Mother and Child Healthcare Market Report by Services (Pre-Natal Services, Birthing Services, Post-Natal Services, Fertility Services), Maternal Age (Under 20 Years, 21 to 30 Years, 31 to 38 Years, 39 and above Years), Location (Hospitals, Nursing Homes and Clinics, In-home Services, and Others), and Region 2026-2034

Mother and Child Healthcare Market Overview:

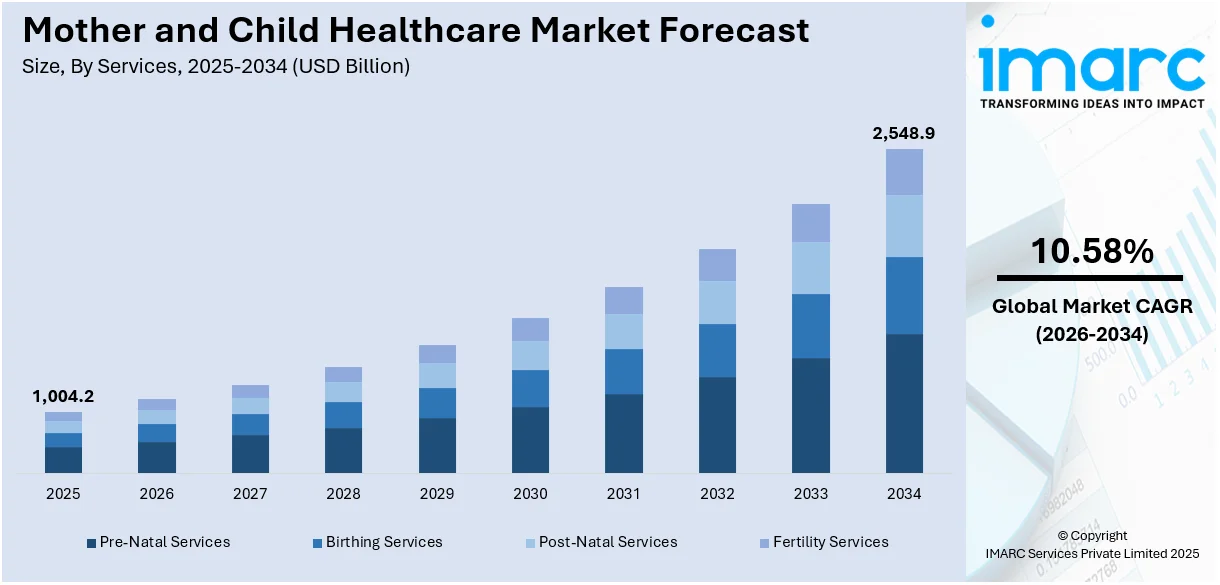

The global mother and child healthcare market size reached USD 1,004.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2,548.9 Billion by 2034, exhibiting a growth rate (CAGR) of 10.58% during 2026-2034. The market is driven by the growing adoption of digital health solutions, as they improve accessibility, efficiency, and patient engagement, increasing healthcare spending, which plays a vital role in advancing maternal and child healthcare by enhancing access and quality of healthcare services, and rising reliance on healthcare insurance coverage.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1,004.2 Billion |

|

Market Forecast in 2034

|

USD 2,548.9 Billion |

| Market Growth Rate 2026-2034 | 10.58% |

Mother and Child Healthcare Market Analysis:

- Major Market Drivers: The rising adoption of mother and child healthcare services and willingness among parents to seek opinion from super-specialists are bolstering the market growth.

- Key Market Trends: The growing number of women suffering from immunodeficiency virus, along with various government initiatives to enhance public health, is positively influencing the market.

- Geographical Trends: North America holds the largest segment because of its advanced healthcare infrastructure and ongoing innovations in technology.

- Competitive Landscape: Some of the major market players in the mother and child healthcare industry include Apollo Cradle, Arrowhead Regional Medical Center, ChristianaCare, Cincinnati Children's Hospital Medical Center, Cleveland Clinic, Cloudnine Group of Hospitals, FMCH India, King Faisal Specialist Hospital & Research Centre (KFSHRC), Koninklijke Philips N.V., Medela, Riley Children's Health, The Carle Foundation, among many others.

