Micro Lending Market Size, Share, Trends and Forecast by Provider, End User, and Region, 2025-2033

Micro Lending Market Size and Share:

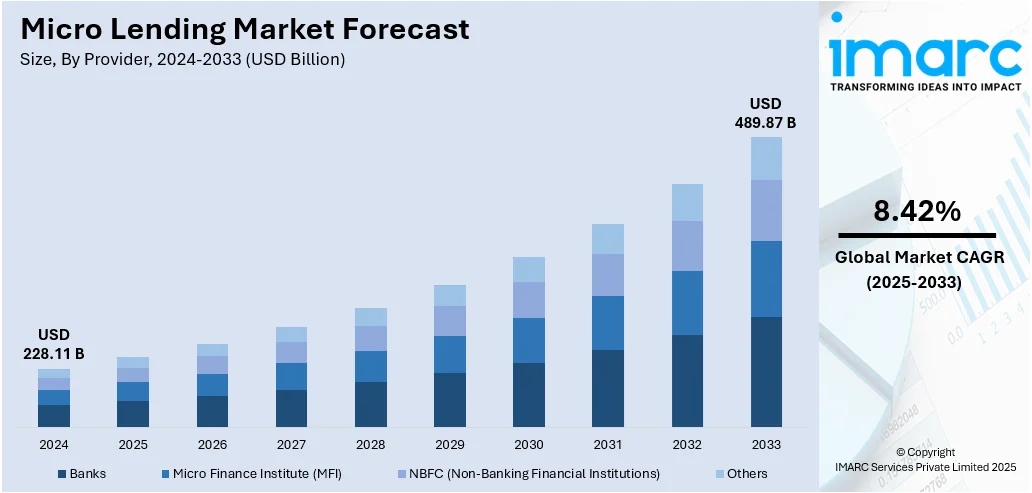

The global micro lending market size was valued at USD 228.11 Billion in 2024. The market is projected to reach USD 489.87 Billion by 2033, exhibiting a CAGR of 8.42% from 2025-2033. Asia-Pacific currently dominates the market, holding a market share of 30.0% in 2024. The implementation of supportive government policies, widespread prevalence of income inequality, and increasing utilization of micro lending in the agriculture industry are positively influencing the market. Besides this, rapid technological advancements are contributing to the expansion of the micro lending market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 228.11 Billion |

| Market Forecast in 2033 | USD 489.87 Billion |

| Market Growth Rate 2025-2033 | 8.42% |

At present, the market is expanding consistently as an increasing number of individuals and small enterprises are looking for convenient access to credit. Numerous individuals in rural and economically disadvantaged regions are ineligible for conventional bank loans because of insufficient collateral and the absence of a formal credit history. Micro lending offers small, convenient loans that assist individuals in launching and growing businesses, pursuing education, and fulfilling personal requirements. The emergence of digital platforms and mobile banking is streamlining the loan process, increasing speed and accessibility. Government agencies are backing micro lending to enhance financial inclusion and alleviate poverty. Programs for social and economic development are also promoting loans to women and underrepresented communities.

To get more information on this market, Request Sample

The United States has emerged as a major region in the micro lending market owing to many factors. Small companies and startups are exploring funding alternatives outside of conventional banks. Numerous entrepreneurs, particularly from underrepresented communities, encounter challenges in obtaining substantial loans because of restricted credit history or inadequate collateral. Micro lending provides a remedy through small loan sums, fast approval procedures, and adaptable conditions. The emergence of fintech platforms is enhancing the speed and efficiency of accessing microloans, benefiting a wider variety of borrowers. According to the IMARC Group, the United States fintech market size reached USD 53.0 Billion in 2024. Additionally, the growth of the gig economy and freelance work is offering a favorable micro lending market outlook.

