand retail outlets, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Women Apparel Market News:

- In June 2024, Balenciaga, the luxury fashion house, inaugurated its first store at La Isla Shopping Village in Cancún, Mexico. The store covers an expansive 580 square meters and offers a glimpse into Balenciaga’s latest men’s and women’s ready-to-wear collections, complemented by a wide array of shoes, bags, accessories, eyewear, and jewelry.

- In June 2024, TJX, parent of TJ Maxx, Marshalls, HomeGoods and Sierra, entered into a joint venture agreement with the multi-brand retailer Grupo Axo to create its off-price business in Mexico. With Axo, a leading apparel and fashion accessories, footwear and beauty and personal care retailer, under the agreement, TJX will be contributing 49% and Axo the remaining 51% to this joint venture comprising Axo's existing off-price brick-and-mortar operation in Mexico, which means over 200 stores operating under the banners of Promoda, Reduced and Urban Store.

Mexico Women Apparel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Tops and Dresses, Bottom Wear, Innerwear And Sleepwear, Coats, Jackets and Suits, Ethnic Wear, Others |

| Seasons Covered | Summer Wear, Winter Wear, All Season Wear |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Exclusive Stores, Multi-Brand Retail Outlets, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico women apparel market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico women apparel market on the basis of product type?

- What is the breakup of the Mexico women apparel market on the basis of season?

- What is the breakup of the Mexico women apparel market on the basis of distribution channel?

- What is the breakup of the Mexico women apparel market on the basis of region?

- What are the various stages in the value chain of the Mexico women apparel market?

- What are the key driving factors and challenges in the Mexico women apparel market?

- What is the structure of the Mexico women apparel market and who are the key players?

- What is the degree of competition in the Mexico women apparel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico women apparel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico women apparel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico women apparel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)