Milk Powder Market Report by Product Type (Whole Milk Powder, Skimmed Milk Powder), Function (Emulsification, Foaming, Flavouring, Thickening), Application (Infant Formula, Confectionery, Sports and Nutrition Foods, Bakery Products, Dry Mixes, Fermented Milk Products, Meat Products, and Others), and Region 2026-2034

Milk Powder Market Size:

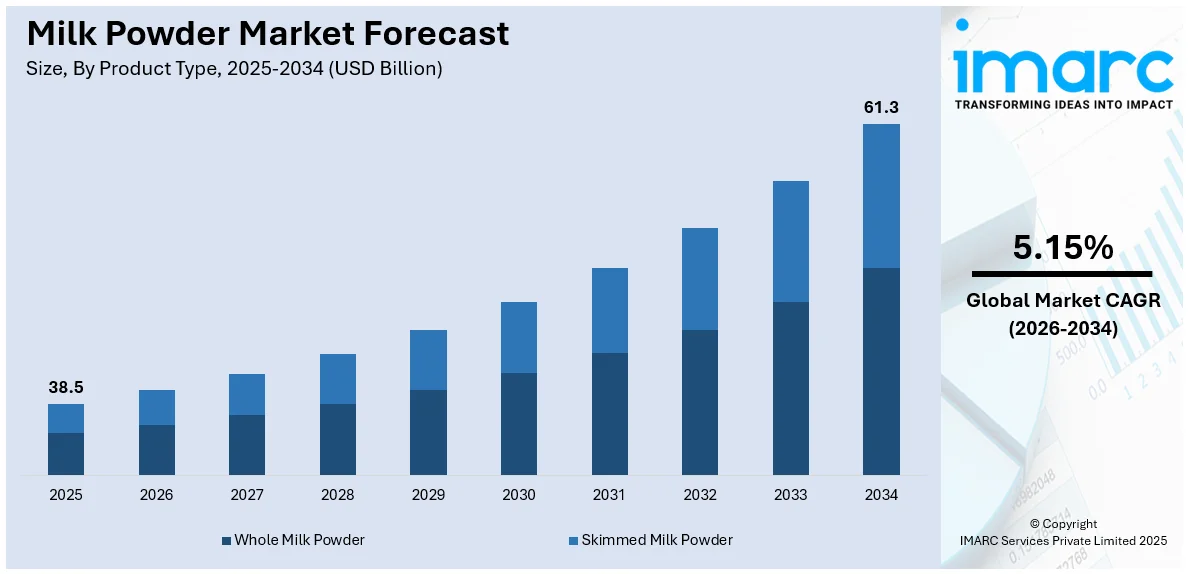

The global milk powder market size reached USD 38.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 61.3 Billion by 2034, exhibiting a growth rate (CAGR) of 5.15% during 2026-2034. Escalating product demand due to rising global population and urbanization, the burgeoning infant formula sector, increasing health consciousness boosting dietary supplement intake, the expansion of the bakery and confectionery industries, and enhanced dairy technology are some of the factors fueling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 38.5 Billion |

|

Market Forecast in 2034

|

USD 61.3 Billion |

| Market Growth Rate 2026-2034 | 5.15% |

Milk Powder Market Analysis:

- Market Growth and Size: The milk powder market size is expanding significantly, driven by its integral role in various industries and the shifting consumer preferences towards convenient, long-lasting food products. The market's growth is mirrored in its increasing market share, reflecting a rising demand across global households, especially in regions with limited access to fresh milk. The scalability of milk powder production meets the growing nutritional needs of the burgeoning global population, further contributing to the market's size. As urbanization continues, the convenience that milk powder offers ensures its staple status in daily consumption, thereby consistently enlarging the milk powder market share.

- Major Market Drivers: The kye drivers shaping the milk powder market include evolving consumer preferences towards plant-based diets, which is leading to a rise in demand for plant-based milk powders. Innovations in flavor and fortification are attracting a broader consumer base, while the integration of organic and non genetically modified organisms (GMO) ingredients caters to the health-conscious segment, which is boosting the market growth. Besides this, the shift towards sustainable packaging solutions, growing environmental awareness, the surging fitness and sports nutrition sector, and the rise in lactose intolerance are bolstering the market growth.

