Molecular Sieves Market Size, Share, Trends and Forecast by Type, Material Type, Application, Shape, Size, End-Use Industry, and Region, 2026-2034

Molecular Sieves Market Size and Share:

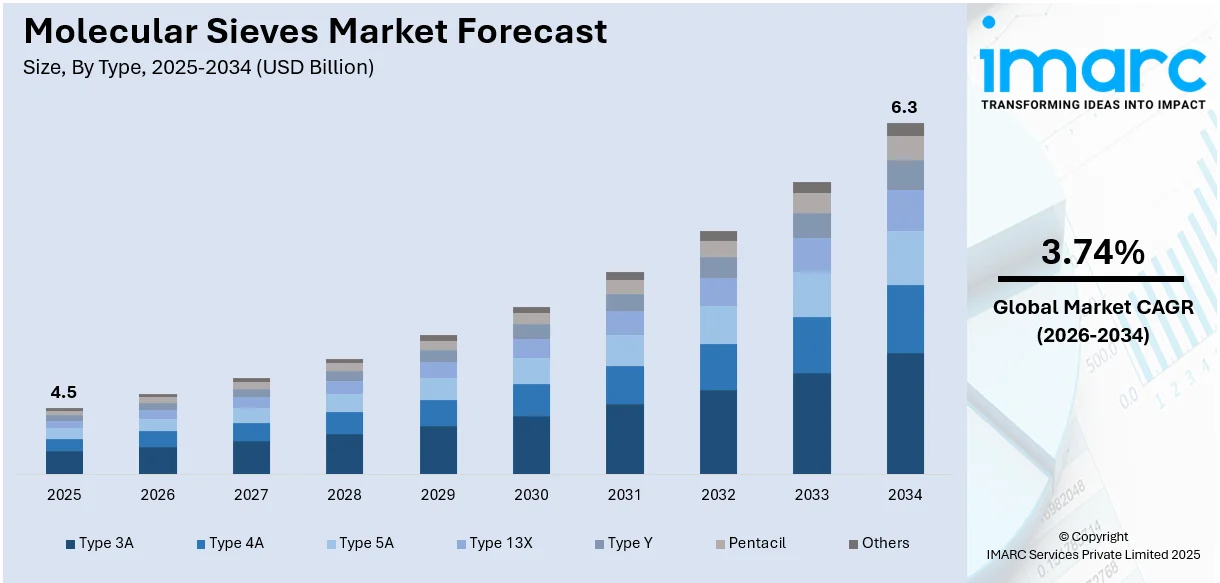

The global molecular sieves market size reached USD 4.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 6.3 Billion by 2034, exhibiting a growth rate (CAGR) of 3.74% during 2026-2034. Asia Pacific currently dominates the molecular sieves market with a 33.4% share in 2025. This dominance is driven by rapid industrialization, growing petrochemical and water treatment sectors, and increasing demand for efficient purification solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 4.5 Billion |

|

Market Forecast in 2034

|

USD 6.3 Billion |

| Market Growth Rate (2026-2034) | 3.74% |

The molecular sieves market is being propelled by the increasing product demand from industries for efficient gas separation and purification processes. Molecular sieves are widely used in adsorption applications due to their superior adsorption capabilities coupled with selectivity including natural gas dehydration and oxygen generation, among others. This trend is further supported by clean energy utilization, stringent environmental regulations, and expansion of industrial sectors across the globe. Furthermore, advancements in molecular sieve technologies bring an improvement in their efficiencies, making them indispensable for making quality industrial outputs with cheaper and less environmental impacts to running costs. For instance, in 2024, Honeywell's Ecofining technology enables St1's Gothenburg biorefinery to produce 200,000 tons of SAF and renewable fuels annually, reducing CO₂ emissions by 500,000 tons using flexible feedstocks like cooking oil and animal fats. This technology relies on advanced molecular sieve systems to enhance the production of sustainable aviation fuel (SAF) and other renewable fuels.

To get more information on this market Request Sample

The United States plays a pivotal role in the molecular sieves market, driven by its advanced industrial infrastructure and significant focus on innovation. As a leading producer and consumer, the US supports market growth through extensive applications in petrochemicals, natural gas processing, and air separation technologies. Investments in research and development enhance the efficiency and performance of molecular sieves, catering to stringent environmental regulations and energy optimization demands. For instance, in 2024, Honeywell will provide adsorption-based technology for Mozambique's Rovuma LNG project, enabling water, CO2, and hydrocarbon removal, supporting ExxonMobil's 18 Mtpa production via modular trains and enhancing global energy accessibility. Furthermore, the country’s robust manufacturing base and export capabilities ensure a steady supply of high-quality molecular sieves to global markets, reinforcing its position as a key contributor to the industry's expansion.

