Netherlands E-Invoicing Market Size, Share, Trends and Forecast by Channel, Deployment Type, Application, and Province, 2025-2033

Netherlands E-Invoicing Market Overview:

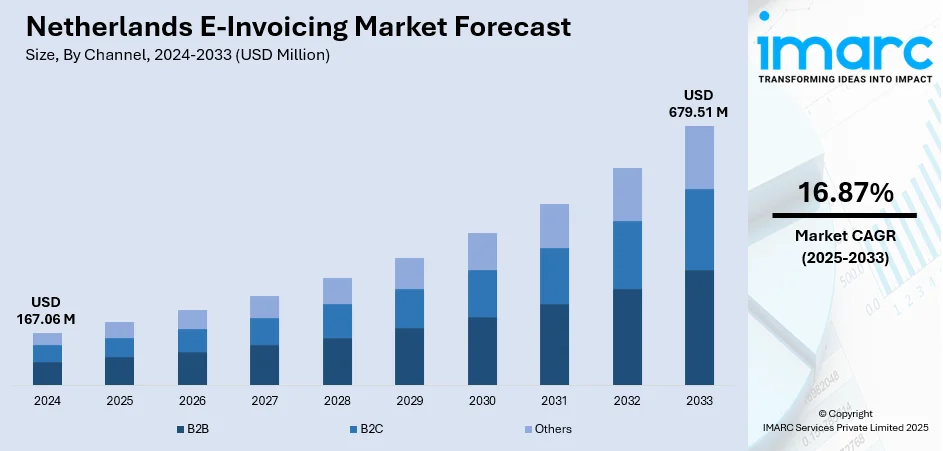

The Netherlands e-invoicing market size reached USD 167.06 Million in 2024. Looking forward, the market is expected to reach USD 679.51 Million by 2033, exhibiting a growth rate (CAGR) of 16.87% during 2025-2033. The market is experiencing strong momentum, driven by growing digital adoption, regulatory mandates, and the need for streamlined financial operations. Businesses are also embracing electronic invoicing to enhance efficiency, reduce errors, and ensure compliance. These advancements continue to strengthen the competitive landscape and contribute to the expansion of the Netherlands e-invoicing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 167.06 Million |

| Market Forecast in 2033 | USD 679.51 Million |

| Market Growth Rate 2025-2033 | 16.87% |

Netherlands E-Invoicing Market Trends:

Strong Regulatory Push and Public Sector Adoption

Government mandates have been central to accelerating e-invoicing adoption in the Netherlands. Since the enforcement of the EU Directive on e-invoicing in public procurement, Dutch central and local authorities are required to accept structured electronic invoices, especially via Peppol and NLCIUS standards. Platforms like Digipoort have become integral to public sector invoicing workflows. This top-down push has influenced suppliers and businesses to align with digital standards, recognizing the need for long-term compliance and interoperability. While B2B adoption remains voluntary, the success of B2G initiatives demonstrates the reliability and benefits of e-invoicing, encouraging broader use across industries. Regulatory clarity and public sector leadership have laid the groundwork for a stable, scalable e-invoicing ecosystem in the Netherlands.

To get more information on this market, Request Sample

Efficiency Gains and Cost Optimization

Operational efficiency is a key motivator for e-invoicing adoption among Dutch businesses, which is driving the Netherlands e-invoicing market growth. By automating invoice creation, delivery, validation, and archiving, companies significantly reduce manual errors, processing delays, and administrative costs. Traditional invoicing methods involve paper, postage, and manual entry—all of which are time-consuming and error-prone. In contrast, digital invoices streamline workflows, improve accuracy, and accelerate cash flow through quicker approvals and payments. Additionally, standardized formats like UBL and Peppol enhance compatibility between systems, further reducing reconciliation issues. Beyond cost savings, the switch to electronic invoicing also supports sustainability goals by minimizing paper usage. As firms seek to remain competitive and efficient, the tangible business benefits of e-invoicing are driving rapid adoption across both SMEs and large enterprises.

Standardization through Peppol and NLCIUS Frameworks

The adoption of standardized frameworks like Peppol and the Dutch-specific NLCIUS has created a reliable and interoperable infrastructure for e-invoicing in the Netherlands. These frameworks ensure consistent data formats, security protocols, and delivery mechanisms, making it easier for businesses and government entities to exchange invoices efficiently. The Netherlands Peppol Authority oversees compliance and ensures seamless connectivity among access point providers. This has fostered trust in digital invoicing systems and simplified cross-border transactions, especially within the EU. With formats such as Peppol BIS and SI-UBL widely supported, businesses can integrate e-invoicing into their ERP systems with minimal friction. This high level of standardization not only reduces onboarding time but also drives adoption by offering a dependable, scalable solution across the market.

Netherlands E-Invoicing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on channel, deployment type, and application.

Channel Insights:

- B2B

- B2C

- Others

The report has provided a detailed breakup and analysis of the market based on the channel. This includes B2B, B2C, and others.

Deployment Type Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes cloud-based and on-premises.

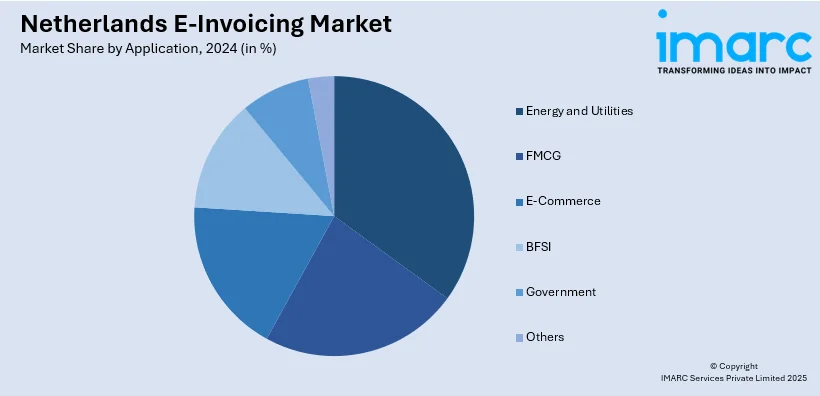

Application Insights:

- Energy and Utilities

- FMCG

- E-Commerce

- BFSI

- Government

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes energy and utilities, FMCG, e-commerce, BFSI, government, and others.

Province Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands E-Invoicing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Channels Covered | B2B, B2C, Others |

| Deployment Types Covered | Cloud-Based, On-Premises |

| Applications Covered | Energy and Utilities, FMCG, E-Commerce, BFSI, Government, Others |

| Provinces Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands e-invoicing market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands e-invoicing market on the basis of channel?

- What is the breakup of the Netherlands e-invoicing market on the basis of deployment type?

- What is the breakup of the Netherlands e-invoicing market on the basis of application?

- What is the breakup of the Netherlands e-invoicing market on the basis of province?

- What are the various stages in the value chain of the Netherlands e-invoicing market?

- What are the key driving factors and challenges in the Netherlands e-invoicing market?

- What is the structure of the Netherlands e-invoicing market and who are the key players?

- What is the degree of competition in the Netherlands e-invoicing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands e-invoicing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands e-invoicing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands e-invoicing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)