- Challenges and Opportunities: While the market faces challenges like supplying of drugs and medicines in remote areas, it also encounters opportunities, such as the easy availability of digitized claim processing.

To get more information on this market Request Sample

Mother and Child Healthcare Market Trends:

Growing adoption of digital health

As per the IMARC Group’s report, the global digital health market reached US$ 421.7 Billion in 2023. Digital health platforms involve the use of remote communications and information technologies in the provision of healthcare to pregnant women or parents of young children, which improves access to healthcare services, especially in rural or underserved areas, and reduces barriers to timely medical advice. In addition, maternal and pediatric health status is constantly monitored by wearable devices and mobile health apps during pregnancy and after the birth of a child. Besides this, parents have easy access to information and resources from digital platforms concerning maternal and childhood health, enabling them to learn about pregnancy, child growth, feeding, and healthcare.

Rising healthcare spending

High healthcare spending is leading to the development of infrastructure, facilities and easy access to maternal and child health care services, encompassing antenatal care, obstetrics, gynecology services, neonatal, child health care, and specialized treatments. In addition, increasing healthcare spending allows for investments in training healthcare professionals, improving clinical practices, and implementing quality assurance measures, which is leading to improved healthcare, increase in patient safety, and better health of mothers and children. In line with this, healthcare spending promotes the goal of preventive healthcare, including maternal and child health like vaccinations, prenatal testing, nutritional education, and birth control, thereby influencing the mother and child healthcare market revenue. According to the content updated on the website of the Centers for Medicare & Medicaid Services in 2024, the health spending share of GDP is forecasted to grow from 17.3 percent in 2022 to 19.7 percent in 2032.

Increasing reliance on healthcare insurance coverage

Health insurance helps to increase the utilization of essential maternal and child health care services, such as prenatal, childbirth services, postpartum care, and pediatric care. People with insurance embrace the importance of early and regular medical and preventive care services. Additionally, many insurance plans offer preventive care services which are important for the health of mothers and children like prenatal and newborn care, vaccinations and family planning services. Coverage for preventive care reduces long-term healthcare costs by preventing complications and chronic diseases. The IMARC Group’s report shows that the global health insurance market is expected to reach US$ 3,208.4 Billion by 2032.

Mother and Child Healthcare Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our mother and child healthcare report has categorized the market based on services, maternal age, and location.

Breakup by Services:

- Pre-Natal Services

- Birthing Services

- Post-Natal Services

- Fertility Services

Post-natal services account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the services. This includes pre-natal services, birthing services, post-natal services, and fertility services. According to the report, post-natal services represent the largest segment.

Post-natal services include numerous deliverables of medical nature, nutritional support, and counseling tailored to address the specific needs of mothers and newborns. Moreover, post-natal care comprises frequent follow-up visits to observe the health of the mother and newborn. Additionally, post-natal services encompass breastfeeding and lactation consultation which are essential in meeting the needs of the newborns. Besides medical treatment, post-natal services incorporate counseling, representing diverse aspects, including childcare information and preventive immunizations, family planning education to empower parents with essential knowledge and skills for nurturing their children development.