Micro Lending Market Trends:

Rising implementation of supportive government initiatives

Government initiatives and regulatory reforms aimed at increasing financial inclusion are significant drivers in the micro lending market. In emerging economies, a substantial portion of the population remains unbanked due to the inability of traditional banks to extend their services in remote areas or to individuals with low-income levels. As a result, governments play a significant role in incentivizing micro lending practices through legislation and also launching their own initiatives, such as state-backed microfinance institutions (MFIs). These actions provide both direct and indirect employment, stimulate local economies, and promote socio-economic development. Furthermore, financial inclusion policies are typically intertwined with broader goals, such as poverty reduction, economic equality, and social stability, which provide a fertile ground for micro lending growth. With the increasing adoption of microfinancing, the market is set to expand. As per industry reports, the global market for microfinance is set to attain USD 506.0 Billion by 2030.

Rapid technological advancements

The integration of technology is fueling the micro lending market growth. Fintech companies and digital platforms are leveraging technologies, such as big data, machine learning (ML), blockchain, and artificial intelligence (AI), to assess borrower creditworthiness, streamline loan disbursal processes, and reduce the cost of servicing loans. Furthermore, the increasing penetration of mobile technology and internet connectivity is allowing individuals to access micro lending services, especially in remote regions. According to the updated 2024 data from the International Telecommunication Union (ITU), approximately 5.5 Billion individuals were online, indicating a rise of 227 Million from adjusted 2023 projections. Apart from this, these technologies aid in the creation of a robust credit scoring system, enabling efficient risk management. Moreover, technology assists in automating the underwriting and disbursal processes, which increases the speed and convenience for borrowers and significantly decreases the operational cost for lenders, thus making it economically viable to issue smaller loans.

Widespread prevalence of income inequality

Rising income inequality worldwide is among the major micro lending market trends. An industry survey found that in 2024, 54% of adults considered income inequality a significant problem in their nation, whereas 30% regarded it as a moderate issue. Low-income earners and small business owners have limited access to traditional credit channels due to the perceived high risk associated with this demographic and the high cost of servicing small loans. Micro lending fills this gap by providing affordable financial services that meet the requirements of these individuals and businesses. Moreover, micro-loans come with lower interest rates than traditional loans and have more flexible repayment schedules, which makes them an attractive option for those without collateral or credit history. Besides this, the demand for affordable financial services is also reinforced by the financial challenges associated with urbanization and the increasing demand for capital among small businesses and entrepreneurs, which micro lending can aptly cater to.

Micro Lending Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global micro lending market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on provider and end user.

Analysis by Provider:

- Banks

- Micro Finance Institute (MFI)

- NBFC (Non-Banking Financial Institutions)

- Others

Banks held 55.6% of the market share in 2024. They have established infrastructure, regulatory backing, and strong financial capabilities. With extensive branch networks and digital platforms, banks can easily reach both urban and rural customers, ensuring wider access to micro credit. They also offer competitive interest rates due to their stable funding sources and economies of scale. Banks integrate micro lending into their broader financial services, allowing borrowers to access savings, insurance, and advisory support alongside credit. Their ability to manage risk and maintain regulatory compliance gives borrowers greater confidence in their services. In addition, banks are partnering with governments and development programs to implement inclusive financial schemes, targeting underbanked populations. They also leverage advanced technologies and data analytics to assess creditworthiness, even for customers without formal credit history. According to the micro lending market forecast, with trust, accessibility, and diverse offerings, banks will continue to dominate the provider segment, supporting small-scale entrepreneurs, self-employed individuals, and low-income households effectively and sustainably.

