Netherlands Board Games Market Size, Share, Trends and Forecast by Product Type, Game Type, Age Group, Distribution Channel, and Region, 2025-2033

Netherlands Board Games Market Overview:

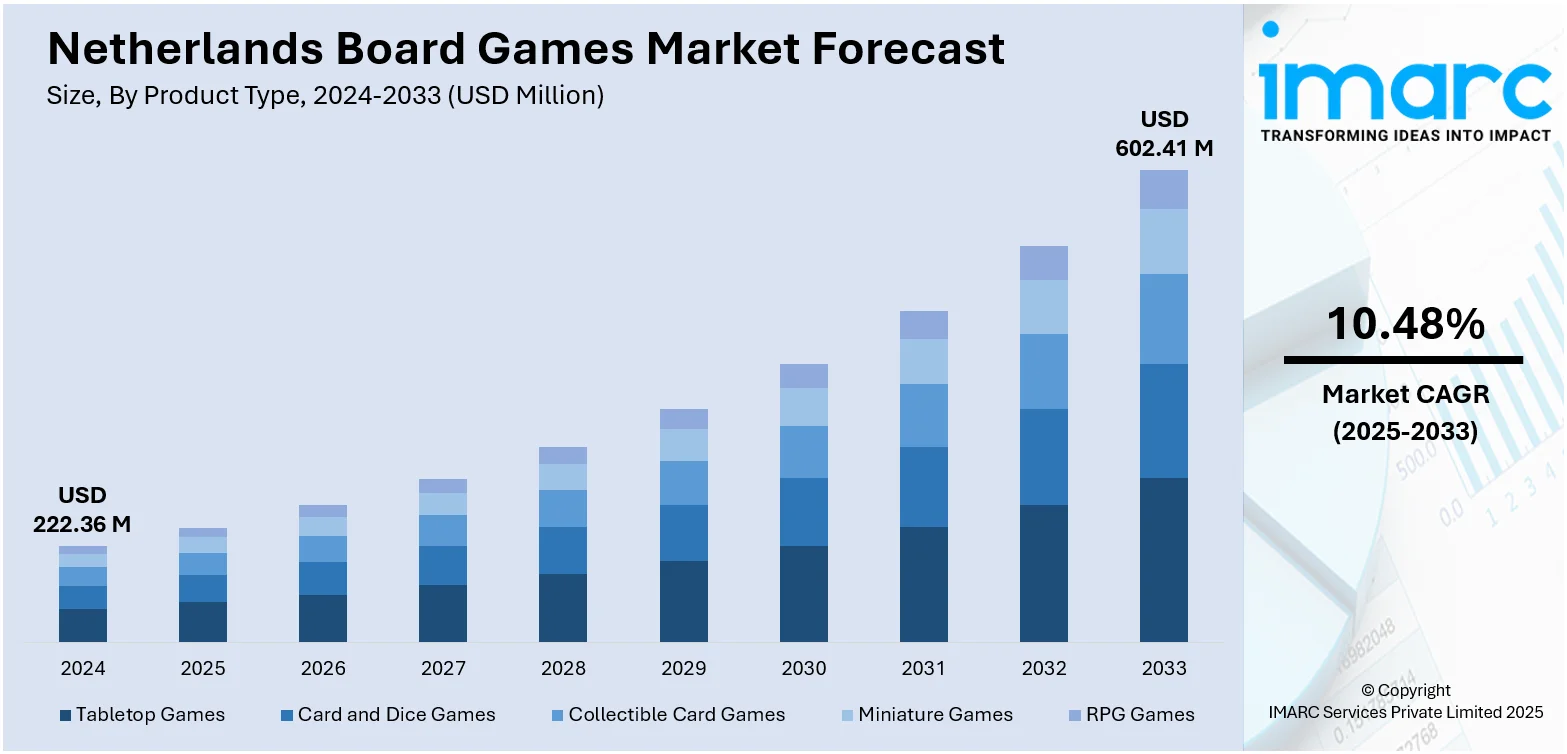

The Netherlands board games market size reached USD 222.36 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 602.41 Million by 2033, exhibiting a growth rate (CAGR) of 10.48% during 2025-2033. At present, continued expansion of e-commerce websites and specialty retailing channels for recreational products is impelling the market growth. Moreover, there is an increasing interest in social and family entertainment across Netherlands. This, along with the heightened focus of publishers and designers on launching innovative and niche games that cater to a broad range of interests, is expanding the Netherlands board games market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 222.36 Million |

| Market Forecast in 2033 | USD 602.41 Million |

| Market Growth Rate 2025-2033 | 10.48% |

Netherlands Board Games Market Trends:

