Middle East Steel Market Report by Type (Flat Steel, Long Steel), Product (Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, Braids), Application (Building and Construction, Electrical Appliances, Metal Products, Automotive, Transportation, Mechanical Equipment, Domestic Appliances), and Country 2026-2034

Market Overview:

Middle East steel market size reached USD 45,012.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 65,178.0 Million by 2034, exhibiting a growth rate (CAGR) of 4.20% during 2026-2034. The market is being propelled by substantial expansion in construction and infrastructure development, an increasing embrace of advanced manufacturing technologies and processes, and growing apprehensions regarding environmental sustainability and carbon emissions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 45,012.1 Million |

| Market Forecast in 2034 | USD 65,178.0 Million |

| Market Growth Rate (2026-2034) | 4.20% |

Access the full market insights report Request Sample

Steel is a widely utilized alloy consisting primarily of iron and carbon, supplemented by small amounts of other elements. It is renowned for its strength, versatility, and durability, establishing it as a crucial material across diverse industries and everyday applications. Its malleability allows it to be molded into various structures such as beams, sheets, rods, and wires, catering to a wide array of purposes. The applications of steel span construction, manufacturing, transportation, and infrastructure projects, serving as a foundational material in the creation of buildings, bridges, automobiles, ships, machinery, and appliances. Notably, its outstanding strength-to-weight ratio renders it ideal for constructing robust and dependable structures. Steel's ductility ensures flexibility without compromising integrity, providing resistance against fractures and deformation. Furthermore, its recyclability contributes to sustainability and environmental advantages.

Middle East Steel Market Trends:

Technological Advancements and Innovation

The steel industry in the region is adopting innovative technologies like automation, state-of-the-art manufacturing methods, and increased sustainable production practices. Automation enhances efficiency by minimizing human mistakes, accelerating processes, and maximizing production capabilities. The incorporation of artificial intelligence (AI) and data analytics into manufacturing processes enhances operations through real-time supervision, predictive maintenance, and improved scheduling, resulting in substantial decreases in waste and expenses. Robotics improves accuracy and uniformity, allowing for the creation of top-quality steel with little waste. Moreover, advancements in steel varieties and coatings, featuring high-strength and corrosion-resistant substances, are broadening the scope of applications in diverse industries such as automotive, construction, and infrastructure. Ongoing investment in research activities guarantees that the region stays competitive by addressing the changing needs of industries, establishing the Middle East as a frontrunner in the production of advanced, high-quality steel products and strengthening its position in global supply chains.

Rising Demand for Specialized Steel Products

With the ongoing evolution of industries, there is an increase in the demand for superior steel grades that fulfill particular performance criteria. Industries like aerospace, automotive, oil and gas, and renewable energy are driving the need for lightweight, high-strength, and corrosion-resistant steels. These specialized materials are vital for building intricate infrastructure such as pipelines, pressure vessels, and automotive parts, where durability and performance in extreme conditions are critical. The steel industry in the Middle East is reacting by investing in the creation and manufacturing of these advanced materials to address these specific demands. This encompasses advancements in steel alloys, coatings, and production techniques aimed at enhancing product performance and durability. As sectors implement more advanced technologies and increase their activities, the need for these specific steel products is growing. This trend not only boosts the competitiveness of the Middle East steel market but also creates growth prospects as local manufacturers improve their skills in producing high-performance steels designed to satisfy contemporary industrial needs.

Sustainability and Green Steel Production

With nations in the region establishing ambitious environmental objectives, such as net-zero emissions targets, the need for sustainable steel is rising. The use of green steel, made with renewable energy like green hydrogen, is becoming a critical focus for manufacturers. This transition not only corresponds with worldwide decarbonization initiatives but also aids businesses in complying with strict environmental laws and appealing to sustainability-focused investors. In addition, governing bodies in the region are promoting green steel manufacturing via policies, financing, and collaborations designed to lessen carbon emissions. With the region adopting sustainable industrial approaches, the steel industry is experiencing a transition toward cleaner, more efficient manufacturing methods, supporting long-term market growth. In 2024, Masdar and EMSTEEL produced the first green steel in the Middle East using green hydrogen in a pilot project. The renewable hydrogen was certified under ISO 19870 by Avance Labs. This achievement supported the UAE’s Net Zero by 2050 initiative and global decarbonization efforts.

