Motorcycle Rental Market Size, Share, Trends and Forecast by Type, Booking Channel, Application, and Region, 2026-2034

Motorcycle Rental Market Size and Share:

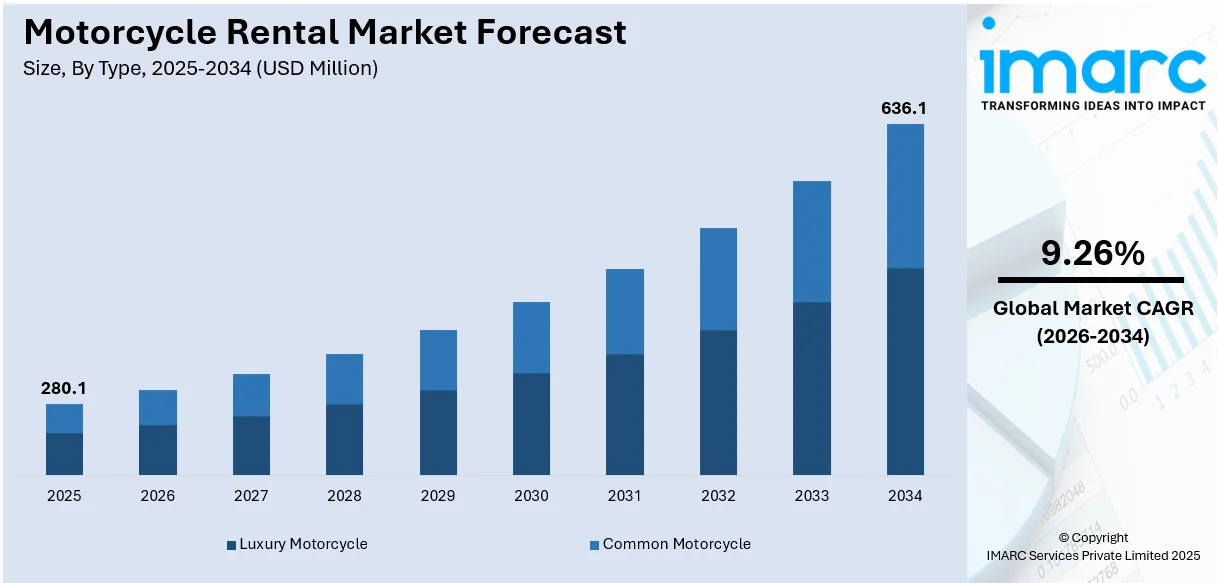

The global motorcycle rental market size was valued at USD 280.1 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 636.1 Million by 2034, exhibiting a CAGR of 9.26% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of over 34.4% in 2025. The easy availability of a wide range of luxury motorbikes at affordable rental fees, the accelerating purchasing cost of luxury bikes and two-wheelers, and the development of energy-efficient e-bikes represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 280.1 Million |

|

Market Forecast in 2034

|

USD 636.1 Million |

| Market Growth Rate (2026-2034) | 9.26% |

The surge in global motorcycle rentals is closely linked to the rise of adventure tourism. According to the IMARC Group’s latest report, the global adventure tourism industry is expected to reach USD 1716 billion by 2023, growing at a rate of 17% annually. Travelers increasingly seek unique experiences, and motorcycles offer an engaging way to explore diverse terrains. The appeal of motorcycles lies in their ability to navigate various landscapes, from urban streets to remote trails, providing a sense of freedom and adventure. This flexibility aligns with the preferences of modern travelers, especially millennials and Gen Z, who prioritize experiences over material possessions. The increase of social media has further amplified this trend, as travelers share their motorcycle journeys, inspiring others to embark on similar adventures. Additionally, the economic aspect plays a role; renting motorcycles is more cost-effective than ownership, especially for occasional use. This affordability, combined with the thrill of adventure, makes motorcycle rentals an attractive option for tourists worldwide.

