Processed Meat Market Size, Share, Trends and Forecast by Meat Type, Product Type, Processing Type, Distribution, and Region, 2025-2033

Processed Meat Market Size and Share:

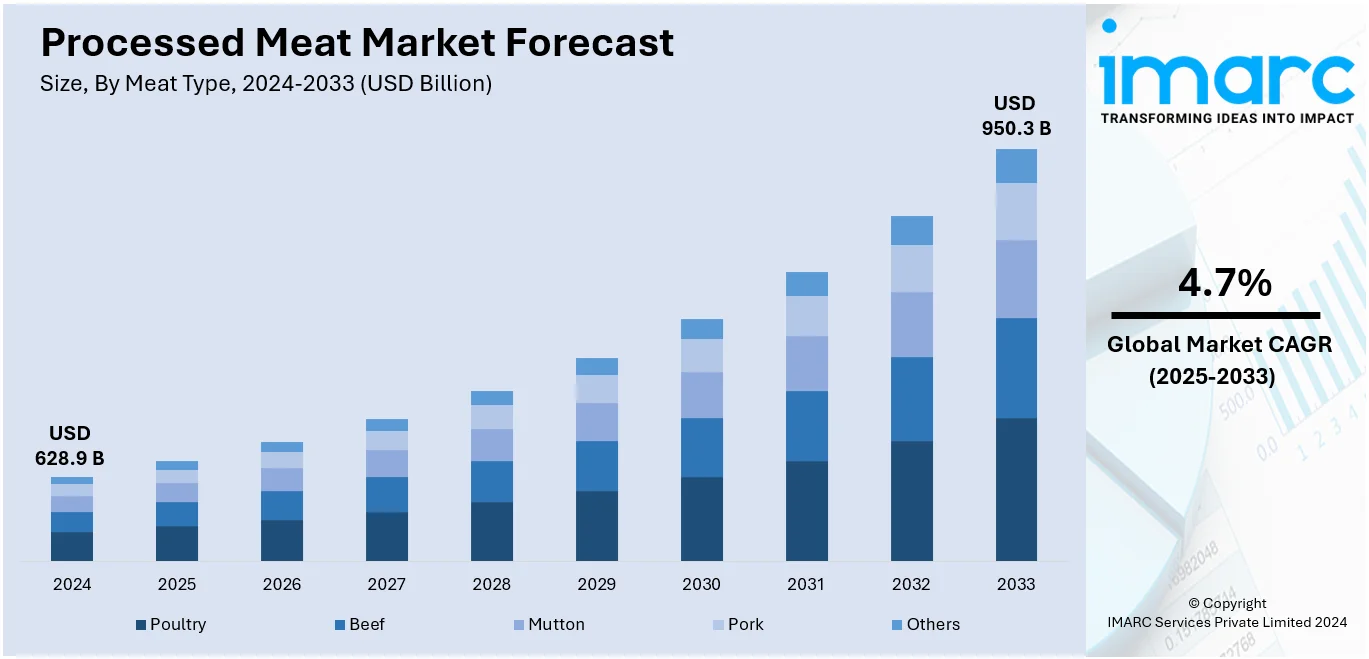

The global processed meat market size was valued at USD 628.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 950.3 Billion by 2033, exhibiting a CAGR of 4.7% from 2025-2033. North America currently dominates the market in 2024. The global market is primarily driven by the increasing consumer demand for convenience and protein-rich diets, continual technological advancements in food processing, the globalization of food cultures, rising disposable income levels, and changing consumer preferences.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 628.9 Billion |

|

Market Forecast in 2033

|

USD 950.3 Billion |

| Market Growth Rate (2025-2033) | 4.7% |

The global market is primarily driven by rising demand for convenient, ready-to-eat food options among urban, particularly the urban working population. Increasing disposable incomes and changing dietary preferences strengthen demand for premium and diverse processed meat products. Continual technological advancements in processing and packaging enhance quality, shelf life, and safety. For instance, on March 21, 2024, Meatable’s breakthrough, reducing cell differentiation time to four days with its patented Opti-Ox technology, enables faster, scalable production of cultivated meat. This breakthrough reduces resource usage and CAPEX costs while enhancing sustainability. The growing influence of Western diets in emerging economies and the expansion of organized retail and e-commerce platforms improve accessibility. Health-focused innovations, such as low-sodium and preservative-free options, attract health-conscious consumers, further impelling global market growth.

