Netherlands Cement Market Size, Share, Trends and Forecast by Type, End-Use, and Region, 2025-2033

Netherlands Cement Market Overview:

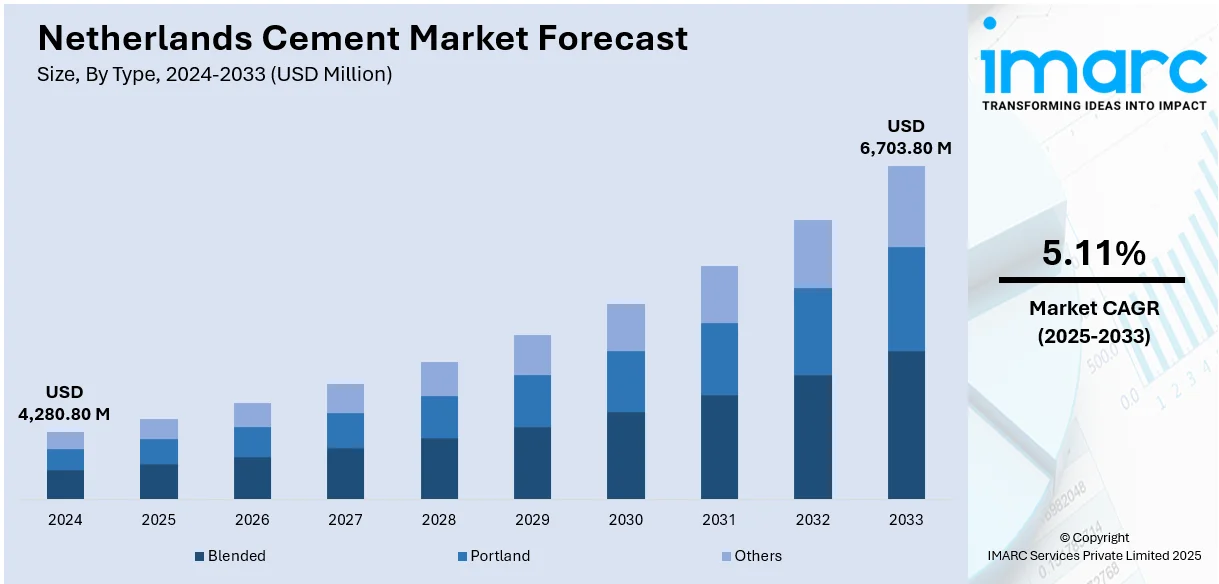

The Netherlands Cement market size reached USD 4,280.80 Million in 2024. The market is projected to reach USD 6,703.80 Million by 2033, exhibiting a growth rate (CAGR) of 5.11% during 2025-2033. The market is witnessing steady growth driven by ongoing infrastructure development and sustainable construction practices. Companies are focusing on low-carbon and blended cement types to align with environmental regulations. Demand is supported by housing expansion, commercial projects, and urban redevelopment. Digital innovations in production and logistics are improving efficiency and quality. Additionally, circular economy initiatives are promoting the reuse of construction materials, further shaping market dynamics. Netherlands cement share continues to grow as green construction gains momentum.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,280.80 Million |

| Market Forecast in 2033 | USD 6,703.80 Million |

| Market Growth Rate 2025-2033 | 5.11% |

Netherlands Cement Market Trends:

The Netherlands is witnessing a growing alignment between cement usage and national green building standards. As construction regulations increasingly emphasize environmental impact, builders are opting for cement types that contribute to reduced embodied carbon in structures. This shift is encouraging producers to enhance the environmental performance of their offerings by lowering the clinker content and incorporating renewable or recycled additives. In March 2024, a major development occurred with the announcement of a new 1.2 Mt/yr facility in Amsterdam powered by volcanic ash and recycled concrete fines, replacing 70 % of clinker and consuming 90 % less energy than traditional Portland cement—expected to be carbon‑neutral from the outset. This innovation exemplifies how alternative materials are being scaled to meet stricter building criteria. Certifications related to energy efficiency and material sustainability have become key benchmarks for public and private projects, driving consistent demand for sustainable cement solutions. Urban developments, infrastructure upgrades, and residential buildings are all adopting environmentally certified cement as part of their compliance with evolving standards. This shift not only supports the country’s climate goals but also reinforces the importance of sustainability in long-term construction planning. The heightened focus on environmental criteria is a notable factor contributing to Netherlands cement market growth, particularly in the context of green urban development initiatives.

