Mobile Phone Accessories Market Size, Share, Trends and Forecast by Product Type, Price Range, Distribution Channel, and Region, 2025-2033

Mobile Phone Accessories Market Report 2025-2033:

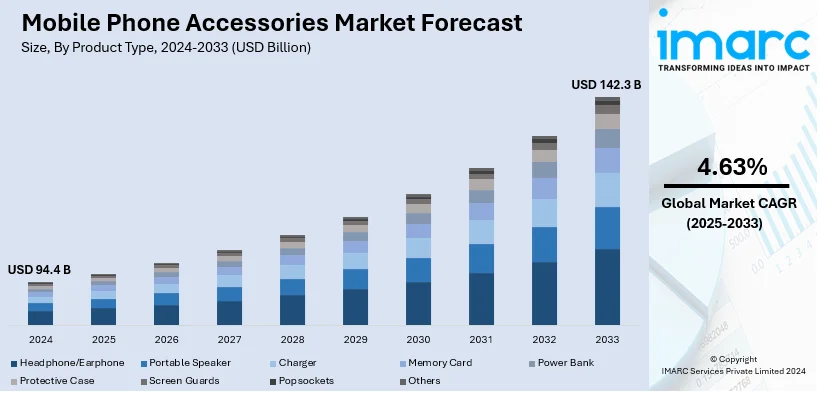

The global mobile phone accessories market size was valued at USD 94.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 142.3 Billion by 2033, exhibiting a CAGR of 4.63% from 2025-2033. Asia Pacific currently dominates the market, holding a mobile phone accessories market share of over 46.9% in 2024. The increasing demand for customization and personalization, along with the expanding e-commerce industry, is propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 94.4 Billion |

|

Market Forecast in 2033

|

USD 142.3 Billion |

| Market Growth Rate 2025-2033 | 4.63% |

The increasing adoption and utilization of smartphones is greatly affecting the market for mobile phone accessories worldwide. Among major countries, United States has some of the highest smartphone adoption rate and, as of 2023, its usage was reported to exceed 81% of its population. That has created a direct and significant increase in demand for mobile phone accessories. As smartphones become integral to daily life, consumers are interested in investing more in accessories to support their devices. For instance, mobile phone cases, which help protect expensive smartphones, are among the most popular accessory types in the U.S. This market is growing rapidly as customers depend on smartphones for communication, entertainment, and even work. According to 2023 research, 56.9% of American claim that they are attached to their phones. Also, nearly nine out of ten Americans (89%) check their phones within ten minutes of waking up. This dependence has increased the use of accessories like chargers, screen protectors, and wireless earphones.

Another key factor propelling the mobile phone accessories market in the United Stated is the focus on personalization and customization. Customers are becoming more inclined to buy accessories that let them personalize their smartphones as they see these devices as an extension of their identity. According to a recent poll, nearly 58% of American customers admitted and said they were interested in personalizing the look of their cellphones. Accessories like phone cases, skins, and decals offer a simple method to do this. This is more popular among the Millennials and Gen Z generation as they focus on building their personal identity. Businesses in the United States have also realized this and are capitalizing by offering customized solution for everything from bespoke colors and materials to personalized text and graphics. This has led to a significant growth in the accessories market, as consumers are willing to spend on unique products that match their style.

Mobile Phone Accessories Market Trends:

Rising Demand for Sustainable Alternatives

Leading manufacturers are developing accessories made from biodegradable components, recycled materials, sustainable packaging, etc. Data from Shorr’s The 2022 Sustainable Packaging Consumer Report, which looks at results from a survey of 1,113 U.S. consumers, highlights that 76% of the shoppers surveyed have made a conscious effort to purchase more sustainable products in the past year. In fact, 86% of the consumers surveyed are more likely to purchase a product from a brand or retailer if the packaging is considered sustainable. Brands like Nimble, which offers eco-friendly chargers, and Pela Case, known for their compostable phone cases, are leading this green revolution. In July 2024, Onsitego, one of the smartphone care experts, announced the pan-India launch of its mobile phone accessories brand, Juice, with an improved focus on sustainability. This, in turn, is elevating the mobile phone accessories market demand.

Growing Popularity of Personalization

Consumers increasingly seek customization that reflects their individual preferences and styles. Consequently, brands are offering a wide range of customizable options, from personalized phone cases with unique designs and monograms to modular accessories that can be specifically tailored to specific needs. In June 2024, Samsung developed new smartphone accessories that are designed with the special colors of the Paris 2024 Olympic Games in mind. This represents a mobile phone accessories business opportunity.