The United States is a key regional market and is growing due to increasing consumer preference for protein-rich diets and convenient, ready-to-eat meals, particularly among the urban population. Also, the rising demand for frozen and packaged meat products with long shelf life is further driving market growth. Continual advancements in food processing and packaging technologies enhance safety, quality, and appeal, which is creating a positive market outlook. The popularity of plant-based and hybrid meat products, combining animal and plant proteins, is attracting diverse consumers. Strategic partnerships between food service providers and retailers improve accessibility and product variety. Premium, flavored, and organic processed meats are also gaining traction. For instance, on June 4, 2024, Applegate launched the APPLEGATE ORGANICS® Pepperoni, the first nationally available organic pepperoni, catering to demand for humane, antibiotic-free, and natural options. Additionally, Applegate’s products, priced at USD 6.49, are now available at Sprouts and Whole Foods, catering to rising demand for sustainable, organic meat.

Processed Meat Market Trends:

Increased Convenience and Busy Lifestyles

With more individuals juggling work, personal commitments, and social activities, the demand for convenient and quick meal options has increased. Meats, such as sausages, ham, and ready-to-eat meat products, cater to this need by offering time-saving solutions for meal preparation. The ease of cooking and the minimal preparation time render meats a preferred choice for people seeking both efficiency and nutritional value in their diets. Furthermore, the availability of a wide range of meat products across various retail formats enhances consumer access and convenience, further fueling market growth. According to the United Nations, more than 50% of the global population currently lives in urban areas, a rate anticipated to reach 68% by 2050. This urbanization trend highlights the growing demand for convenient food options, as city dwellers often face time constraints. This trend is highlighted by the expansion of the global food processing technology and services sector, which continuously innovates to improve the quality, safety, and shelf life of meat products, aligning with consumer expectations for convenience without compromising on taste or health.

Growing Demand for Protein-Rich Diets

The global increase in health consciousness among consumers resulted in heightened demand for protein-rich diets, positioning meats as a primary dietary component for many. Protein is needed for different bodily functions such as the building, repair, and general upkeep of good health. Consequently, meats being high-protein foods render them conveniently available to meet these dietary needs. The protein Reference Daily Intake (RDI) for an adult, which consumes 2,000 calories per day, as set by Dietary Guidelines for Americans 2020-2025 is approximately 5.5 ounces or 10-35% of the total calorie intake. Given that meats are rich in proteins, it is an easy way to achieve the required quantity. The market is responding to such demand by diversifying product offerings to include a range of meats processed in ways that retain nutritional value but improve flavor and shelf life. Innovations in meat processing techniques have also enabled the minimization of unhealthy additives and preservatives, which enhances the appeal of meats among health-conscious consumers.

Technological Advancements in Food Processing

Modern technologies like high-pressure processing (HPP), smoking, curing, and vacuum packaging have greatly improved the safety, quality, and shelf-life of processed meat products. WHO 2024 reports that nearly 600 million, or 1 in 10 people in the world, fall ill after eating contaminated food, and 420,000 die annually, which highlights the importance of food safety. Such advances render the meat products retain all nutritional content, taste, and texture over a longer period compared to the previous ones; they will, therefore, appear attractive to consumers who major in convenience but also with respect to quality. This means technology also helped manufacturers ramp up production to meet ever-growing global demand while guaranteeing uniform quality. As highlighted by industry reports, 73% of Gen-Z consumers mention that they are willing to pay more for sustainable products and, therefore, represent the growing trend toward conscious consumption. Innovations in processing technologies also allow for decreasing the food waste concern for consumers and producers, as processing technologies extend the usability period of meat products. The adoption of advanced processing technologies reassures consumers, becoming more aware of food safety and sustainability issues, on the integrity of the products they consume, which will propel market growth.

Processed Meat Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global processed meat market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on meat type, product type, processing type and distribution.

Analysis by Meat Type:

- Poultry

- Beef

- Mutton

- Pork

- Others

The poultry segment leads the global processed meat market, attributed to its widespread consumer acceptance, perceived health benefits, and versatility in various cuisines. Poultry, especially chicken, is considered a lean source of protein and is lower in saturated fats compared to red meats, aligning with the health-conscious trends among consumers. Its affordability and availability across markets also contribute to its dominant position. Innovations in poultry processing, packaging, and flavoring have expanded the product range, catering to diverse consumer tastes and preferences.

