Mining Lubricants Market Report by Product (Mineral Oil Lubricants, Synthetic Lubricants, Bio-Based Lubricants), Equipment Function (Engine, Hydraulic, Transmission, Gear), Mining Techniques (Surface Mining, Underground Mining), Application (Coal Mining, Bauxite Mining, Iron Ore Mining, Precious Metals Mining, Rare Earth Mineral Mining, and Others), and Region 2025-2033

Mining Lubricants Market Size:

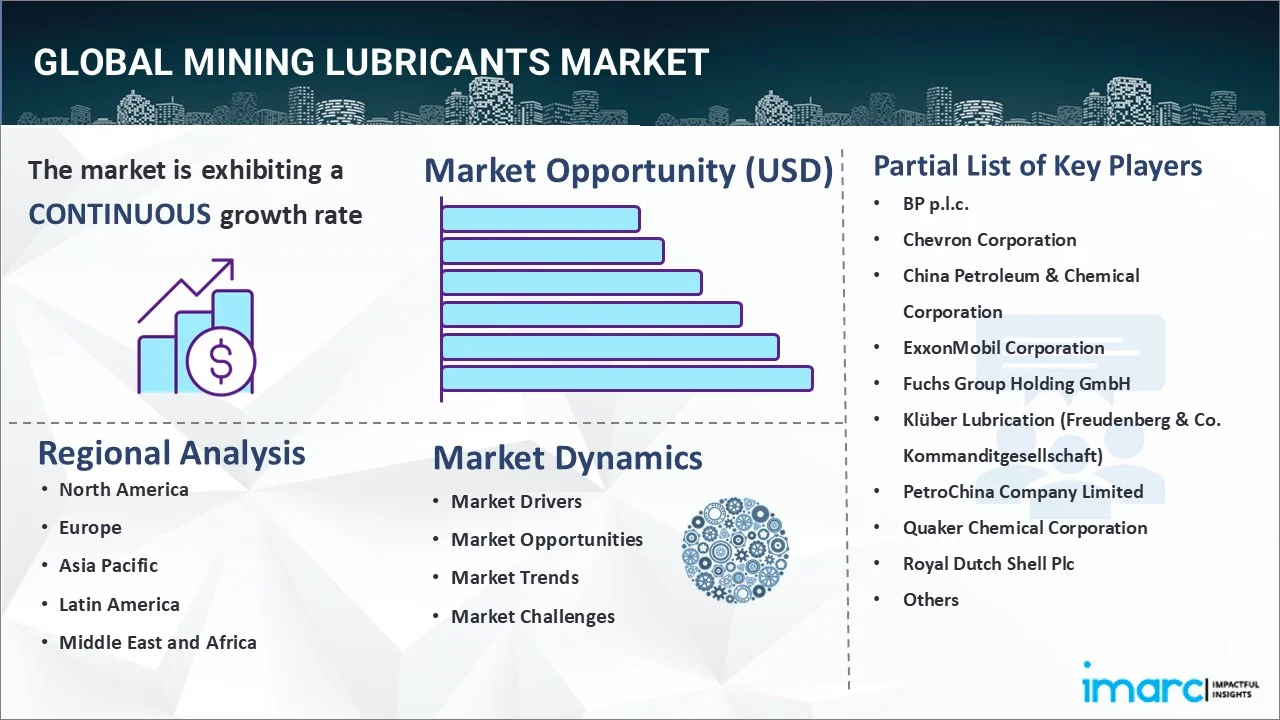

The global mining lubricants market size reached USD 2.54 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.50 Billion by 2033, exhibiting a growth rate (CAGR) of 3.43% during 2025-2033. Increasing demand for minerals and metals, expanding mining activities in emerging economies, advancements in mining technologies, stringent environmental regulations, the trend of predictive maintenance, rise in automation, emphasis on cost optimization, surging demand for bio-based lubricants, and escalating investments in infrastructure development are some of the factors accelerating the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.54 Billion |

| Market Forecast in 2033 | USD 3.50 Billion |

| Market Growth Rate 2025-2033 | 3.43% |

Mining Lubricants Market Analysis:

- Major Market Drivers: Various factors fuel the global mining lubricants market share, including the growing mechanization in mining for improved efficiency and productivity increases the demand for advanced lubricants. Since new mining equipment is becoming more technologically advanced, they need high-performance lubricants to operate smoothly with minimal downtime, which in turn is propelling the product demand. The market is also stimulated by the increasing investment in mining, especially in emerging economies. As the search for energy-efficient and environmentally friendly solutions continues, there is a high demand for synthetic lubricants. The market is driven by high performance requirements due to climate change, which makes countries enact stringent environmental laws. Moreover, the need for lubricants to work in extreme conditions is increasing, which is creating a positive outlook for the mining lubricants market growth.