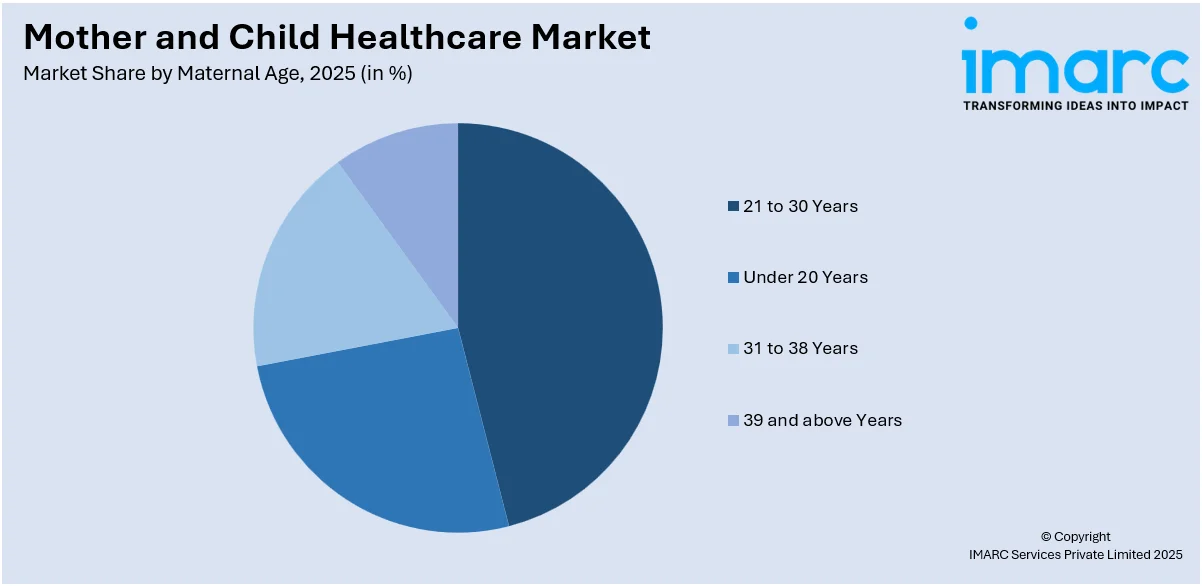

Breakup by Maternal Age:

Access the comprehensive market breakdown Request Sample

- Under 20 Years

- 21 to 30 Years

- 31 to 38 Years

- 39 and above Years

21 to 30 years hold the largest share of the industry

A detailed breakup and analysis of the market based on the maternal age have also been provided in the report. This includes under 20 years, 21 to 30 years, 31 to 38 years, and 39 and above years. According to the report, 21 to 30 years account for the largest market share.

People in this age group normally represent a large percentage of the population either planning or within their childbearing age, which directly relates to the provision of prenatal care, childbirth and postnatal care, as this age of women generally have higher fertility rates compared to older age groups. Additionally, women within the age of 20 are generally considered to be in their peak reproductive years, characterized by optimal fertility and lower risks related to pregnancy and childbirth complications compared to older age women, thus driving the mother and child healthcare demand.

Breakup by Location:

- Hospitals

- Nursing Homes and Clinics

- In-home Services

- Others

The report has provided a detailed breakup and analysis of the market based on the location. This includes hospitals, nursing homes and clinics, in-home services, and others.

Hospitals offer a range of specialized facilities and departments including maternity wards, labor and delivery units, neonatal intensive care units (NICUs), pediatric departments, and child healthcare clinics. These facilities are equipped with advanced medical technologies and staffed by skilled healthcare professionals, such as obstetricians, gynecologists, pediatricians, neonatologists, and nurses specializing in maternal and child health. Hospitals play a pivotal role in providing prenatal care, childbirth services, postnatal care, pediatric consultations, vaccinations, and treatment for childhood illnesses and injuries.

Nursing homes and clinics play a pivotal role in promoting preventive healthcare practices and early intervention strategies. They facilitate regular monitoring of maternal health during pregnancy, ensure timely screenings and tests for fetal development, and offer guidance on nutrition, prenatal exercises, and childbirth preparation classes. This proactive approach helps in mitigating risks and complications, ultimately strengthening the mother and child healthcare market growth.

In-home services cater directly to the needs of expectant mothers, infants, and young children by delivering healthcare services in the comfort of their homes. This approach is particularly favored for its convenience, allowing families to receive essential healthcare without the need to travel to healthcare facilities, which can be especially beneficial for mothers recovering from childbirth or managing newborns. In-home services encompass a wide range of offerings including postnatal care, breastfeeding support, newborn care, vaccinations, pediatric check-ups, and even specialized care for children with chronic conditions.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest mother and child healthcare market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for mother and child healthcare.

As per an article published on the website of Canadian Institute for Health Information, Canada health care spending reached $344 billion in 2023. With the growing emphasis on preventive care and early intervention, healthcare spending is rising continuously in the region, supporting initiatives aimed at improving maternal and child health outcomes. Moreover, North America has a high level of healthcare expenditure per capita, facilitating extensive prenatal and postnatal care services, including routine check-ups, vaccinations, and early childhood development programs. In line with this, robust public health initiatives and awareness campaigns contribute to higher healthcare utilization rates among expectant mothers and children, further strengthening the market growth.