Molecular Sieves Market Trends:

Increasing Demand in the Petrochemical Industry

The primary driver for the global market is the growing demand in the petrochemical industry. Molecular sieves are critical to refining processes, where they are used for drying and purifying various hydrocarbon streams and gases. Their high selectivity and efficiency in separating molecules based on size make them indispensable for ensuring the purity of final products. With the growth of the petrochemical sector, in particular in developing economies, the demand for molecular sieves is on the rise. This is because countries like India are attracting investment in the petrochemical industry. For instance, according to the Ministry of Petroleum & Natural Gas, the Indian Government, the petrochemical sector in India is projected to attract investments exceeding USD 87 Billion in the next decade, representing over 10% of global petrochemical growth. Under the new PCPIR Policy 2020-35, a combined investment of INR 10 lakh crore (approximately USD 142 Billion) is targeted by 2025, underscoring the government's long-term vision for the industry. This trend is further fueled by advancements in refining technologies and the growing need for cleaner, more efficient fuel processing methods. As such, the market is steadily growing as a result of the continuous quest for operational efficiency and regulatory compliance within the petrochemical industry.

Advancements in Water Treatment Technologies

The other major driving factor behind the market is their rising applications in water treatment technologies. With the growing demand for clean and safe water globally, molecular sieves are increasingly becoming a favorite choice for purifying and decontaminating water. They have a very high adsorption capacity and are known to target particular molecular sizes, which makes them highly effective in the treatment of water for a wide range of industrial and municipal applications. According to an industrial report, the gap between global water supply and demand is projected to reach 40% by 2030. Moreover, water management practices that are termed to be sustainable and the various norms regarding water quality are, on the other hand, generating much demand for molecular sieves in water treatment plants. It is not only across the developed regions, but it also dominates the developing countries facing problems of water scarcity and environmental pollution.

Expansion of Green and Sustainable Practices

Another key reason driving the market is that the world is shifting more towards sustainability and green practices. Molecular sieves hold a crucial position in numerous eco-friendly processes, including carbon capture and green chemistry applications. Through selective adsorption of gases and organic compounds, they help reduce emissions as well as increase energy efficiency in various industrial processes, which aligns with the increasing pressure from regulations and corporate commitments for environmental sustainability. Further, new, more efficient types of molecular sieves, which are environmentally friendly, also catalyze market growth. This trend is more pronounced in automotive and renewable energy industries where molecular sieves are used to reduce pollution in fuel evaporation control systems and assist in the storage and purification processes in renewable energy, respectively. For instance, in 2024, Honeywell's UOP eFining™ technology was selected by Jiutai Group to produce 100,000 tons of sustainable aviation fuel annually from eMethanol, reducing greenhouse gas emissions by 88% versus conventional jet fuel.

Molecular Sieves Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global molecular sieves market, along with forecast at the global, regional, and country levels from 2026-2034. Our report has categorized the market based on type, material type, application, shape, size, and end-use industry.

Analysis by Type:

- Type 3A

- Type 4A

- Type 5A

- Type 13X

- Type Y

- Pentacil

- Others

Type 3A leads the market with around 38.2% of the market share in 2025. Type 3A has pore sizes of about 3 angstroms. They can thus be used to selectively adsorb water and exclude larger molecules, for example. This characteristic is thus excellent for industries that involve the use of such materials where drying and dehydration must be ensured, for instance in the drying of unsaturated hydrocarbons, ethanol, and refrigerants. Their market segment is based on their efficiency in applications requiring the removal of stringent moisture. They are widely adopted in both industrial and laboratory settings.

Analysis by Material Type:

- Carbon

- Clay

- Porous Glass

- Silica Gel

- Zeolite

- Others

Zeolite leads the market with around 37.2% of the market share in 2025. The zeolite market has the highest share mainly due to the excellent versatility and efficiency that zeolites offer in the process of adsorption and catalysis. There are many applications for zeolites, ranging from refining in petrochemical plants, water treatment, air purification, to name just a few. Its very structure of pores and higher thermal stability make it perfect in a variety of complex separation and catalytic processes. The reason for the prevalence of zeolites in markets is their extensive industrial applications and continuous research with discoveries of new and innovative ways.