To get more information on this market Request Sample

The U.S. motorcycle rental market is experiencing significant growth, driven by several key factors. The increasing popularity of motorcycle tourism is a major contributor, as travelers seek unique and adventurous experiences. Motorcycle rentals offer a flexible and immersive way to explore diverse landscapes, aligning with the preferences of modern tourists. Urban traffic congestion is another factor influencing the market growth. According to the latest report, New York is world’s most congested urban area, costing the city an estimated $9.1 billion in lost time. Motorcycles provide an efficient alternative for navigating crowded city streets, making them an attractive option for both residents and visitors. The rise of e-commerce platforms has also facilitated this growth by simplifying the rental process. Online booking systems and mobile applications have made it easier for consumers to access rental services, contributing to the market's expansion.

Motorcycle Rental Market Trends:

Easy Availability of a Variety of Options

The easy availability of a wide range of luxury motorbikes at affordable rental fees is a significant factor propelling the growth of the market. This can be attributed to the accelerating purchasing cost of luxury bikes and two-wheelers. According to FADA, the two-wheeler market saw a 15.8% year-on-year growth in November 2024, with sales reaching 26,15,953 units, up from 22,58,970 units in November 2023. This surge in sales presents a strong opportunity for Motorcycle Rental services to expand their customer base. In line with this, the emerging trend of motorcycle tours across tourist destinations is providing an impetus to the market.

Changing Consumer Preferences

The shift of consumer preference towards rental services over buying because of more convenience and no maintenance has been another strong driving force for the market. This is because the rental services provide unmatched convenience in terms of access to motorcycles without buying or maintaining them. This has especially appealed to urban consumers and tourists with a need for flexibility and cost effectiveness. In urban environments, motorbikes are increasingly being used for short-term commutes or weekend getaways. Rentals save consumers the trouble of long-term parking, insurance, and repair expenses. The advent of digital platforms has made the process much easier, as consumers can rent motorcycles instantly through mobile applications or websites. Such platforms usually offer real-time availability, customizable rental periods, and transparent pricing, thereby improving the overall user experience.

Expanding Automotive Industry

Besides this, considerable expansion in the automotive industry resulting in the development of energy-efficient e-bikes is also resulting in a higher product uptake on the global level. According to the IMARC Group, global e-bike market size reached USD 26.4 Billion in 2024. This trend reflects the growing consumer preference for sustainable transportation solutions, driven by environmental awareness and regulatory measures to curb carbon emissions. E-bikes, which offer a greener alternative to traditional motorcycles, have become increasingly popular due to their low operational costs and enhanced performance capabilities. Manufacturers are investing heavily in research and development (R&D) to produce e-bikes with improved battery life, faster charging capabilities, and modern designs. These innovations align with the needs of rental companies aiming to attract eco-conscious customers and urban commuters. Moreover, the affordability and convenience of renting e-bikes make them an appealing choice for tourists and city dwellers seeking short-term transportation solutions.

Motorcycle Rental Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global motorcycle rental market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, booking channel, and application.

Analysis by Type:

- Luxury Motorcycle

- Common Motorcycle

Common motorcycle stands as the largest component in 2025, holding around 80.7% of the market. Common motorcycles are capturing the majority share in the motorcycle rental market due to their ease of use, affordability, and widespread availability. These motorcycles appeal to a broad consumer base, including tourists and local commuters, as they provide a practical and budget-friendly solution for short-distance travel. Rental companies prefer common motorcycles in their fleets because of lower maintenance costs and high demand in both urban and rural settings. The adaptability of common motorcycles to various road conditions further cements their dominance in the market.

Analysis by Booking Channel:

- Websites

- Apps

Apps stand as the largest component in the market as they are transforming the motorcycle rental market by offering seamless and user-friendly booking experiences. Apps allow users to compare prices, check vehicle availability, and complete bookings in real time, enhancing convenience. Integration of GPS tracking, payment gateways, and customer support into these platforms has boosted consumer trust and satisfaction. As smartphone penetration and internet access continue to rise, particularly in developing regions, apps are becoming the preferred booking channel, driving substantial market growth.