Smart Technology Integration

Fitness trackers, smartwatches, and smart speakers are becoming increasingly popular, which is inflating the growth of the market. Roughly one-in-five U.S. adults (21%) say they regularly wear a smart watch or wearable fitness tracker, according to a Pew Research Center survey conducted June 3-17, 2019. Moreover, Fitbit devices and the Apple Watch provide notifications, monitor health metrics, even support contactless payments, etc. These smart accessories further seamlessly integrate with mobile phones, thereby creating an ecosystem that improves health management and monitors health metrics. This is strengthening the mobile phone accessories market outlook.

Mobile Phone Accessories Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global mobile phone accessories market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, price range, distribution channel, and region.

Analysis by Product Type:

- Headphone/Earphone

- Portable Speaker

- Charger

- Memory Card

- Power Bank

- Protective Case

- Screen Guards

- Popsockets

- Others

Headphone/earphone stand as the largest component with around 21.6% of market share in 2024. The increasing demand for high-quality audio experiences is augmenting the segment. Sony's WF-1000XM4 illustrates this trend by offering advanced features like improved battery life, noise cancellation, seamless connectivity, etc. This is bolstering the mobile phone accessories market statistics across the segmentation.

Analysis by Price Range:

- Premium

- Mid

- Low

Premium accessories target consumers seeking high-end features. In contrast, mid-range accessories offer a balanced quality. Besides this, low-range accessories cater to price-sensitive individuals looking for essential functionality.

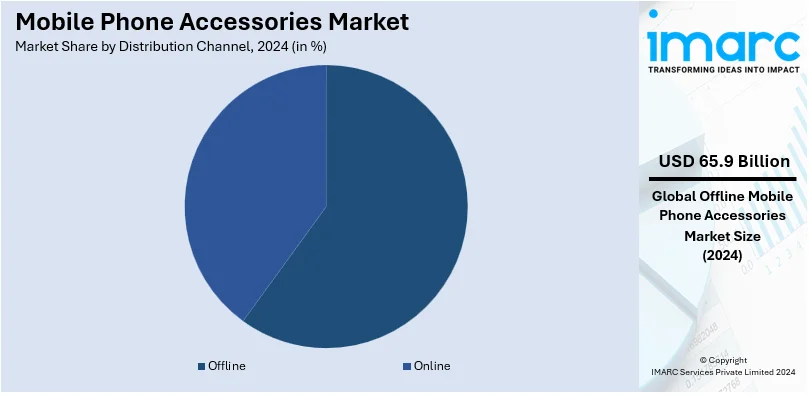

Analysis by Distribution Channel:

- Online

- Offline

Offline leads the market with around 69.8% of market share in 2024. Offline channels like Best Buy provide a tactile environment where customers can try out products before buying. This, in turn, is propelling the segment's growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 46.9%. The easy availability of smartphones, along with the rising number of customization options, is bolstering the regional market. As per the IMARC, the India smartphone market size is expected to exhibit a growth rate (CAGR) of 4.86% during 2024-2032.

Key Regional Takeaways:

North America Mobile Phone Accessories Market Analysis

The market for mobile phone accessories in North America is growing rapidly because of factors like high usage rate of smartphones, breakthroughs in technology, and increased consumer demand for personalized products. Phone covers, chargers, wireless headphones, and screen protectors are highly sought after in the region since the US and Canada have some of the highest smartphone penetration rates in the world. It has been noted that there is an increased demand for additional accessories that improves user experiences due to increasing focus on innovations like wireless charging, 5G smartphones, and high-quality camera capabilities. Aside from this, there is a desire for customized accessories as North American customers increasingly want to personalize their mobile devices, which fuels the market expansion.

U.S. Mobile Phone Accessories Market Analysis

The United States held the highest market share in North America in 2024, with a share of about 88.00%. In the US, the market for mobile phone accessories is revolutionizing the economy by encouraging innovation and growth. The NPD Group performed a proprietary consumer survey that provided information on smartphone users' charging habits. According to the survey, 88% of participants who bought a smartphone over the previous 12 months in the United States reported using a wired charger. Additional charging options included power banks (19%), wireless chargers (28%), and automobile chargers (46%). Accessories like wireless chargers, sturdy cases, and high-performance headphones are increasing customer happiness and convenience owing to developments in wireless technology and materials. The United States is also becoming a pioneer in sustainable technology owing to innovations in eco-friendly materials and adaptable designs. In order to maintain global competitiveness and strengthen local economies, major corporations are collaborating with domestic suppliers. For example, manufacturers in Ohio concentrate on producing high-quality screen protectors, while entrepreneurs in New York are developing stylish, multipurpose accessories. By addressing important infrastructural gaps, this sector is also improving connection in rural regions via power banks and signal boosters. In addition to satisfying customer needs, mobile phone accessories are bolstering the nation's status in the international IT industry.