- Technological Advancements: Technological advancements in the milk powder market are revolutionizing the industry, enhancing product quality, and optimizing production efficiency. Innovations in spray drying technologies and membrane filtration have significantly improved the consistency and shelf-life of milk powder, thereby boosting the milk powder market size. Advances in packaging technology ensure longer freshness and easier transportation, augmenting the market's growth. Moreover, the development of instant milk powder, which dissolves more readily in water, showcases the industry's adaptation to consumer convenience, further solidifying its market share.

- Industry Applications: The milk powder market finds extensive applications across various industries, significantly influencing its market share. In the food industry, it's a vital ingredient in chocolates, bakery products, confectioneries, and infant formula, adding nutritional value and flavor. The pharmaceutical sector utilizes milk powder in vitamin and mineral supplements due to its high calcium and protein content. Additionally, the cosmetic industry incorporates it into skincare products, exploiting its moisturizing and skin-nourishing properties.

- Key Market Trends: The emerging trends in the milk powder market include the rising popularity of protein-enriched and fortified milk powders, catering to the health and wellness sector. Moreover, the increasing consumer inclination towards clean-label products is pushing manufacturers to adopt transparent labeling practices, which is bolstering the market growth. Additionally, the trend of personalization and customization of milk powder blends and the exploration of exotic and diverse flavors in milk powder appeals are supporting the market growth.

- Geographical Trends: The Asia-Pacific region leads in the milk powder market, attributed to its large population, increasing urbanization, and shifting dietary patterns. This region's dominance is supported by the high consumption rates in countries like China and India, where milk powder is heavily incorporated into daily diets, infant nutrition, and various culinary practices. The market's expansion in this region is also fueled by rising income levels, growing awareness about the nutritional benefits of milk powder, and the convenience it offers.

- Competitive Landscape: The competitive landscape of the milk powder market is characterized by the presence of both large multinational corporations and local players, contributing to a fragmented market structure. Companies are increasingly focusing on expanding their product portfolio, improving quality, and implementing innovative marketing strategies to enhance their market presence and increase their market share. Strategic alliances, mergers, acquisitions, and partnerships are prevalent, aiming to leverage mutual strengths for expanded distribution networks and enhanced product offerings.

- Challenges and Opportunities: The milk powder market faces challenges such as fluctuating milk supply prices, stringent regulatory standards, and the need for high-quality control to prevent contamination. However, these challenges present opportunities for market players to innovate and differentiate their products. There's a growing demand for specialty milk powders tailored for specific health needs or dietary restrictions, offering considerable growth opportunities. Additionally, expanding into emerging markets can provide new revenue streams and customer bases.

To get more information on this market Request Sample

Milk Powder Market Trends:

Increasing population and urbanization

The global milk powder market thrives as the world's population grows and urbanization accelerates, leading to heightened demand for convenient, non-perishable food items. Urban lifestyles, characterized by busy schedules and smaller living spaces, favor easily stored and long-lasting food products like milk powder. It offers a practical solution for consumers seeking nutritious, quick-to-prepare options, fitting seamlessly into the fast-paced urban life. The durability and storage efficiency of milk powder, devoid of the refrigeration need, align perfectly with the urban demand for convenience and longevity in food choices, thereby driving the market growth.

Expanding infant formula industry

Milk powder is a cornerstone ingredient in infant formula, an essential food product for babies who are not breastfed. The expanding infant formula industry significantly propels the milk powder market, given its critical role in providing necessary nutrients, vitamins, and minerals to infants. This industry’s growth is fueled by increasing awareness of the benefits of fortified infant formula, rising global birth rates, and the growing number of working mothers seeking convenient feeding solutions. As manufacturers strive to meet the stringent quality and nutritional standards required for infant nutrition, the demand for high-quality milk powder escalates, thereby bolstering the market.

Rising trend of dietary supplements

The global surge in health consciousness and the popularity of dietary supplements significantly impact the milk powder market. Milk powder, rich in calcium, protein, and other essential nutrients, is a favored ingredient in the formulation of these supplements. Consumers increasingly turn to dietary supplements to fulfill their nutritional needs, maintain health, and enhance their overall well-being. This trend is particularly pronounced in the fitness and wellness communities, where milk powder is incorporated into protein shakes, bars, and health drinks, driving its demand and, subsequently, market growth.