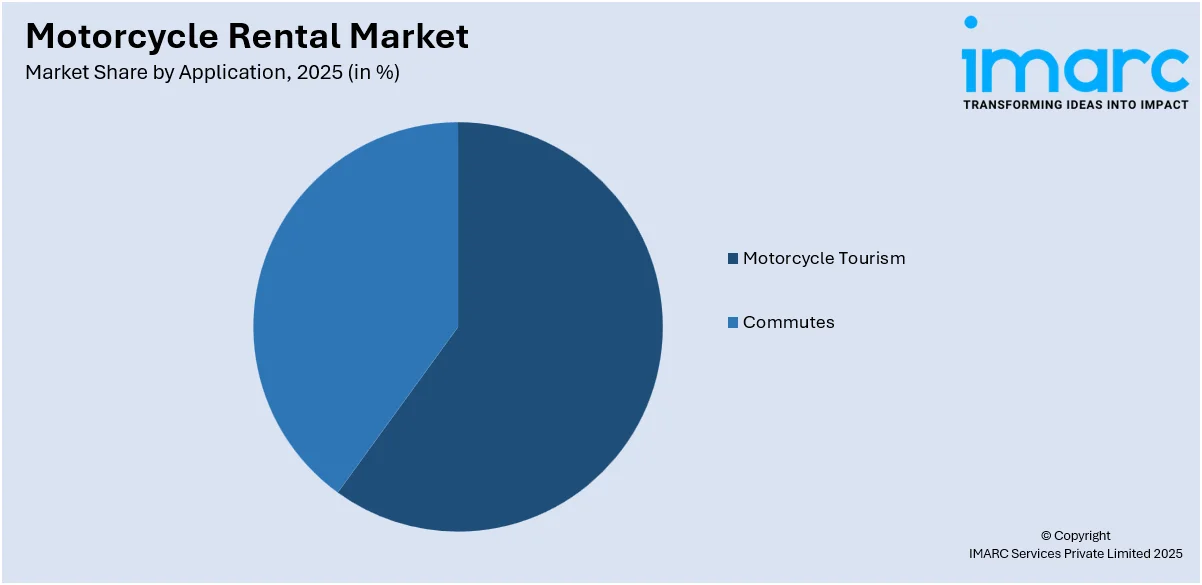

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Motorcycle Tourism

- Commutes

Motorcycle tourism stand as the largest component in 2025, holding around 56.7% of the market. Motorcycle tourism is emerging as the leading application segment due to the growing popularity of adventure travel and experiential tourism. Many tourists prefer motorcycles for their ability to explore offbeat destinations and enjoy scenic routes at their own pace. Rental companies cater to this demand by offering diverse options, including touring bikes and packages tailored for specific travel routes. This trend is particularly strong in areas with iconic travel destinations, where motorcycle tourism has become a significant contributor to the local economy.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific accounted for the largest market share of over 34.4%. The Asia Pacific region is leading the motorcycle rental market, driven by its large population, growing tourism industry, and high demand for affordable transportation solutions. Countries like India, Thailand, and Indonesia are witnessing a surge in motorcycle rentals due to their popularity among tourists and locals alike. Additionally, the region's dense urban areas and congested traffic conditions make motorcycles a practical choice. The presence of well-established rental services and rising smartphone adoption for app-based bookings further bolster Asia Pacific's dominance in the market.

Key Regional Takeaways:

North America Keyword Market Analysis

The motorcycle rental market in North America is expanding due to various influential factors. The growing interest in experiential travel and adventure tourism is a significant driver, as more individuals seek unique ways to explore scenic destinations. Motorcycles offer an engaging and flexible option for navigating diverse landscapes, catering to both tourists and local residents. Urbanization and increasing traffic congestion in cities also contribute to the market’s growth, with motorcycles providing an efficient solution for navigating crowded areas. The convenience of digital platforms has enhanced access to rental services, with mobile apps and online booking systems simplifying the process. These advancements have broadened the consumer base, attracting millennials and Gen Z travelers who value convenience and affordability. Additionally, sustainability trends are influencing the market, with electric motorcycles gaining traction among environmentally conscious consumers. Rental companies are responding by expanding their fleets to include environmentally friendly options.