- Key Market Trends: As the automation and remote monitoring of machines become more widespread, the need for appropriate specialized lubricants grows. Automation trends have led to manufacturers leaving the old mineral lubricants and turning to bio-based and eco-friendly options due to enhanced environmental regulation. Additionally, predictive maintenance is growing across almost all industries, further boosting the possibilities for data analytics to be used on measuring lubricant performance and machinery conditions. Apart from this, companies are involving in partnerships with lubricant producers to develop new and improve existing solutions, which is another crucial mining lubricants market trends. Other factors, such as the increasing technological sophistication and efficiency and rapid technological advancements, are favoring the market growth.

- Geographical Trends: In terms of regional market share, the Asia-Pacific is the largest in the global mining lubricants market. Mineral reserves contribute to the domination of China’s mining activities around the world. With the highest demand for minerals in various industries, the country is doing well in the mining sector. Australia is an outstanding country too due to its long-established mining sectors, which is further driving the mining lubricants demand. The same case applies to India’s mining sector, considering that the mining sector in the country is still increasing. The countries also host several prime companies in the mining sector. They also have an investiture culture in mining projects sparking demand for mining lubricants. The other top regions for the mining lubricants market are North America and Europe.

- Competitive Landscape: The competitive landscape of the market is characterized by the presence of key mining lubricants companies, such as BP p.l.c., Chevron Corporation, China Petroleum & Chemical Corporation, ExxonMobil Corporation, Fuchs Group Holding GmbH, Klüber Lubrication (Freudenberg & Co. Kommanditgesellschaft), PetroChina Company Limited, Quaker Chemical Corporation, Royal Dutch Shell Plc, Total SE, etc.

- Challenges and Opportunities: The mining lubricants market is fraught with several market challenges, such as the fluctuating prices of raw materials and environmental concerns such as lubricant disposal. As manufacturers strive to meet more rigorous and harsher environmental standards and ensure lubricant sustainability, market challenges continue to emerge for these firms. Nonetheless, there is still an opportunity here. The quest for eco-lubricant lubes utilizing bio and eco-friendly elements is promising, with substantial room for augmentation. Similarly, as the mining sector becomes increasingly automated and digitized, there is a strong need for enhanced lubrication to back the advancing technology. Moreover, the mining lubricants industry is young, and given the development of mining operations into fresh new markets and mineral reserves that have not yet been touched, it presents a great opportunity for growth.

Mining Lubricants Market Trends:

Increasing Demand for Minerals and Metals

One of the key drivers of the global mining lubricants market is the increasing need for minerals and metals by industries, including construction, automotive, and manufacturing. These industries rely on raw materials such as iron, copper, and aluminum, which are key materials for metallic products. In addition, the escalating demand for consumer goods has necessitated the need to support extensive mining activities to extract the raw materials required to manufacture them, which is further providing a positive mining lubricants market outlook. Consequently, the pressure on mining businesses is growing, prompting them to generate more products and using high-performance lubricants to improve production efficiency, which is another growth-inducing factor for the market. The mentioned lubricants are valuable ingredients in ensuring mining equipment works as designed by reducing friction between moving components.

Expansion of Mining Activities in Emerging Economies

Another vital factor driving the global mining lubricants market is the spread of exploration and mining activities into emerging markets. Emerging economies such as China, India, South Africa, and Brazil are channeling vast resources into developing their mining industries to exploit the enormous mineral deposits in their territories. For example, in India, the overall growth in mineral production from April 2023 to September 2023 saw a total of 8.7%. Most of the resources will be used to meet the high demand for raw materials in the domestic industries and explore exportation opportunities. The mining industries in these regions are developing at alarming rates, leading to increased reliance on advanced machinery and equipment. The machines are exposed to severe conditions and operate almost non-stop, only stopping to refuel, which calls for the need for high-quality lubricants.

Advancements in Mining Technologies

The mining industry’s growing installed capacity and modern technological advancements, as well as high mechanization, have created the need for the use of high-performance lubricants. Mining lubricants have been highly utilized over the years due to the technological advancements in the mining industry that have made possible and simplified many processes associated with mining. Most mining industries have implemented advanced technologies that include having remote monitoring equipment and the automation of activities, that have enabled them to invest in advanced machinery in ensuring better safety, environmental, and operational practices. However, the sophisticated machinery has required high-performance lubricants to keep the equipment in operation.

Mining Lubricants Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on the product, equipment function, mining techniques, and application.

Breakup by Product:

- Mineral Oil Lubricants

- Synthetic Lubricants

- Bio-Based Lubricants

Mineral oil lubricants accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product. This includes mineral oil lubricants, synthetic lubricants, and bio-based lubricants. According to the report, mineral oil lubricants represented the largest segment.