Significant growth in bakery and confectionery sectors

Milk powder is integral to the bakery and confectionery industries, valued for its ability to enhance flavor, texture, and shelf-life of products like cakes, cookies, and chocolates. As these sectors expand globally, the demand for milk powder escalates. Its versatility allows for a wide range of applications, from improving the tenderness of baked goods to serving as a key ingredient in confectionery items. The growth of these industries is driven by increasing consumer indulgence in sweet goods, innovation in bakery and confectionery products, and the rising trend of artisanal and premium baked items, all of which fuel the market demand for milk powder.

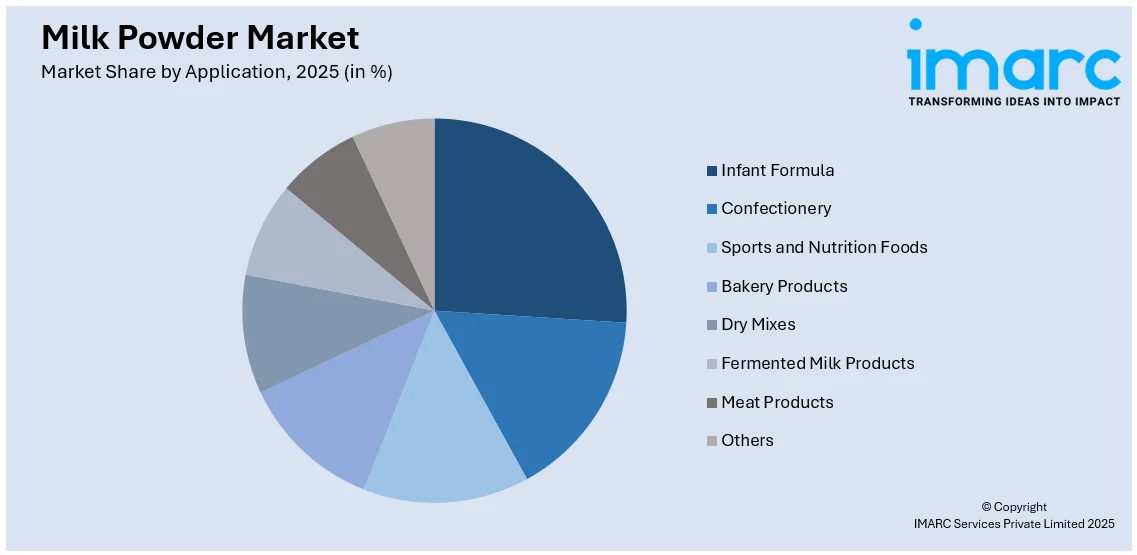

Milk Powder Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2026-2034. Our report has categorized the market based on the product type, function, and application.

Breakup by Product Type:

- Whole Milk Powder

- Skimmed Milk Powder

Whole milk powder dominates the market

The report has provided a detailed breakup and analysis of the market based on the product type. This includes whole milk powder and skimmed milk powder. According to the report, whole milk powder represented the largest segment.

The whole milk powder segment is driven by the increasing consumer demand for richer flavor profiles and higher nutritional content, particularly in terms of fat-soluble vitamins and essential fatty acids found abundantly in whole milk powder. This segment benefits from its widespread use in the culinary world, where its full-fat content is preferred for creating creamy, rich textures in baked goods, confectioneries, and dairy products. The trend towards convenience foods also propels this segment, as whole milk powder offers a convenient, shelf-stable alternative to fresh milk, preserving the flavor and nutritional integrity. Additionally, the rising global consumption of dairy products in emerging economies, where whole milk powder is often favored for its energy and nutrient density, significantly contributes to the segment's growth.

The skimmed milk powder segment is driven by the increasing health consciousness among consumers, who prefer low-fat, high-protein dairy options that skimmed milk powder provides. This segment capitalizes on the growing fitness and wellness trend, where individuals seek out food products that support their dietary and lifestyle goals, including weight management and cardiovascular health. Skimmed milk powder is also gaining traction in the food processing industry for its functional properties, such as its ability to add texture and flavor without the added fat, making it a preferred ingredient in low-calorie baked goods, confections, and dairy products. Moreover, its extended shelf life and lower storage and transportation costs, compared to liquid milk, appeal to both manufacturers and consumers, further fueling the market growth.

Breakup by Function:

- Emulsification

- Foaming

- Flavouring

- Thickening

The report has provided a detailed breakup and analysis of the market based on the function. This includes emulsification, foaming, flavouring, and thickening.