United States Motorcycle Rental Market Analysis

The motorcycle rental industry in the United States is chiefly influenced by the rising demand for flexible and economical transportation choices, especially in metropolitan regions. Numerous travellers are choosing motorcycles because of their ability to manoeuvre easily through traffic-jammed cities and their reduced operating expenses in comparison to standard vehicles. The surge in experiential travel, where individuals seek distinctive, adventure-driven activities, is driving the need for motorcycle rentals. Furthermore, the growing trend of motorcycle tourism, where travellers navigate picturesque roads and natural vistas, is aiding in this expansion. The emergence of ride-sharing services, particularly regarding short-term rentals, has rendered motorcycle renting more accessible, particularly to younger demographics. The cost-effectiveness and convenience of short-term rental arrangements also attract both residents and visitors, particularly for weekend escapes and brief excursions. The enhancement of road infrastructure and the advancement of safety protocols for motorcycles have also increased their allure as a transportation option. For example, recent investments in U. S. infrastructure, including USD 1. 2 Trillion from the Bipartisan Infrastructure Law, are improving road conditions, which favors sectors like motorcycle rentals. With augmented state funding, especially for regions with lower infrastructure assessments, this upgraded road framework encourages growth in rental services by enhancing accessibility and safety. Additionally, the fuel efficiency and lowered environmental impact of motorcycles make them appealing in a time of escalating environmental awareness. Finally, the rise in disposable income among millennials and the increase in solo travel further bolster the requirement for motorcycle rentals as an affordable and exhilarating alternative to conventional rental cars.

Europe Motorcycle Rental Market Analysis

Europe’s expanding motorcycle rental sector is being propelled by the increasing number of tourists in search of distinctive travel experiences and the growing interest in alternative forms of transportation. According to the European Travel Commission, Europe's tourism industry experienced a 7% increase in foreign arrivals and a 5% rise in overnight stays in Q3 2024, indicating a heightened demand for tourism. This growth is advantageous for motorcycle rentals, providing opportunities to cater to the escalating tourist requirements amid capacity limitations and elevated tourism-related expenses. Urbanization, in conjunction with the region's dedication to sustainable travel, has rendered motorcycles an attractive choice, especially for short trips and day outings. The need for rental services is particularly pronounced in urban areas where conventional public transportation systems might not be as effective for tourists aiming to discover the nearby attractions. Moreover, the expansion of the adventure tourism sector has led to a stronger preference for motorcycle rentals for leisure activities. Motorcycles are also regarded as more economical and practical options for residents in urban environments, where issues such as parking and traffic congestion can be challenging. The implementation of digital platforms for convenient access to rental services and payment options has further promoted the market, enhancing the customer experience. Environmental concerns have additionally influenced the preference for motorcycles, as they are viewed as having a smaller carbon footprint than cars. With governments backing green transportation efforts and investing in infrastructure, the appeal of motorcycle rentals is poised to increase. In addition, the popularity of motorcycle tours and the demand for flexible travel alternatives is expected to keep fostering the growth of rental services, particularly in areas with rich cultural heritage and picturesque routes.