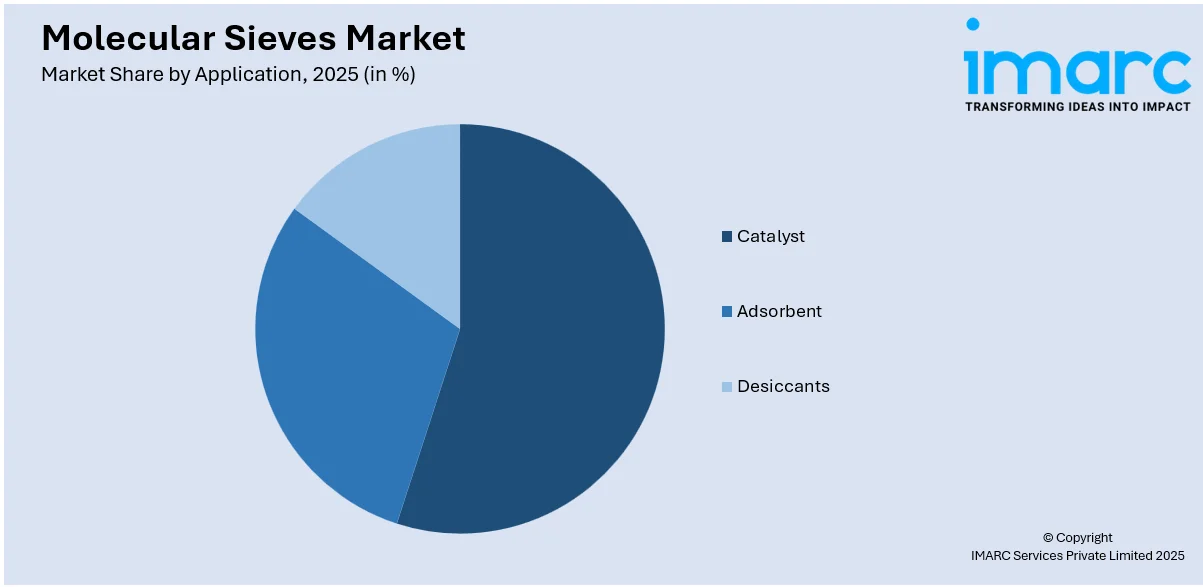

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Catalyst

- Adsorbent

- Desiccants

Catalyst is used in large amounts in multiple chemical and refining reactions, making them an important application in the market. They play a fundamental role for processes in petrochemical products where crucial reactions are taken place that can be hydrocracking, fluid catalytic cracking, among others. The use of these materials in improving reaction rates and selectivity while allowing reusability and excellent thermal stability makes them indispensable for industrial catalysis. Ongoing research and development in catalytic processes continue to improve efficiency and environmental sustainability, which supports the growth of this segment.

The adsorbent segment is another key area in the market, which is characterized by the use of these materials in separation and purification processes. They are highly efficient at adsorbing specific molecules from liquid or gas mixtures, making them essential in applications such as gas purification, water treatment, and air separation. This growth is due to the flexibility and high efficiency of molecular sieves as adsorbents for capturing a wide range of molecular species. The use of these materials in environmental applications, like pollutant removal and carbon capture, contributes significantly to the expansion of this market segment.

The desiccants involve a type of application of moisture control and drying. This kind of material is efficient in absorbing water vapor in the air and gases; these applications are essential to ensure the protection of products and processes against moisture damage. Pharmaceutical, electronics, and food industries utilize desiccants based on molecular sieves since they require maintaining very low humidity. This demand is driven by the requirement for good moisture control solutions in industries and superior performance as to other desiccating materials.

Analysis by Shape:

- Pelleted

- Beaded

- Powdered

Pelleted lead the market with around 48.2% of the market share in 2025. The pelleted segment occupies the largest market share mainly because of the ease in handling and operational efficiency that this form offers. Pelleted is widely used in industrial applications where large-scale adsorption or catalytic processes are involved, such as in petrochemical refining and air purification systems. Their uniform shape ensures consistent flow and contact with gases or liquids, thereby enhancing process efficiency. This segment is dominated by the fact that pelleted molecular sieves are widely used in industry, they are durable, and they can be used for a wide range of large-scale applications.

