Netherlands Craft Beer Market Size, Share, Trends and Forecast by Product Type, Age Group, Distribution Channel, and Region, 2025-2033

Netherlands Craft Beer Market Overview:

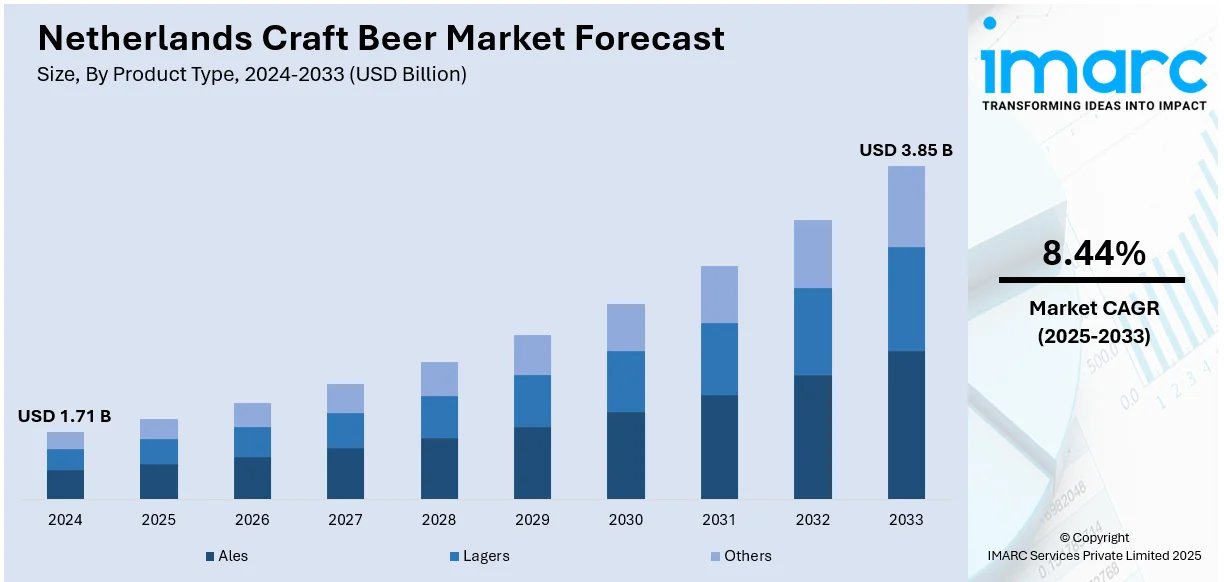

The Netherlands Craft Beer market size reached USD 1.71 Billion in 2024. The market is projected to reach USD 3.85 Billion by 2033, exhibiting a growth rate (CAGR) of 8.44% during 2025-2033. The market is undergoing steady growth, with a dynamic culture of brewing and an increased demand for variety, high-quality beers. Consumers are increasingly attracted to local, brewed products that focus on unique flavors and environmentally friendly production. Microbreweries and regional producers keep developing, strengthening their position through specialty retailing outlets, hospitality establishments, and internet channels. Such advancements, along with changing consumer tastes, are remapping the competitive landscape and contributing to the continued increase in the Netherlands craft beer market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.71 Billion |

| Market Forecast in 2033 | USD 3.85 Billion |

| Market Growth Rate 2025-2033 | 8.44% |

Netherlands Craft Beer Market Trends:

Regional Terroir Sparks Flavorful Innovation

The Netherlands craft beer industry has witnessed an explosion of local innovation as microbrewers in provinces such as Noord‑Brabant, Utrecht, and Drenthe look to local flavors. Brewers are looking at ingredients such as seaweed from the North Sea, Zeeland berries, and Utrecht-grown hops. These local profiles are being promoted at local beer festivals, making for community-based events that celebrate local brewing. Taprooms are increasingly becoming cultural centers where regional storytelling and authenticity matter as much as flavor. The trend reflects international interest in terroir-driven drinks, but with a Dutch flavor. It emphasizes the ways in which local traditions and landscapes are informing brewing decisions, from recipe formulation to event design. Winemakers, distillers, and chefs increasingly partner with microbrewers to build upon the sense of place and heritage. These terroir-linked initiatives are reinforcing Netherlands craft beer market trends, demonstrating the way local pride and flavor discovery are propelling the development of craft beer in the Netherlands. While these practices become increasingly mainstream, the craft beer industry continues to develop a market that emphasizes sustainability, locality, and handcrafted manufacturing.

To get more information on this market, Request Sample

Explosive Microbrewery Growth Drives Market Expansion

The Netherlands is also witnessing growth in its craft brewing infrastructure over the past few years. From a little over 200 breweries in the start, the figure has ballooned to more than 900 in years, ranking it among the fastest-growing craft beer environments in Europe. This expansion is a testament to growing consumer demand for artisanal beer and drives Netherlands craft beer market growth by diversifying product selection and expanding regional penetration. Consumers are moving to local IPA, barrel-aged sours, farmhouse ales, and gluten-free versions, demonstrating an openness to try specialty styles. Specialty beer stores, beer-to-go growler bars, and retail-serving breweries have subsequently become more common, allowing smaller breweries to distribute their products to broader markets. This new infrastructure also benefits tourism, with brewery trails attracting people to lesser-known areas, supporting local economies. Microbreweries are transforming the beer scene in both production and distribution creativity, cementing craft beer as a key element in the beverage story of the Netherlands. The combined impact is a strong and constantly developing environment that is lifting the national profile of the beer both domestically and internationally.