Asia Pacific Mobile Phone Accessories Market Analysis

The market for mobile accessories in Asia Pacific is expanding rapidly because of the increasing appeal of smartphones and a need for supplementary goods that improve the experience of users. The market in the region is dominated by large mobile phone makers like Samsung, Xiaomi, and Huawei, which is driving up the demand for accessories. The market for wireless accessories is expanding due to factors like the widespread use of 5G, wireless charging, and Bluetooth technologies, as well as growing disposable incomes and customer preferences for high-end, fashionable goods. Additionally, customers now can easily acquire a wide range of mobile accessories at affordable costs because to the growth of e-commerce platforms. Southeast Asia is at the forefront of digital transformation, according to a new analysis by Facebook and Bain & Company (Meta 2021). The gross merchandise value (GMV) of the region's e-commerce industry has the potential to reach USD 254 billion over the next five years, suggesting that the industry is on track for considerable expansion. Since the end of 2021, when its worth was USD 132 billion, it has roughly doubled. Also, there has been a demand for gaming controllers and specialized accessories because of the region's increasing acceptance of mobile gaming and streaming. Eco-friendly items are becoming increasingly common as people grow more conscious of sustainability.

Europe Mobile Phone Accessories Market Analysis

The European mobile accessories industry is being pushed by a number of reasons, including strong smartphone adoption and rising consumer demand for personalized and premium accessories. 90% of Europeans now use mobile phones, according to GSMA. Demand for compatible accessories like wireless earphones, power banks, and smartwatches is growing as 5G technology, wireless charging, and Bluetooth connectivity become more widely used. A growing desire for eco-friendly mobile accessories has also resulted from the region's emphasis on sustainability, which encourages buyers to look for goods made of biodegradable materials. The market for mobile accessories is growing as a consequence of the development of e-commerce platforms and the popularity of online shopping, which facilitates consumer access to a large selection of goods.

Latin America Mobile Phone Accessories Market Analysis

The high penetration of smartphones in Latin America, especially in major markets such as Brazil, Mexico, and Argentina, is driving the market for mobile accessories. The usage of supplementary accessories, such as phone covers, chargers, and headphones, is growing with the use of smartphones. In 2023, mobile technology and services added USD 520 billion in economic value added, or 8% of Latin America's GDP, GSMA reported. Also, the trend toward digitization due to the growth in social media, mobile gaming, and mobile payments is driving the expansion of the market. Notably, the Ministry of Culture of Argentina reported that 70% of new users play video games, and over 60% of them would rather do so on smartphones, which further increases the demand for gaming accessories like controllers and specialized earphones. Consumer spending on mobile accessories has been rising in the region with an increasingly middle-class population and enhanced internet and mobile connectivity. E-commerce platforms have also been instrumental in broadening market reach, thereby providing easy access to consumers of a wide range of affordable and stylish accessories.

Middle East and Africa Mobile Phone Accessories Market Analysis

The Middle East and Africa (MEA) mobile phone accessories market is growing rapidly because of the increasing demands for improved mobile experiences via emerging technologies. In the region, countries such as the UAE and Saudi Arabia have the highest rates of smartphone penetration, which is indirectly propelling the demand for accessories, such as wireless chargers, protective cases, and earphones. According to sources, the UAE's TRA notes that mobile penetration in the region is at 204%, as well as intense competition amongst telecom operators Etisalat and Du is driving innovative efforts that target increased data uptake and increased mobile accessory adoption because operators are looking to gain revenue in a bid for reduced ARPU. The innovative mobile accessories, the smart wearables, as well as gaming accessories, further present another momentum area where this product is gaining more attraction based on consumer interest toward these tech-driven products.