The emulsification segment is driven by the increasing demand for processed and convenience foods, where stable emulsions are crucial for product quality. Innovations in food processing technologies and the growing need for extended shelf life in products such as dressings, mayonnaise, and sauces fuel this segment. The industry's push towards clean-label ingredients has also heightened the demand for natural emulsifiers, which are perceived as healthier alternatives. The quest for improved texture and consistency in food and beverage products, along with the expanding range of applications in personal care and pharmaceuticals, further bolsters the growth of this segment.

The foaming segment is driven by the increasing consumer interest in products with enhanced sensory attributes and textures, such as light, airy, and frothy consistencies found in beverages, whipped creams, and mousse. The segment benefits from technological advancements in food processing and the incorporation of foaming agents that ensure product stability, longevity, and quality. There's also a significant push towards natural and plant-based foaming agents, reflecting the growing trend of clean-label and vegan products. The expanding applications in cosmetic and personal care products, particularly in skincare and haircare formulations, contribute substantially to the segment's growth, capitalizing on the consumer's desire for products offering rich and luxurious experiences.

The flavoring segment is driven by the increasing consumer demand for new, exotic, and authentic flavors, reflecting the global palate's expansion and the desire for culinary exploration. The food and beverage industry's continuous innovation, coupled with the rising popularity of ethnic cuisines and fusion flavors, propels this segment. There's a growing emphasis on natural, organic flavorings and clean-label ingredients, resonating with the health-conscious consumer seeking transparency and simplicity. The segment also benefits from advancements in flavor encapsulation and delivery technologies, enhancing flavor stability, intensity, and longevity in products, thus meeting the consumer demand for high-quality, flavorful, and consistent food experiences.

The thickening segment is driven by the increasing consumer preference for products with enhanced textures and viscosities, such as sauces, gravies, soups, and dairy products. The demand for natural and clean-label thickening agents is on the rise, in line with the overall shift towards healthier and more transparent food choices. Technological advancements in food processing and the development of new and innovative thickening agents enable manufacturers to improve product quality and shelf life. Additionally, the segment is supported by the growing demand in the pharmaceutical industry, where thickeners are used in formulations to improve the administration and efficacy of medicinal products, reflecting the sector's broadening scope and the continuous evolution of consumer preferences.

Breakup by Application:

Access the comprehensive market breakdown Request Sample

- Infant Formula

- Confectionery

- Sports and Nutrition Foods

- Bakery Products

- Dry Mixes

- Fermented Milk Products

- Meat Products

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes infant formula, confectionery, sports and nutrition foods, bakery products, dry mixes, fermented milk products, meat products and others.

The infant formula segment is driven by increasing awareness among parents about the nutritional benefits of infant formula, mimicking the nutritional profile of human milk. This awareness, coupled with rising infant population and working mothers, fuels the demand. Additionally, innovations in formula development, such as the inclusion of probiotics, prebiotics, and specific vitamins, enhance the appeal to health-conscious consumers. The segment also benefits from stringent safety and quality standards, reassuring parents about the product's reliability and safety, thereby boosting its market presence.

The confectionery segment is driven by the increasing consumer demand for indulgent, high-quality confectionery products. Milk powder plays a crucial role in enhancing flavor, texture, and shelf-life of chocolates, candies, and other sweets, making it a preferred ingredient among manufacturers. The growing trend of premiumization in confectioneries, along with innovation in flavors and healthier reformulations with reduced sugar and fat, further stimulates the segment’s growth. The global expansion of confectionery brands and the rising popularity of artisanal and craft confections also significantly contribute to the demand for milk powder in this sector.

The sports and nutrition foods segment is driven by the increasing consumer focus on health, wellness, and fitness, leading to heightened demand for protein-rich and fortified nutritional products. Milk powder is integral in manufacturing energy bars, protein shakes, and dietary supplements due to its high protein content and functional properties. The expanding fitness industry, coupled with the rising trend of athleisure and proactive health management, supports the segment's growth. Moreover, the innovation in flavors and convenient, on-the-go packaging options are key factors appealing to the health-conscious, active population.

The bakery products segment is driven by the increasing consumer preference for fresh, tasty, and high-quality baked goods. Milk powder is essential in bakery products for improving texture, flavor, and shelf life, contributing to its widespread use in bread, cakes, pastries, and other bakery items. The growth of artisanal bakeries and the innovation in gluten-free and organic bakery products also fuel the demand for specialized milk powders.