Increased Demand for Social and Family Recreation:

The Netherlands board games market is witnessing strong growth as a result of the increasing interest in social and family entertainment. People are actively looking for dynamic activities to enable face-to-face communication, especially as a countermeasure to the stronghold of digital forms of entertainment. Families, groups of friends, and communities are making board games a top priority as a way to encourage bonding and shared experiences. This trend is catching up as individuals are appreciating the physical and sociality of board games, which do not register in digital media. Board game events and game cafés are increasing in number, further providing a boost to board games as a popular form of entertainment. Publishers are taking note by bringing out games that can cater to various age groups and interests, further promoting innovation in the market. This increasing cultural adoption of analogue gaming is encouraging retailers to improve shelf space and inventory to cater to the high demand.

To get more information on this market, Request Sample

Expanding Availability of Innovative and Niche Games

The rising focus of publishers and designers on launching innovative and niche games that cater to a broad range of interests is contributing to the Netherlands board games market growth. Independent developers and small publishing houses are using crowdfunding sites and web forums to bring new, niche ideas to the market, thus broadening the range of products on offer. Consumers are enjoying sophisticated strategy games, co-op modes, and games with rich stories, catalyzing the demand for products outside the traditional masters. International successes localized and the advent of local designers are enriching the local market with products that are culturally sensitive and linguistically relevant. Specialized selections are curated by retailers to appeal to enthusiasts that are hunting for new experiences. The trend, which is continuous, is driving repeat purchases as hobbyists seek to continually enlarge their collections. In 2025, Hachette Livre declared the acquisition of 999 Games, a major manufacturer of board games in the Netherlands. This move will allow Hachette Boardgames to enhance its footprint in Europe, where it presently functions in France, the United Kingdom, and the Benelux region. 999 Games will create new opportunities for Hachette Boardgames' publishers and creators, while providing avenues to uncover fresh talent and nurture future hits.

Growing E-commerce and Specialty Retail Channels

The market is reaping gains from the continued expansion of e-commerce websites and specialty retailing channels for recreational products. The clientele is increasingly resorting to online shops for browsing vast catalogs at their convenience, reading reviews about the same, and procuring exclusive or imported games not easily available in brick-and-mortar stores. Specialty shops and specialty board game cafés also delivering curated experiences, featuring trained personnel, game demonstrations, and community activities that stimulate interaction and repeated store visits. This multi-channel retail strategy is bringing board games within the reach of urban and rural residents. Small game publishers are taking advantage of digital marketplaces to make targeted marketing available to niched audiences without having to establish high-cost distribution systems. A 2024 report from the United Nations Conference on Trade and Development (UNCTAD) stated that the e-commerce penetration rate in the Netherlands was the highest in the world, reaching 84%.

Netherlands Board Games Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, game type, age group, and distribution channel.

Product Type Insights:

- Tabletop Games

- Card and Dice Games

- Collectible Card Games

- Miniature Games

- RPG Games

The report has provided a detailed breakup and analysis of the market based on the product type. This includes tabletop games, card and dice games, collectible card games, miniature games, and RPG games.

Game Type Insights:

- Strategy and War Games

- Educational Games

- Fantasy Games

- Sport Games

- Others

The report has provided a detailed breakup and analysis of the market based on the game type. This includes strategy and war games, educational games, fantasy games, sport games, and others.

Age Group Insights:

- 0-2 Years

- 2-5 Years

- 5-12 Years

- Above 12 Years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 0-2 years, 2-5 years, 5-12 years, and above 12 years.