Analysis by Product Type:

- Fresh-Processed Meat

- Raw Fermented Meat

- Raw-Cooked Meat

- Pre-Cooked Meat

- Cured Meat

- Dried Meat

- Others

Fresh-processed meat leads the market share in 2024. Dominating the meat market, the fresh- processed meat segment includes products such as sausages, patties, and meatballs that are prepared from ground or minced meat with the addition of various ingredients for flavoring. This segment's popularity is driven by its convenience, flavor diversity, and the minimal cooking time required, making it a favored choice for quick and easy meal preparations. The appeal of fresh variants lies in their ability to blend seamlessly into a wide array of culinary traditions, offering consumers a versatile option for enhancing their dishes. Manufacturers have also focused on addressing health concerns by offering options with reduced fat, sodium, and additives, further solidifying this segment's position at the forefront of the market.

Analysis by Processing Type:

- Chilled

- Frozen

- Canned

The chilled segment represents the largest share of the market, largely as it caters to consumer demand for freshness and minimal processing, which are key factors driving purchasing decisions. Chilled meats, including various cuts and types of meats that are kept refrigerated but not frozen, are favored for maintaining a closer taste and texture to fresh meat. This segment's prominence is highlighted by the consumer perception that chilled meats are healthier and of higher quality compared to their frozen or canned counterparts. The preference for chilled meats reflects a broader market trend towards convenience foods that do not compromise on taste or nutritional value, driving innovations in packaging and preservation techniques to extend and the meat shelf-life without using preservatives.

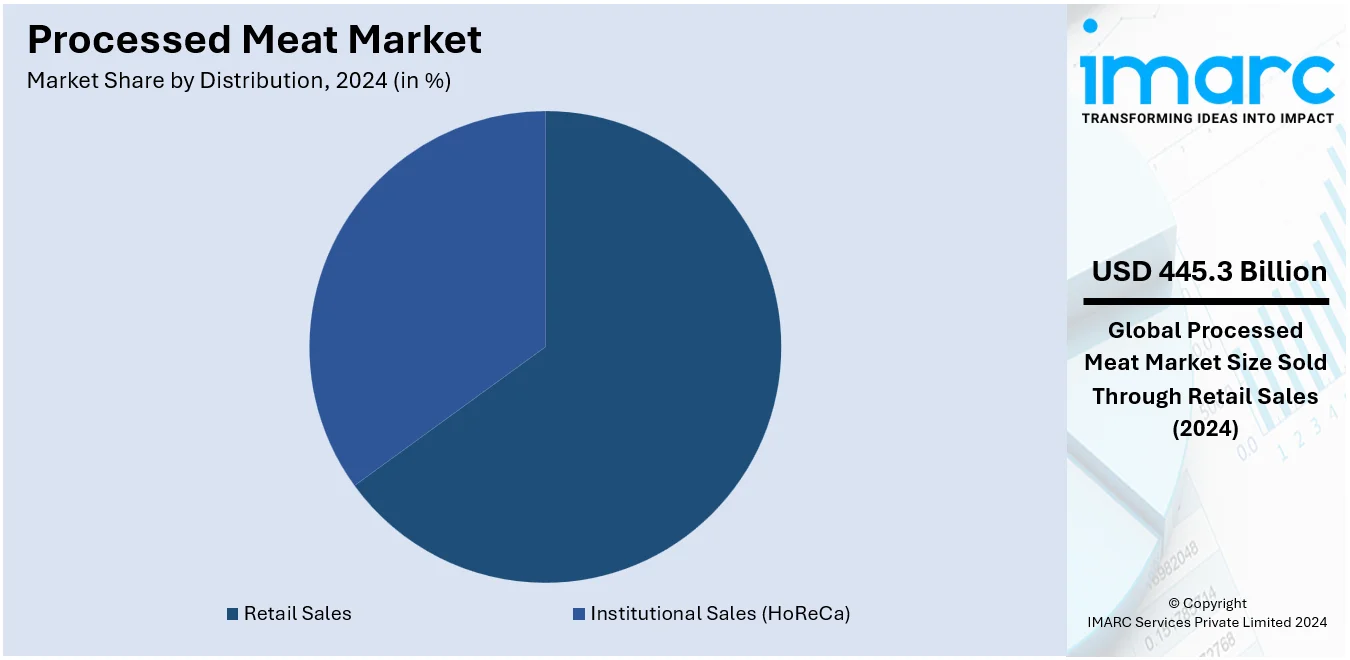

Analysis by Distribution:

- Institutional Sales (HoReCa)

- Retail Sales

- Supermarkets and Hypermarkets

- Grocery Stores

- Specialty Retailers

- Online Stores

- Others

Retail sales constitute the largest segment in the distribution of processed meats, encompassing sales through supermarkets, hypermarkets, convenience stores, and online platforms. This segment captures a broad consumer base, offering accessibility and a wide selection of products tailored to individual preferences and needs. Retail outlets serve as the primary touchpoint for consumers seeking convenience, variety, and value, providing a diverse range of meat products from fresh to frozen options. The growth in retail sales is propelled by the expanding global supermarket culture, increasing consumer reliance on one-stop shopping experiences, and the rising trend of online grocery shopping, which offers added convenience through home delivery services.