To get more information on this market, Request Sample

Emphasis on Alternative Raw Materials

The cement industry is increasingly incorporating alternative raw materials to reduce environmental impact and improve production efficiency. Industrial by-products such as fly ash, blast furnace slag, and recycled concrete aggregates are replacing conventional raw materials like limestone and clay. These substitutions help lower the carbon footprint of cement while promoting the reuse of materials that would otherwise contribute to industrial waste. Additionally, the shift supports the broader goal of reducing reliance on imported resources and enhancing local supply chains. The controlled blending of these alternative inputs ensures that performance standards are met while also enabling a more sustainable lifecycle for construction materials. With steady support from environmental policy frameworks and industry standards, the integration of alternative raw materials is expected to expand further. These innovations reflect broader Netherlands cement trends, which emphasize environmental stewardship, material efficiency, and circularity within the construction sector.

Energy Efficiency Through Technological Innovation

Technological innovation is playing a vital role in advancing energy efficiency across cement manufacturing facilities in the Netherlands. Upgrades to kilns, heat recovery systems, and grinding technologies are allowing producers to optimize fuel consumption and electricity usage. Automation systems, supported by real-time monitoring tools and data analytics, enhance process control and reduce operational variability. These measures contribute to lower greenhouse gas emissions, improved energy productivity, and reduced production costs. Furthermore, the adoption of electric-powered systems and renewable energy sources in certain facilities aligns with the nation’s broader energy transition goals. Innovations in thermal efficiency and smart metering tools are also enabling manufacturers to benchmark and improve their energy profiles across production lines. This progressive focus on clean technologies and optimized processes is transforming the energy dynamics of cement production and ensuring long-term sustainability. These improvements are increasingly viewed as strategic investments that support Netherlands Cement growth in a competitive and regulated market.

Netherlands Cement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end-use.

Type Insights:

- Blended

- Portland

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes blended, Portland, and others.

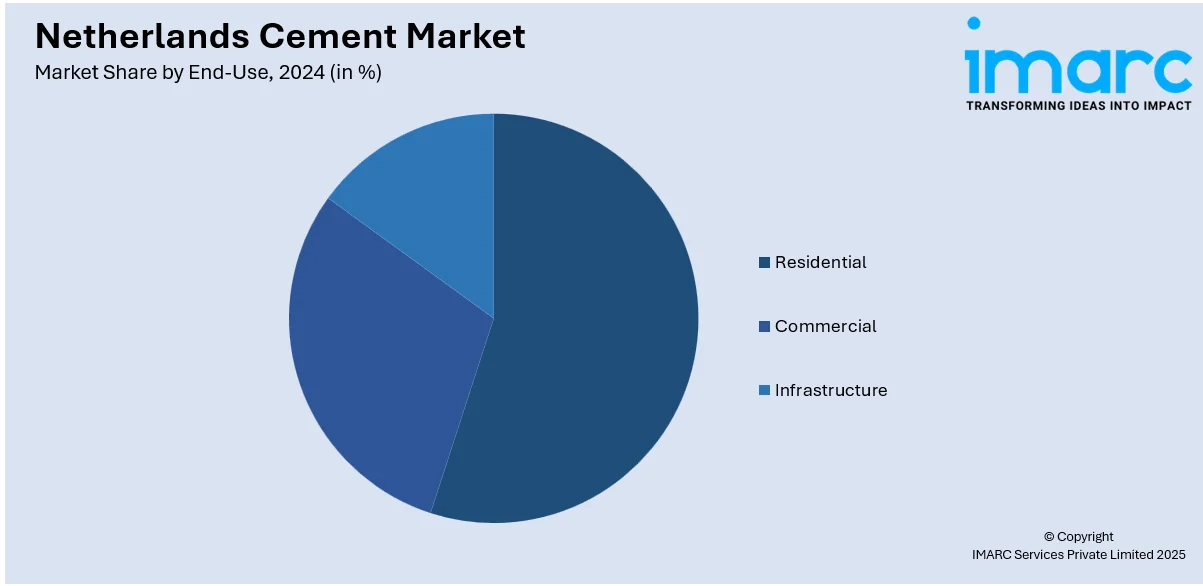

End-Use Insights:

- Residential

- Commercial

- Infrastructure

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes residential, commercial, and infrastructure.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Cement Market News:

- March 2024: EMC Cement and HES International announced plans to construct a carbon-neutral cement plant in Amsterdam using volcanic ash and recycled concrete fines. The innovative process replaces most traditional clinker, delivering major energy savings and climate benefits without carbon capture, aligning with global emission reduction goals.

Netherlands Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blended, Portland, Others |

| End-Uses Covered | Residential, Commercial, Infrastructure |

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands cement market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands cement market on the basis of type?

- What is the breakup of the Netherlands cement market on the basis of end-use?

- What is the breakup of the Netherlands cement market on the basis of region?

- What are the various stages in the value chain of the Netherlands cement market?

- What are the key driving factors and challenges in the Netherlands cement?

- What is the structure of the Netherlands cement market and who are the key players?

- What is the degree of competition in the Netherlands cement market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands cement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands cement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)