Netherlands Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Province, 2025-2033

Netherlands Air Freight Market Overview:

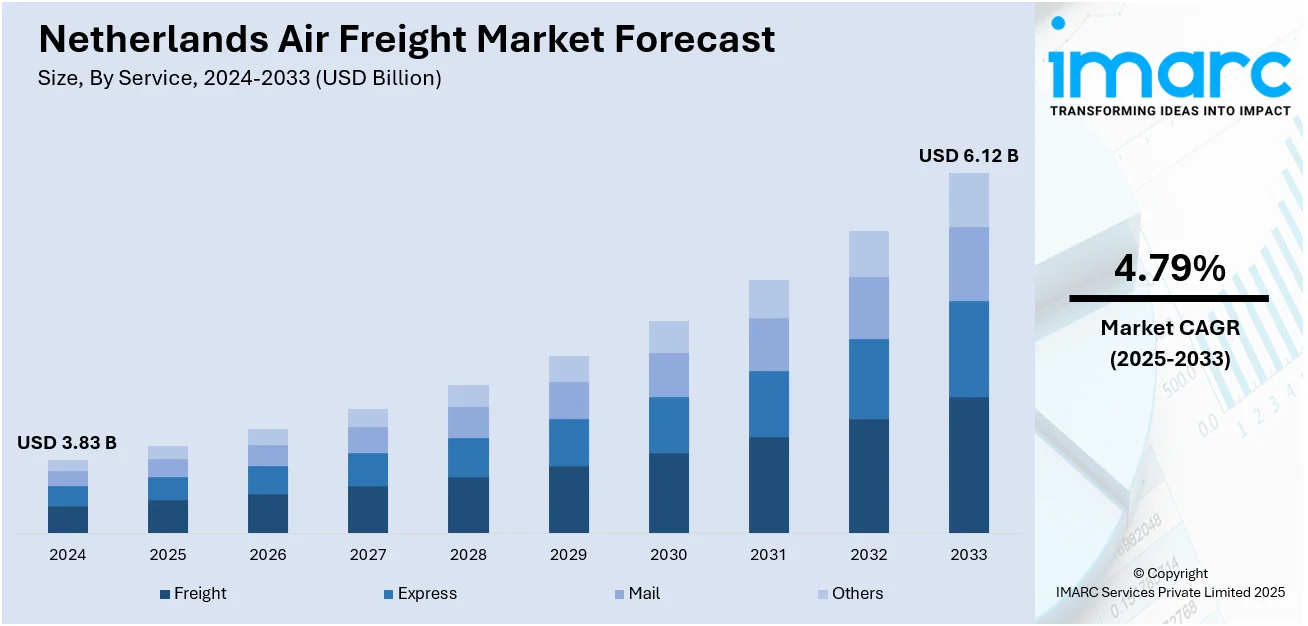

The Netherlands air freight market size reached USD 3.83 Billion in 2024. Looking forward, the market is projected to reach USD 6.12 Billion by 2033, exhibiting a growth rate (CAGR) of 4.79% during 2025-2033. The market is driven by the Netherlands’ position as a central European logistics hub with strong multimodal infrastructure supporting global trade flows. High demand for specialized perishable and pharmaceutical air cargo services underscores the importance of temperature-controlled logistics. Additionally, rapid growth in e-commerce and dedicated express cargo operations is further augmenting the Netherlands air freight market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.83 Billion |

| Market Forecast in 2033 | USD 6.12 Billion |

| Market Growth Rate 2025-2033 | 4.79% |

Netherlands Air Freight Market Trends:

Strategic Position as a European Logistics Hub

The Netherlands is globally recognized as a central logistics hub for Europe, driven by its advantageous geographic location and advanced infrastructure. Amsterdam Airport Schiphol plays a critical role in connecting major trade flows between Europe, Asia, and North America. The airport operates as one of Europe’s busiest cargo gateways, handling a high volume of express, perishable, and industrial goods. China, the United States, and the United Arab Emirates collectively accounted for 155 thousand tons of air freight to and from the Netherlands in Q1 2025, representing 44% of the total. This share was consistent with Q1 2024, although the absolute volume declined from 171 thousand tons. Germany led intra-EU shipments with 6.1 thousand tons, while Türkiye dominated non-EU European trade, contributing 10.2 thousand tons, or 62% of that segment, emphasizing key corridors in the Netherlands air cargo market. The Netherlands’ integration with the Port of Rotterdam, Europe’s largest seaport, creates a powerful multimodal logistics ecosystem that combines sea, road, rail, and air transport seamlessly. This alignment allows businesses to optimize supply chain operations by leveraging combined maritime and air freight solutions, catering to industries such as electronics, chemicals, and machinery. Additionally, Dutch trade policies emphasize open markets, technological innovation, and customs efficiency, providing exporters and importers with frictionless access to European markets. Government-led initiatives, such as the Smart Logistics Programme, are actively promoting digitization and automation in cargo handling. These factors ensure the Netherlands’ continued prominence in European trade corridors and reinforce its status as a core contributor to Netherlands air freight market growth, supporting its leadership role in regional and global commerce.