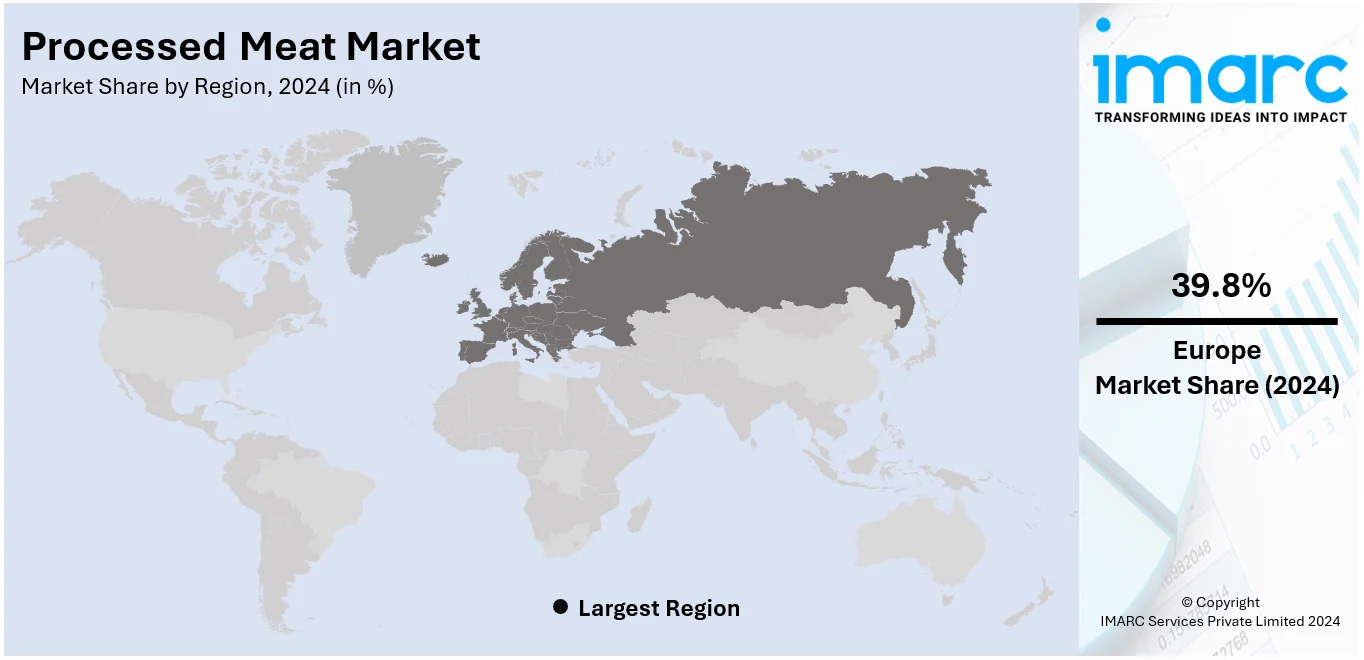

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

In 2024, North America accounted for the largest share in the global market, driven by high consumer demand for convenience foods, a well-established meat processing industry, and a strong culture of meat consumption. The region's market dominance is further supported by the presence of major food processing companies and advanced distribution networks that ensure wide availability of diverse meat products. Consumers in North America, particularly in the United States and Canada, exhibit a preference for protein-rich diets, contributing to the high consumption of meats. The market is also seeing shifts towards healthier and premium meat options, reflecting growing health consciousness among consumers.

Key Regional Takeaways:

United States Processed Meat Market Analysis

The United States is the world's largest producer of beef, contributing to the growth of its processed meat market. In 2022, the U.S. produced 28.4 Billion pounds of beef, accounting for 21.7% of the world's total beef output, according to National Beef Wire. Such huge production capacity ensures a steady supply of high-quality grain-fed beef, which serves as the foundation for the processed meat industry. Products like sausages, burgers, and ready-to-cook meals are sold, both in the United States and abroad, by this high-quality U.S. beef.