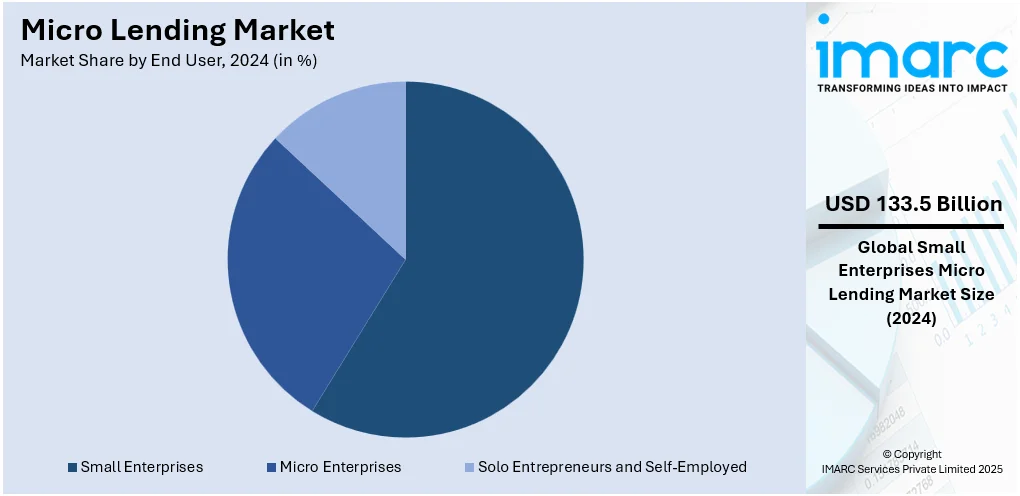

Analysis by End User:

- Small Enterprises

- Micro Enterprises

- Solo Entrepreneurs and Self-Employed

Small enterprises account for 58.5% of the market share. They consistently require easy and quick access to credit for starting, sustaining, and expanding their operations. These businesses often lack the collateral, formal credit history, or financial records needed to qualify for traditional bank loans, making micro lending an ideal solution. Micro loans offer small amounts with flexible repayment terms, helping small enterprises manage day-to-day expenses, purchase inventory, and invest in tools and equipment. As these enterprises form a significant part of the economy, especially in developing and underserved regions, their demand for short-term, low-risk financing is high. Additionally, micro lending helps small enterprises improve cash flow, navigate seasonal fluctuations, and remain competitive. Many microfinance institutions and fintech platforms design their services specifically for the requirements of small business owners, ensuring better financial inclusion.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific, accounting for a share of 30.0%, enjoys the leading position in the market. The region is noted for its large population, rising number of small businesses, and strong encouragement for financial inclusion across developing countries. As per the CEIC, as of March 2025, India's population was 1,408.0 Million. Many individuals and micro enterprises in this region lack access to traditional banking services due to limited income, lack of credit history, or remote locations. Micro lending fills this gap by offering small, flexible loans tailored to the needs of informal workers and entrepreneurs. Government agencies and development organizations in countries like India, Indonesia, and Bangladesh are actively supporting microfinance programs to reduce poverty and empower local communities. The rise of digital payment systems and mobile banking is also boosting micro lending, making financial services more accessible even in rural areas. Additionally, the entrepreneurial culture and demand for self-employment options are creating the need for micro loans to fund small ventures.

Key Regional Takeaways:

United States Micro Lending Market Analysis

The United States holds 82.20% of the market share in North America. The market is primarily driven by the expansion of gig and freelance economies, driving the demand for short-term, accessible credit among self-employed individuals. An industry report stated that 59 Million Americans, representing 36% of the labor force, were freelancers in 2024, and gig work was expected to encompass half of the US workforce by 2025. The US also held 44% of the global gig economy gross volume. In line with this, rising digital adoption in underserved communities is enhancing loan origination and servicing efficiency, enabling lenders to scale their operations. Similarly, community development financial institutions (CDFIs) and credit unions are also expanding their market outreach, reinforcing grassroots efforts to promote financial inclusion. Furthermore, increasing regulatory flexibility, such as fintech charters and revised lending thresholds, is encouraging market participation and innovation. The rise in immigrant entrepreneurship is catalyzing the demand for microloans to support the formation of new businesses. Additionally, the rapid integration of alternative data in credit scoring, which is improving access for individuals with limited credit histories, is stimulating the market appeal. Moreover, numerous corporate–non-profit partnerships are driving targeted microfinance in underserved regions.