Analysis by Size:

- Microporous

- Mesoporous

- Macroporous

The microporous consists of pores with a diameter below 2 nanometers. Sieves in this class work exceptionally well in terms of their adsorption abilities toward smaller molecules, so applications involve separation of gases, removal of impurities from the air, and processing within the petrochemical industry with cracking and isomerization processes. High specificity and efficiency in sieving small molecules make up for the demand for these microporous molecular sieves, particularly in industries whose activities rely on precision and selectivity. Their significant presence in the market is the result of their extensive usage in a multitude of industrial procedures requiring the separation of fine molecules.

The pores of mesoporous molecular sieves range from 2 to 50 nanometers. These are primarily used in applications where bigger molecules have to be adsorbed. They have significant values in the chemical industry, especially in catalysis and separation processes. In the pharmaceutical industry, they have been used to design drug delivery systems. The large pore size will allow the adsorption and catalysis of bigger organic and inorganic molecules, thus making them quite ideal for industrial applications. The growth in this segment is because of their unique properties that are ideal for specialized applications that microporous sieves cannot fulfill.

The macroporous segment has the pore size more than 50 nanometers. These sieves are used in applications requiring a large amount of adsorbable particle and molecules' size, for example, filtration in water treatment to remove heavy metals and other sizeable contaminants and in food companies for filtration purposes. Their macro-porous size makes the sieves less selective for microporous and mesoporous sieves but for applications involving large molecules or large particles. The utility of macroporous molecular sieves in industries, where large-scale filtration and adsorption is required, supports the market.

Analysis by End-Use Industry:

- Oil and Gas Industry

- Agricultural Industry

- Chemical Industry

- Pharmaceutical Industry

- Water Treatment Industry

- Construction Industry

- Others

Oil and gas industry leads the market with around 34.5% of the market share in 2025. The oil and gas segment accounts for the largest size of the market as they are essential in various uses such as refining processes, purifying natural gas, and making petrochemicals. The desiccants find application to dry and dehydrate impurities from hydrocarbon streams which improves the quality of products and their efficiency as well. This demand is driven by the expansion of the global energy sector and the need for more efficient and environmentally friendly refining technologies. The versatility and high performance of molecular sieves in handling various hydrocarbons under demanding conditions cement their dominant position in the oil and gas industry.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia Pacific accounted for the largest market share of over 33.4%. The Asia Pacific region stands as the largest segment in the market, primarily due to rapid industrialization and significant growth in key sectors such as petrochemicals, water treatment, and pharmaceuticals across countries like China, India, and Japan. The expanding manufacturing sector, driven by strong economic growth and infrastructural advancements, further accelerates the adoption of molecular sieves in the region. Growing environmental concerns and stringent regulatory requirements regarding clean water and air quality are encouraging industries to integrate efficient filtration and purification systems. Additionally, increasing demand for clean water, rising urbanization, and investments in industrial development are further fueling market growth. The region’s large-scale adoption of molecular sieves highlights its critical role in sustainable industrial processes.

Key Regional Takeaways:

United States Molecular Sieves Market Analysis

US accounts for 89.5% share of the market in North America. The United States' thriving industrial landscape makes it a significant market for molecular sieves. A major factor in the need for molecular sieves for gas separation and drying operations is the petrochemical industry. In hydrogen purification and CO₂ capture technologies, molecular sieves are essential as the United States moves towards cleaner energy practices. Additionally, the rise in shale gas has increased demand, especially for natural gas processing applications including dehydration. The use of molecular sieves in drug formulation and packaging to regulate humidity is expanding in the pharmaceutical and healthcare industries. According to an industrial report, in 2021, the pharmaceutical sector in the United States brought in USD 550 Billion and Americans spent a whopping USD 576.9 Billion on medications. The United States is projected to spend between USD 605 and USD 635 Billion on healthcare. This makes the application significant. Furthermore, growing molecular sieve uses in environmental settings, such as wastewater treatment, are consistent with sustainability and federal environmental requirements. Opportunities are constantly being created by advancements in zeolite-based molecular sieves, particularly in catalysis. Strong R&D expenditures, an emphasis on high-performance materials, and cooperation between businesses and academic institutions all help the U.S. market. The market for molecular sieves in the United States is expected to increase steadily due to rising demand from a variety of industries, government initiatives to promote industrial efficiency and technical advancements.