Asia Pacific Motorcycle Rental Market Analysis

In the Asia-Pacific area, swift urban growth and an increase in population have created a heightened need for more affordable transport options. As per the Asian Development Bank, the rapid urbanization in Asia, with an additional 1. 1 Billion people anticipated in cities by 2040, offers a considerable opportunity for Motorcycle Rental services. As urban centers grow, particularly in major regions like Tokyo and Bangkok, the necessity for adaptable, efficient transport options will rise, enhancing the motorcycle rental market. Motorcycles are progressively regarded as a practical substitute for public transportation and private vehicles, particularly in heavily populated cities where parking is limited. As economic development persists, a broader portion of the population is able to afford personal transportation, which amplifies the demand for rental services, especially in tourist destinations. The expanding tourism sector also significantly impacts the market, as tourists seek convenient and cost-effective methods to discover new places. Moreover, the introduction of the gig economy has aided in the rise of two-wheeler rentals for delivery operations, further growing the market. With the progress in mobile technology and the increasing reliance on digital platforms for renting and managing services, convenience has greatly improved, drawing in more customers. In addition, as environmental issues gain attention, motorcycles are being regarded as a more eco-friendly mode of transportation in comparison to cars, rendering them an attractive option for environmentally conscious individuals. This, along with the expanding middle class and rising disposable income, is propelling the growth of rental services throughout the region, enabling people to enjoy flexibility without the obligation of ownership.

Latin America Motorcycle Rental Market Analysis

In Latin America, the increasing demand for economical transportation is a major catalyst for the motorcycle rental business. Escalating fuel expenses, scarce public transit alternatives, and traffic jams in metropolitan areas make motorcycles a favoured selection for those looking for an effective, budget-friendly means of getting around. For example, the hike in fuel prices, with gasoline rising by 3. 33%, has increased transportation expenses, adding 0. 17 percentage points to Brazil's inflation rate in August. This increase benefits the motorcycle rental sector, providing an economical substitute for elevated fuel and airfare prices. With motorcycles being more fuel-efficient than automobiles, they offer a practical solution for short-distance travel and commuting. Furthermore, as disposable incomes rise in different regions, consumers are increasingly inclined to allocate funds for leisure activities, including motorcycle rentals for enjoyment. Another contributing factor is the rising demand for delivery services, with motorcycles emerging as a preferred transportation mode due to their capability to manoeuvre through crowded areas effortlessly. The rising popularity of motorbiking in various locations throughout the region also aids in the acceptance of motorcycle rentals as a flexible transportation option. The emergence of technology-driven solutions such as mobile applications and digital platforms has made motorcycle rental services more reachable, simplifying bookings for consumers. The cost-effectiveness, convenience, and efficiency of motorcycle rentals render them an appealing choice for individuals seeking improved mobility in the region, fuelling the overall expansion of this industry.

Middle East and Africa Motorcycle Rental Market Analysis

In the Middle East and Africa, various elements are contributing to the expansion of motorcycle rentals, with a significant factor being the increasing demand for affordable and adaptable transportation options. The high costs associated with car ownership, coupled with limited public transportation choices in certain areas, has resulted in motorcycles becoming a preferred means for short trips. Motorcycles offer a practical solution to manoeuvre through the heavy traffic that is prevalent in many metropolitan regions, presenting a faster and more convenient alternative to traditional vehicles. For instance, the traffic congestion in Dubai, which averages 19% and peaks at 39% during evening peak hours, highlights the city's notable car-to-population ratio of 540 cars for every 1,000 residents. This scenario positions motorcycle rentals as a sensible and effective means to address the city's traffic challenges. The rising interest in recreational and adventure activities in the region, especially in countries with extensive outdoor landscapes, has led to a greater demand for motorcycles for exploration and enjoyment. Moreover, the increasing dependence on mobile technology and digital services has made the motorcycle rental experience easier for consumers, offering improved flexibility and convenience. As the population in the area becomes more mobile and technologically proficient, the demand for accessible and economical transportation continues to grow, further enhancing the motorcycle rental market. All these aspects collectively promote a robust demand for motorcycle rentals, supporting the growth of this industry throughout the Middle East and Africa.