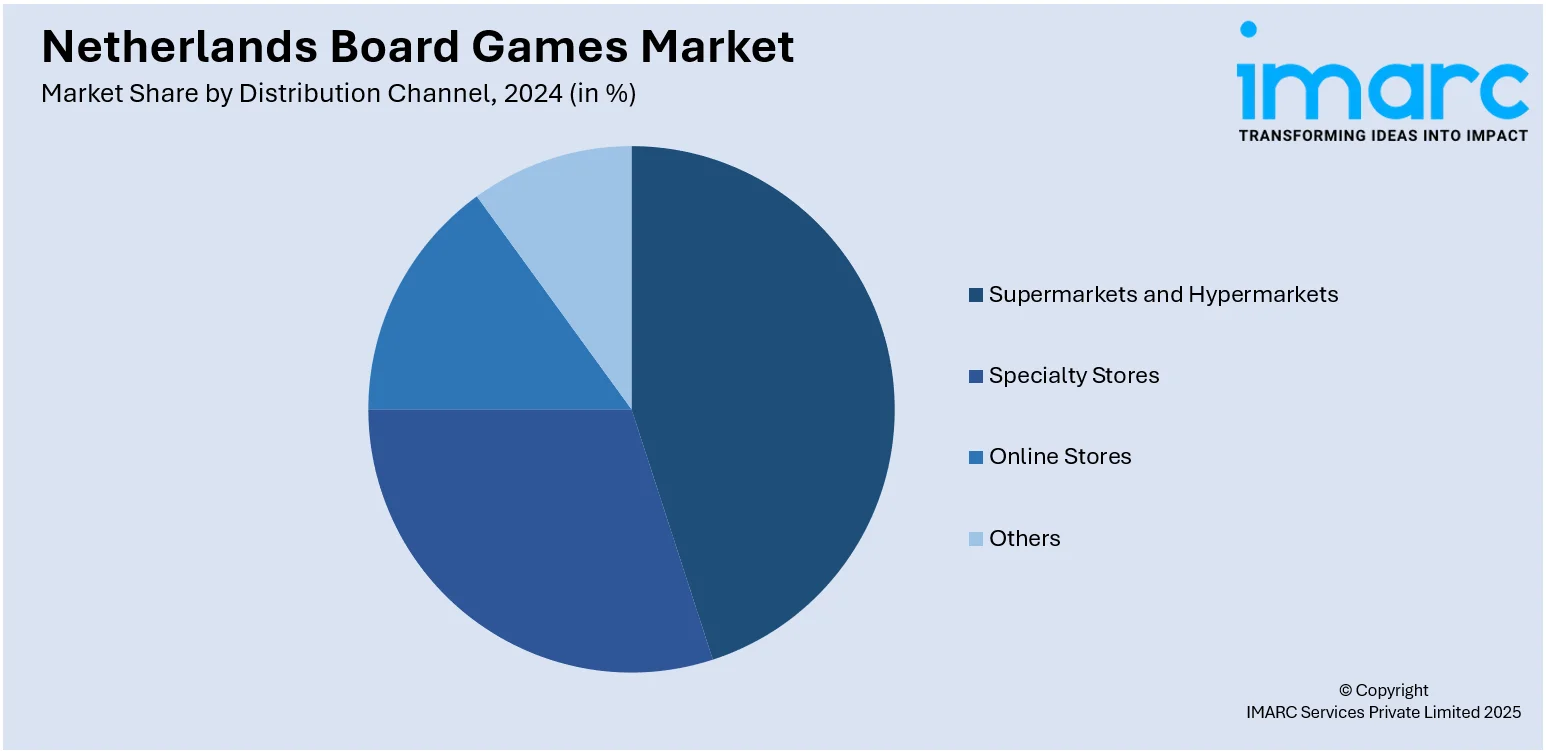

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, specialty stores, online stores, and others.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Board Games Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Tabletop Games, Card and Dice Games, Collectible Card Games, Miniature Games, RPG Games |

| Game Types Covered | Strategy and War Games, Educational Games, Fantasy Games, Sport Games, Others |

| Age Groups Covered | 0-2 Years, 2-5 Years, 5-12 Years, Above 12 Years |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands board games market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands board games market on the basis of product type?

- What is the breakup of the Netherlands board games market on the basis of game type?

- What is the breakup of the Netherlands board games market on the basis of age group?

- What is the breakup of the Netherlands board games market on the basis of distribution channel?

- What is the breakup of the Netherlands board games market on the basis of region?

- What are the various stages in the value chain of the Netherlands board games market?

- What are the key driving factors and challenges in the Netherlands board games market?

- What is the structure of the Netherlands board games market and who are the key players?

- What is the degree of competition in the Netherlands board games market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands board games market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands board games market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands board games industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)