Europe Molecular Sieves Market Analysis

The market for molecular sieves in Europe is fuelled by strict environmental laws and a strong emphasis on sustainability. Molecular sieves are widely used for drying, purification, and catalysis applications in important sectors like petrochemicals, pharmaceuticals, and environmental services. Molecular sieves are essential to CO₂ capture technologies, which are in high demand due to the EU's Green Deal, which places a strong emphasis on lowering emissions. The market is further boosted by the expansion of the pharmaceutical industry, especially in Germany and Switzerland. Germany is one of the top countries in the world for pharmaceutical manufacture, according to data from Germany Trade and Invest. The volume of pharmaceutical production reached EUR 34.6 billion (USD 36.4 billion) in 2021, representing a 6.9 percent increase from the previous year. Germany is one of the largest pharmaceutical production hubs in the European Union, along with Belgium and Italy. Molecular sieves are crucial for preserving product stability during the production and storage of drugs. The use of molecular sieves in the field of renewable energy, such as hydrogen purification and biogas upgrading, is also growing in Europe. European producers are creating sophisticated zeolite sieves with a significant emphasis on research and innovation to increase productivity and broaden applications. The region's commitment to environmental sustainability and technological leadership positions it as a significant contributor to the global molecular sieves market.

Asia Pacific Molecular Sieves Market Analysis

The market for molecular sieves is expanding at the quickest rate in Asia-Pacific due to the region's rising urbanisation and industrialisation. Molecular sieves for gas drying and separation are widely used by the region's leading chemical and petrochemical industries, especially in China and India. The need for these materials has increased because of increased energy demand driving natural gas processing activities. Molecular sieves are utilized for product stability and moisture control in the pharmaceutical and food packaging industries in Asia-Pacific, which also make substantial contributions. There are further potential prospects due to the increasing use of renewable energy sources like hydrogen and biogas in nations like South Korea and Japan. Approximately 9% of South Korea's electricity generation came from renewable sources in 2022, according to the Renewable Energy Institute. By 2030, this percentage is expected to rise to 21.6%, and by 2036, it will reach 30.6%. This is expected to bolster the market growth in the country. Asia-Pacific is a desirable market for producers of molecular sieves due to its low manufacturing costs and supportive government policies for industrial expansion. APAC is also expected to maintain strong growth due to its expanding industrial base and focus on sustainable practices.

Latin America Molecular Sieves Market Analysis

The thriving oil and gas sector in Latin America, especially in Brazil and Mexico, is driving growth in the market for molecular sieves. According to IEA data, Latin America, and the Caribbean (LAC) is well-placed to produce low-emissions hydrogen and its derivatives, building on its abundant natural and renewable energy resources and largely decarbonised electricity mix (of which 60% comes from renewables). In 2023, hydrogen demand in the region reached 4 Mt, mostly for use in oil refining and chemical manufacturing. Almost 90% is produced using natural gas, which contributes to the region’s reliance on imports. In keeping with the region's emphasis on boosting energy exports, molecular sieves are essential for the dehydration and separation operations of natural gas. Driven by expanding consumer markets and advancing industrial infrastructure, the food packaging and pharmaceutical industries are likewise becoming more significant providers. The use of molecular sieves in air purification and wastewater treatment applications is being encouraged by environmental legislation. Opportunities for the adoption of molecular sieves are presented by the economic growth and government initiatives to modernise industry in Latin America. Despite being smaller than in other areas, the market is growing steadily because of growing industrialization and environmental consciousness.

Middle East and Africa Molecular Sieves Market Analysis

The oil and gas sector is the main driver of the market for molecular sieves in the Middle East and Africa. According to an industrial report, energy investment in the Middle East is expected to reach approximately USD 175 Billion in 2024, with clean energy accounting for around 15% of the total investment. Molecular sieves are widely used in the petrochemical and natural gas processing industries in nations like Saudi Arabia and the United Arab Emirates. The region's water shortage has raised the demand for molecular sieves in water treatment and desalination systems. Furthermore, the expansion of South Africa's pharmaceutical sector is increasing demand for molecular sieves for drug packaging and storage. The market for molecular sieves is anticipated to rise steadily as the area makes investments in sustainable practices and industrial modernization.