Europe Micro Lending Market Analysis

The European market is experiencing growth due to the rising prominence of social entrepreneurship, which is driving the demand for tailored microcredit solutions among impact-oriented ventures. In line with this, EU funding initiatives, such as the InvestEU program, which enhances financial tools dedicated to inclusive lending, are impelling the market growth. Similarly, various national recovery schemes aimed at channeling support towards microenterprises in vulnerable sectors are facilitating the market expansion. The heightened adoption of digital identity is streamlining compliance and refining borrower access across the region. The 2024 Digital Identity and Attributes Assessment estimated that extensive use of digital IDs could result in GBP 701 Million each year. To support compliance, the UK government introduced a certification process, which was adopted by 57 active digital ID services. Furthermore, the emerging trend of senior entrepreneurship is catalyzing the demand for flexible micro lending options among older populations. Additionally, cross-border microfinance collaborations, which are promoting operational efficiency and shared innovations within the sector, are broadening the market reach.

Asia-Pacific Micro Lending Market Analysis

In the Asia-Pacific region, the market is majorly propelled by rising mobile penetration, enabling digital loan disbursement in remote and underserved areas. In addition to this, government-led financial inclusion programs, such as India’s PMMY and Indonesia’s Kredit Usaha Rakyat, are expanding access to formal credit for microenterprises. Furthermore, the growing use of mobile wallets and digital payment platforms is streamlining loan repayment processes and enhancing borrower convenience. A recent Reserve Bank of India report showed that in India, the number of digital wallet users increased by 40% in two years, while rural usage surged by 35% in 2024, showcasing robust national acceptance. The heightened employment of AI-oriented credit risk models tailored to informal and cash-based economies is improving underwriting accuracy. Additionally, cross-sector collaborations between fintech companies and microfinance institutions are strengthening distribution networks and service delivery.

Latin America Micro Lending Market Analysis

In Latin America, the market is progressing, attributed to rising financial innovations targeting informal workers and unbanked communities. Similarly, the expansion of agent banking and mobile branches, which improve credit access in remote and underserved regions, is fueling the market expansion. An industry report stated that in 2024, Brazil boasted one of the most extensive mobile banking agent networks worldwide, with around 780,000 agents functioning across the country. Furthermore, various government-supported credit guarantee schemes that incentivize microenterprise lending by reducing lender exposure to risk are stimulating the market appeal. Moreover, the region’s cooperatives and credit unions are broadening their tailored microfinance services.

Middle East and Africa Micro Lending Market Analysis

The market in the Middle East and Africa region is significantly driven by expanding financial inclusion programs that target underserved and unbanked communities. Furthermore, the rapid adoption of mobile banking and fintech platforms is streamlining loan distribution, especially in remote and rural areas. A 2024 industry survey revealed that 72% of participants in the UAE and 46% in Saudi Arabia employed mobile applications as their primary banking method. Additionally, the increasing involvement of private investors and impact funds is injecting essential capital into micro lending networks, empowering small businesses and entrepreneurs with accessible working capital solutions. Besides this, this trend is playing a pivotal role in promoting local economic development and reducing poverty throughout emerging economies in the Middle East and Africa.

Competitive Landscape:

Key players are offering accessible, tailored financial solutions to underserved individuals and small businesses. These players, including microfinance institutions, fintech companies, and non-governmental organizations, provide user-friendly platforms, simplified application processes, and quick disbursal of funds. They are investing in digital technologies to streamline operations, reduce costs, and improve borrower experiences. By using alternative data for credit scoring, they extend credit to individuals without formal credit histories. Key players also focus on financial education, helping borrowers manage funds responsibly. Many firms are collaborating with government agencies and development agencies to broaden their reach and impact. Their continued innovations, outreach, and focus on inclusion are enabling more people to access essential financial support, thereby boosting entrepreneurship, self-employment, and community development. For instance, in September 2024, AFG Holding obtained a majority interest in Access Microfinance Holding AG, securing five microfinance subsidiaries in Africa. With EUR 135 Million in microloan assets, the agreement enhanced AFG’s digital finance presence throughout Africa.