Ohio is an example of the strength of beef production in the nation: it ranks among the top states with 2.9 Million cattle slaughtered in 2022, as per an industry report. Beef farms and ranches also render more than 30% of all farms in the United States, illustrating the size and economic significance of the sector. The integration of advanced meat processing technologies and the increasing consumer need for convenient, protein-rich food further supports the market. This synergy of production efficiency, quality, and consumer needs places the United States on top in the global marketplace for processed meats.

Europe Processed Meat Market Analysis

Processed meat is growing in Europe, as consumer preferences are changing, and socio-economic factors contribute to this. Processed minced beef is one product that experienced a very high increase in its percentage share of total beef sold. This is as it is relatively cheap and can be used in modern dishes. The increasing use of cooking sauces, such as pasta sauces, is also pushing the demand for minced beef, which the modern consumer prefers to be convenient.

The growth in the market is driven by changing lifestyles, increased disposable incomes, and rising demand for ready-to-eat and ready-to-cook meat products. The growing demand for convenience, taste, and quality makes consumers increasingly accept and aware of processed meat products. This is why companies are expanding their operations and investing in innovation to meet the rising demand. In 2021, the world's largest protein company, JBS, acquired Spain-based BioTech Foods and has commenced construction of a new plant in Spain to further improve production capacity.

This would also include Europe having the strongest employment rate among its regions at 75.3% in 2023 (80.4% for men, and 70.2% for women), as per an industry report. Increased purchasing power supports demand for ready solutions in convenient food solutions, which in turn situates Europe as a lively marketplace for processed meat products.

Asia Pacific Processed Meat Market Analysis

The Asia-Pacific processed meat market is thriving with trends in production and consumption of the product increasing in the region. According to an industrial report, in 2023, the pork production in China was 57.94 Million tons. This is a 2.53-Million-ton rise or 4.6% increase over last year. The total sales nationwide amount to 726.62 million pigs, which can give an idea of the extent of China's contribution to the supply of processed meat in the region.

Moreover, the increased poultry meat consumption in countries like India is a growing demand for processed meat products. According to the OECD, poultry meat consumption in India reached more than four Million metric tons in 2022. From 4,107.12 thousand metric tons in 2021, it increased to 4,253.74 thousand metric tons. The consumption trend is rising with increasing demand for convenient and protein-rich food items.

The Asia-Pacific region is one of the major growth drivers for the global processed meat market due to the combined effects of expanding production capabilities and rising consumer demand for processed and ready-to-eat meat products.

Latin America Processed Meat Market Analysis

The Latin America processed meat market is going to have growth. Rising protein demand and shifts in dietary choice are the key drivers in this regard. According to OECD 2023 figures, per capita protein intake in the region is scheduled to rise to 90g per person per day by 2032-that is, up 3.5g from today's level. The increasing trend is mainly due to a rise in the demand for animal-based proteins, accounting for two-thirds of the increment in protein availability. Meat consumption in Latin America will continue to rise at 2.9 kg per capita and reach almost 53 kg per person per year in 2032, roughly 80% higher than the global average.

This is driven by the fact that this region prefers high-protein diets, and this trend is supported by the fact that urbanization is on the rise, and so is the middle-class population that looks for convenient yet nutritious meal options. Thus, processed meat products, including sausages, ham, and ready-to-eat meals, are sought for time-saving meal preparation. Meat processing technologies are innovated to enhance flavor, nutritional value, and shelf life and fuel market growth in tandem with changing consumer preferences in the region.

Middle East and Africa Processed Meat Market Analysis

The Middle East and Africa processed meat market is witnessing growth with the region's growing production capabilities of meat. According to an industrial report, South Africa is the largest contributor as it is the largest beef and poultry producing region in the area, accounting for 1 Million metric tons and 1.9 Million metric tons of production in 2021. It also stands as the second largest producer of pig meat accounting for 0.3 Million metric tons in the market.

The production capacity is strong enough to supply raw materials to the processed meat industry, which makes local manufacturers able to provide for the increasing demand by the consumers. The growth of urban populations and a rise in disposable incomes is also promoting the market with a shift towards convenient food options. Moreover, expansion of halal-certified processed meat products is in accordance with cultural and dietary preferences of the people of the region. Together, all these factors combine to favor the growth of the market for processed meat in the Middle East and Africa.