Experience Elevates Consumer Loyalty

Dutch craft breweries are strengthening consumer relationships by creating immersive experiences and digital engagement. In 2025, measures such as guided brewing workshops, virtual tastings, and taproom membership are taking center stage. Several breweries have small-group events where consumers are introduced to new releases accompanied by pairing menus of local cheeses or pastries. In addition, digital interaction through loyalty apps and advanced access to restricted releases through email marketing has become prevalent, generating a bespoke experience and continuous conversation with consumers. Seasonal festivals e.g., autumn trub festivals or spring hop celebration, have increased community participation and created a sense of belonging around craft beer. This move toward experiential marketing is essential for cultivating brand loyalty and broadening craft beer's acceptance beyond non-enthusiastic drinkers. These efforts represent Netherlands craft brewing market, which show how breweries are developing rich relationships and robust consumer bases through meaningful connections. With the industry embracing community-centric programming and technology, craft brewing is transforming into a lifestyle product tied to cultural experiences and social values.

Netherlands Craft Beer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, age group, and distribution channel.

Product Type Insights:

- Ales

- Lagers

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes ales, lagers, and others.

Age Group Insights:

- 21–35 Years Old

- 40–54 Years Old

- 55 Years and Above

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 21–35 years old, 40–54 years old, and 55 years and above.

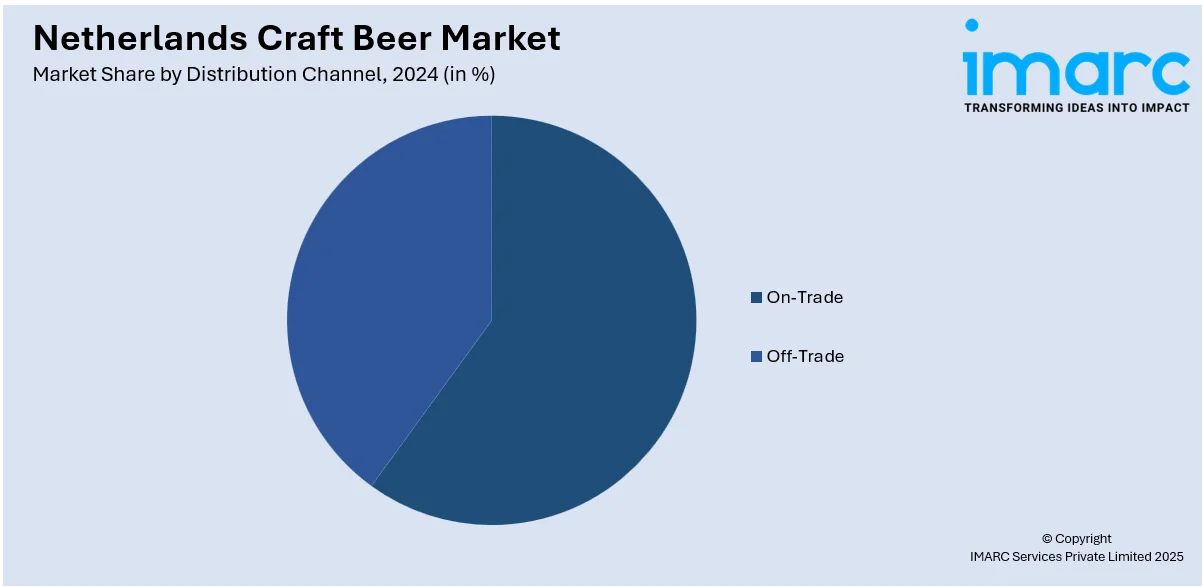

Distribution Channel Insights:

- On-Trade

- Off-Trade

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes on-trade and off-trade.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Craft Beer Market News:

- April 2025: Heineken Netherlands has introduced a large-scale industrial electric boiler (e‑boiler) at its Zoeterwoude brewery, in partnership with Eneco, to reduce reliance on gas-fired boilers. The 12 MW unit will gradually take over a significant portion of steam production, aligning with Heineken's global “Brew a Better World” sustainability initiative. This electrification effort supports the company’s goals of achieving carbon neutrality at its breweries by 2030 and grid stability through renewable energy integration. It demonstrates Heineken’s commitment to sustainable brewing practices in the Netherlands.

Netherlands Craft Beer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ales, Lagers, Others |

| Age Groups Covered | 21–35 Years Old, 40–54 Years Old, 55 Years and Above |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands craft beer market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands craft beer market on the basis of product type?

- What is the breakup of the Netherlands craft beer market on the basis of age group?

- What is the breakup of the Netherlands craft beer market on the basis of distribution channel?

- What is the breakup of the Netherlands craft beer market on the basis of region?

- What are the various stages in the value chain of the Netherlands craft beer market?

- What are the key driving factors and challenges in the Netherlands craft beer?

- What is the structure of the Netherlands craft beer market and who are the key players?

- What is the degree of competition in the Netherlands craft beer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands craft beer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands craft beer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands craft beer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)