The mineral oil lubricants segment is driven by the increasing availability and affordability of mineral oil-based products, making them a cost-effective option for mining companies. Their widespread availability ensures a steady supply to meet the high demand in the mining industry. Additionally, the superior lubrication properties of mineral oils, including excellent thermal stability and viscosity control, make them highly effective in protecting mining equipment under harsh operating conditions. Moreover, continuous advancements in mineral oil formulations enhance their performance and extend equipment lifespan, reducing maintenance costs. The established infrastructure for the production and distribution of mineral oil lubricants further supports their dominance in the market.

Breakup by Equipment Function:

- Engine

- Hydraulic

- Transmission

- Gear

The report has provided a detailed breakup and analysis of the market based on the equipment function. This includes engine, hydraulic, transmission, and gear.

The engine segment is driven by the increasing demand for high-performance lubricants that can withstand extreme temperatures and heavy loads in mining machinery. The efficiency and longevity of engines in mining equipment are critical, necessitating lubricants that offer superior protection against wear, corrosion, and oxidation. Furthermore, advancements in engine technologies and the growing emphasis on reducing maintenance costs and downtime are propelling the demand for specialized engine lubricants. The focus on enhancing fuel efficiency and meeting stringent emission regulations also contributes to the growth of this segment, as high-quality lubricants play a vital role in optimizing engine performance and compliance.

The hydraulic segment is driven by the increasing need for reliable and efficient hydraulic systems in mining operations. Hydraulic systems are crucial for the operation of various mining equipment, including excavators, loaders, and drills, which require lubricants that provide excellent anti-wear properties and thermal stability. Additionally, the emphasis on extending the service life of hydraulic components and minimizing equipment downtime is further supporting the growth of this segment, as specialized lubricants help maintain optimal performance under severe operating conditions.

The transmission segment is driven by the increasing need for lubricants that ensure smooth and efficient power transfer in mining machinery. Transmission systems in mining equipment operate under high stress and extreme conditions, requiring lubricants that offer exceptional friction control, wear protection, and thermal stability. Moreover, the focus on reducing operational costs and enhancing equipment reliability is encouraging the adoption of specialized transmission lubricants that help minimize maintenance requirements and extend the lifespan of transmission components.

The gear segment is driven by the increasing requirement for lubricants that can withstand high loads and provide superior protection against wear and corrosion in gear systems used in mining equipment. Gears are subject to intense pressure and harsh environmental conditions, making the need for high-quality lubricants essential for preventing gear failure and ensuring efficient operation. The adoption of advanced gear technologies and the emphasis on improving the performance and durability of gear systems are boosting the demand for specialized gear lubricants.

Breakup by Mining Techniques:

- Surface Mining

- Underground Mining

The report has provided a detailed breakup and analysis of the market based on mining techniques. This includes surface mining and underground mining.

The surface mining segment is driven by the increasing demand for minerals used in construction and manufacturing, necessitating efficient extraction processes. The use of large-scale machinery in surface mining operations, such as excavators and haul trucks, requires high-performance lubricants to ensure optimal functioning and reduce wear and tear. Additionally, advancements in mining equipment technology, emphasizing the need for specialized lubricants to handle extreme operating conditions, further boost the market. The trend towards environmentally sustainable practices also encourages the adoption of bio-based and eco-friendly lubricants in surface mining activities.

The underground mining segment is driven by the increasing need to access deeper mineral deposits, requiring advanced and reliable machinery to operate in confined and harsh environments. The complexity and intensity of underground mining operations demand lubricants that provide superior protection against extreme pressures, high temperatures, and contamination. Moreover, the implementation of stringent safety regulations and the focus on reducing operational downtime propel the use of high-quality, specialized lubricants. The growing adoption of automation and remote monitoring technologies in underground mining also enhances the demand for lubricants that can support sophisticated equipment and ensure continuous operation.

Breakup by Application:

- Coal Mining

- Bauxite Mining

- Iron Ore Mining

- Precious Metals Mining

- Rare Earth Mineral Mining

- Others

Coal mining accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on application. This includes coal mining, bauxite mining, iron ore mining, precious metals mining, rare earth mineral mining, and others. According to the report, coal mining represented the largest segment.

