Netherlands Corporate Wellness Market Size, Share, Trends and Forecast by Service, Category, Delivery, Organization Size, and Region, 2025-2033

Netherlands Corporate Wellness Market Overview:

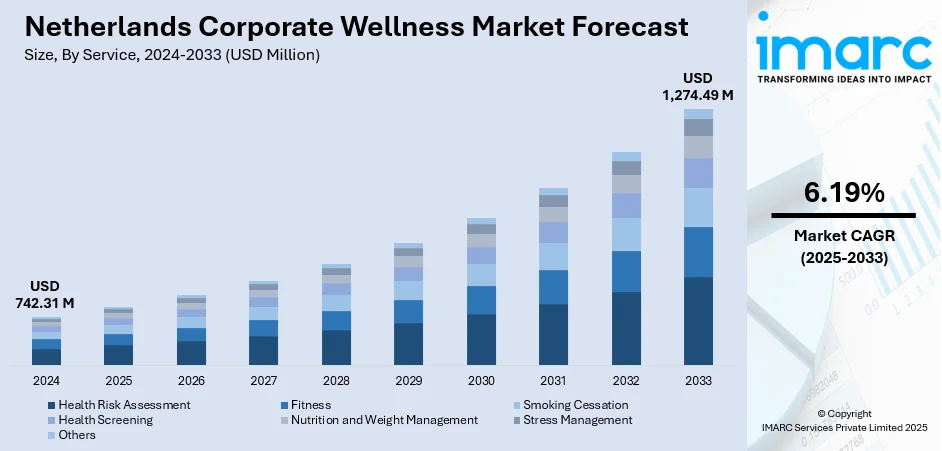

The Netherlands corporate wellness market size reached USD 742.31 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,274.49 Million by 2033, exhibiting a growth rate (CAGR) of 6.19% during 2025-2033. Businesses in the Netherlands are increasingly looking to prioritize the well-being of their employees, recognizing its direct correlation with overall productivity. Moreover, the growing use of digital health and wellness technology is offering a favorable market outlook. Apart from this, the heightened focus on implementing policies and practices that help protect the physical and mental well-being of employees is expanding the Netherlands corporate wellness market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 742.31 Million |

| Market Forecast in 2033 | USD 1,274.49 Million |

| Market Growth Rate 2025-2033 | 6.19% |

Netherlands Corporate Wellness Market Trends:

Growing Emphasis on Staff Wellbeing and Performance

Businesses in the Netherlands are increasingly looking to prioritize the well-being of their employees, recognizing its direct correlation with overall productivity. Corporate wellness programs are being introduced by many firms to help curb stress, burnout, and mental illness and facilitate a healthier, more productive workforce. In light of the growing expectations of the contemporary workplace, employers are engaging in wellness programs that promote physical fitness, access to mental health services, and integrated work-life balance. These programs are viewed as integral to boosting employee satisfaction, cutting absenteeism, and improving the level of retention. Companies are building a positive environment that makes employees feel valued, which is fueling the Netherlands corporate wellness market growth. Through the promotion of a health culture, businesses are responding to the increasing need to address work-related stress and mental illness as primary drivers of both organizational and individual performance. Workforce Pulse 2024, an annual survey by Personio, a European HR software provider for small and medium enterprises, indicated that Dutch employees were placing greater importance on their work-life balance, reduced stress, and supportive company culture. In the survey, 64% of employees stated that work is no longer their main focus. A greater number of employees were seeking satisfying jobs, with 36% expressing a desire to switch careers or fields. Furthermore, 32% might contemplate accepting a reduced salary if a different position is more engaging. Additional proof of discontent is that more than a third of workers (36%) expressed a desire to transition to a different career or field.

To get more information on this market, Request Sample

Increasing Use of Digital Health and Wellness Solutions

The corporate health market in the Netherlands is influenced by the growing use of digital health and wellness technology. Businesses are incorporating mobile apps, virtual coaching, web-based fitness programs, and telehealth services into their wellness programs to make employees' health solutions more convenient and tailored. This transformation to digital well-being is being fueled by increasing remote working and rising dependence on technology in daily life. Digital platforms are supporting employees to monitor their physical activity, track mental well-being, and have virtual consultations, thereby making wellness programs more convenient and customized. Employers are seeing the value of tapping into these digital solutions to keep workers engaged and healthy in a convenient and scalable way. With technology's relentless innovation, the need for these types of solutions is fueling the growth of the corporate wellness sector in the Netherlands.