Competitive Landscape:

Key players in the market are focusing on innovation, product diversification, and strategic partnerships to maintain their competitive edge. They are continuously releasing new accessory lines that complement their latest smartphone models, such as wireless chargers, MagSafe accessories, and high-quality cases. Besides this, some companies are expanding their portfolios by introducing products that support fast charging, including wireless chargers, power banks, and car charging solutions, while also developing new Bluetooth earphones and other wearable tech accessories. Apart from this, they are introducing phone protection by offering durable cases and accessories with enhanced features, such as antimicrobial coatings. Additionally, these players are investing in e-commerce platforms and leveraging online retail channels to reach consumers more effectively.

The report provides a comprehensive analysis of the competitive landscape in the mobile phone accessories market with detailed profiles of all major companies, including:

- Apple Inc.

- Bose Corporation

- Energizer Holdings Inc.

- JVCKENWOOD Corporation

- Kingston Technology Corporation

- Panasonic Corporation

- Plantronics Inc.

- Samsung Electronics Co. Ltd.

- Sennheiser electronic GmbH & Co. KG

- Sony Corporation

- Western Digital Corporation

- Xiaomi Inc.

Latest News and Developments:

- July 2024: Onsitego expanded its portfolio by introducing Juice, a brand focused on mobile phone accessories. The launch spans across India, aiming to cater to the growing demand for high-quality yet affordable smartphone add-ons. Juice offers a variety of products, including charging solutions and protective gear, promising durability and style. This move positions Onsitego as a comprehensive player in the smartphone care and accessories market.

- July 2024: CMF, a sub-brand of Nothing, unveiled its first smartphone, the CMF Phone 1, emphasizing innovative repairability. The phone features a sleek design with a replaceable back panel, secured by stainless steel screws for easy maintenance. It combines functionality with style, reflecting the brand’s commitment to sustainability and user-friendly technology. This launch aligns with CMF's vision of creating accessible and practical tech solutions.

- June 2024: Samsung revealed a new range of smartphone accessories inspired by the Paris 2024 Olympic Games. These accessories are designed with unique color schemes that celebrate the spirit of the global event. The collection includes cases, straps, and chargers, merging aesthetics with functionality. This initiative reinforces Samsung’s brand presence by associating with major international events.

- August 2023: Taiwanese electronics manufacturer Foxconn plans to invest up to USD 500 Million to establish a new facility near Kempegowda International Airport in Bengaluru, India, dedicated to producing smartphone accessories. This initiative is part of Foxconn's broader strategy to expand its presence in India, encompassing sectors from semiconductors to electric vehicles. The company aims to leverage India's growing electronics market and strengthen its global supply chain resilience.

- January 2022: iQmetrix, a retail management solutions provider, announced a partnership with Ice Mobility, a distributor and manufacturer of wireless accessories. This collaboration integrates Ice Mobility's wireless accessory distribution and Vendor Managed Inventory (VMI) services with iQmetrix's retail management systems. The partnership aims to ensure that retailers have timely access to essential products, enhancing inventory efficiency and customer satisfaction.

Mobile Phone Accessories Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Headphone/Earphone, Portable Speaker, Charger, Memory Card, Power Bank, Protective Case, Screen Guards, Popsockets, Others |

| Price Ranges Covered | Premium, Mid, Low |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Apple Inc., Bose Corporation, Energizer Holdings Inc., JVCKENWOOD Corporation, Kingston Technology Corporation, Panasonic Corporation, Plantronics Inc., Samsung Electronics Co. Ltd., Sennheiser electronic GmbH & Co. KG, Sony Corporation, Western Digital Corporation, Xiaomi Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the mobile phone accessories market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global mobile phone accessories market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the mobile phone accessories industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mobile phone accessories market was valued at USD 94.4 Billion in 2024.

The mobile phone accessories market is projected to exhibit a CAGR of 4.63% during 2025-2033, reaching a value of USD 142.3 Billion by 2033.

The market is driven by increasing smartphone adoption, rapid technological advancements in mobile devices, growing consumer demand for personalization, rising disposable incomes, and the convenience of online shopping.

Asia Pacific currently dominates the mobile phone accessories market, accounting for a share of 46.9% in 2024. The dominance is fueled by rising smartphone penetration, affordable accessories, tech-savvy consumers, and the growing e-commerce sector in the region.

Some of the major players in the mobile phone accessories market include Apple Inc., Bose Corporation, Energizer Holdings Inc., JVCKENWOOD Corporation, Kingston Technology Corporation, Panasonic Corporation, Plantronics Inc., Samsung Electronics Co. Ltd., Sennheiser electronic GmbH & Co. KG, Sony Corporation, Western Digital Corporation, and Xiaomi Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)