Native Starch Market in India Size, Share, Trends and Forecast by End Use, Feedstock, and Region, 2025-2033

Market Overview :

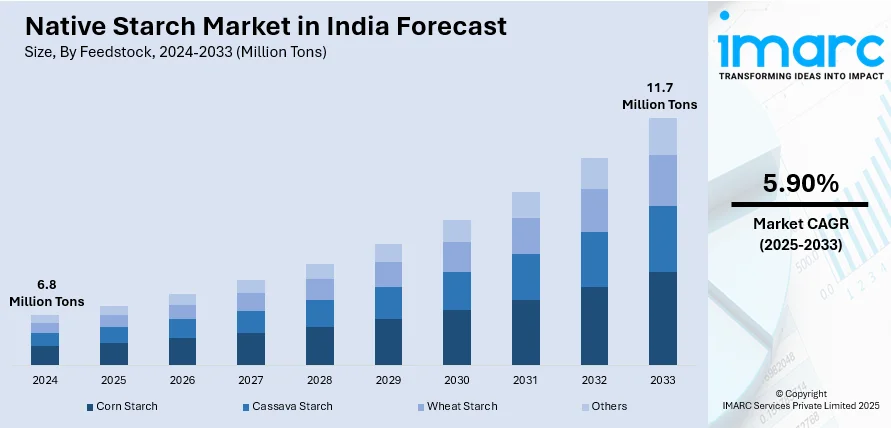

The native starch market in India size reached 6.8 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 11.7 Million Tons by 2033, exhibiting a growth rate (CAGR) of 5.90% during 2025-2033. The growing application in various cleansing products, rising employment of native starch in cosmetic powders, and increasing adoption in the production of adhesives ideal for bonding paper-based materials represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

6.8 Million Tons |

|

Market Forecast in 2033

|

11.7 Million Tons |

| Market Growth Rate 2025-2033 | 5.90% |

Native starch refers to a polysaccharide found in various staple food crops, such as maize, potato, rice, and cassava. It is basically the pure form of starch and comprises long-chain carbohydrates that are insoluble in cold water and swell at different temperature conditions. It is incorporated in a wide variety of consumable products, such as bakery mixes, frozen cakes, sheeted snacks, batter mixes, brewing adjuncts, dry mix soups and sauces, processed meat, pudding powders, cold process salad dressings, dips, and fruit preparations. It is also added to pet food products as native starch is an effective source of energy for dogs and cats and enhances the density and texture of the product. It is used as a stabilizing, thickening, gelling, and moisture-retaining agent. It is also employed to stiffen textiles for improving the appearance of fabrics by imparting a glossy texture. It is widely used as a flocculant, binder, and bonding agent in the paper industry.

To get more information of this market, Request Sample

Native Starch Market in India Trends:

At present, the increasing demand for native starch as it is biodegradable, cost-effective, and renewable in nature represents one of the primary factors influencing the market positively in India. Besides this, the rising utilization of native starch in various cleansing products to provide a milky formulation, improve foam formation, and provide moisturization to the skin is propelling the growth of the market in the country. In addition, the growing employment of native starch in cosmetic powders, talc, and baby powder is offering a favorable market outlook. Apart from this, the increasing utilization of glucose syrup as a sweetener in manufacturing candies, fondants, and beer is contributing to the growth of the market in India. Additionally, there is a rise in the application of native starch in producing naturally genetically modified organism (GMO) free and non-allergic vegan cheese. This, coupled with the increasing production of various starch derivatives, such as maltodextrin and cyclodextrin, is supporting the market growth in the country. Moreover, the rising usage of bioethanol as a motor fuel and as an additive in gasoline is strengthening the market growth. Furthermore, the increasing adoption of native starch in the production of adhesives ideal for bonding paper-based materials and making corrugated boards and tube winding is bolstering the growth of the market in India.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the native starch market in India report, along with forecasts at the country and state level from 2025-2033. Our report has categorized the market based on end use and feedstock.