Competitive Landscape:

Key players in the meat market are highly involved in strategic initiatives to improve their market presence and meet the changing consumer preferences. Some of these initiatives include product innovation, which focuses on healthier and more sustainable methods of meat processing to meet the increasing demand for nutritious and environmentally friendly products. Companies are further expanding their global footprint through mergers, acquisitions, and partnerships, which help them tap into new markets and diversify their product portfolios. Major investments in research and development are also made to enhance food safety and shelf life. Marketing efforts are increasingly using digital platforms to reach wider audiences and build brand awareness. These together form the industry's responses to market dynamics as well as continuous pursuit for opportunities for growth.

The report provides a comprehensive analysis of the competitive landscape in the processed meat market with detailed profiles of all major companies, including:

- BRF SA

- Cargill Inc.

- Foster Farms

- Hormel Foods Corporation

- JBS SA

- Marel hf

- Marfrig

- National Beef

- Nippon Ham Foods Ltd.

- OSI Group

- Perdue Farms

- Pilgrim's Pride

- Sadia

- Sanderson Farms Inc

- Sysco

- Tyson Foods

Latest News and Developments:

- July 2024: Agthia Group PJSC, a leading food and beverage company in the region, officially inaugurated its new protein manufacturing facility in Industrial City 1, Jeddah, Saudi Arabia. This state-of-the-art facility is designed to meet the increasing demand for Agthia's core protein brands, underscoring the company's strategic focus on leveraging the significant growth opportunities in the GCC's largest market.

- February 2024: Cargill Inc. expanded its operations by acquiring two meat processing plants from its long-standing partner, Ahold Delhaize USA. These facilities aim to enhance Cargill's ability to produce and distribute case-ready beef and pork to supermarkets and retailers in the northeastern United States.

- May 2023: Tyson Foods increased its cocktail sausage production capacity at its Claryville facility to address rising consumer demand for Hillshire Farm products. The USD 83 Million expansion added 15,000 square feet to the 342,000-square-foot facility, incorporating advanced equipment to enhance production by 50%. This investment supports more efficient operations and strengthens Tyson's market presence in high-quality processed meats.

- April 2023: The HERDEZ brand creators unveiled the HERDEZ™ Mexican Refrigerated Entrées line with two delicious varieties, including HERDEZ™ Carnitas Slow Cooked Pork as well as HERDEZ™ Chicken Shredded in Mild Chipotle Sauce.

- August 2022: Hormel Foods Corporation has announced a new strategic operating model, aligning its businesses to be more agile, market driven, and consumer and customer focused.

Processed Meat Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Meat Types Covered | Poultry, Beef, Mutton, Pork, Others |

| Product Types Covered | Fresh-Processed Meat, Raw Fermented Meat, Raw-Cooked Meat, Pre-Cooked Meat, Curated Meat, Dried Meat, Others |

| Processing Types Covered | Chilled, Frozen, Canned |

| Distributions Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | BRF SA, Cargill Inc., Foster Farms, Hormel Foods Corporation, JBS SA, Marel hf, Marfrig, National Beef, Nippon Ham Foods Ltd., OSI Group, Perdue Farms, Pilgrim's Pride, Sadia, Sanderson Farms Inc, Sysco, Tyson Foods, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the processed meat market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global processed meat market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the processed meat industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Processed meat refers to meat that has been preserved or modified through methods such as smoking, curing, salting, or adding preservatives. Common examples include sausages, bacon, ham, and salami. These processes enhance flavor, extend shelf life, and alter the texture, making it a popular choice in various cuisines.

The processed meat market was valued at USD 628.9 Billion in 2024.

IMARC estimates the global processed meat market to exhibit a CAGR of 4.7% during 2025-2033.

Increasing demand for protein-rich and convenient diets, continual advancements in processing and packaging technologies, rising disposable incomes, the globalization of food cultures, and health-conscious innovations such as preservative-free and low-sodium options are majorly driving the growth of the global market.

In 2024, poultry represented the largest segment by meat type, driven by its affordability, health benefits, and versatility in cuisines.

Fresh processed meat leads the market by product type attributed to its convenience, flavor diversity, and minimal preparation time.

Chilled is the leading segment by processing type, driven by consumer preference for freshness and minimal processing for better taste and texture.

In 2024, retail sales represented the largest segment by distribution, driven by wide product availability, variety, and increasing online grocery shopping trends.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global processed meat market include BRF SA, Cargill Inc., Foster Farms, Hormel Foods Corporation, JBS SA, Marel hf, Marfrig, National Beef, Nippon Ham Foods Ltd., OSI Group, Perdue Farms, Pilgrim's Pride, Sadia, Sanderson Farms Inc, Sysco, and Tyson Foods, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)