The coal mining segment is driven by the increasing global energy demand, which necessitates a steady supply of coal for electricity generation and industrial use. As countries strive to meet their energy needs and reduce reliance on oil and natural gas, coal remains a vital resource, especially in emerging economies with growing industrial sectors. This demand compels coal mining companies to enhance their operational efficiency, where high-performance lubricants play a crucial role in maintaining the machinery and equipment used in harsh mining conditions. Furthermore, stringent environmental regulations require the use of eco-friendly and efficient lubricants to minimize the environmental impact of mining activities. The adoption of advanced mining technologies and automation also demands specialized lubricants that can handle extreme temperatures, high loads, and continuous operation. Additionally, the increasing focus on safety and equipment reliability in coal mining operations further drives the demand for high-quality mining lubricants, ensuring optimal performance and reduced downtime.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest mining lubricants market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

The Asia Pacific region is driven by the increasing demand for minerals and metals, fueled by rapid industrialization and urbanization, particularly in countries like China and India. This demand necessitates efficient mining operations, thus boosting the need for high-performance lubricants. Additionally, the region's expanding mining activities, supported by substantial investments in exploration projects, enhance the market growth. Governments in these countries are also implementing favorable policies and infrastructure development plans that encourage mining activities, thereby driving the demand for specialized lubricants. Furthermore, advancements in mining technologies, such as automation and remote monitoring, require advanced lubricants to ensure optimal equipment performance. The stringent environmental regulations in the region are prompting mining companies to adopt eco-friendly lubricants, contributing to market growth. Apart from this, the focus on cost optimization and operational efficiency in the mining sector is leading to an increased adoption of high-performance lubricants that reduce maintenance costs and extend equipment life.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the mining lubricants include BP p.l.c., Chevron Corporation, China Petroleum & Chemical Corporation, ExxonMobil Corporation, Fuchs Group Holding GmbH, Klüber Lubrication (Freudenberg & Co. Kommanditgesellschaft), PetroChina Company Limited, Quaker Chemical Corporation, Royal Dutch Shell Plc, Total SE, etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Key players in the mining lubricants market are actively engaging in strategic initiatives to strengthen their market presence and meet the evolving demands of the industry. They are investing heavily in research and development (R&D) to formulate advanced lubricants that offer superior performance under extreme conditions, ensuring equipment longevity and operational efficiency. These companies are also focusing on expanding their product portfolios with eco-friendly and bio-based lubricants to comply with stringent environmental regulations and cater to the growing demand for sustainable solutions. Additionally, they are enhancing their global distribution networks through strategic partnerships and acquisitions to improve market reach and customer service. To stay competitive, they are adopting digital technologies and predictive maintenance strategies that leverage data analytics to optimize lubrication solutions and reduce downtime. Marketing efforts are also being intensified to promote the benefits of their high-performance lubricants, emphasizing cost savings and increased productivity for mining operations.

Mining Lubricants Market News:

- In 2024: ADNOC and BP p.l.c announced that they have agreed to form a new joint venture (JV) in Egypt. The JV (51% bp and 49% ADNOC) will combine the pair’s deep technical capabilities and proven track records as it aims to grow a highly competitive gas portfolio.

- In 2023: ExxonMobil Corporation announced the successful startup of its Beaumont refinery expansion project, which adds 250,000 barrels per day of capacity to one of the largest refining and petrochemical complexes along the U.S. Gulf Coast., which costed about US$ 2 billion.

Mining Lubricants Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Mineral Oil Lubricants, Synthetic Lubricants, Bio-Based Lubricants |

| Equipment Functions Covered | Engine, Hydraulic, Transmission, Gear |

| Mining Techniques Covered | Surface Mining, Underground Mining |

| Applications Covered | Coal Mining, Bauxite Mining, Iron Ore Mining, Precious Metals Mining, Rare Earth Mineral Mining, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BP p.l.c., Chevron Corporation, China Petroleum & Chemical Corporation, ExxonMobil Corporation, Fuchs Group Holding GmbH, Klüber Lubrication (Freudenberg & Co. Kommanditgesellschaft), PetroChina Company Limited, Quaker Chemical Corporation, Royal Dutch Shell Plc, Total SE, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the mining lubricants market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global mining lubricants market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the mining lubricants industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global mining lubricants market was valued at USD 2.54 Billion in 2024.

We expect the global mining lubricants market to exhibit a CAGR of 3.43% during 2025-2033.

The growing popularity of mining lubricants over manual lubrications to provide continuous flow of lubricants to machines and prevent drag on the bearings is primarily driving the global mining lubricants market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous manufacturing units for mining lubricants.

Based on the product, the global mining lubricants market has been segmented into mineral oil lubricants, synthetic lubricants, and bio-based lubricants. Among these, mineral oil lubricants represent the largest market share.

Based on the application, the global mining lubricants market can be bifurcated into coal mining, bauxite mining, iron ore mining, precious metals mining, rare earth mineral mining, and others. Currently, coal mining accounts for the majority of the total market share.

On a regional level, the market has been classified into North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America, where Asia Pacific currently dominates the global market.

Some of the major players in the global mining lubricants market include BP p.l.c., Chevron Corporation, China Petroleum & Chemical Corporation, ExxonMobil Corporation, Fuchs Group Holding GmbH, Klüber Lubrication (Freudenberg & Co. Kommanditgesellschaft), PetroChina Company Limited, Quaker Chemical Corporation, Royal Dutch Shell Plc, and Total SE.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)