Competitive Landscape:

Key players in the market are actively engaged in research and development to innovate and enhance the efficiency of their products. These efforts are particularly focused on increasing adsorption capacity, improving selectivity for specific molecules, and developing environmentally sustainable solutions. Many companies are expanding their global presence through strategic partnerships, mergers, and acquisitions, aiming to enhance their market reach and capitalize on emerging market opportunities, especially in regions such as Asia Pacific and the Middle East. Additionally, these players are investing in production capacity expansion to meet the growing demand from various industries such as oil and gas, pharmaceuticals, and water treatment. This focus on innovation, expansion, and sustainability is pivotal to maintaining their competitive edge in the changing molecular sieves market. For instance, in October 2024, Axens, IFPEN, and JEPLAN announced the commercialization of Rewind PET, enabling global licensing of PET glycolysis-based depolymerization technology. This process involves the continuous breakdown of PET into BHET (Bis(2-Hydroxyethyl) terephthalate), followed by its purification. Molecular sieves play a critical role in this stage, ensuring the removal of water and impurities to achieve high-purity BHET.

The report provides a comprehensive analysis of the competitive landscape in the molecular sieves market with detailed profiles of all major companies, including:

- Axens

- BASF SE

- Bear River Zeolite Company (USAC)

- Caledon Laboratories Limited

- CECA (Arkema)

- Clariant Produkte (Schweiz AG)

- Honeywell UOP

- Interra Global Corporation

- KNT Group

- Merck & Co.

- Sorbead India

- Tosoh Corporation

- Zeochem AG (Cph Chemie & Papier)

Recent Developments:

- August 2024: Luoyang Jalon Micro-Nano New Materials Co., Ltd., a leader in molecular sieve solutions, showcased its advanced products at OGA 2024 in Kuala Lumpur, Malaysia. This exhibition highlighted Jalon's innovative solutions for the energy and gas industries, emphasizing applications in gas separation and purification. The event, held at the Kuala Lumpur Convention Centre, provided a platform for the company to connect with global industry players and explore collaborative opportunities.

- September 2023: Axens, Paul Wurth, and IFPEN agreed to collaborate on the development of reverse water gas shift technology (RWGS) and how to best integrate it into e-fuel projects.

- June 2023: BASF SE announced that it will expand its ability to produce alkyl polyglucosides (APGs) globally by building two new facilities in Bangpakong, Thailand, and Cincinnati, Ohio. By expanding simultaneously in two regions, BASF will be able to reduce cross-regional volume flows while meeting the growing demand for bio-based surfactants and providing clients with an even quicker and more flexible service.

- October 2022: Clariant Produkte (Schweiz AG) stated it has successfully acquired the Attapulgite business assets of BASF located in the United States for a cash payment of USD 60 million.

Molecular Sieves Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Type 3A, Type 4A, Type 5A, Type 13X, Type Y, Pentacil, Others |

| Material Types Covered | Carbon, Clay, Porous Glass, Silica Gel, Zeolite, Others |

| Applications Covered | Catalyst, Adsorbent, Desiccants |

| Shapes Covered | Pelleted, Beaded, Powdered |

| Sizes Covered | Microporous, Mesoporous, Macroporous |

| End-Use Industries Covered | Oil and Gas Industry, Agricultural Industry, Chemical Industry, Pharmaceutical Industry, Water Treatment Industry, Construction Industry, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Axens, BASF SE, Bear River Zeolite Company (USAC), Caledon Laboratories Limited, CECA (Arkema), Clariant Produkte (Schweiz AG), Honeywell UOP, Interra Global Corporation, KNT Group, Merck & Co., Sorbead India, Tosoh Corporation, Zeochem AG (Cph Chemie & Papier), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, molecular sieves market forecast, and dynamics of the market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global molecular sieves market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the molecular sieves industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The molecular sieves market was valued at USD 4.5 Billion in 2025.

The molecular sieves market is projected to exhibit a CAGR of 3.74% during 2026-2034, reaching a value of USD 6.3 Billion by 2034.

The molecular sieves market is majorly driven by rising demand for industrial gas drying, increasing use in water treatment, growth of petrochemical and pharmaceutical industries, and stringent environmental regulations. Additionally, advancements in energy-efficient processes and expanding applications in air separation, refining, and packaging.

Asia Pacific currently dominates the market, accounting for a share of around 33.4%. The dominance is driven by growing demand in petrochemicals, rising industrialization, increasing energy-efficient technologies, expanding healthcare applications, environmental regulations, and rapid urbanization in developing countries.

Some of the major players in the molecular sieves market include Axens, BASF SE, Bear River Zeolite Company (USAC), Caledon Laboratories Limited, CECA (Arkema), Clariant Produkte (Schweiz AG), Honeywell UOP, Interra Global Corporation, KNT Group, Merck & Co., Sorbead India, Tosoh Corporation, and Zeochem AG (Cph Chemie & Papier), among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)