Competitive Landscape:

Major players in the motorcycle rental market are focusing on expanding their offerings and improving customer experience to stay competitive. Many companies are leveraging digital platforms and mobile apps to streamline the booking process, enhance accessibility, and offer real-time availability tracking. These platforms often have features such as personalized recommendations, dynamic pricing, and loyalty programs to attract and retain customers. Some players are diversifying their fleets, introducing a mix of common motorcycles, premium models, and electric bikes to cater to various customer preferences and sustainability goals. Partnerships with travel agencies, tour operators, and hospitality providers are also gaining traction, helping companies tap into the booming tourism sector. Regional expansion is another key strategy, with companies establishing rental hubs in popular travel destinations and high-traffic urban areas.

The report provides a comprehensive analysis of the competitive landscape in the motorcycle rental market with detailed profiles of all major companies, including:

- Adriatic Moto Tours

- EagleRider

- Harley-Davidson Inc.

- MotoQuest

- Motoroads

- Rental 819 (Kizuki Rental Service)

- The Hertz Corporation

- WickedRide Adventure Services Pvt. Ltd.

Latest News and Developments:

- September 2024: Tryke, a Malaysian startup, has launched the country's first shared electric motorbike rental service, expanding its fleet of electric scooters and bicycles. The service aims to enhance urban mobility by providing cost-effective, sustainable transportation options while reducing traffic congestion and air pollution. With over 700 electric vehicles across multiple cities, Tryke continues to promote eco-friendly commuting solutions.

- April 2024: Royal Enfield launched a motorcycle rental service available through its website, catering to travelers. The service spans 52 touring destinations across 25 countries, offering affordable rental options for those seeking adventure on two wheels. This initiative aims to enhance the travel experience, providing convenient access to Royal Enfield motorcycles at popular locations.

- March 2022: The Indian mobility startup Chalo acquired Vogo, a Bengaluru-based two-wheeler rental platform. As part of the acquisition, Vogo is transitioning its entire fleet to electric vehicles, aligning with Chalo’s sustainability goals. The move is set to reduce the environmental impact of the platform and contribute to India's growing EV market.

- February 2022: Yamaha Motors' subsidiary Moto Business Service India (MBSI) invested in bike rental company Royal Brothers through a revenue-sharing agreement. This acquisition marks MBSI's entry into the bike rental sector. Additionally, MBSI plans to collaborate with other emerging companies in the market.

Motorcycle Rental Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types covered | Luxury Motorcycle, Common Motorcycle |

| Booking Channels Covered | Websites, Apps |

| Applications Covered | Motorcycle Tourism, Commutes |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adriatic Moto Tours, EagleRider, Harley-Davidson Inc., MotoQuest, Motoroads, Rental 819 (Kizuki Rental Service), The Hertz Corporation, WickedRide Adventure Services Pvt. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the motorcycle rental market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global motorcycle rental market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the motorcycle rental industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Motorcycle rental is a service that allows individuals to temporarily hire motorcycles for personal or business use. It provides an alternative to purchasing a motorcycle, offering flexibility for short-term or occasional use. Rental services typically cater to tourists, adventure enthusiasts, commuters, or businesses requiring delivery solutions. Customers can choose from a range of motorcycle types, including common models, touring bikes, sports motorcycles, or electric options, depending on their specific needs.

The motorcycle rental market was valued at USD 280.1 Million in 2025.

IMARC estimates the global motorcycle rental market to exhibit a CAGR of 9.26% during 2026-2034.

The market is growing rapidly due to rising tourism and adventure activities, the easy availability of a wide range of luxury motorbikes at affordable rental fees, the accelerating purchasing cost of luxury bikes and two-wheelers, and the development of energy-efficient e-bikes.

In 2025, common motorcycles represented the largest segment by type, due to their affordability, ease of use, and widespread availability.

Apps lead the market by booking channel as they offer seamless and user-friendly booking experiences.

Motorcycle tourism is the leading segment by application due to the growing popularity of adventure travel and experiential tourism.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global motorcycle rental market include Adriatic Moto Tours, EagleRider, Harley-Davidson Inc., MotoQuest, Motoroads, Rental 819 (Kizuki Rental Service), The Hertz Corporation, WickedRide Adventure Services Pvt. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)