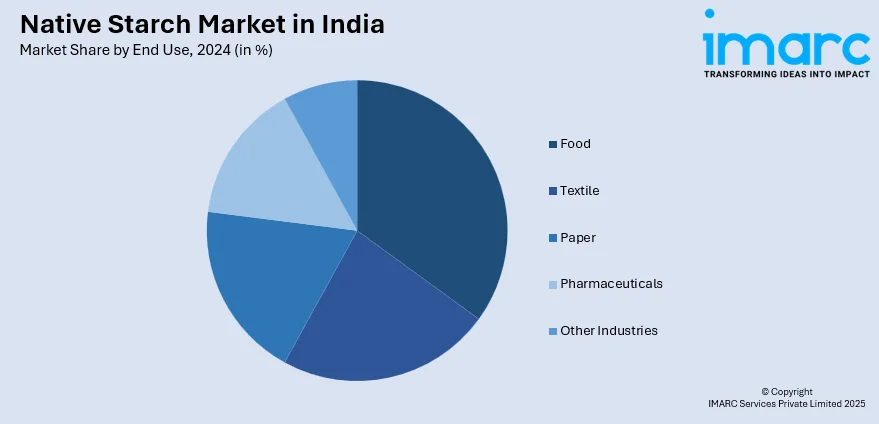

End Use Insights:

- Food

- Textile

- Paper

- Pharmaceuticals

- Other Industries

The report has provided a detailed breakup and analysis of the native starch market in India based on the end use. This includes food, textile, paper, pharmaceuticals, and other industries. According to the report, food represented the largest segment.

Feedstock Insights:

- Corn Starch

- Cassava Starch

- Wheat Starch

- Others

A detailed breakup and analysis of the native starch market in India based on the feedstock has also been provided in the report. This includes corn starch, cassava starch, wheat starch, and others.

Regional Insights:

- Andhra Pradesh

- Bihar

- Chhattisgarh

- Delhi

- Goa

- Gujarat

- Haryana

- Himachal Pradesh

- Jharkhand

- Karnataka

- Kerala

- Madhya Pradesh

- Maharashtra

- Odisha

- Punjab

- Rajasthan

- Tamil Nadu

- Telangana

- Uttar Pradesh

- Uttarakhand

- West Bengal

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Andhra Pradesh, Bihar, Chhattisgarh, Delhi, Goa, Gujarat, Haryana, Himachal Pradesh, Jharkhand, Karnataka, Kerala, Madhya Pradesh, Maharashtra, Odisha, Punjab, Rajasthan, Tamil Nadu, Telangana, Uttar Pradesh, Uttarakhand, West Bengal, and others. According to the report, Maharashtra was the largest market for native starch in India. Some of the factors driving the Maharashtra native starch market in India included the growing integration of starch in various local cuisines, increasing employment in the pharmaceutical industry, rising incorporation of starch in numerous baked products, etc.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the native starch market in India. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include Roquette Riddhi Siddhi Private Limited, Gujarat Ambuja Exports Limited, Sukhjit Starch & Chemicals Ltd., Sayaji Industries Limited, Universal Starch Chem Allied Ltd., etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Segment Coverage | End Use, Feedstock, State |

| States Covered | Andhra Pradesh, Bihar, Chhattisgarh, Delhi, Goa, Gujarat, Haryana, Himachal Pradesh, Jharkhand, Karnataka, Kerala, Madhya Pradesh, Maharashtra, Odisha, Punjab, Rajasthan, Tamil Nadu, Telangana, Uttar Pradesh, Uttarakhand, West Bengal, Others |

| Companies Covered | Roquette Riddhi Siddhi Private Limited, Gujarat Ambuja Exports Limited, Sukhjit Starch & Chemicals Ltd., Sayaji Industries Limited, Universal Starch Chem Allied Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the native starch market in India from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the native starch market in India.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key state-level markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the native starch market in India industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The native starch market in India reached a volume of 6.8 Million Tons in 2024.

We expect the native starch market in India to exhibit a CAGR of 5.90% during 2025-2033.

The rising utilization of native starch across the food and non-food sector as a stabilizer and thickening agent for various food products such as soups, sauces, gravies, etc., is primarily driving the native starch market in India.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of native starch across the nation.

Based on the end use, the native starch market in India can be segmented into food, textile, paper, pharmaceuticals, and other industries. Currently, the food industry holds the majority of the total market share.

On a regional level, the market has been classified into Andhra Pradesh, Bihar, Chhattisgarh, Delhi, Goa, Gujarat, Haryana, Himachal Pradesh, Jharkhand, Karnataka, Kerala, Madhya Pradesh, Maharashtra, Odisha, Punjab, Rajasthan, Tamil Nadu, Telangana, Uttar Pradesh, Uttarakhand, West Bengal, and others, where Maharashtra currently dominates the native starch market in India.

Some of the major players in the native starch market in India include Roquette Riddhi Siddhi Private Limited, Gujarat Ambuja Exports Limited, Sukhjit Starch & Chemicals Ltd., Sayaji Industries Limited, Universal Starch Chem Allied Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)