The report provides a comprehensive analysis of the competitive landscape in the micro lending market with detailed profiles of all major companies, including:

- American Express Company

- BlueVine Inc.

- Funding Circle

- Lendio Inc.

- Lendr

- Manappuram Finance Limited

- NerdWallet

- On Deck Capital (Enova International)

- StreetShares Inc. (MeridianLink)

Latest News and Developments:

- June 2025: Poonawalla Fincorp introduced 'Business Loan 24/7', a completely digital and paperless MSME loan offering accessible at any time. It employed STP and risk-focused digital underwriting combined with GST information, credit bureaus, and account aggregators. The program focused on providing micro-loans to MSMEs in Tier 1–3 cities spanning various industries.

- April 2025: Credilab, the fintech division of VCI Global, obtained a USD 1 Million investment from Triple Helix Capital in Dubai. Credilab provided rapid, technology-based microloans to marginalized SMEs and individuals in Malaysia. Robust revenue growth and a low NPL rate bolstered its funding, aiding its expansion and drive towards unicorn status.

- March 2025: Bain Capital revealed an investment of INR 4,390 Crore in Manappuram Finance, acquiring an initial 18% stake. S&P and Fitch observed that this would improve governance and redirect attention to loans backed by gold and secured loans, as microfinance, comprising 21% of AUM, confronted regulatory challenges and possible divestment of Asirvad Micro Finance.

- March 2025: Moniepoint Inc, a company located in Lagos, declared intentions to purchase a 78% share in Kenya's Sumac Microfinance Bank. This strategic action sought to strengthen micro lending services in Kenya, promoting financial inclusion for marginalized communities.

- November 2024: ADB and Mastercard initiated a partnership worth USD 5 Million to boost micro and SME lending throughout the Asia-Pacific region. Focusing on underrepresented businesses, particularly those led by women and centered on climate, the program facilitated USD 1 Billion in funding over four years via risk-reduction capital, incentives, and strengthening the capabilities of local financial institutions.

Micro Lending Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Providers Covered | Banks, Micro Finance Institute (MFI), NBFC (Non-Banking Financial Institutions), Others |

| End Users Covered | Small Enterprises, Micro Enterprises, Solo Entrepreneurs and Self-Employed |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Express Company, BlueVine Inc., Funding Circle, Lendio Inc., Lendr, Manappuram Finance Limited, NerdWallet, On Deck Capital (Enova International), StreetShares Inc. (MeridianLink) etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the micro lending market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global micro lending market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the micro lending industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The micro lending market was valued at USD 228.11 Billion in 2024.

The micro lending market is projected to exhibit a CAGR of 8.42% during 2025-2033, reaching a value of USD 489.87 Billion by 2033.

Advancements in digital technology and mobile banking are making loan disbursement and repayment more efficient, especially in remote and rural areas. Government agencies and financial institutions are also supporting micro lending as a tool for financial inclusion and poverty reduction. Additionally, rising self-employment and the growth of micro enterprises are catalyzing the demand for small-scale credit.

Asia-Pacific currently dominates the micro lending market, accounting for a share of 30.0% in 2024, driven by its large unbanked population, rising small businesses, and strong government support. Mobile banking and digital platforms are further improving access, enabling widespread adoption of micro loans across both urban and rural areas.

Some of the major players in the micro lending market include American Express Company, BlueVine Inc., Funding Circle, Lendio Inc., Lendr, Manappuram Finance Limited, NerdWallet, On Deck Capital (Enova International), StreetShares Inc. (MeridianLink), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)