The dry mixes segment is driven by the increasing consumer demand for convenient, quick-preparation food products. Milk powder is a key ingredient in dry mixes for soups, sauces, desserts, and instant meals, providing flavor, nutritional value, and ease of use. The growing trend of home cooking, accelerated by recent global shifts towards more time spent at home, along with the rise of the meal-prep culture, are significant factors boosting this segment. Additionally, the demand for clean-label, natural, and non-GMO ingredients in dry mixes is influencing the incorporation of high-quality milk powder variants.

The fermented milk products segment is driven by the increasing consumer inclination towards probiotic-rich foods for their health benefits, such as improved digestion and enhanced immune function. Milk powder is crucial in producing yogurt, kefir, and other fermented milk products, offering consistency, nutritional enhancement, and extended shelf life. The rising popularity of ethnic and artisanal fermented dairy products, along with consumer demand for low-fat and high-protein options, further propels this segment's growth.

The meat products segment is driven by the increasing use of milk powder as a functional ingredient in processed meat products to enhance flavor, bind ingredients, and retain moisture, leading to improved texture and extended shelf life. The growing consumer demand for high-quality, protein-rich, and convenient meat products supports the segment's expansion. Additionally, the trend towards cleaner labels and the reduction of artificial additives in meat products encourages the use of natural ingredients like milk powder, aligning with consumer preferences for healthier, minimally processed foods.

The others segment, encompassing a variety of food applications, is driven by the versatility and functional benefits of milk powder. This includes its use in beverages, ice creams, and ready-to-eat meals, where it contributes to flavor, texture, and nutritional value. The sector benefits from the growing consumer demand for convenience foods, innovative product offerings, and the shift towards nutritional and fortified food options.

Breakup by Region:

- European Union

- New Zealand

- China

- United States

- Brazil

- Others

European Union leads the market, accounting for the largest milk powder market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include European Union, New Zealand, China, United States, Brazil, and Others. According to the report, European Union accounted for the largest market share.

The European Union milk powder market is driven by the increasing demand for dairy products in sustainable and convenient formats, high standards of quality, and stringent regulatory frameworks ensuring product safety and environmental stewardship. Innovations in dairy processing and the presence of well-established dairy industries in countries like the Netherlands, France, and Germany contribute significantly. The region's focus on exporting high-quality milk powder, especially to markets with a deficit in dairy production, coupled with a strong emphasis on organic and non-GMO products, reflects the unique drivers of this market.

New Zealand milk powder market is driven by the country's strong reputation for high-quality dairy products, efficient pasture-based dairy farming, and substantial export-oriented production. The industry benefits from free trade agreements, advanced dairy technology, and a global reputation for clean, green, and natural products. New Zealand's focus on meeting the demands of key international markets, particularly in Asia, where there is a high trust in its dairy quality, significantly influences its market dynamics.

China milk powder market is driven by the increasing consumer demand for infant formula, nutritional supplements, and dairy-based products, amidst growing health awareness and higher disposable incomes. The market is also shaped by the desire for imported high-quality milk powder due to food safety concerns with domestic products. Rapid urbanization, changing lifestyles, and the loosening of the one-child policy have further spurred the demand for milk powder, making China a pivotal player in the global dairy industry.

The United States milk powder market is driven by innovative product offerings, a well-established dairy industry, and a strong domestic and international demand. The U.S. benefits from advanced dairy processing technologies and a large scale of production, catering to both local and export markets. The versatility of milk powder applications, from infant formula to sports nutrition and bakery products, aligns with the diverse dietary trends and preferences of the American population, fueling the market's growth.

Brazil milk powder market is driven by the growing domestic demand influenced by the rising middle class, urbanization, and an increasing inclination towards convenient and long-lasting dairy products. The country's vast agricultural sector supports the dairy industry, with a focus on meeting the internal demand and expanding its footprint in the South American market. Brazil's emphasis on improving dairy quality and production efficiency is pivotal in shaping its milk powder market landscape.

Others milk powder market is driven by varying factors depending on the specific region, including emerging economies' increasing nutritional awareness, rising income levels, and urbanization. Markets like India, Southeast Asia, and Africa are experiencing a surge in demand due to population growth, dietary shifts, and the integration of milk powder into traditional diets. These regions are focusing on enhancing local production capabilities, quality standards, and tapping into the burgeoning demand for dairy nutrition, each adapting uniquely to their cultural, economic, and social landscapes.