Competitive Landscape:

Key players are adopting telemedicine, mobile health apps, and remote monitoring tools. They are also investing in research and development (R&D) activities to introduce advanced medications and therapies specific to maternal and pediatric care. In addition, key manufactures are increasing access to maternal and pediatric healthcare services through new clinics, hospitals, and specialized centers. Besides this, mother and child healthcare market recent developments, such as specialized care for high-risk pregnancies, including fetal monitoring and intervention techniques are done by key players. They are implementing quality improvement measures and patient safety protocols to enhance healthcare service delivery. For instance, in 2024, Truveta, the company with a mission of Saving Lives with Data, announced the largest and most complete mother-child electronic health record (EHR) dataset to advance healthcare.

The report provides a comprehensive analysis of the competitive landscape in the global mother and child healthcare market with detailed profiles of all major companies, including:

- Apollo Cradle

- Arrowhead Regional Medical Center

- ChristianaCare

- Cincinnati Children's Hospital Medical Center

- Cleveland Clinic

- Cloudnine Group of Hospitals

- FMCH India

- King Faisal Specialist Hospital & Research Centre (KFSHRC)

- Koninklijke Philips N.V.

- Medela

- Riley Children's Health

- The Carle Foundation

Mother and Child Healthcare Market News:

- October 5, 2023: SingHealth reaffirmed its commitment to maternal and child healthcare in Tamil Nadu, India. This collaborative effort elevates the standards of maternal and child healthcare, ensuring that every mother and child in the state receives the highest quality of medical care and attention.

- March 5, 2024: Arrowhead Regional Medical Center (ARMC) listed as a “Birthing-Friendly” hospital for its commitment to provide evidence-based, high-quality maternity care to women and their families in the Inland Empire.

Mother and Child Healthcare Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Mother and Child Healthcare Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Pre-Natal Services, Birthing Services, Post-Natal Services, Fertility Services |

| Maternal Ages Covered | Under 20 Years, 21 to 30 Years, 31 to 38 Years, 39 and above Years |

| Locations Covered | Hospitals, Nursing Homes and Clinics, In-home Services, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Apollo Cradle, Arrowhead Regional Medical Center, ChristianaCare, Cincinnati Children's Hospital Medical Center, Cleveland Clinic, Cloudnine Group of Hospitals, FMCH India, King Faisal Specialist Hospital & Research Centre (KFSHRC), Koninklijke Philips N.V., Medela, Riley Children's Health, The Carle Foundation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, mother and child healthcare market forecasts, and dynamics of the market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the mother and child healthcare industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global mother and child healthcare market was valued at USD 1,004.2 Billion in 2025.

We expect the global mother and child healthcare market to exhibit a CAGR of 10.58% during 2026-2034.

The rising adoption of mother and child healthcare treatments, as they aid in reducing morbidity and mortality, levels of unwanted and unplanned pregnancies, female genital mutilation, risks of developing cervical cancer, etc., is primarily driving the global mother and child healthcare market.

The sudden outbreak of the COVID-19 pandemic had led to the postponement of elective mother and child healthcare treatment procedures to reduce the risk of the coronavirus infection upon hospital visits and interaction with healthcare professionals or medical equipment.

Based on the services, the global mother and child healthcare market has been segregated into pre-natal services, birthing services, post-natal services, and fertility services. Among these, post-natal services currently exhibit a clear dominance in the market.

Based on the maternal age, the global mother and child healthcare market can be bifurcated into under 20 years, 21 to 30 years, 31 to 38 years, and 39 and above years. Currently, 21 to 30 years hold the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global mother and child healthcare market include Apollo Cradle, Arrowhead Regional Medical Center, ChristianaCare, Cincinnati Children's Hospital Medical Center, Cleveland Clinic, Cloudnine Group of Hospitals, FMCH India, King Faisal Specialist Hospital & Research Centre (KFSHRC), Koninklijke Philips N.V., Medela, Riley Children's Health, and The Carle Foundation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)