To get more information on this market, Request Sample

E-Commerce Expansion and Express Cargo Integration

The Netherlands’ dynamic e-commerce landscape is reshaping logistics demands, generating significant growth in express air cargo volumes. Amsterdam Airport Schiphol handled approximately 1.49 million metric tons of air cargo in 2024, marking an 8% increase compared to 2023. With Dutch consumers embracing online shopping at increasing rates, fast cross-border shipping has become critical, especially for goods sourced from Asia and North America. Schiphol Airport’s dedicated express cargo terminals handle substantial volumes of e-commerce shipments, facilitating smooth coordination between global platforms, freight integrators, and last-mile delivery providers. Companies such as DHL, FedEx, and UPS maintain major operational hubs in the Netherlands, leveraging the country’s proximity to key European markets. Additionally, Dutch logistics providers are integrating advanced tracking systems, predictive analytics, and automated sorting technologies to improve delivery accuracy and efficiency. Government-backed initiatives supporting logistics digitalization are further enhancing processing speeds and reducing lead times for e-commerce shipments. The Netherlands’ well-established distribution networks and dense transportation infrastructure contribute to seamless intra-European parcel deliveries. The convergence of e-commerce growth, technological advancements, and dedicated express cargo solutions positions the country as a regional leader in air-based retail logistics, strengthening its role in the European supply chain ecosystem.

Netherlands Air Freight Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service, destination, and end user.

Service Insights:

- Freight

- Express

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes freight, express, mail, and others.

Destination Insights:

- Domestic

- International

The report has provided a detailed breakup and analysis of the market based on the destination. This includes domestic and international.

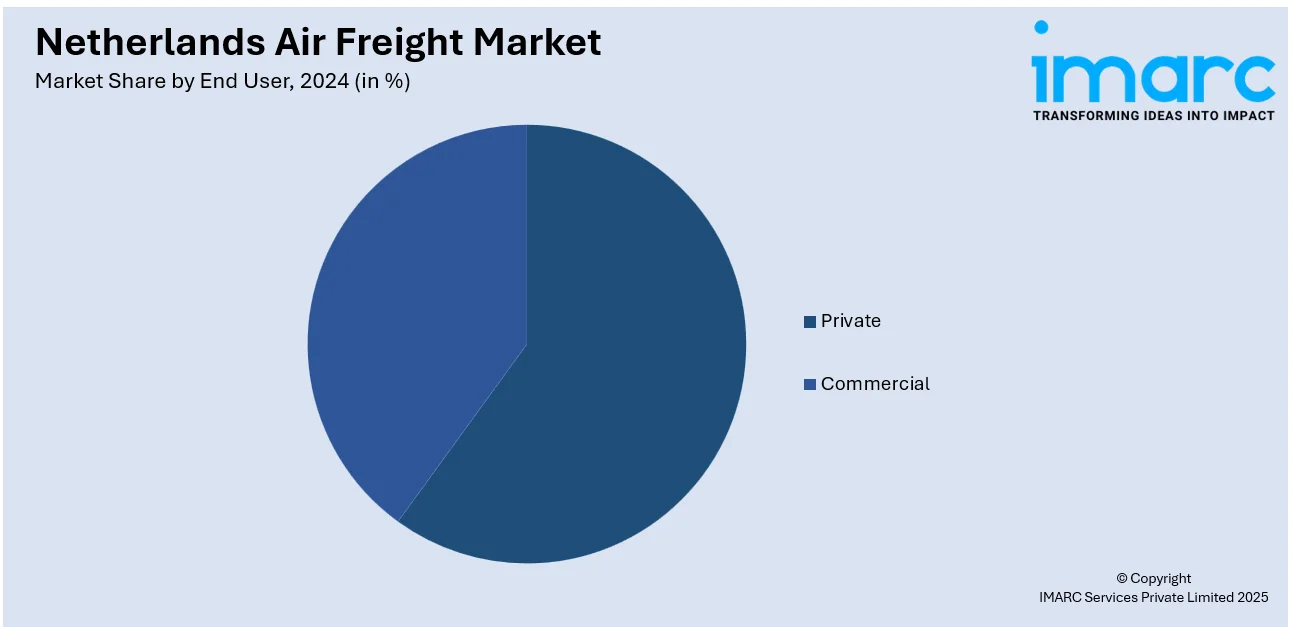

End User Insights:

- Private

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes private and commercial.

Province Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Air Freight Market News:

- On December 1, 2023, Logwin Air + Ocean strengthened its position in the Netherlands by acquiring all shares of ATL Logistics BV in Amsterdam. The acquisition notably expands Logwin’s air and sea freight capacities at Amsterdam Schiphol, enhancing service for its global air cargo customers. With ATL’s established handling facilities and integration into Logwin’s network, this move significantly reinforces the Netherlands air cargo market growth.

Netherlands Air Freight Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Freight, Express, Mail, Others |

| Destinations Covered | Domestic, International |

| End Users Covered | Private, Commercial |

| Provinces Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands air freight market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands air freight market on the basis of service?

- What is the breakup of the Netherlands air freight market on the basis of destination?

- What is the breakup of the Netherlands air freight market on the basis of end user?

- What is the breakup of the Netherlands air freight market on the basis of province?

- What are the various stages in the value chain of the Netherlands air freight market?

- What are the key driving factors and challenges in the Netherlands air freight market?

- What is the structure of the Netherlands air freight market and who are the key players?

- What is the degree of competition in the Netherlands air freight market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands air freight market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands air freight market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands air freight industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)