Middle East Steel Market Growth Drivers:

Strategic Regional Partnerships and Collaboration

The region is boosting its production capacity and increasing the competitiveness of its steel market through collaborations, agreements, and partnerships between local and foreign steel manufacturers. These partnerships frequently aim to enhance self-sufficiency, lower reliance on imports, and bolster regional supply networks. Regional partnerships enhance efficient production processes, improve quality control, and promote sustainable steel manufacturing by combining resources, expertise, and technology. Additionally, these collaborations address the increasing demand in areas such as construction, energy, and infrastructure, while also aiding in the overall economic progress of the area. For instance, in 2025, Qatar Steel and Bahrain Steel signed a $1.27 billion agreement, where Bahrain Steel will supply 5 million tons of steel to Qatar Steel over five years. This partnership is part of the Industrial Partnership for Sustainable Economic Development, aimed at boosting economic growth and self-reliance in the region. It is expected to enhance industrial competitiveness, reduce dependency on imports, and strengthen local supply chains.

Foreign Investment in Advanced Steel Manufacturing

International steel manufacturers are progressively dedicating resources to advanced production plants in the region, drawn by advantageous economic factors, prime location, and robust demand in multiple sectors. These investments aim to improve production capacity, adopt innovative technologies, and address the growing demand for specialized steel products like electric steel and premium rolled strips. The arrival of foreign investment enhances domestic manufacturing capabilities while also aligning with national industrial growth strategies, fostering economic diversification and decreasing dependence on imports. Additionally, these initiatives generate skilled employment, promote technological advancements, and enhance the overall competitiveness of the regional steel sector. In 2025, SIJ Group signed a $1.54 billion agreement to build a specialized steel plant in Saudi Arabia, marking its first investment outside Slovenia. The project, set to start operations by 2029, will focus on electric steel production and high-quality rolled strips. It aligns with Saudi Arabia’s long-term industrial development plan and is largely funded by the Kingdom.

Government Support and Investment Incentives

Governing bodies in the region are promoting investment from both domestic and foreign firms in the modernization and expansion of steel production facilities by offering tax breaks, regional incentives, and subsidies. These incentives typically focus on advanced manufacturing, energy savings, and renewable energy utilization, aligning with wider sustainability objectives. For Through offering financial assistance for large-scale and technologically superior projects, governments boost the competitiveness of the steel sector and also guarantee long-term market stability. For example, in 2025, Turkey introduced a new presidential decree, effective from May 31, 2025, updating investment incentives for the steel sector. The decree focuses on modernizing and expanding projects, offering support like tax exemptions, regional incentives, and environmental initiatives. It also includes strategic incentives for high-tech production, energy efficiency, and large-scale projects with renewable energy use. Moreover, these policies facilitate the attraction of foreign investment, generate employment, and encourage innovation, supporting overall industrial advancement.

Middle East Steel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on type, product, and application.

Type Insights:

To get detailed segment analysis of this market Request Sample

- Flat Steel

- Long Steel

The report has provided a detailed breakup and analysis of the market based on the type. This includes flat steel and long steel.

Product Insights:

- Structural Steel

- Prestressing Steel

- Bright Steel

- Welding Wire and Rod

- Iron Steel Wire

- Ropes

- Braids

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes structural steel, prestressing steel, bright steel, welding wire and rod, iron steel wire, ropes, and braids.

Application Insights:

- Building and Construction

- Electrical Appliances

- Metal Products

- Automotive

- Transportation

- Mechanical Equipment

- Domestic Appliances

The report has provided a detailed breakup and analysis of the market based on the application. This includes building and construction, electrical appliances, metal products, automotive, transportation, mechanical equipment, and domestic appliances.