Growing Legislative Support for Employee Wellness Programs

Dutch legislative actions are also working towards the encouragement of corporate wellness programs. The government is urging employers to implement policies and practices that help protect the physical and mental well-being of employees. Regulations and incentives are being created to guarantee that businesses invest in programs that enable employees to manage stress, enhance physical well-being, and enjoy work-life balance. The Dutch labor regulations are emphasizing the development of settings that avert chronic diseases as well as enhance workers' quality of life, hence the increased uptake of wellness programs. Employers are also being offered money incentives as well as tax relief in an effort to finance such wellness programs, which are actually lowering healthcare expenses as well as enhancing productivity overall. In 2025, various changes are introduced in the employment law landscape by the government. The minimum wage in the Netherlands will rise starting January 1, 2025. The hourly pay for full-time workers aged 21 and older increased from €13.68 to €14.06. This rise is a component of the government’s standard semiannual updates aimed at safeguarding employees’ purchasing power. The “Flexible Workers (Increased Security) Act” aims to enhance job security for workers in temporary and flexible roles. This legislation suggests substituting zero-hour contracts with "basic agreements," ensuring a minimum hour guarantee for employees. This change intends to minimize uncertainty for employees in variable sectors.

Netherlands Corporate Wellness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service, category, delivery, and organization size.

Service Insights:

- Health Risk Assessment

- Fitness

- Smoking Cessation

- Health Screening

- Nutrition and Weight Management

- Stress Management

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes health risk assessment, fitness, smoking cessation, health screening, nutrition and weight management, stress management, and others.

Category Insights:

- Fitness and Nutrition Consultants

- Psychological Therapists

- Organizations/Employers

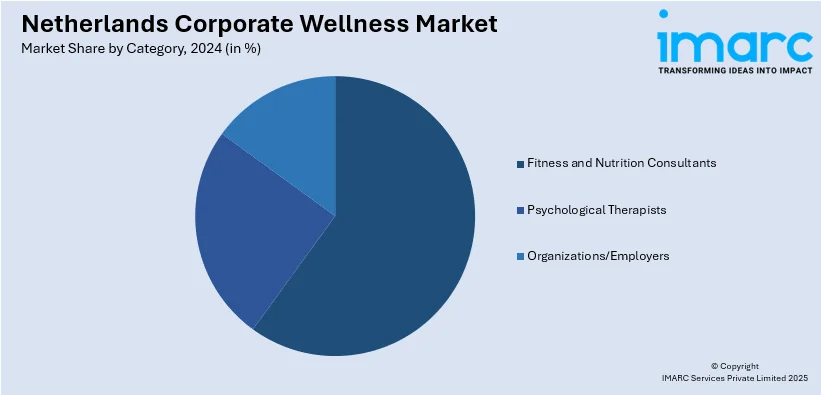

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes fitness and nutrition consultants, psychological therapists, and organizations/employers.

Delivery Insights:

- Onsite

- Offsite

A detailed breakup and analysis of the market based on the delivery have also been provided in the report. This includes onsite and offsite.

Organization Size Insights:

- Small Scale Organizations

- Medium Scale Organizations

- Large Scale Organizations

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small scale organizations, medium scale organizations, and large scale organizations.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Corporate Wellness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Health Risk Assessment, Fitness, Smoking Cessation, Health Screening, Nutrition and Weight Management, Stress Management, Others |

| Categories Covered | Fitness and Nutrition Consultants, Psychological Therapists, Organizations/Employers |

| Deliveries Covered | Onsite, Offsite |

| Organization Sizes Covered | Small Scale Organizations, Medium Scale Organizations, Large Scale Organizations |

| Regions Covered | Noord-Holland. Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands corporate wellness market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands corporate wellness market on the basis of service?

- What is the breakup of the Netherlands corporate wellness market on the basis of category?

- What is the breakup of the Netherlands corporate wellness market on the basis of delivery?

- What is the breakup of the Netherlands corporate wellness market on the basis of organization size?

- What is the breakup of the Netherlands corporate wellness market on the basis of region?

- What are the various stages in the value chain of the Netherlands corporate wellness market?

- What are the key driving factors and challenges in the Netherlands corporate wellness market?

- What is the structure of the Netherlands corporate wellness market and who are the key players?

- What is the degree of competition in the Netherlands corporate wellness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands corporate wellness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands corporate wellness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands corporate wellness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)