Leading Key Players in the Milk Powder Industry:

Key players in the milk powder market are actively engaging in various strategic initiatives to bolster their market position and respond to the evolving consumer demands. They are heavily investing in research and development (R&D) to innovate and enhance product quality, focusing on nutritional benefits, ease of use, and extended shelf life. These companies are also expanding their global footprint through mergers, acquisitions, and partnerships, aiming to tap into new markets and consolidate their presence in existing ones. There's a significant emphasis on sustainability, with efforts to improve supply chain efficiency, reduce carbon footprints, and ensure ethical sourcing. Marketing strategies are being refined to resonate with health-conscious consumers, emphasizing the purity, safety, and nutritional aspects of their products. Moreover, adapting to digital transformation, they are leveraging online platforms for marketing and distribution, enhancing their reach and customer engagement in a competitive marketplace.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Arla Foods amba

- Dairy Farmers of America Inc.

- Danone S.A.

- Fonterra Co-Operative Group Limited

- HOCHDORF Swiss Nutrition AG

- Lactalis Ingredients

- Nestlé S.A.

- Olam International Limited

- Royal FrieslandCampina N.V.

- Saputo Inc.

- Schreiber Foods

- Westland Milk Products

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- In March 2022: Fonterra announced their plan to reduce greenhouse gas emissions by 30% at all their manufacturing sites by 2030, aligning with their long-term sustainability goals.

- In September 2022: Arla Foods launched a new infant milk formula range under their existing brand. This launch was aimed at strengthening their position in the global infant nutrition market, offering products enriched with essential nutrients and tailored to different stages of infant growth.

- In January 2023: Royal FrieslandCampina N.V. launched a new range of milk powder products under its well-known brand, targeting health-conscious consumers worldwide. These products are fortified with additional vitamins and minerals, addressing the nutritional needs of specific consumer segments, including the elderly and athletes.

Milk Powder Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD, Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Whole Milk Powder, Skimmed Milk Powder |

| Functions Covered | Emulsification, Foaming, Flavouring, Thickening |

| Applications Covered | Infant formula, Confectionery, Sports and Nutrition Foods, Bakery Products, Dry Mixes, Fermented Milk Products, Meat Products, Others |

| Regions Covered | European Union, New Zealand, China, United States, Brazil, Others |

| Companies Covered | Arla Foods amba, Dairy Farmers of America Inc., Danone S.A., Fonterra Co-Operative Group Limited, HOCHDORF Swiss Nutrition AG, Lactalis Ingredients, Nestlé S.A., Olam International Limited, Royal FrieslandCampina N.V., Saputo Inc., Schreiber Foods, Westland Milk Products |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the milk powder market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global milk powder market.

- The study maps the leading, as well as the fastest growing, markets in the region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the milk powder industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global milk powder market was valued at USD 38.5 Billion in 2025.

We expect the global milk powder market to exhibit a CAGR of 5.15% during 2026-2034.

The market potential of milk powder is significant and is driven by increasing urbanization and rapid growth in disposable incomes, paired with the convenience and nutritional benefits offered by milk powder.

The sudden outbreak of the COVID-19 pandemic has led to the shifting consumer preferences from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of milk powder.

Based on the product type, the global milk powder market can be categorized into whole milk powder and skimmed milk powder. Currently, whole milk powder exhibits clear dominance in the market.

Based on the function, the global milk powder market has been segmented into emulsification,

foaming, flavoring, and thickening.

Based on the application, the global milk powder market can be bifurcated into infant formula,

confectionery, sports and nutrition foods, bakery products, dry mixes, fermented milk products,

meat products, and others.

On a regional level, the market has been classified into European Union, New Zealand, China, United States, Brazil, and others, where European Union currently dominates the global market.

Some of the major producers in the global milk powder market include Arla Foods amba, Dairy Farmers of America, Inc., Danone S.A., Fonterra Co-Operative Group Limited, HOCHDORF Swiss Nutrition AG, Lactalis Ingredients, Nestlé S.A., Olam International Limited, Royal FrieslandCampina N.V., Saputo Inc., Schreiber Foods, Westland Milk Products, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)