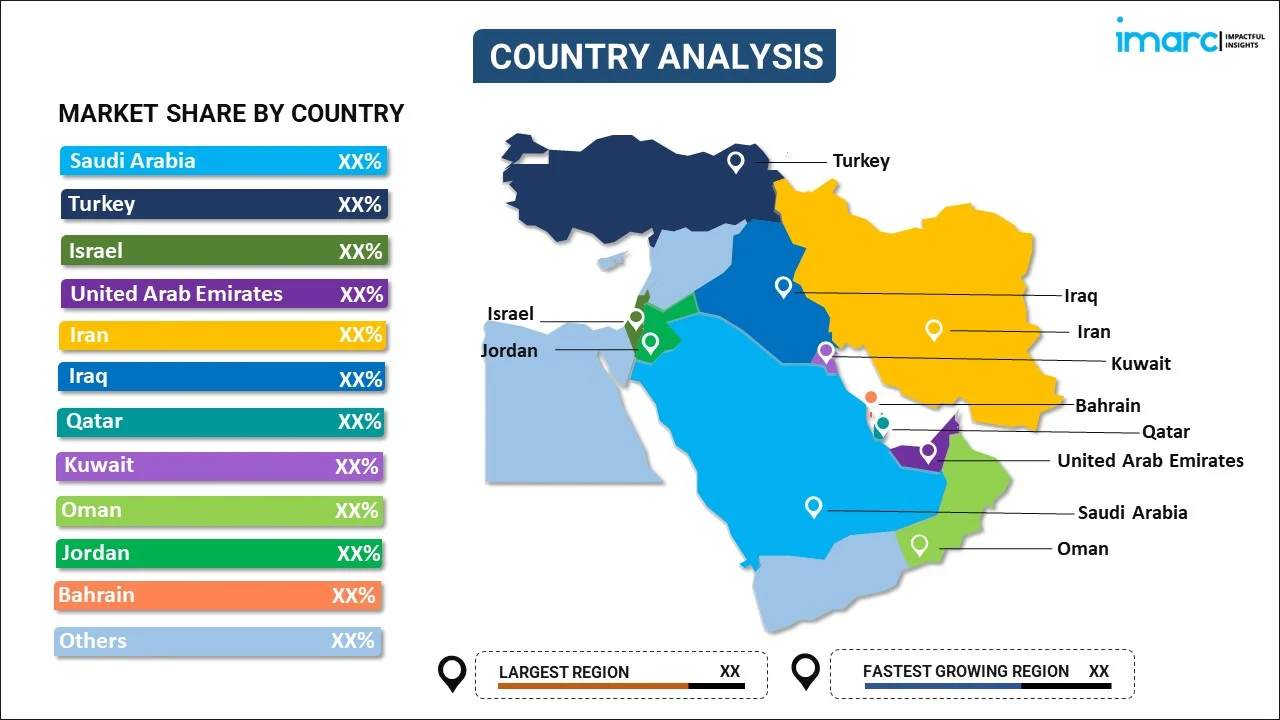

Country Insights:

To get detailed regional analysis of this market Request Sample

- Saudi Arabia

- Turkey

- Israel

- United Arab Emirates

- Iran

- Iraq

- Qatar

- Kuwait

- Oman

- Jordan

- Bahrain

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, Turkey, Israel, United Arab Emirates, Iran, Iraq, Qatar, Kuwait, Oman, Jordan, Bahrain, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Middle East Steel Market News:

- August 2025: Turkey unveiled a $1.5 billion technology hub in Ankara for the development of its Steel Dome air defence system, marking a historic investment in the country’s defense industry. The facility, set to begin operations in mid-2026, will boost production capacity and support the self-sufficiency of Turkey's defense sector. This initiative underscores Turkey's push for independence in air defense technology amid regional security tensions.

- June 2025: Kuwait's Metal & Recycling Company (MRC) announced the opening of a steel recycling plant with a capacity to process 60,000 tons of scrap metal annually. The plant, set to begin operations in Q1 2025, will help reduce reliance on imported steel and prevent up to 90,000 tons of CO₂ emissions annually. This initiative aligns with Kuwait's Vision 2035 and supports sustainable industrial development.

- January 2025: Vale partnered with Saudi Arabia's Royal Commissions to launch a green steel mega hub in Ras Al-Khair. The project, developed in two phases, aims to produce up to 12 million tons of cold-briquetted iron ore annually. This initiative supports the region's shift toward net-zero steel production and aligns with Vale's emission reduction goals.

Middle East Steel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Flat Steel, Long Steel |

| Products Covered | Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, Braids |

| Applications Covered | Building and Construction, Electrical Appliances, Metal Products, Automotive, Transportation, Mechanical Equipment, Domestic Appliances |

| Countries Covered | Saudi Arabia, Turkey, Israel, United Arab Emirates, Iran, Iraq, Qatar, Kuwait, Oman, Jordan, Bahrain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Middle East steel market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Middle East steel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Middle East steel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The steel market in Middle East was valued at USD 45,012.1 Million in 2025.

The Middle East steel market is projected to exhibit a CAGR of 4.20% during 2026-2034, reaching a value of USD 65,178.0 Million by 2034.

The Middle East steel market is driven by factors such as rapid industrialization, rising investment in infrastructure projects, and increasing demand for construction materials. The region's expanding manufacturing sector and strategic investment in large-scale development projects enhance steel usage. Additionally, government initiatives to boost economic diversification and support local production contribute significantly to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)